100 percent correct answer please

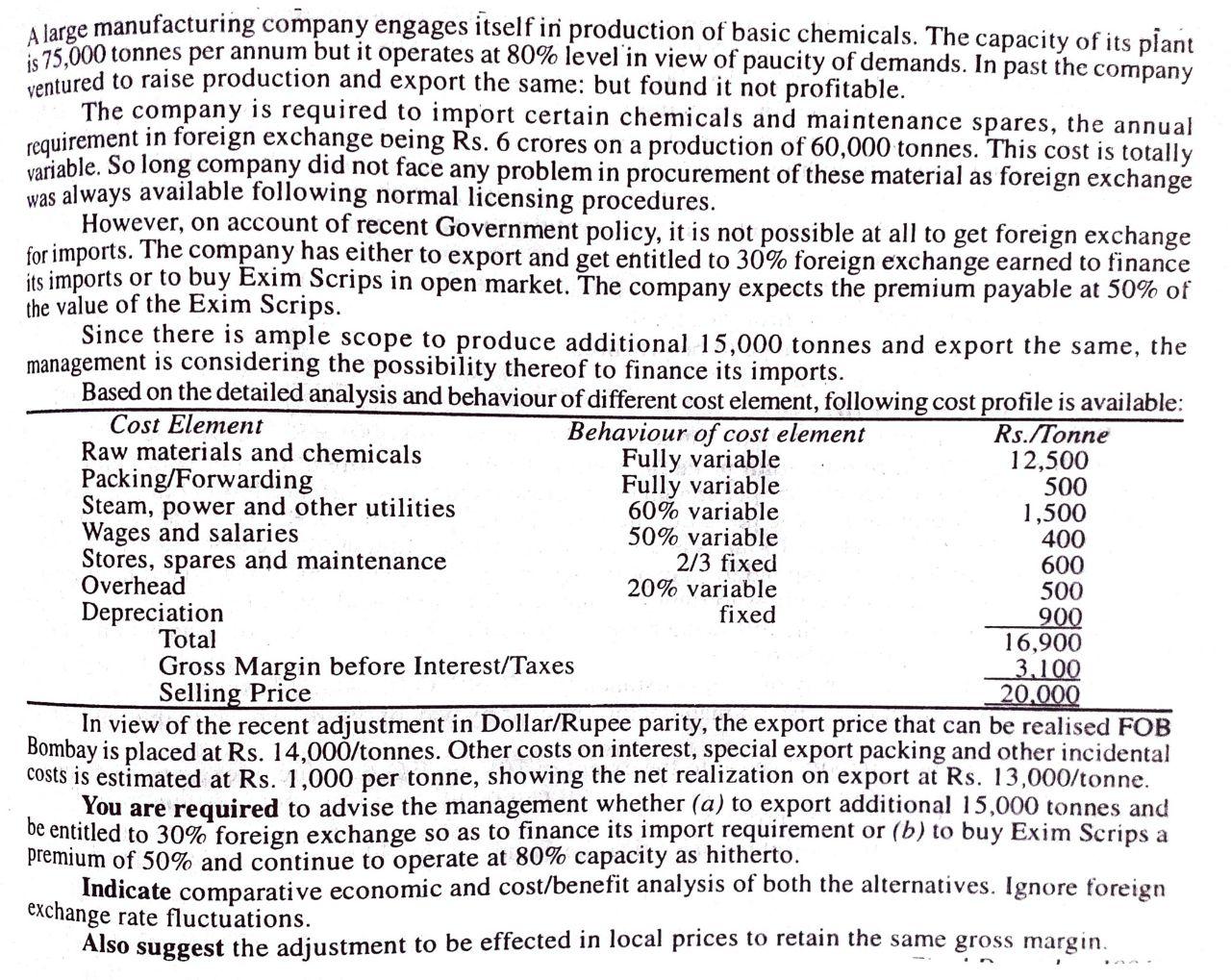

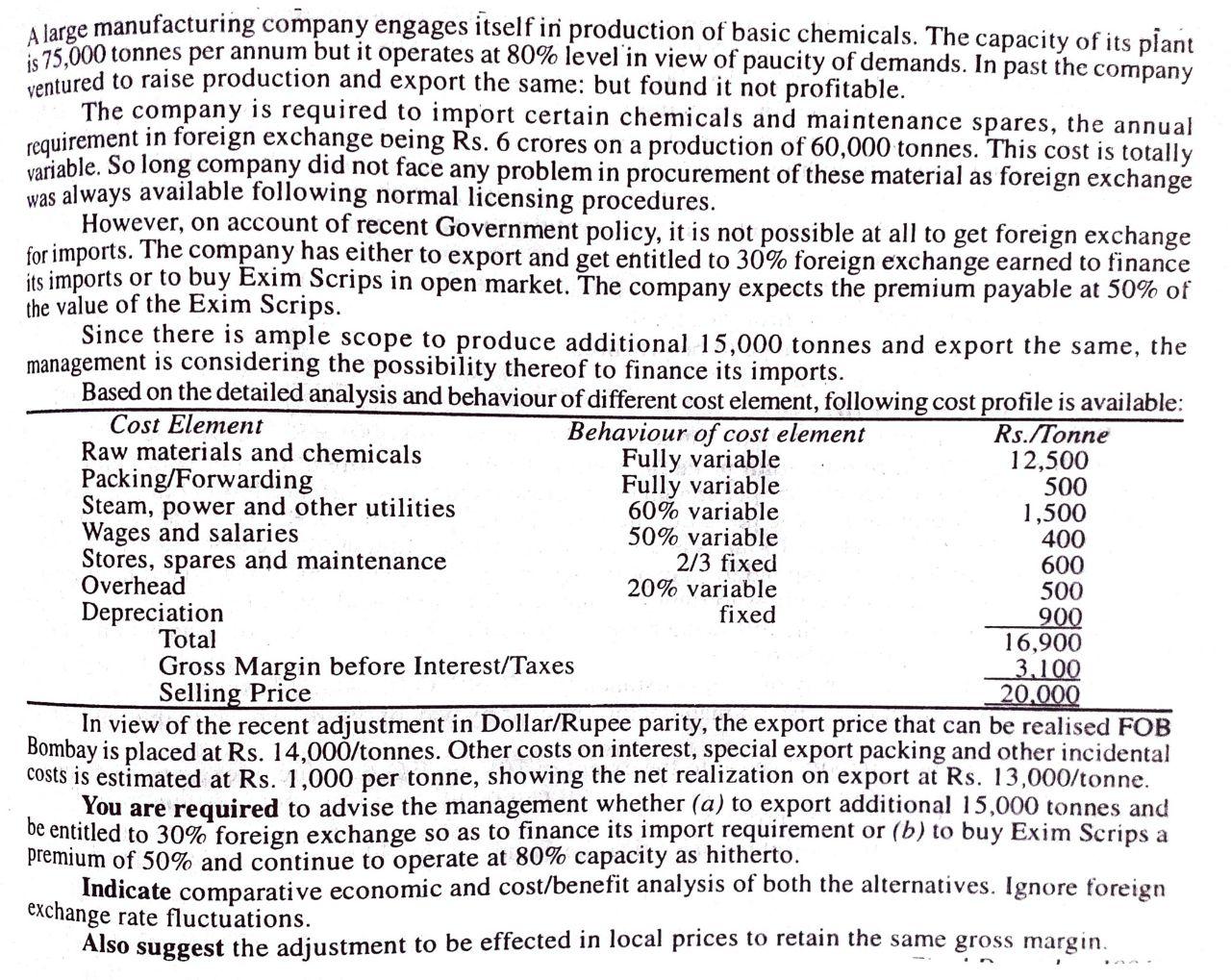

A large manufacturing company engages itself in production of basic chemicals. The capacity of its plant 1575,000 tonnes per annum but it operates at 80% level in view of paucity of demands. In past the company ventured to raise production and export the same: but found it not profitable. The company is required to import certain chemicals and maintenance spares, the annual requirement in foreign exchange being Rs. 6 crores on a production of 60,000 tonnes. This cost is totally variable. So long company did not face any problem in procurement of these material as foreign exchange was always available following normal licensing procedures. However, on account of recent Government policy, it is not possible at all to get foreign exchange for imports. The company has either to export and get entitled to 30% foreign exchange earned to finance its imports or to buy Exim Scrips in open market. The company expects the premium payable at 50% of the value of the Exim Scrips. Since there is ample scope to produce additional 15,000 tonnes and export the same, the management is considering the possibility thereof to finance its imports. Based on the detailed analysis and behaviour of different cost element, following cost profile is available: Cost Element Behaviour of cost element Rs./Tonne Raw materials and chemicals Fully variable 12,500 Packing/Forwarding Fully variable 500 Steam, power and other utilities 60% variable 1,500 Wages and salaries 50% variable 400 Stores, spares and maintenance 2/3 fixed 600 Overhead 20% variable 500 Depreciation fixed 900 Total 16,900 Gross Margin before Interest/Taxes 3.100 Selling Price 20.000 In view of the recent adjustment in Dollar/Rupee parity, the export price that can be realised FOB Bombay is placed at Rs. 14,007/tonnes. Other costs on interest, special export packing and other incidental costs is estimated at Rs. 1,000 per tonne, showing the net realization on export at Rs. 13,000/tonne. You are required to advise the management whether (a) to export additional 15,000 tonnes and be entitled to 30% foreign exchange so as to finance its import requirement or (b) to buy Exim Scrips a premium of 50% and continue to operate at 80% capacity as hitherto. Indicate comparative economic and cost/benefit analysis of both the alternatives. Ignore foreign exchange rate fluctuations. Also suggest the adjustment to be effected in local prices to retain the same gross margin