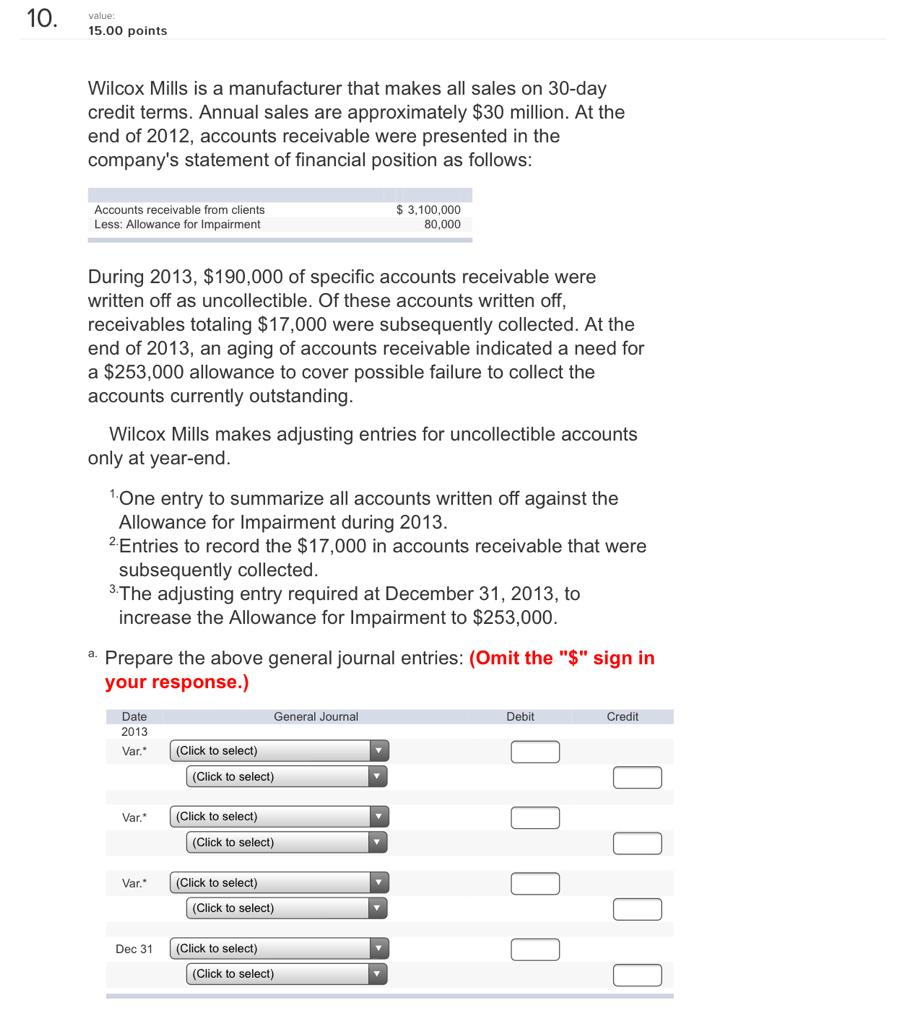

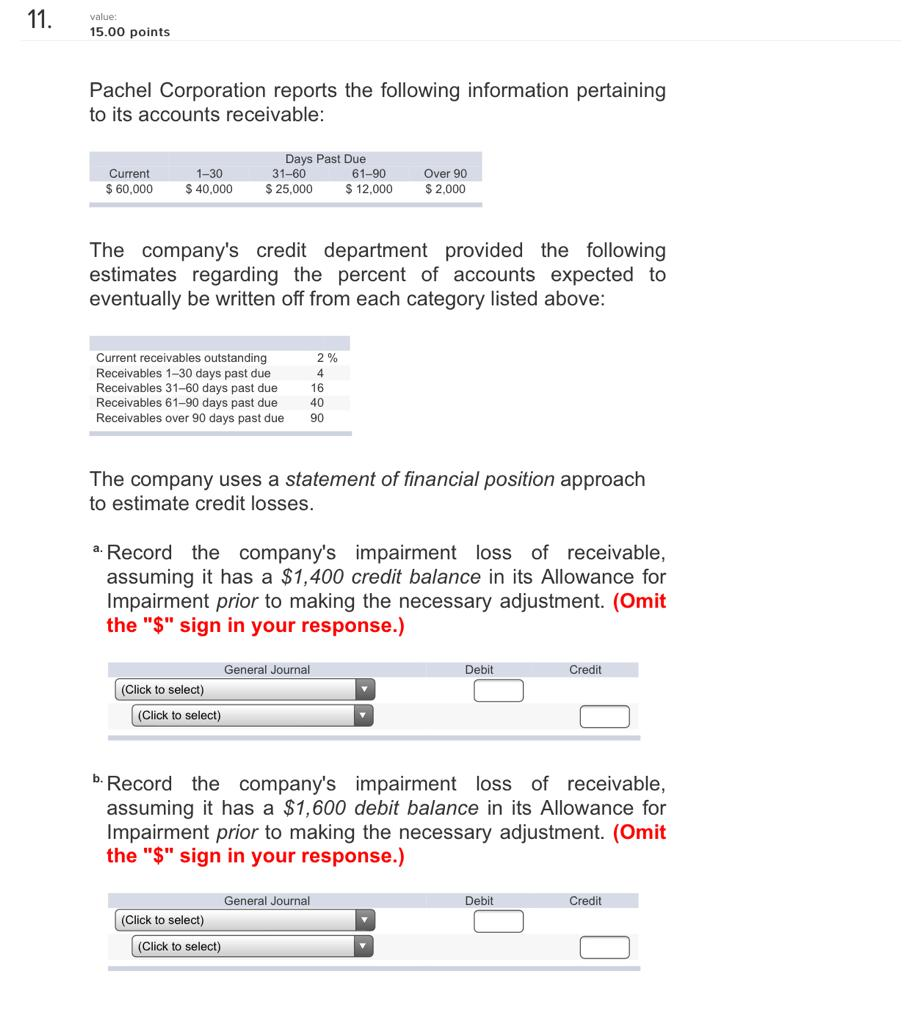

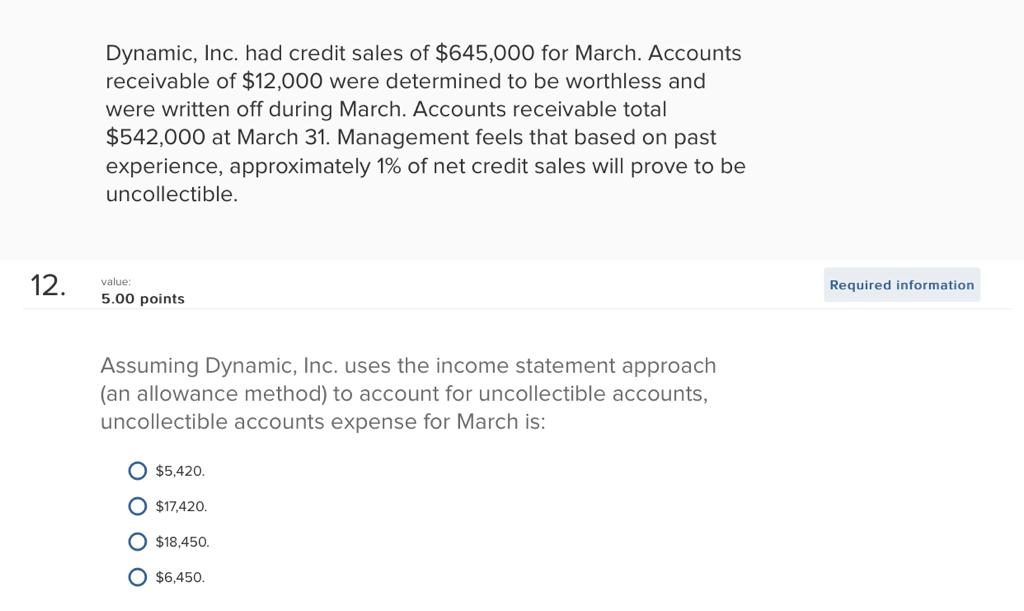

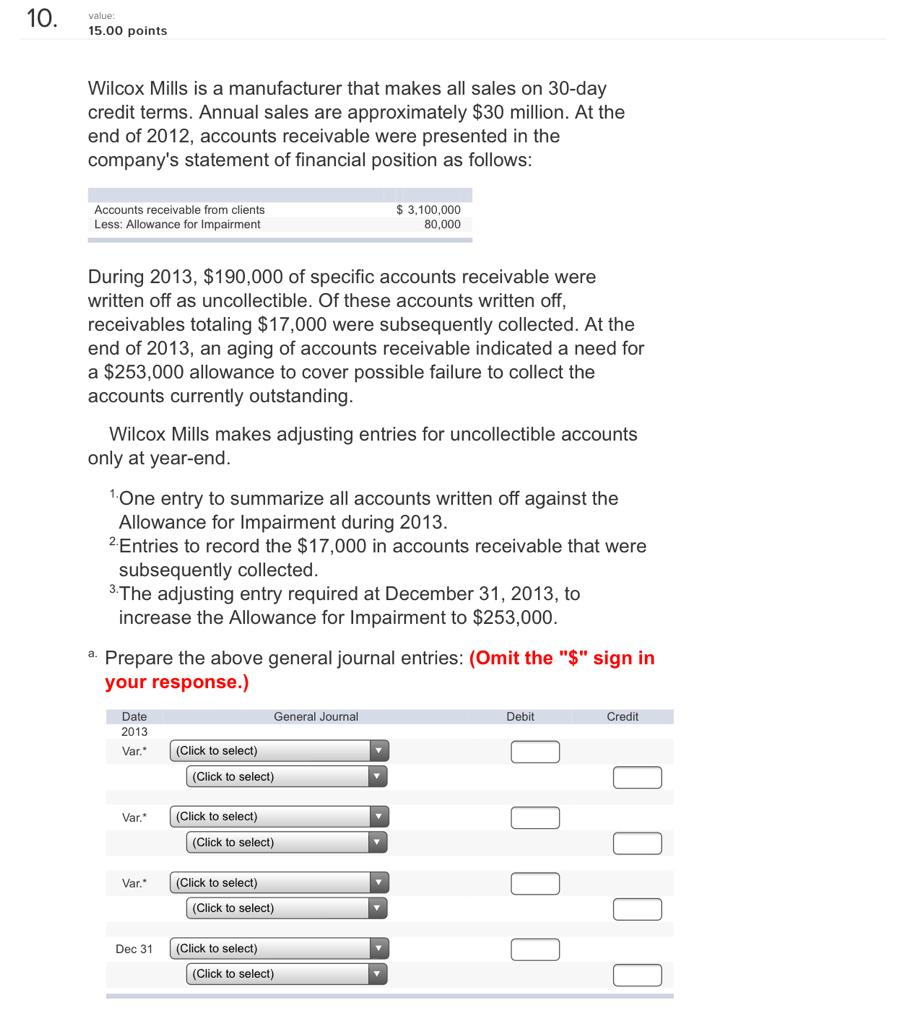

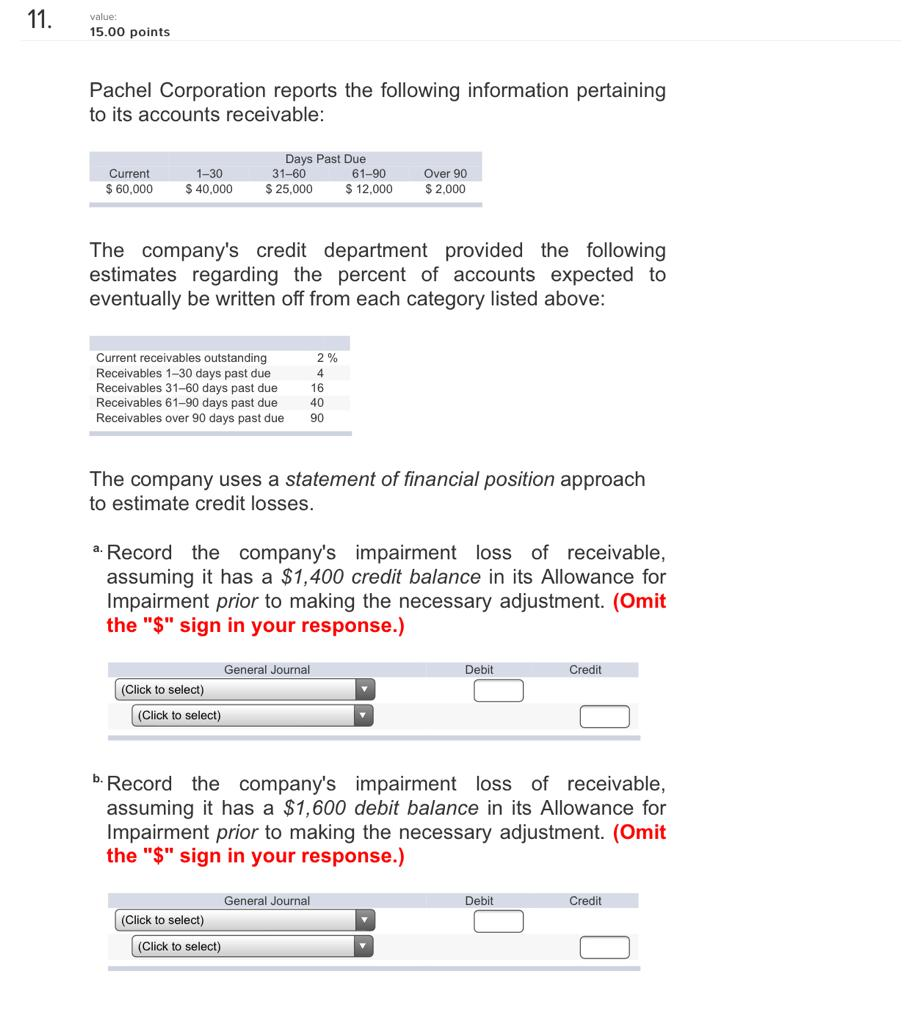

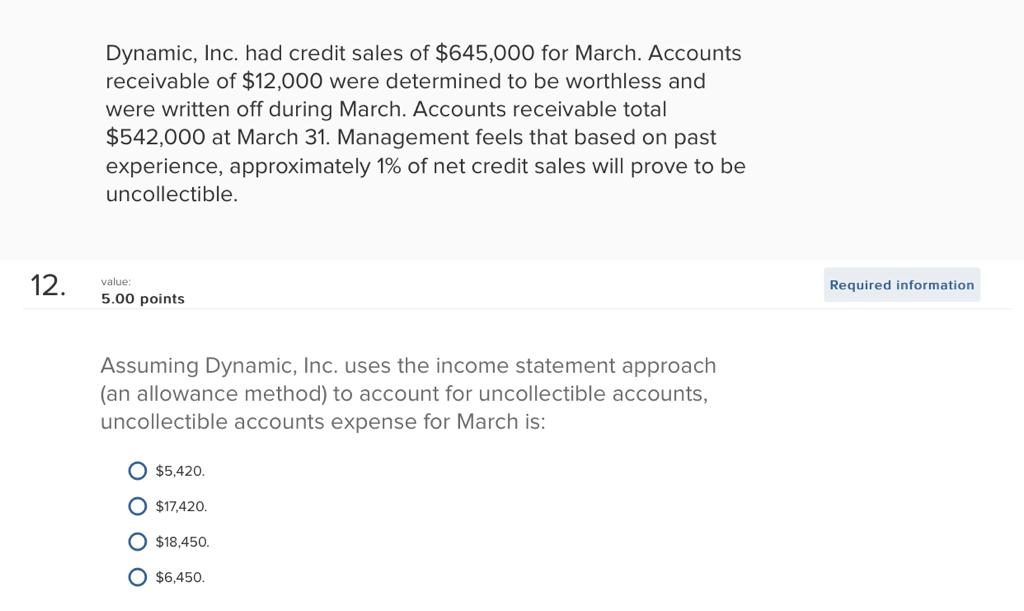

10. value 15.00 points Wilcox Mills is a manufacturer that makes all sales on 30-day credit terms. Annual sales are approximately $30 million. At the end of 2012, accounts receivable were presented in the company's statement of financial position as follows: Accounts receivable from clients Less: Allowance for Impairment $ 3,100,000 80,000 During 2013, $190,000 of specific accounts receivable were written off as uncollectible. Of these accounts written off, receivables totaling $17,000 were subsequently collected. At the end of 2013, an aging of accounts receivable indicated a need for a $253,000 allowance to cover possible failure to collect the accounts currently outstanding. Wilcox Mills makes adjusting entries for uncollectible accounts only at year-end. One entry to summarize all accounts written off against the Allowance for Impairment during 2013. 2.Entries to record the $17,000 in accounts receivable that were subsequently collected. 3. The adjusting entry required at December 31, 2013, to increase the Allowance for Impairment to $253,000. a. Prepare the above general journal entries: (Omit the "$" sign in your response.) General Journal Debit Credit Date 2013 Var." (Click to select) (Click to select) Var* (Click to select) (Click to select) Var.. (Click to select) (Click to select) Dec 31 (Click to select) (Click to select) 11. value: 15.00 points Pachel Corporation reports the following information pertaining to its accounts receivable: Current $ 60,000 1-30 $ 40,000 Days Past Due 31-60 61-90 $25,000 $ 12,000 Over 90 $2,000 The company's credit department provided the following estimates regarding the percent of accounts expected to eventually be written off from each category listed above: 2% Current receivables outstanding Receivables 1-30 days past due Receivables 31-60 days past due Receivables 61-90 days past due Receivables over 90 days past due 4 16 40 90 The company uses a statement of financial position approach to estimate credit losses. a. Record the company's impairment loss of receivable, assuming it has a $1,400 credit balance in its Allowance for Impairment prior to making the necessary adjustment. (Omit the "$" sign in your response.) Debit Credit General Journal (Click to select) (Click to select) b. Record the company's impairment loss of receivable, assuming it has a $1,600 debit balance in its Allowance for Impairment prior to making the necessary adjustment. (Omit the "$" sign in your response.) Debit Credit General Journal (Click to select) (Click to select) Dynamic, Inc. had credit sales of $645,000 for March. Accounts receivable of $12,000 were determined to be worthless and were written off during March. Accounts receivable total $542,000 at March 31. Management feels that based on past experience, approximately 1% of net credit sales will prove to be uncollectible. 12. value: 5.00 points Required information Assuming Dynamic, Inc. uses the income statement approach (an allowance method) to account for uncollectible accounts, uncollectible accounts expense for March is: 0 $5,420. $17,420. $18,450. $6,450