Answered step by step

Verified Expert Solution

Question

1 Approved Answer

10. (Variable-rate mortgage ) The Smith family just took out a variable-rate mortgage on their new home. The mortgage value is $100,000, the term is

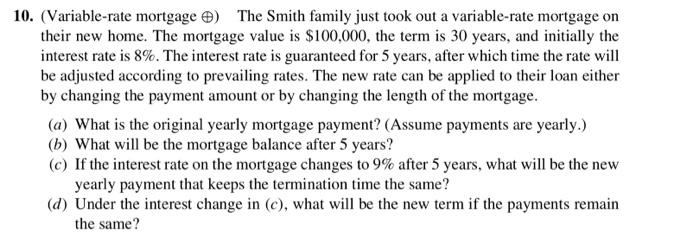

10. (Variable-rate mortgage ) The Smith family just took out a variable-rate mortgage on their new home. The mortgage value is $100,000, the term is 30 years, and initially the interest rate is 8%. The interest rate is guaranteed for 5 years, after which time the rate will be adjusted according to prevailing rates. The new rate can be applied to their loan either by changing the payment amount or by changing the length of the mortgage. (a) What is the original yearly mortgage payment? (Assume payments are yearly.) (b) What will be the mortgage balance after 5 years? (c) If the interest rate on the mortgage changes to 9% after 5 years, what will be the new yearly payment that keeps the termination time the same? (d) Under the interest change in (c), what will be the new term if the payments remain the same

10. (Variable-rate mortgage ) The Smith family just took out a variable-rate mortgage on their new home. The mortgage value is $100,000, the term is 30 years, and initially the interest rate is 8%. The interest rate is guaranteed for 5 years, after which time the rate will be adjusted according to prevailing rates. The new rate can be applied to their loan either by changing the payment amount or by changing the length of the mortgage. (a) What is the original yearly mortgage payment? (Assume payments are yearly.) (b) What will be the mortgage balance after 5 years? (c) If the interest rate on the mortgage changes to 9% after 5 years, what will be the new yearly payment that keeps the termination time the same? (d) Under the interest change in (c), what will be the new term if the payments remain the same Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started