Answered step by step

Verified Expert Solution

Question

1 Approved Answer

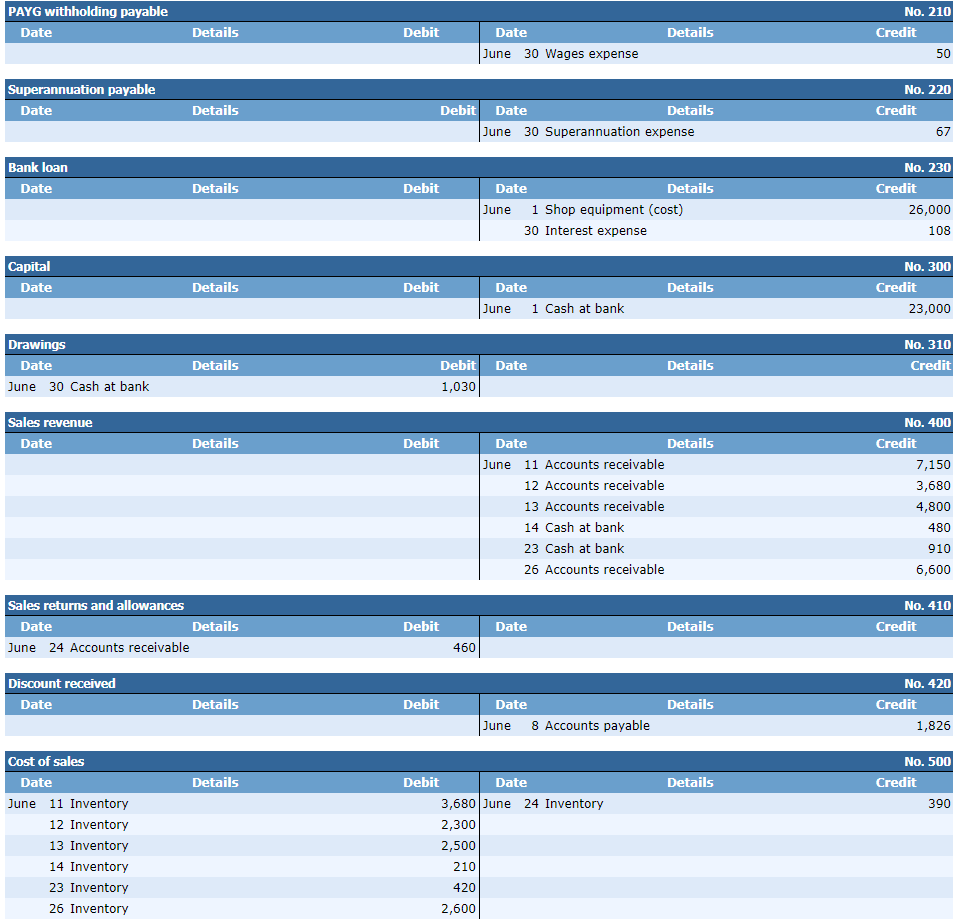

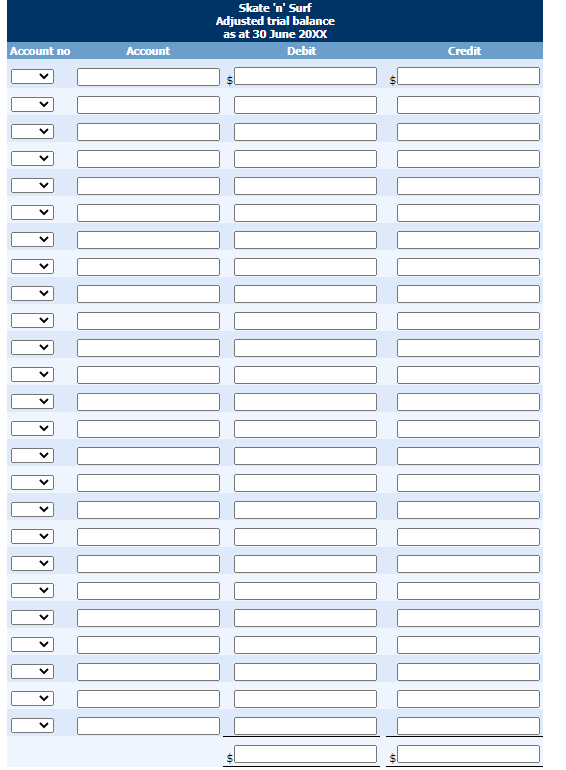

100 Cash at bank 110 Accounts receivable 120 Inventory 130 Prepaid insurance 171 Shop equipment (cost) 172 Accumulated depreciation - shop equipment 200 Accounts payable

| 100 | Cash at bank | |

| 110 | Accounts receivable | |

| 120 | Inventory | |

| 130 | Prepaid insurance | |

| 171 | Shop equipment (cost) | |

| 172 | Accumulated depreciation - shop equipment | |

| 200 | Accounts payable | |

| 210 | PAYG withholding payable | |

| 220 | Superannuation payable | |

| 230 | Bank loan | |

| 300 | Capital | |

| 310 | Drawings | |

| 320 | Profit or loss summary | |

| 400 | Sales revenue | |

| 410 | Sales returns and allowances | |

| 420 | Discount received | |

| 500 | Cost of sales | |

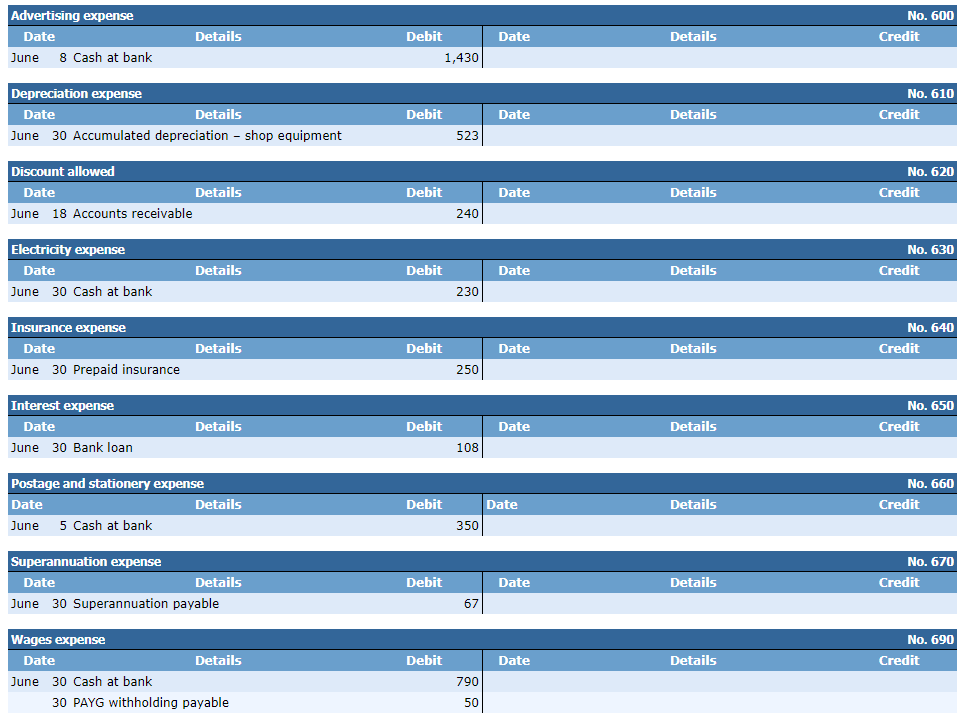

| 600 | Advertising expense | |

| 610 | Depreciation expense | |

| 620 | Discount allowed | |

| 630 | Electricity expense | |

| 640 | Insurance expense | |

| 650 | Interest expense | |

| 660 | Postage and stationery expense | |

| 670 | Superannuation expense | |

| 680 | Telephone expense | |

| 690 | Wages expense |

| Transactions | |||

| June | 1 | The owner opened a bank account for the business with a deposit of $23,000. This is capital provided by him. | |

| 1 | Purchased display stands, shelving etc. (shop equipment) from Shop Displays Pty Ltd for $26,400 and computer equipment for the shop from Computer Wizards for $5,000. These were paid for with a loan of $26,000 from the bank and cheque for $5,400 from the business bank account. The bank loan is repayable over 4 years. | ||

| 1 | Paid $3,000 for a 1-year insurance policy covering fire, theft, and public liability. | ||

| 2 | Purchased inventory (skateboards and protective gear) from Excitement Plus for $20,600 on terms on net 30. | ||

| 5 | Cash purchase of postage stamps and stationery from Australia Post for $350. | ||

| 7 | Purchased surfboards and wetsuits from Surf Imports for $18,260 on terms of 10/10, n/30. | ||

| 8 | Paid $1,430 to Local Newspapers for advertising for the shop for the month. | ||

| 8 | Paid Surf Imports the amount owing to them less the prompt payment discount. | ||

| 11 | Credit sale to Surfing World of various inventory items for $7,150 (cost of sales $3,680). Terms net 30. | ||

| 12 | Credit sale to Academy Diving School of 16 wetsuits at a discounted price of $230 each on terms of net 15. Cost of sales $2,300. | ||

| 13 | Credit sale to Serious Fun of skateboards and protective gear for $4,800 (cost of sales $2,500). This customer was given terms of 5/10, n/30. | ||

| 14 | Cash sale of a skateboard and protective gear for $480 (cost of sales $210). | ||

| 18 | Received a cheque from Serious Fun for the amount owing by them after deducting the prompt payment discount. | ||

| 23 | Cash sale of inventory to the value of $910 (cost of sales $420). | ||

| 24 | Issued an adjustment note (credit note) to Academy Diving School for 2 wetsuits at $230 each that was not the size they required. The cost of the wetsuits to us was $390 and they were put back into inventory. | ||

| 25 | Paid Excitement Plus $5,300 of the amount owing to them. | ||

| 26 | Credit sale to Serious Fun of skateboards for $6,600 (cost of sales $2,600). Terms 5/10, n/30. | ||

| 27 | Purchased wetsuits from Surf Imports for $7,100 on terms of 10/10, n/30. | ||

| 27 | Received and banked a cheque from Academy Diving School for the amount owing by them. | ||

| 30 | Paid Energy Australia $230 for electricity expenses. | ||

| 30 | The owner cashed a cheque for $1,820 to pay wages to Scott Walker the sales assistant of $840 less PAYG Withholding of $50, and $1,030 drawings for himself. | ||

The end of month adjustments are below.

| a. | Depreciation on shop equipment for the month is 20% p.a. prime cost (straight line). |

| b. | One-twelfth of the insurance expired. |

| c. | Superannuation payable for the month is 8% of the gross wages paid. |

| d. | Interest charged on the bank loan for the month was $108. |

Prepare an adjusted trial balance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started