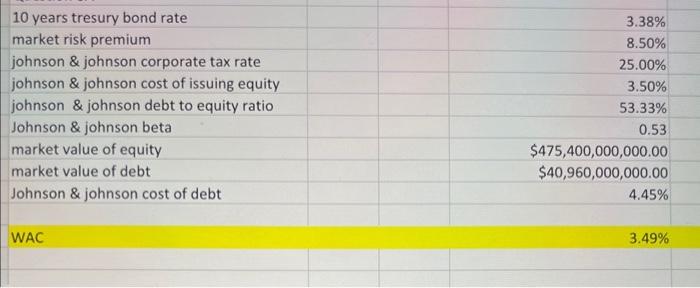

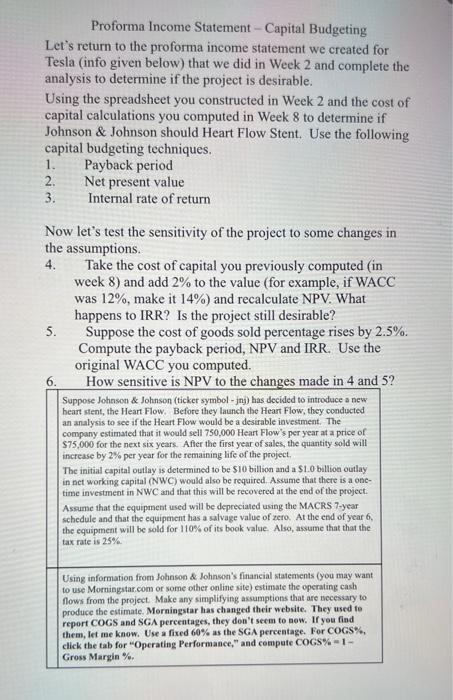

10 years tresury bond rate market risk premium johnson \& johnson corporate tax rate johnson \& johnson cost of issuing equity johnson \& johnson debt to equity ratio Johnson \& johnson beta market value of equity market value of debt Johnson \& johnson cost of debt 3.38% 8.50% 25.00% 3.50% 53.33% 0.53 0,000.00 0,000.00 4.45% WAC 3.49% Proforma Income Statement - Capital Budgeting Let's return to the proforma income statement we created for Tesla (info given below) that we did in Week 2 and complete the analysis to determine if the project is desirable. Using the spreadsheet you constructed in Week 2 and the cost of capital calculations you computed in Week 8 to determine if Johnson \& Johnson should Heart Flow Stent. Use the following capital budgeting techniques. 1. Payback period 2. Net present value 3. Internal rate of return Now let's test the sensitivity of the project to some changes in the assumptions. 4. Take the cost of capital you previously computed (in week 8 ) and add 2% to the value (for example, if WACC was 12%, make it 14% ) and recalculate NPV. What happens to IRR? Is the project still desirable? 5. Suppose the cost of goods sold percentage rises by 2.5%. Compute the payback period, NPV and IRR. Use the original WACC you computed. 6. How sensitive is NPV to the changes made in 4 and 5 ? Suppose Johnson \& Johnson (ticker symbol - jnig) has decided to introduce a new heart stent, the Heart Flow. Before they launch the Heart Flow, they conducted an analysis to see if the Heart Flow would be a desirable investment. The company estimated that it would sell 750,000 Heart Flow's per year at a price of $75,000 for the next six years. Affer the first year of sales, the quantity sold will increase by 2% per year for the remaining life of the project. The initial capital outlay is determined to be $10 billion and a $1.0 ballion outlay in net working capial (NWC) would also be required. Assume that there is a onetime investment in NWC and that this will be recovered at the end of the project. Assume that the equipment used will be depreciated using the MACRS 7-year schedule and that the equipponent has a salvage value of zero. At the end of year 6 , the equipment will be sold for 110% of its book value. Also, assume that that the tax rate is 25% Using information from Johnson & Johnson's financial statements (you may want to use Morningatarcom or some other online site) estimate the operating cash flows from the project. Make any simplifying assamptions that are necessary to produce the estimate. Morningstar has changed their website. They used te report COGS and SGA percentages, they don't seem to now. If you find them, Iet me know. Use a fixed 60% as the SGA pereentage. For COGS\%, click the tab for "Operating Performance," and cempute COGS\% =1 Gross Margin \%. 10 years tresury bond rate market risk premium johnson \& johnson corporate tax rate johnson \& johnson cost of issuing equity johnson \& johnson debt to equity ratio Johnson \& johnson beta market value of equity market value of debt Johnson \& johnson cost of debt 3.38% 8.50% 25.00% 3.50% 53.33% 0.53 0,000.00 0,000.00 4.45% WAC 3.49% Proforma Income Statement - Capital Budgeting Let's return to the proforma income statement we created for Tesla (info given below) that we did in Week 2 and complete the analysis to determine if the project is desirable. Using the spreadsheet you constructed in Week 2 and the cost of capital calculations you computed in Week 8 to determine if Johnson \& Johnson should Heart Flow Stent. Use the following capital budgeting techniques. 1. Payback period 2. Net present value 3. Internal rate of return Now let's test the sensitivity of the project to some changes in the assumptions. 4. Take the cost of capital you previously computed (in week 8 ) and add 2% to the value (for example, if WACC was 12%, make it 14% ) and recalculate NPV. What happens to IRR? Is the project still desirable? 5. Suppose the cost of goods sold percentage rises by 2.5%. Compute the payback period, NPV and IRR. Use the original WACC you computed. 6. How sensitive is NPV to the changes made in 4 and 5 ? Suppose Johnson \& Johnson (ticker symbol - jnig) has decided to introduce a new heart stent, the Heart Flow. Before they launch the Heart Flow, they conducted an analysis to see if the Heart Flow would be a desirable investment. The company estimated that it would sell 750,000 Heart Flow's per year at a price of $75,000 for the next six years. Affer the first year of sales, the quantity sold will increase by 2% per year for the remaining life of the project. The initial capital outlay is determined to be $10 billion and a $1.0 ballion outlay in net working capial (NWC) would also be required. Assume that there is a onetime investment in NWC and that this will be recovered at the end of the project. Assume that the equipment used will be depreciated using the MACRS 7-year schedule and that the equipponent has a salvage value of zero. At the end of year 6 , the equipment will be sold for 110% of its book value. Also, assume that that the tax rate is 25% Using information from Johnson & Johnson's financial statements (you may want to use Morningatarcom or some other online site) estimate the operating cash flows from the project. Make any simplifying assamptions that are necessary to produce the estimate. Morningstar has changed their website. They used te report COGS and SGA percentages, they don't seem to now. If you find them, Iet me know. Use a fixed 60% as the SGA pereentage. For COGS\%, click the tab for "Operating Performance," and cempute COGS\% =1 Gross Margin \%