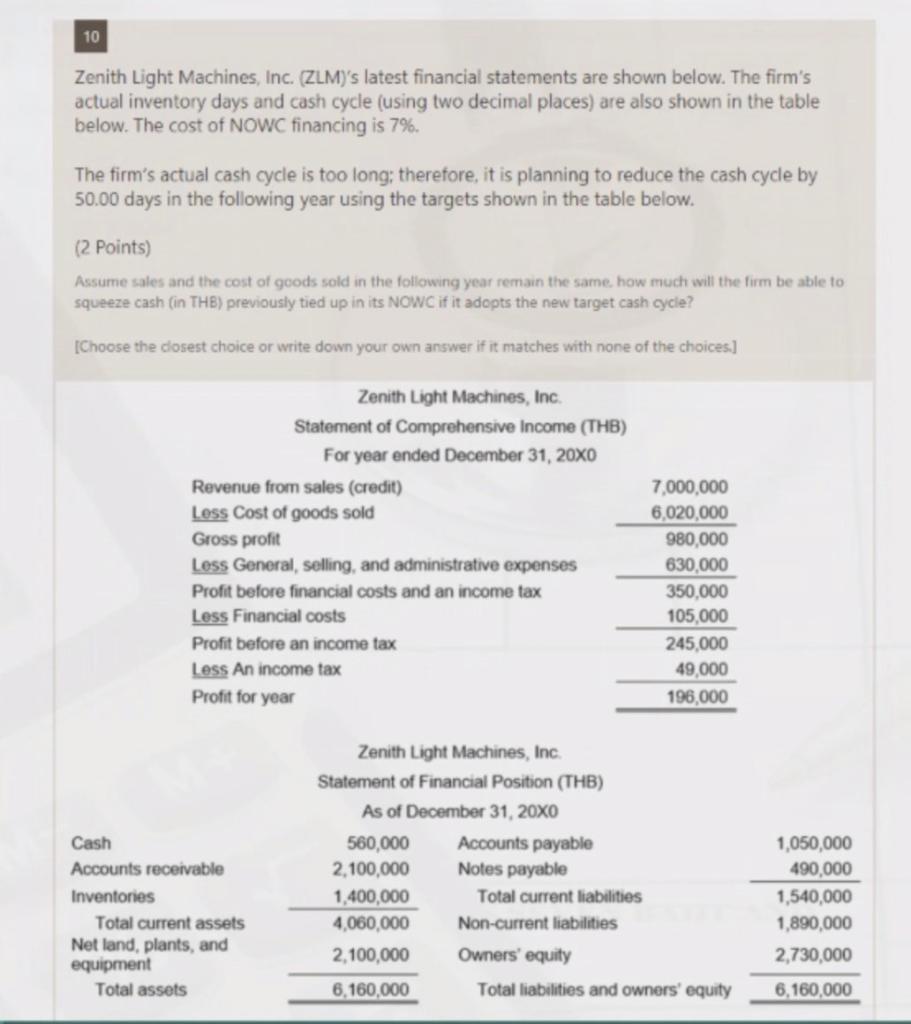

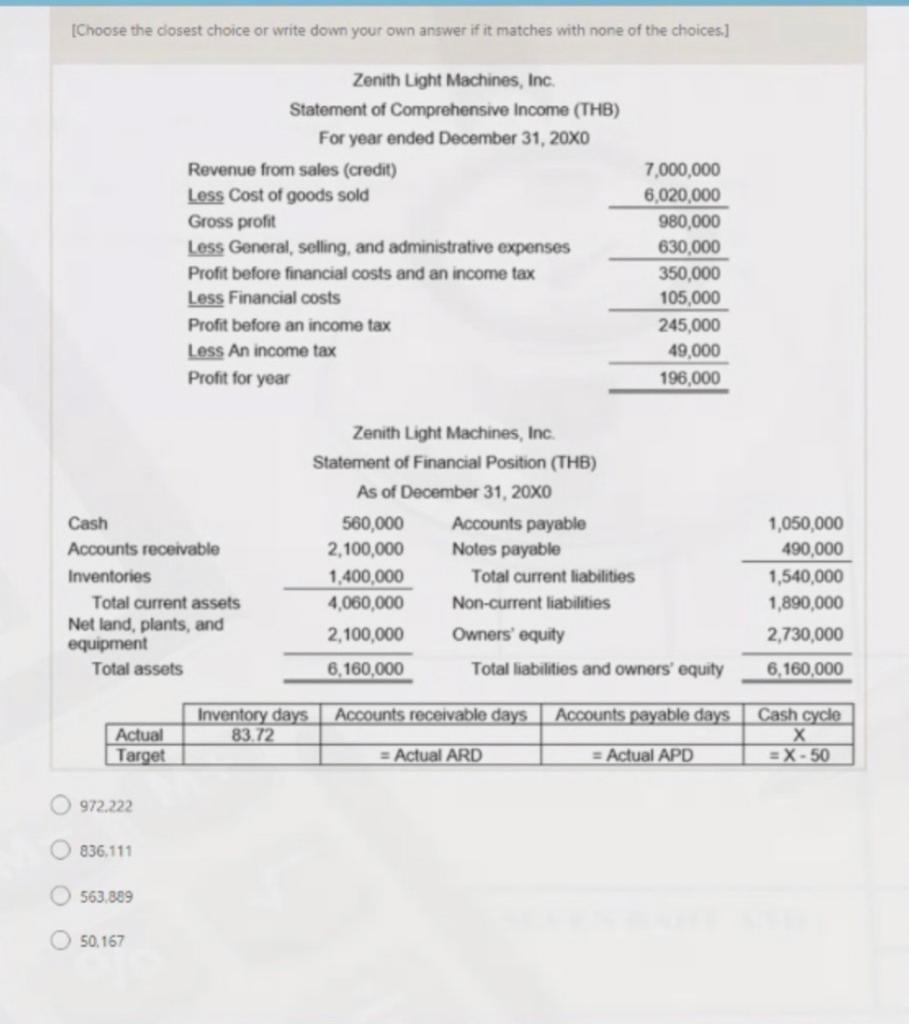

10 Zenith Light Machines, Inc. (ZLM)'s latest financial statements are shown below. The firm's actual inventory days and cash cycle (using two decimal places) are also shown in the table below. The cost of NOWC financing is 7%. The firm's actual cash cycle is too long; therefore, it is planning to reduce the cash cycle by 50.00 days in the following year using the targets shown in the table below. (2 Points) Assume sales and the cost of goods sold in the following year remain the same, how much will the firm be able to squeeze cash (in THB) previously tied up in its NOWC if it adopts the new target cash cycle? [Choose the closest choice or write down your own answer if it matches with none of the choices.] Zenith Light Machines, Inc. Statement of Comprehensive Income (THB) For year ended December 31, 20X0 Revenue from sales (credit) 7,000,000 Less Cost of goods sold 6,020,000 Gross profit 980,000 630,000 Less General, selling, and administrative expenses Profit before financial costs and an income tax 350,000 Less Financial costs 105,000 Profit before an income tax 245,000 Less An income tax 49,000 Profit for year 196,000 Zenith Light Machines, Inc. Statement of Financial Position (THB) As of December 31, 20x0 560,000 Accounts payable 2,100,000 Notes payable 1,400,000 4,060,000 2,100,000 6,160,000 Cash Accounts receivable Inventories Net land, plants, and equipment Total assets Total current assets Total current liabilities Non-current liabilities Owners' equity Total liabilities and owners' equity 1,050,000 490,000 1,540,000 1,890,000 2,730,000 6,160,000 [Choose the closest choice or write down your own answer if it matches with none of the choices.] Zenith Light Machines, Inc. Statement of Comprehensive Income (THB) For year ended December 31, 20X0 Revenue from sales (credit) 7,000,000 Less Cost of goods sold 6,020,000 Gross profit 980,000 630,000 Less General, selling, and administrative expenses Profit before financial costs and an income tax Less Financial costs 350,000 105,000 Profit before an income tax 245,000 Less An income tax 49,000 Profit for year 196,000 Zenith Light Machines, Inc. Statement of Financial Position (THB) As of December 31, 20X0 560,000 Accounts payable 2,100,000 Notes payable 1,400,000 4,060,000 Non-current liabilities 2,100,000 Owners' equity 6,160,000 Total liabilities and owners' equity Accounts receivable days Accounts payable days = Actual ARD = Actual APD Cash Accounts receivable Inventories Net land, plants, and equipment Total assets Actual Target Total current assets 972.222 836.111 563.889 50.167 Inventory days 83.72 Total current liabilities 1,050,000 490,000 1,540,000 1,890,000 2,730,000 6,160,000 Cash cycle X =X-50 10 Zenith Light Machines, Inc. (ZLM)'s latest financial statements are shown below. The firm's actual inventory days and cash cycle (using two decimal places) are also shown in the table below. The cost of NOWC financing is 7%. The firm's actual cash cycle is too long; therefore, it is planning to reduce the cash cycle by 50.00 days in the following year using the targets shown in the table below. (2 Points) Assume sales and the cost of goods sold in the following year remain the same, how much will the firm be able to squeeze cash (in THB) previously tied up in its NOWC if it adopts the new target cash cycle? [Choose the closest choice or write down your own answer if it matches with none of the choices.] Zenith Light Machines, Inc. Statement of Comprehensive Income (THB) For year ended December 31, 20X0 Revenue from sales (credit) 7,000,000 Less Cost of goods sold 6,020,000 Gross profit 980,000 630,000 Less General, selling, and administrative expenses Profit before financial costs and an income tax 350,000 Less Financial costs 105,000 Profit before an income tax 245,000 Less An income tax 49,000 Profit for year 196,000 Zenith Light Machines, Inc. Statement of Financial Position (THB) As of December 31, 20x0 560,000 Accounts payable 2,100,000 Notes payable 1,400,000 4,060,000 2,100,000 6,160,000 Cash Accounts receivable Inventories Net land, plants, and equipment Total assets Total current assets Total current liabilities Non-current liabilities Owners' equity Total liabilities and owners' equity 1,050,000 490,000 1,540,000 1,890,000 2,730,000 6,160,000 [Choose the closest choice or write down your own answer if it matches with none of the choices.] Zenith Light Machines, Inc. Statement of Comprehensive Income (THB) For year ended December 31, 20X0 Revenue from sales (credit) 7,000,000 Less Cost of goods sold 6,020,000 Gross profit 980,000 630,000 Less General, selling, and administrative expenses Profit before financial costs and an income tax Less Financial costs 350,000 105,000 Profit before an income tax 245,000 Less An income tax 49,000 Profit for year 196,000 Zenith Light Machines, Inc. Statement of Financial Position (THB) As of December 31, 20X0 560,000 Accounts payable 2,100,000 Notes payable 1,400,000 4,060,000 Non-current liabilities 2,100,000 Owners' equity 6,160,000 Total liabilities and owners' equity Accounts receivable days Accounts payable days = Actual ARD = Actual APD Cash Accounts receivable Inventories Net land, plants, and equipment Total assets Actual Target Total current assets 972.222 836.111 563.889 50.167 Inventory days 83.72 Total current liabilities 1,050,000 490,000 1,540,000 1,890,000 2,730,000 6,160,000 Cash cycle X =X-50