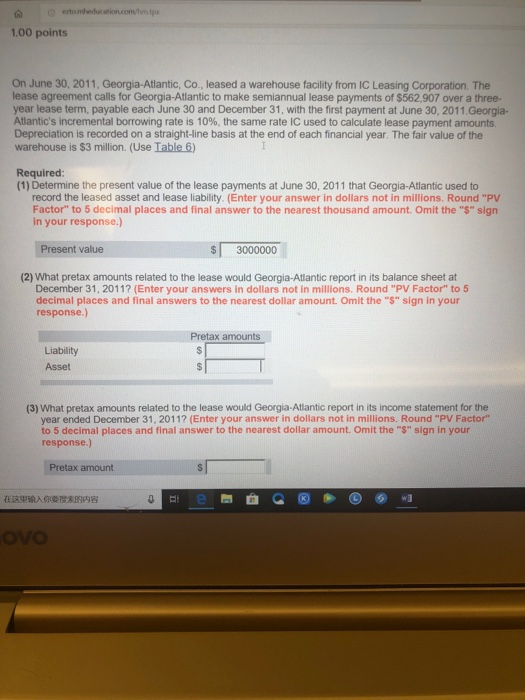

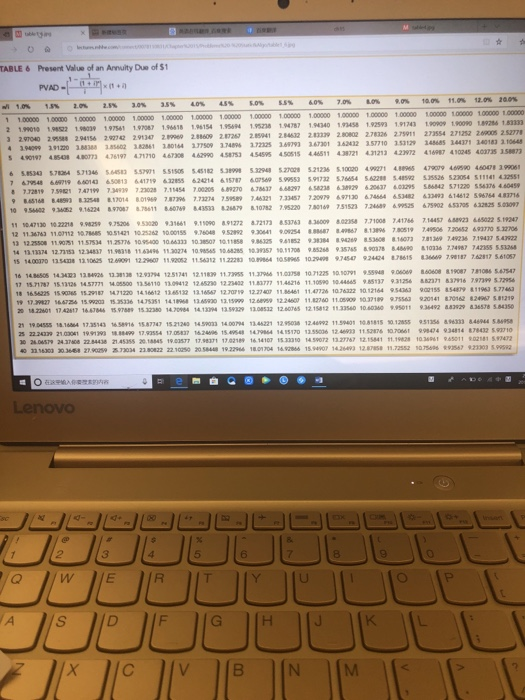

1.00 points On June 30, 2011, Georgia-Atlantic, Co., leased a warehouse facility from IC Leasing Corporation. The lease agreement calls for Georgia-Atlantic to make semiannual lease payments of $562,907 over a three- year lease term, payable each June 30 and December 31, with the first payment at June 30, 2011.Georgia- Atlantic's incremental borrowing rate is 10%, the same rate IC used to calculate lease payment amounts. Depreciation is recorded on a straight-line basis at the end of each financial year. The fair value of the warehouse is $3 million. (Use Table 6) Required: (1) Determine the present value of the lease payments at June 30, 2011 that Georgia-Atlantic used to record the leased asset and lease liability. (Enter your answer in dollars not in millions. Round "PV Factor" to 5 decimal places and final answer to the nearest thousand amount. Omit the "$" sigrn in your response.) Present value S 3000000 (2) What pretax amounts related to the lease would Georgia-Atlantic report in its balance sheet at December 31, 2011? (Enter your answers in dollars not in millions. Round "PV Factor" to 5 decimal places and final answers to the nearest dollar amount. Omit the "$" sign in your response.) Pretax amounts Liability Asset (3) What pretax amounts related to the lease would Georgia-Atlantic report in its income statement for the year ended December 31, 2011? (Enter your answer in dollars not in millions. Round "PV Factor" to 5 decimal places and final answer to the nearest dollar amount. Omit the "$" sign in your response.) Pretax amount TABLE 6 Present Value of an Annuity Due of $1 PVAD- s.0% s.5% 60% 7.0% &0% 9,0% 10.0% 11.0% 12.0% 2a0% 10% ,3% 2.0% 2.5% 3.0% 3.5% 10% 45% 11,00000 1,00000 1,00000 1.0000 1,.00000 1,00000 1,00000 1.00000 1,00000 1,00000 1.00000 100000 1,00000 1,00000 1,00000 100000 1,00000 1.00000 94099 3.91220 3.88388 3.85602 3.82861 3.80144 490, I 'En 476197 471710 467308 4A2990 458753 454995 4SSIS 446811 43872, 421213 422972 41eg87 410245 400735 is" s 641719325 62414 61577 07560 5.99553 5.91732 5.76654 5.6220 5.48592 35526 523054 511141432551 47199 734939 723028 71154 700205 689270 67637 68297 658238 638929 620437 032 5.86842 571220 554376 460459 79548 6 69719 60143 50813 10seses sas8285 57 10.11706 9 266 9 35765 8.90 78 848690 &10326 ,74987 742S5 553268 17 15.71787 15.13t26 1457771 1408800 Tase110 309412 1245230 1225402 1181777 11.46216 1110990 td44d45 ,AStr "use ann uns ,97 snese 975563 17 39827 5326 14 18260 1109 03719 1.03041 19 1792554 17 12.4693 11 s2876 21.45358 20.15 702189 1614 4107 15 333 2