Answered step by step

Verified Expert Solution

Question

1 Approved Answer

100% Fully charged Chapter 11 Current Labies and Payroll Accounting 423 pense and income or's times interest st payments if the Company has one employee.

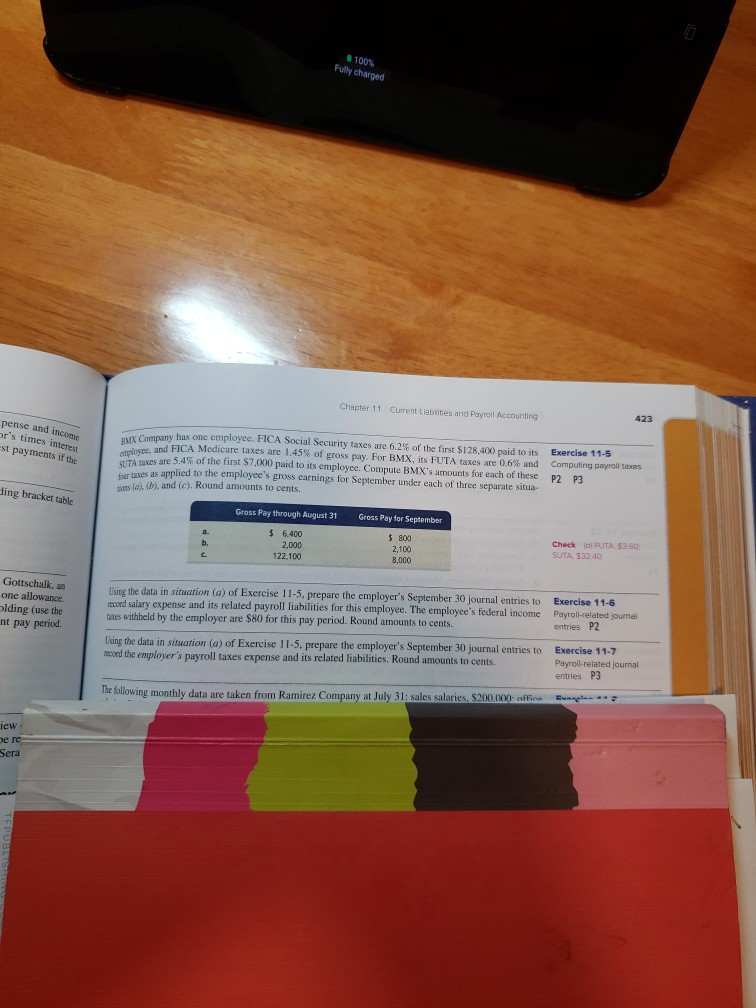

100% Fully charged Chapter 11 Current Labies and Payroll Accounting 423 pense and income or's times interest st payments if the Company has one employee. FICA Social Security taxes are 6.2% of the first $128,400 paid to its and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and ses are 5.4% of the first $7.000 paid to its employee Compute BMX's amounts for each of these es as applied to the employee's gross earnings for September under each of three separate situa us al. (band (c). Round amounts to cents. Exercise 11-5 Computing payroll taxes P2 P3 ding bracket table Gross Pay through August 31 Gross Pay for September $ 6.400 2,000 122.100 $ 800 2,100 8,000 Check FUTA, 5360 SUTA 532 40 Gottschalk, an one allowance olding (use the nt pay period. Using the data in situation (a) of Exercise 11-5, prepare the employer's September 30 journal entries to moord salary expense and its related payroll liabilities for this employee. The employee's federal income taxes withheld by the employer are $80 for this pay period. Round amounts to cents. Exercise 11-6 Payroll-related journal entries P2 Using the data in situation (a) of Exercise 11-5. prepare the employer's September 30 journal entries to record the employer's payroll taxes expense and its related liabilities. Round amounts to cents. Exercise 11-7 Payroll-related journal entries P3 The following monthly data are taken from Ramirez Company at July 31: sales salaries, S200.000 affia n Tew bere Sera

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started