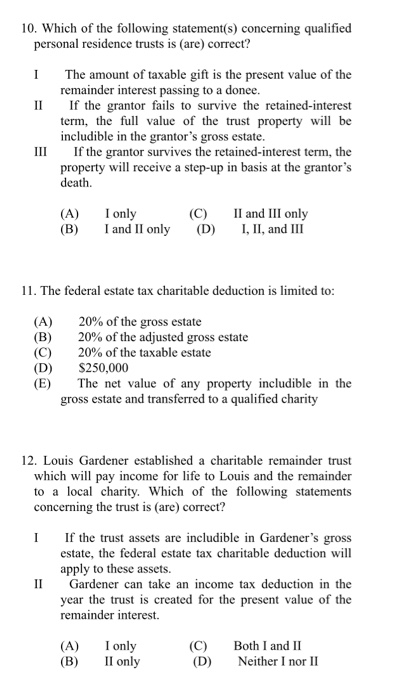

10. Which of the following statement(s) concerning qualified personal residence trusts is (are) correct? T II The amount of taxable gift is the present value of the remainder interest passing to a donee. I f the grantor fails to survive the retained-interest term, the full value of the trust property will be includible in the grantor's gross estate. If the grantor survives the retained-interest term, the property will receive a step-up in basis at the grantor's death. III (A) (B) I only I and II only (C) (D) II and III only I, II, and III 11. The federal estate tax charitable deduction is limited to: (A) (B) (C) (D) (E) 20% of the gross estate 20% of the adjusted gross estate 20% of the taxable estate $250,000 The net value of any property includible in the gross estate and transferred to a qualified charity 12. Louis Gardener established a charitable remainder trust which will pay income for life to Louis and the remainder to a local charity. Which of the following statements concerning the trust is (are) correct? If the trust assets are includible in Gardener's gross estate, the federal estate tax charitable deduction will apply to these assets. Gardener can take an income tax deduction in the year the trust is created for the present value of the remainder interest. (A) (B) I only II only (C) (D) Both I and II Neither I nor II 10. Which of the following statement(s) concerning qualified personal residence trusts is (are) correct? T II The amount of taxable gift is the present value of the remainder interest passing to a donee. I f the grantor fails to survive the retained-interest term, the full value of the trust property will be includible in the grantor's gross estate. If the grantor survives the retained-interest term, the property will receive a step-up in basis at the grantor's death. III (A) (B) I only I and II only (C) (D) II and III only I, II, and III 11. The federal estate tax charitable deduction is limited to: (A) (B) (C) (D) (E) 20% of the gross estate 20% of the adjusted gross estate 20% of the taxable estate $250,000 The net value of any property includible in the gross estate and transferred to a qualified charity 12. Louis Gardener established a charitable remainder trust which will pay income for life to Louis and the remainder to a local charity. Which of the following statements concerning the trust is (are) correct? If the trust assets are includible in Gardener's gross estate, the federal estate tax charitable deduction will apply to these assets. Gardener can take an income tax deduction in the year the trust is created for the present value of the remainder interest. (A) (B) I only II only (C) (D) Both I and II Neither I nor