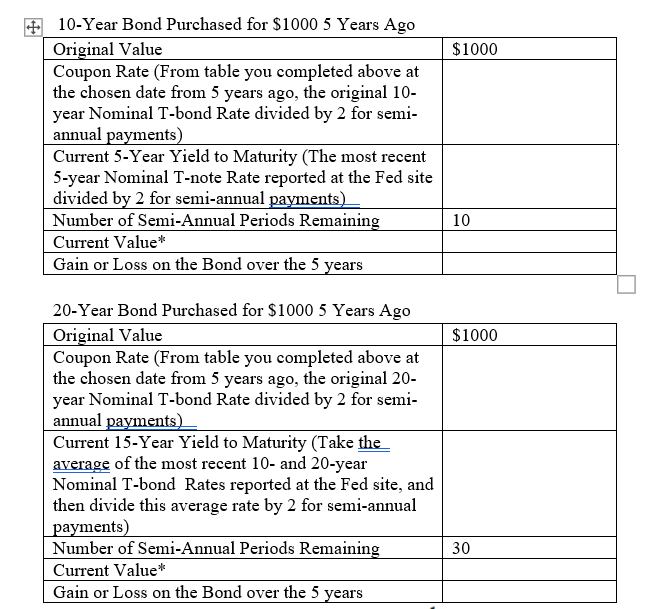

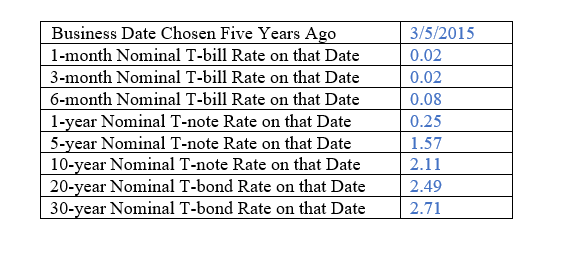

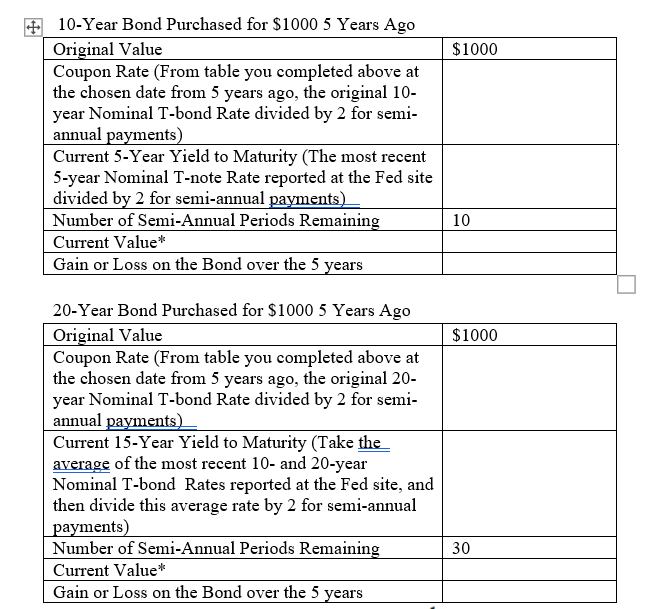

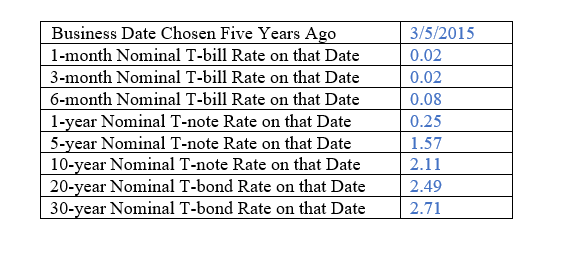

$1000 + 10-Year Bond Purchased for $1000 5 Years Ago Original Value Coupon Rate (From table you completed above at the chosen date from 5 years ago, the original 10- year Nominal T-bond Rate divided by 2 for semi- annual payments) Current 5-Year Yield to Maturity (The most recent 5-year Nominal T-note Rate reported at the Fed site divided by 2 for semi-annual payments) Number of Semi-Annual Periods Remaining Current Value* Gain or Loss on the Bond over the 5 years 10 $1000 20-Year Bond Purchased for $1000 5 Years Ago Original Value Coupon Rate (From table you completed above at the chosen date from 5 years ago, the original 20- year Nominal T-bond Rate divided by 2 for semi- annual payments) Current 15-Year Yield to Maturity (Take the average of the most recent 10- and 20-year Nominal T-bond Rates reported at the Fed site, and then divide this average rate by 2 for semi-annual payments) Number of Semi-Annual Periods Remaining Current Value* Gain or Loss on the Bond over the 5 years 30 Business Date Chosen Five Years Ago 1-month Nominal T-bill Rate on that Date 3-month Nominal T-bill Rate on that Date 6-month Nominal T-bill Rate on that Date 1-year Nominal T-note Rate on that Date 5-year Nominal T-note Rate on that Date 10-year Nominal T-note Rate on that Date 20-year Nominal T-bond Rate on that Date 30-year Nominal T-bond Rate on that Date 3/5/2015 0.02 0.02 0.08 0.25 1.57 2.11 2.49 2.71 $1000 + 10-Year Bond Purchased for $1000 5 Years Ago Original Value Coupon Rate (From table you completed above at the chosen date from 5 years ago, the original 10- year Nominal T-bond Rate divided by 2 for semi- annual payments) Current 5-Year Yield to Maturity (The most recent 5-year Nominal T-note Rate reported at the Fed site divided by 2 for semi-annual payments) Number of Semi-Annual Periods Remaining Current Value* Gain or Loss on the Bond over the 5 years 10 $1000 20-Year Bond Purchased for $1000 5 Years Ago Original Value Coupon Rate (From table you completed above at the chosen date from 5 years ago, the original 20- year Nominal T-bond Rate divided by 2 for semi- annual payments) Current 15-Year Yield to Maturity (Take the average of the most recent 10- and 20-year Nominal T-bond Rates reported at the Fed site, and then divide this average rate by 2 for semi-annual payments) Number of Semi-Annual Periods Remaining Current Value* Gain or Loss on the Bond over the 5 years 30 Business Date Chosen Five Years Ago 1-month Nominal T-bill Rate on that Date 3-month Nominal T-bill Rate on that Date 6-month Nominal T-bill Rate on that Date 1-year Nominal T-note Rate on that Date 5-year Nominal T-note Rate on that Date 10-year Nominal T-note Rate on that Date 20-year Nominal T-bond Rate on that Date 30-year Nominal T-bond Rate on that Date 3/5/2015 0.02 0.02 0.08 0.25 1.57 2.11 2.49 2.71