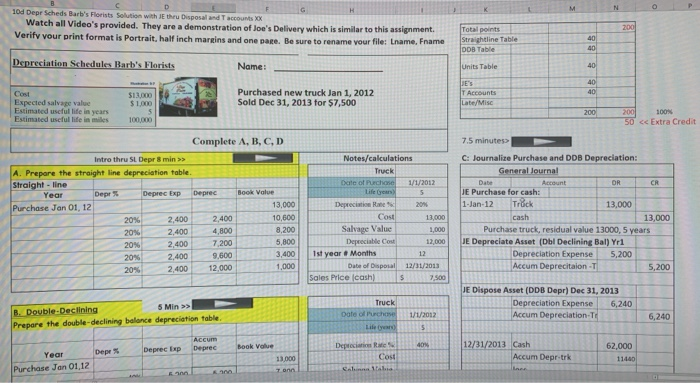

100 Depr Scheds Barb's Florists Solution with thru Disposal and accounts xx Watch all Video's provided. They are a demonstration of Joe's Delivery which is similar to this assignment. Verify your print format is Portrait, half inch margins and one pare. Be sure to rename your file: name, Frame Total points Straightline Table Depreciation Schedules Barb's Florists Name: Units Table Purchased new truck Jan 1, 2012 Sold Dec 31, 2013 for $7,500 Late/Misc Expected salvage value Estimated useful life in years Estimated useful life in miles 100.000 200 100% 50 > A. Prepare the straight line depreciation table. Straight-line Year Depr Deprec Exp Deprec B ook Value Purchase Jan 01, 12 13,000 20% 2,400 2,400 10,600 20% 2.400 4.800 8.200 20% 2,400 7200 5.800 20% 2.400 9,600 20% 2,400 12.000 1,000 Notes/calculations Truck Date of Purchase 1/1/2012 Life O S Depreciation Rate 20% Cost 13.000 Salvace Value 1.000 Dereciate Cou 1 2,000 Ist year. Months 12 Date of Disposal 12/31/2013 Sales Price cash) $ 2.500 7.5 minutes C: Journalize Purchase and DDB Depreciation: General Journal IOR I CR JE Purchase for cash: 1-Jan-12 Trock 13,000 cash 13,000 Purchase truck, residual value 13000, 5 years JE Depreciate Asset (Dbl Declining Bal) Yri Depreciation Expense 5,200 Accum Deprecitaion- T 5 ,200 3.400 JE Dispose Asset (DDB Depr) Dec 31, 2013 Depreciation Expense 6,240 Accum Depreciation-T Truck Date of Purchase Life (years) B. Double-Declining 5 Min >> Prepare the double-declining balance depreciation table 1/1/2012 6,240 Accum Deprec ExpDeprec Depreciati 40 Depes e Cost 12/31/2013 Cash Accum Depr.tr Year Purchase Jan 01,12 62,000 11440 100 Depr Scheds Barb's Florists Solution with thru Disposal and accounts xx Watch all Video's provided. They are a demonstration of Joe's Delivery which is similar to this assignment. Verify your print format is Portrait, half inch margins and one pare. Be sure to rename your file: name, Frame Total points Straightline Table Depreciation Schedules Barb's Florists Name: Units Table Purchased new truck Jan 1, 2012 Sold Dec 31, 2013 for $7,500 Late/Misc Expected salvage value Estimated useful life in years Estimated useful life in miles 100.000 200 100% 50 > A. Prepare the straight line depreciation table. Straight-line Year Depr Deprec Exp Deprec B ook Value Purchase Jan 01, 12 13,000 20% 2,400 2,400 10,600 20% 2.400 4.800 8.200 20% 2,400 7200 5.800 20% 2.400 9,600 20% 2,400 12.000 1,000 Notes/calculations Truck Date of Purchase 1/1/2012 Life O S Depreciation Rate 20% Cost 13.000 Salvace Value 1.000 Dereciate Cou 1 2,000 Ist year. Months 12 Date of Disposal 12/31/2013 Sales Price cash) $ 2.500 7.5 minutes C: Journalize Purchase and DDB Depreciation: General Journal IOR I CR JE Purchase for cash: 1-Jan-12 Trock 13,000 cash 13,000 Purchase truck, residual value 13000, 5 years JE Depreciate Asset (Dbl Declining Bal) Yri Depreciation Expense 5,200 Accum Deprecitaion- T 5 ,200 3.400 JE Dispose Asset (DDB Depr) Dec 31, 2013 Depreciation Expense 6,240 Accum Depreciation-T Truck Date of Purchase Life (years) B. Double-Declining 5 Min >> Prepare the double-declining balance depreciation table 1/1/2012 6,240 Accum Deprec ExpDeprec Depreciati 40 Depes e Cost 12/31/2013 Cash Accum Depr.tr Year Purchase Jan 01,12 62,000 11440