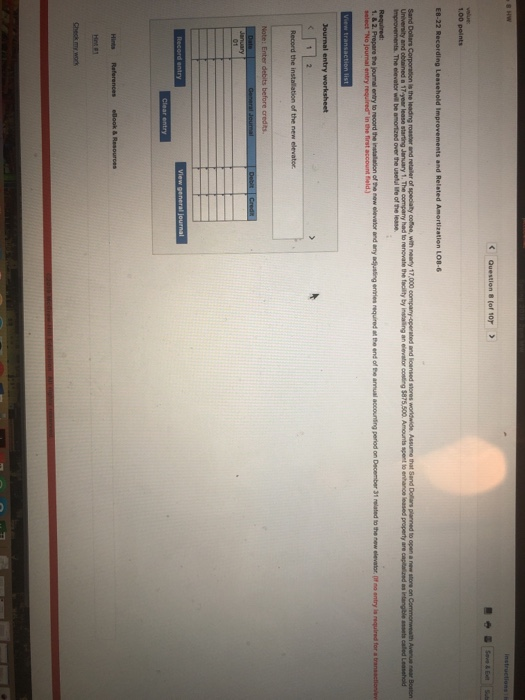

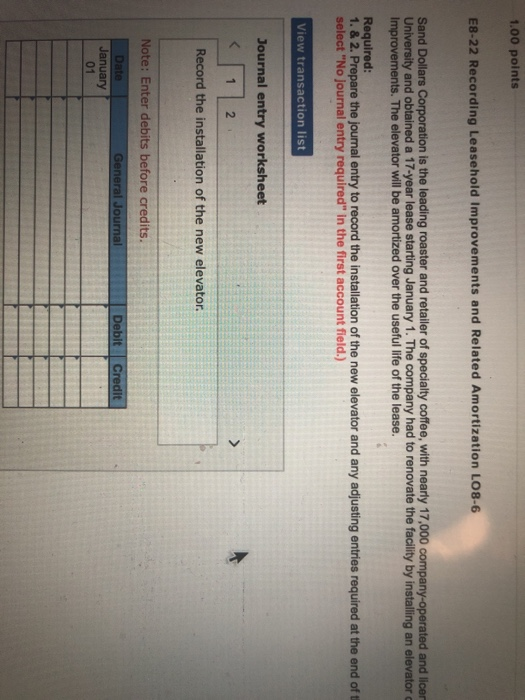

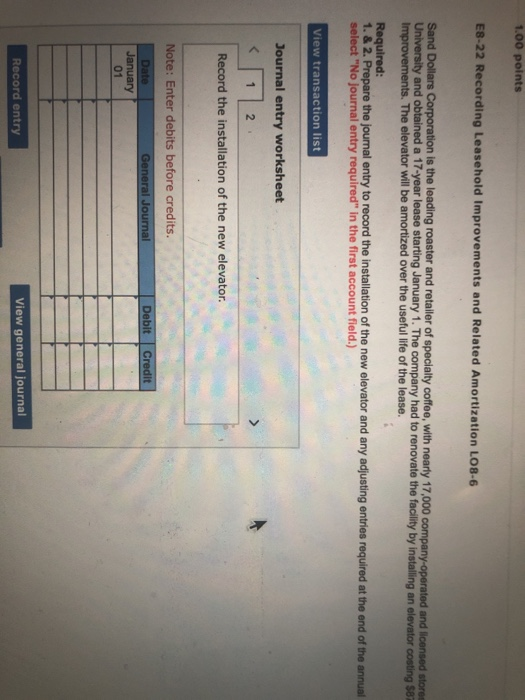

1.00 points Required: 1.00 points E8-22 Recording Leasehold Improvements and Related Amortization LO8-6 Sand Dollars Corporation is the leading roaster and retailer of specialty coffee, with nearly 17,000 company-operated and licer University and obtained a 17-year lease starting January 1. The company had to renovate the facility by installing an elevator c Improvements. The elevator will be amortized over the useful life of the lease. Required: 1. & 2. Prepare the journal entry to record the installation of the new elevator and any adjusting entries required at the end of t select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the installation of the new elevator Note: Enter debits before credits General Jou redi January 01 installing an elevator costing $875,500. Amounts spent to enhance leased property are capitalized as at the end of the annual accounting period on December 31 related to the new elevator. (If no entry is required for a 1.00 points E8-22 Recording Leasehold Improvements and Related Amortization LO8-6 Sand Dollars Corporation is the leading roaster and retailer of specialty coffee, with nearly 17,000 University and obtained a 17-year lease starting January 1. The company had to renovate the facility by instaling an elevator costing $8 The elevator will be a over the useful life of the lease the journal entry to record the installation of the new elevator and any adjusting entries required at the end of the annual select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 2 Record the installation of the new elevator Note: Enter debits before credits Debit Credit 01 Record entry View general journal Save & Exit Subm ated and licensed stores worldwide. Assume that Sand Dollars planned to open a new store on Commonwealth Avenue near Boston an elevator costing $875,500. Amounts spent to enhance leased property are capitalized as intangible assets called Leasehold t the end of the annual accountng period cn Decamber 31 rlated to the now elevator: If no entry le requre for a tranasctione accounting period on December 31 related to the new elevator. (If no entry is required for a transaction/ev Sand select "No journal entry required" in the first account field.) select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 2 Record the installation of the new elevator Note: Enter debits before credits. Da it January 01 Record entry View general journal Clear entry Hints eBook & Resources Check my work View transaction list Journal entry worksheet Record the adjusting entry on December 31 (if necessary), related to the new elevator. Note: Enter debits before credits Debit Credit General Journal December 31 Record entry View general journal Clear entry Hints References eBook & Resources Hint#1