Answered step by step

Verified Expert Solution

Question

1 Approved Answer

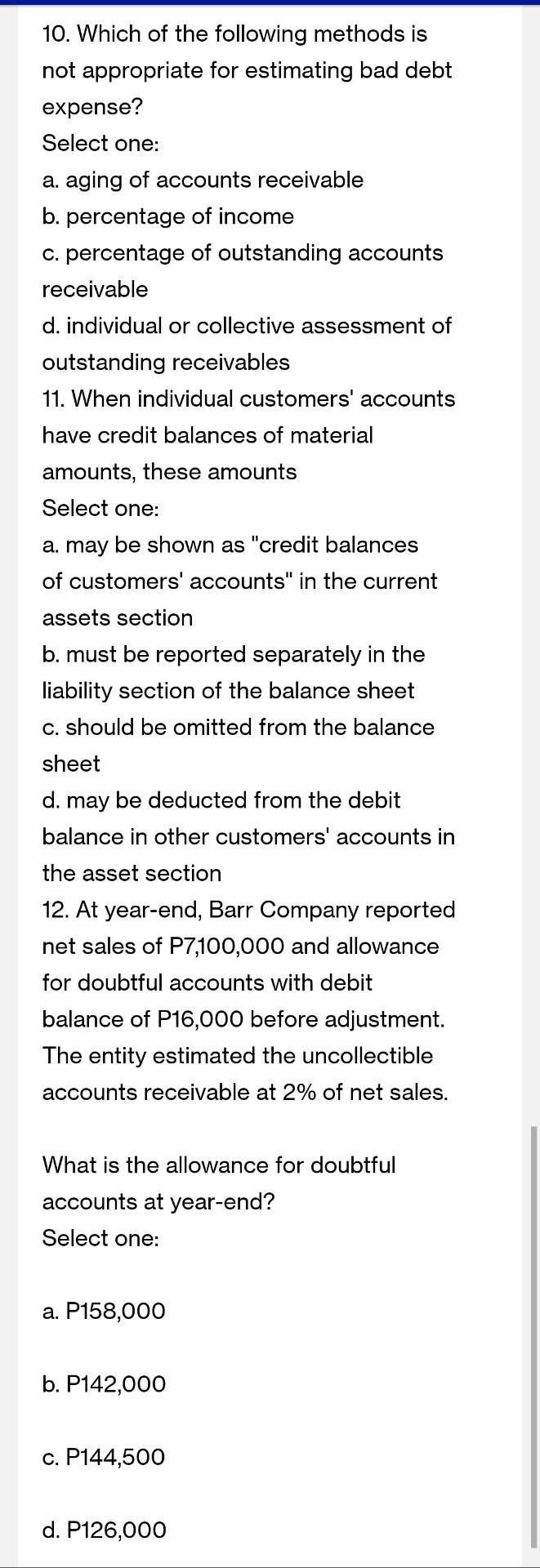

10. Which of the following methods is not appropriate for estimating bad debt expense? Select one: a. aging of accounts receivable b. percentage of income

10. Which of the following methods is not appropriate for estimating bad debt expense? Select one: a. aging of accounts receivable b. percentage of income c. percentage of outstanding accounts receivable d. individual or collective assessment of outstanding receivables 11. When individual customers' accounts have credit balances of material amounts, these amounts Select one: a. may be shown as "credit balances of customers' accounts" in the current assets section b. must be reported separately in the liability section of the balance sheet C. should be omitted from the balance sheet d. may be deducted from the debit balance in other customers' accounts in the asset section 12. At year-end, Barr Company reported net sales of P7,100,000 and allowance for doubtful accounts with debit balance of P16,000 before adjustment. The entity estimated the uncollectible accounts receivable at 2% of net sales. What is the allowance for doubtful accounts at year-end? Select one: a. P158,000 b. P142,000 c. P144,500 d. P126,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started