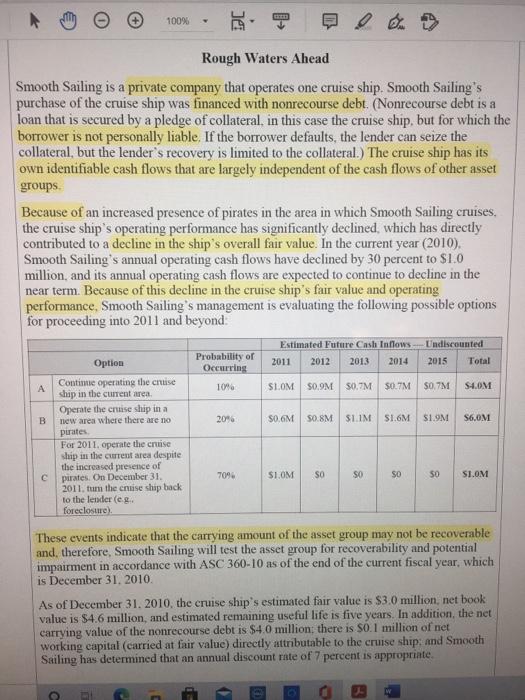

100% Rough Waters Ahead Smooth Sailing is a private company that operates one cruise ship. Smooth Sailing's purchase of the cruise ship was financed with nonrecourse debt. (Nonrecourse debt is a loan that is secured by a pledge of collateral, in this case the cruise ship, but for which the borrower is not personally liable. If the borrower defaults, the lender can seize the collateral, but the lender's recovery is limited to the collateral.) The cruise ship has its own identifiable cash flows that are largely independent of the cash flows of other asset groups Because of an increased presence of pirates in the area in which Smooth Sailing cruises, the cruise ship's operating performance has significantly declined, which has directly contributed to a decline in the ship's overall fair value. In the current year (2010). Smooth Sailing's annual operating cash flows have declined by 30 percent to $1.0 million, and its annual operating cash flows are expected to continue to decline in the near term. Because of this decline in the cruise ship's fair value and operating performance, Smooth Sailing's management is evaluating the following possible options for proceeding into 2011 and beyond Estimated Future Cash Inflows Probability of Option 2011 2012 2013 Continue operating the cruise 1096 ship in the current area SLOM 50.9M 80.7M $0.7M S0.7M Operate the cruise ship in a new area where there are no $0.6M 50.8M SLIM SI6M $1.9M purates For 2011. operate the cruise ship in the current area despite the increased presence of pirates. On December 31. 2011, tum the cruise ship back to the lender (eg. foreclosure) Undiscounted 2015 Total 2014 Occurring A SUOM B 2096 S6.0M S6.OM 709 $1.OM SO SO SO 50 S1.OM These events indicate that the carrying amount of the asset group may not be recoverable and therefore, Smooth Sailing will test the asset group for recoverability and potential impairment in accordance with ASC 360-10 as of the end of the current fiscal year, which is December 31, 2010. As of December 31, 2010, the cruise ship's estimated fair value is $3.0 million, net book value is $4.6 million, and estimated remaining useful life is five years. In addition, the net carrying value of the nonrecourse debt is $4.0 million there is SO. 1 million of net working capital (carried at fair value) directly attributable to the cruise ship: and Smooth Sailing has determined that an annual discount rate of 7 percent is appropriate A. Explain the issue as you see it and what challenges there are in addressing the matter in this specific instance and more broadly. B. Ultimately you must decide on how you want to treat the issue and support your decision with relevant research and citations which you feel support your argument. C. link directly to any accounting standards or sources of information you use in your analysis. 3 1 C