Answered step by step

Verified Expert Solution

Question

1 Approved Answer

100 Print 1 Reference Hank started a new business, Hank's Donut World HW for short), in June of last year. He has requested your

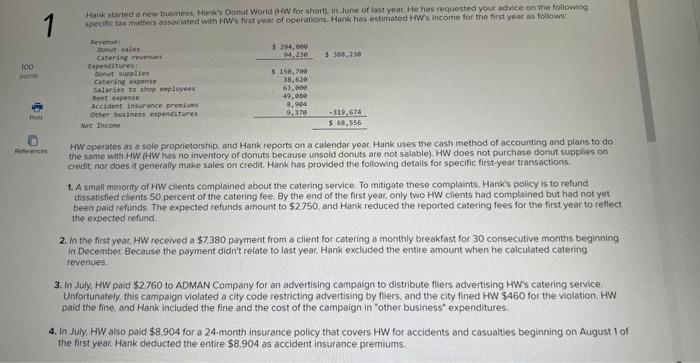

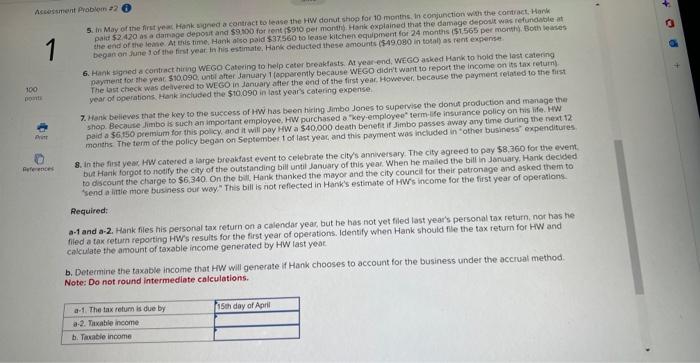

100 Print 1 Reference Hank started a new business, Hank's Donut World HW for short), in June of last year. He has requested your advice on the following specific tax matters associated with HW's first year of operations Hank has estimated HW's income for the first year as follows Revenue Donut sales Catering revenues Expenditures:" Donut supplies Catering expe Salaries to shop employees Rent expense Accident insurance premiums Other business expenditures Net Income $294,000 94,230 $ 388,230 $150,700 38,620 63,000 49,050 8,904 9,370 -319,674 $ 68,556 HW operates as a sole proprietorship, and Hank reports on a calendar year. Hank uses the cash method of accounting and plans to do the same with HW (HW has no inventory of donuts because unsold donuts are not salable). HW does not purchase donut supplies on credit, nor does it generally make sales on credit. Hank has provided the following details for specific first-year transactions. 1. A small minority of HW clients complained about the catering service. To mitigate these complaints. Hank's policy is to refund dissatisfied clients 50 percent of the catering fee. By the end of the first year, only two HW clients had complained but had not yet been paid refunds. The expected refunds amount to $2.750, and Hank reduced the reported catering fees for the first year to reflect the expected refund. 2. In the first year, HW received a $7.380 payment from a client for catering a monthly breakfast for 30 consecutive months beginning in December. Because the payment didn't relate to last year, Hank excluded the entire amount when he calculated catering revenues. 3. In July, HW paid $2,760 to ADMAN Company for an advertising campaign to distribute fliers advertising HW's catering service. Unfortunately, this campaign violated a city code restricting advertising by fliers, and the city fined HW $460 for the violation. HW paid the fine, and Hank included the fine and the cost of the campaign in "other business expenditures. 4. In July, HW also paid $8.904 for a 24-month insurance policy that covers HW for accidents and casualties beginning on August 1 of the first year. Hank deducted the entire $8.904 as accident insurance premiums.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started