Answered step by step

Verified Expert Solution

Question

1 Approved Answer

10% V page L Page view A Read aloud Scenario You have been approached by a client to assist them in planning for a new

10%

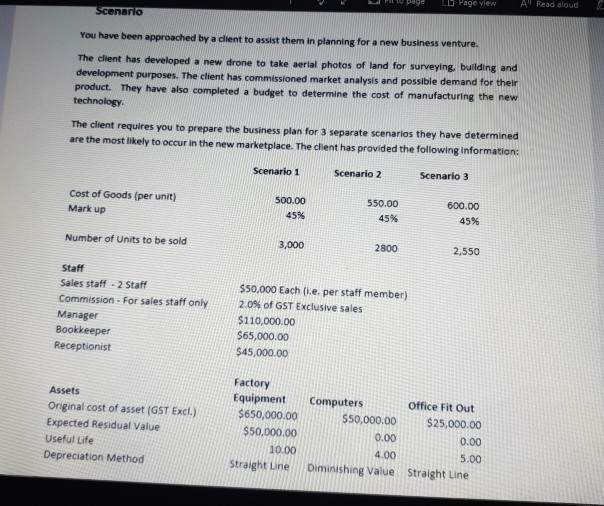

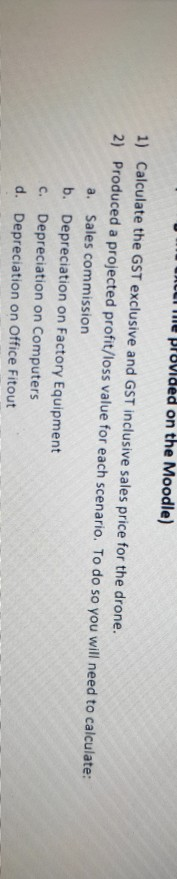

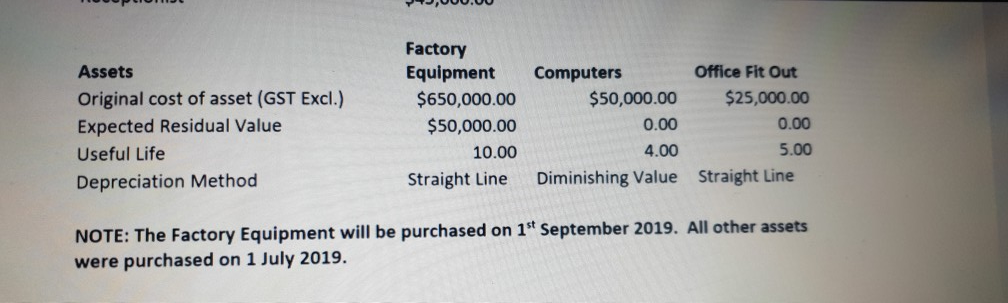

V page L Page view A Read aloud Scenario You have been approached by a client to assist them in planning for a new business venture. The client has developed a new drone to take aerial photos of land for surveying building and development purposes. The client has commissioned market analysis and possible demand for their product. They have also completed a budget to determine the cost of manufacturing the new technology The client requires you to prepare the business plan for 3 separate scenarios they have determined are the most likely to occur in the new marketplace. The client has provided the following information: Scenario 1 Scenario 2 Scenario 3 Cost of Goods (per unit) Mark up 500.00 45% 550.00 45% 600.00 45% Number of Units to be sold 3,000 2800 2,550 Staff Sales staff - 2 Staff Commission - For sales staff only Manager Bookkeeper Receptionist $50,000 Each (i.e. per staff member) 2.0% of GST Exclusive sales $110,000.00 $65,000.00 $45,000.00 Assets Original cost of asset (GST Excl.) Expected Residual Value Useful Life Depreciation Method Factory Equipment $650,000.00 $50,000.00 10.00 Straight Line Computers $50,000.00 0.00 Office Fit Out $25,000.00 0.00 5.00 Straight Line 4.00 Diminishing Value me provided on the Moodle) 1) Calculate the GST exclusive and GST inclusive sales price for the drone. 2) Produced a projected profit/loss value for each scenario. To do so you will need to calculate: a. Sales commission b. Depreciation on Factory Equipment c. Depreciation on Computers d. Depreciation on Office Fitout 3,000.00 Assets Original cost of asset (GST Excl.) Expected Residual Value Useful Life Depreciation Method Factory Equipment $650,000.00 $50,000.00 10.00 Straight Line Computers $50,000.00 0.00 4.00 Diminishing Value Office Fit Out $25,000.00 0.00 5.00 Straight Line NOTE: The Factory Equipment will be purchased on 1st September 2019. All other assets were purchased on 1 July 2019Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started