Answered step by step

Verified Expert Solution

Question

1 Approved Answer

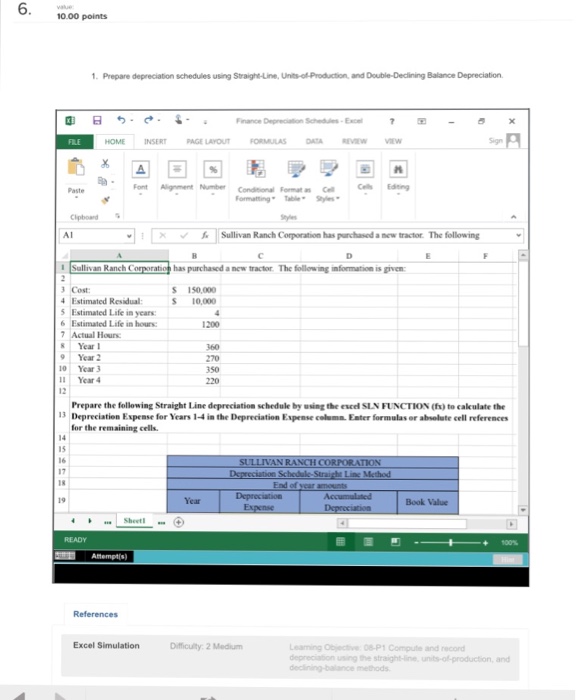

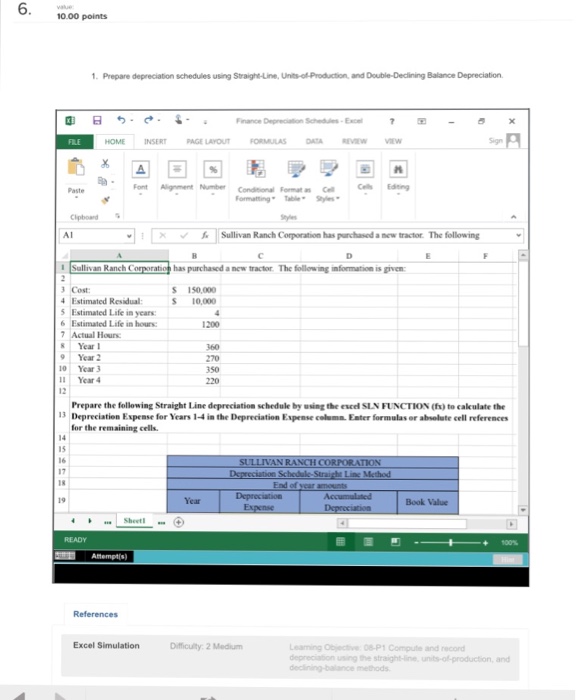

10.00 points 1. Prepare depreciation schedules using Straight-line, Units-ofProduction. and Double Declining Balance Depreciation. Ed Finance Depreciation Excel x Font Alignment Number Conditional Format as

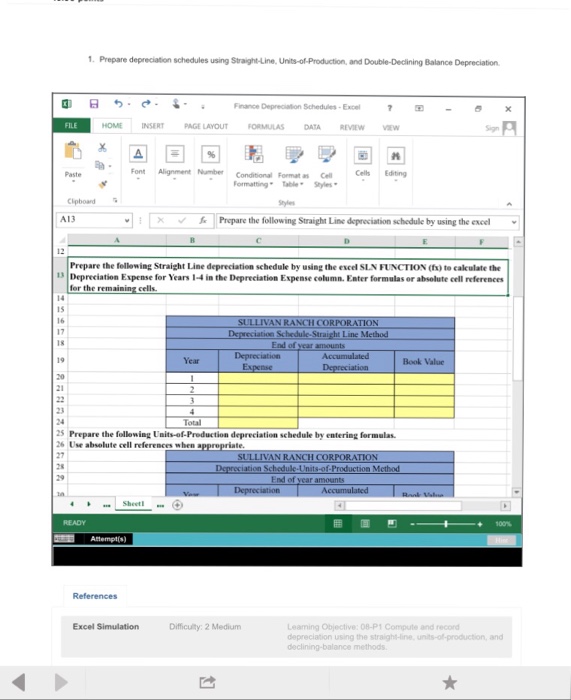

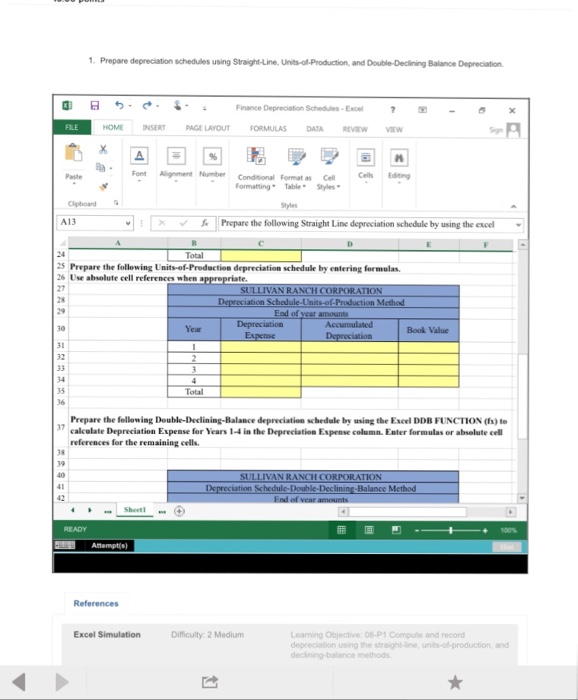

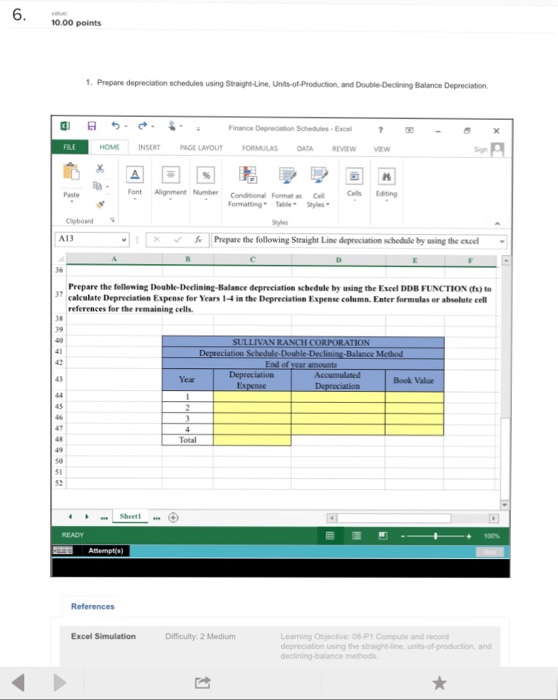

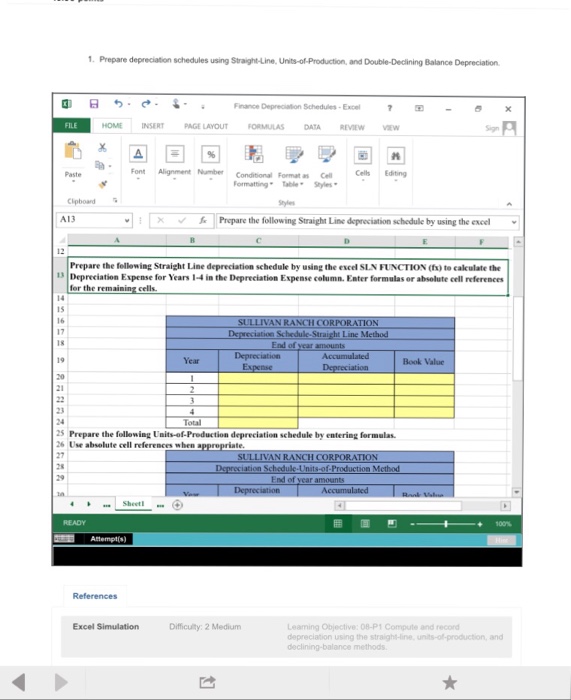

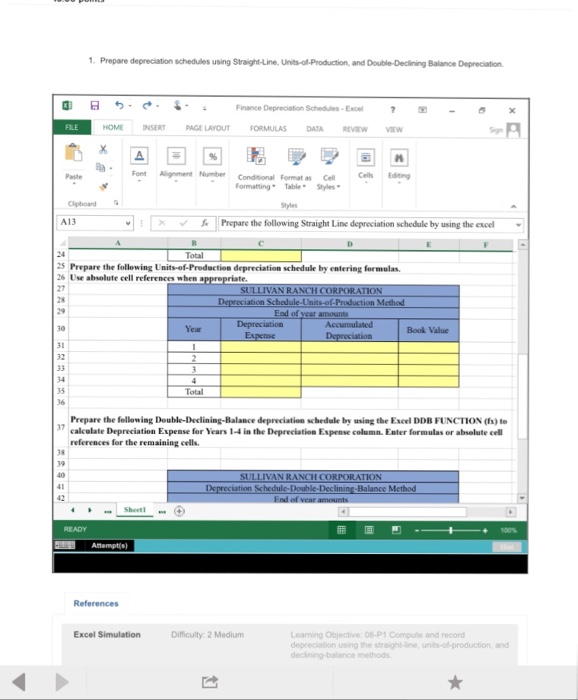

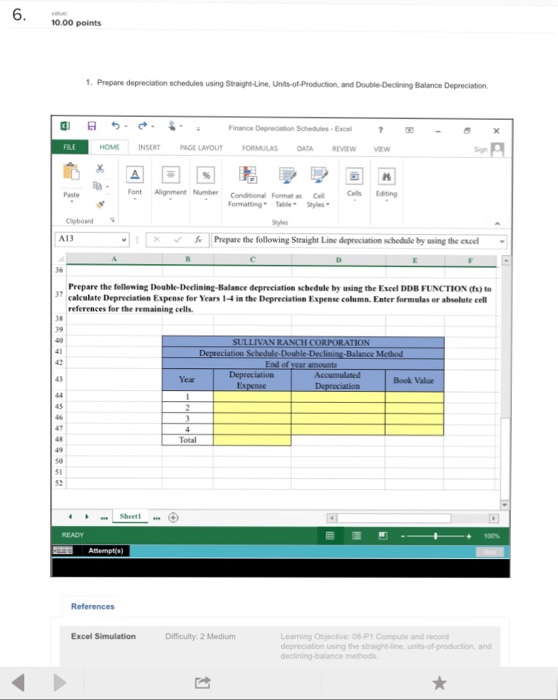

10.00 points 1. Prepare depreciation schedules using Straight-line, Units-ofProduction. and Double Declining Balance Depreciation. Ed Finance Depreciation Excel x Font Alignment Number Conditional Format as Formatting Clipboard s MAI v X Sullivan Ranch Corporation has purchased a new tractor The following I Sullivan Ranch C has purchased a new tractor The following information is given: S 150,000 Estimated Residual 10,000 Estimated Life in years: 6 Estimated Life in hours: 1200 Actual Hours: R Year I Year 2 Year 3 Year 4 Prepare the following Straight Line depreciation schedule by using the eveel SLN FUNCTION (fv) to calculate the 13 Depreciation Expense for Years I-4 in the Depreciation Espense column. Enter formulas absolute cell references for the remaining cells. LLIVAN RANCH CORPORATION Depreciation Schedule Suaight Line Method End of year amounts Sherri Excel Simulation Difficulty: 2 Medium Learning objective 08 P1 Compute and record

10.00 points 1. Prepare depreciation schedules using Straight-line, Units-ofProduction. and Double Declining Balance Depreciation. Ed Finance Depreciation Excel x Font Alignment Number Conditional Format as Formatting Clipboard s MAI v X Sullivan Ranch Corporation has purchased a new tractor The following I Sullivan Ranch C has purchased a new tractor The following information is given: S 150,000 Estimated Residual 10,000 Estimated Life in years: 6 Estimated Life in hours: 1200 Actual Hours: R Year I Year 2 Year 3 Year 4 Prepare the following Straight Line depreciation schedule by using the eveel SLN FUNCTION (fv) to calculate the 13 Depreciation Expense for Years I-4 in the Depreciation Espense column. Enter formulas absolute cell references for the remaining cells. LLIVAN RANCH CORPORATION Depreciation Schedule Suaight Line Method End of year amounts Sherri Excel Simulation Difficulty: 2 Medium Learning objective 08 P1 Compute and record

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started