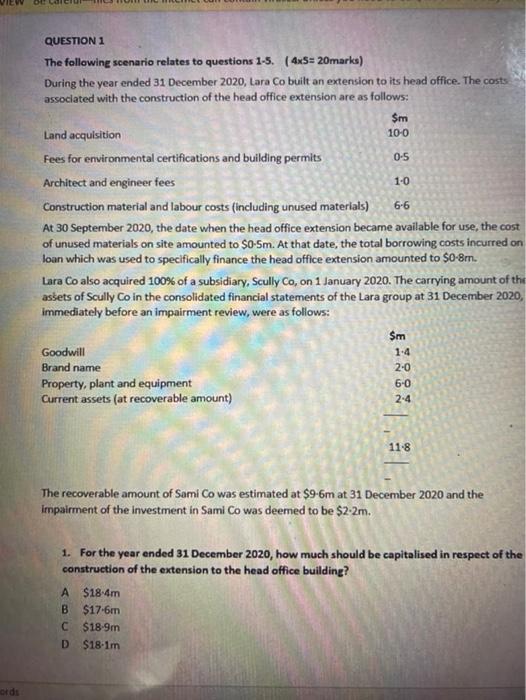

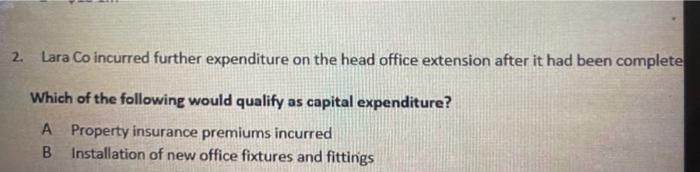

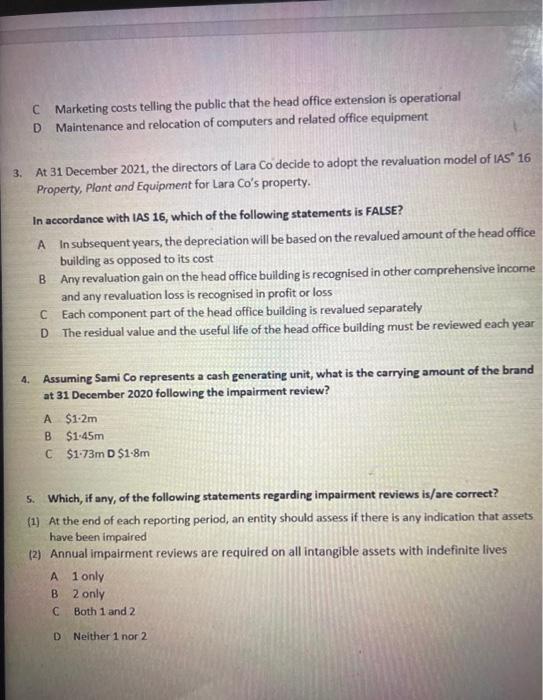

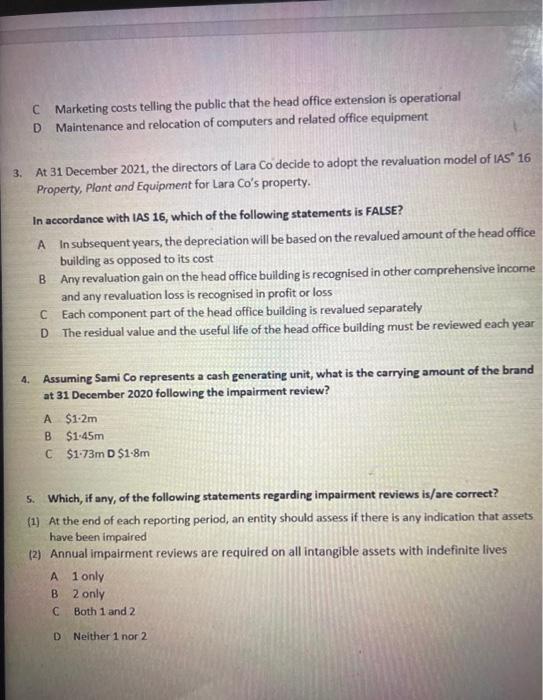

10-0 QUESTION 1 The following scenario relates to questions 1-5. (4xS=20marks) During the year ended 31 December 2020, Lara Co built an extension to its head office. The costs associated with the construction of the head office extension are as follows: $m Land acquisition Fees for environmental certifications and building permits 0-5 Architect and engineer fees 1.0 Construction material and labour costs (including unused materials) 6-6 At 30 September 2020, the date when the head office extension became available for use, the cost of unused materials on site amounted to $o-Sm. At that date, the total borrowing costs incurred on loan which was used to specifically finance the head office extension amounted to $0-8m. Lara Co also acquired 100% of a subsidiary, Scully Co, on 1 January 2020. The carrying amount of the assets of Scully Co in the consolidated financial statements of the Lara group at 31 December 2020, Immediately before an impairment review, were as follows: $m Goodwill Brand name Property, plant and equipment Current assets (at recoverable amount) 1-4 2.0 6-0 2-4 11-8 The recoverable amount of Sami Co was estimated at $9-6m at 31 December 2020 and the Impairment of the investment in Sami Co was deemed to be $2.2m. 1. For the year ended 31 December 2020, how much should be capitalised in respect of the construction of the extension to the head office building? A $18-4m B $17.6m C $18-9m D $18m 2. Lara Co incurred further expenditure on the head office extension after it had been complete Which of the following would qualify as capital expenditure? A Property insurance premiums incurred B Installation of new office fixtures and fittings C Marketing costs telling the public that the head office extension is operational D Maintenance and relocation of computers and related office equipment 3. At 31 December 2021, the directors of Lara Co decide to adopt the revaluation model of IAS 16 Property, Plant and Equipment for Lara Co's property. In accordance with IAS 16, which of the following statements is FALSE? A In subsequent years, the depreciation will be based on the revalued amount of the head office building as opposed to its cost B Any revaluation gain on the head office building is recognised in other comprehensive income and any revaluation loss is recognised in profit or loss C Each component part of the head office building is revalued separately D The residual value and the useful life of the head office building must be reviewed each year 4. Assuming Sami Co represents a cash generating unit, what is the carrying amount of the brand at 31 December 2020 following the impairment review? A $1.2m B $1.45m C$173m D $1.8m 5. Which, if any, of the following statements regarding impairment reviews is/are correct? (1) At the end of each reporting period, an entity should assess if there is any indication that assets have been impaired (2) Annual impairment reviews are required on all intangible assets with indefinite lives A1 only B2 only C Both 1 and 2 D Neither 1 nor 2