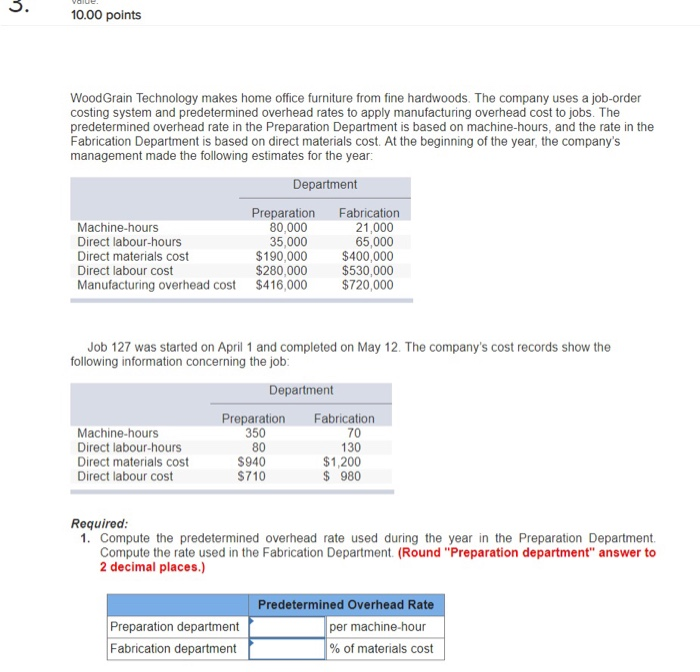

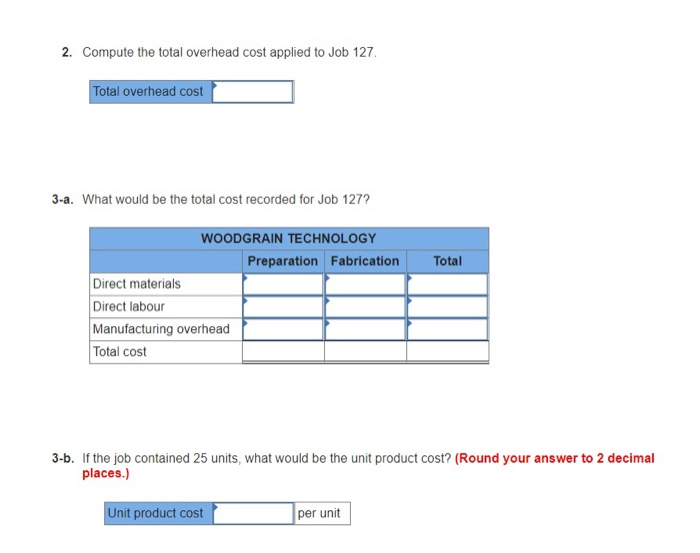

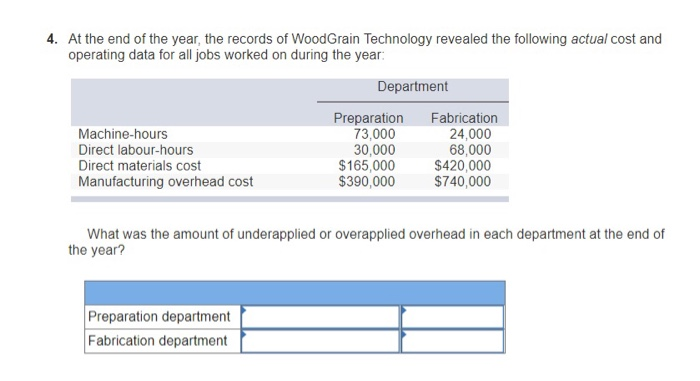

10.00 points WoodGrain Technology makes home office furniture from fine hardwoods. The company uses a job-order costing system and predetermined overhead rates to apply manufacturing overhead cost to jobs. The predetermined overhead rate in the Preparation Department is based on machine-hours, and the rate in the Fabrication Department is based on direct materials cost. At the beginning of the year, the company's management made the following estimates for the year: Department Fabrication Machine-hours Direct labour-hours Direct materials cost Direct labour cost Manufacturing overhead cost Preparation 80,000 35,000 $190,000 $280,000 $416,000 21,000 65,000 $400,000 $530,000 $720,000 Job 127 was started on April 1 and completed on May 12. The company's cost records show the following information concerning the job Department Preparation Fabrication Machine-hours Direct labour-hours Direct materials cost Direct labour cost 350 80 $940 $710 70 130 $1,200 $ 980 Required 1. Compute the predetermined overhead rate used during the year in the Preparation Department Compute the rate used in the Fabrication Department. (Round "Preparation department" answer to 2 decimal places.) Predetermined Overhead Rate Preparation department Fabrication department per machine-hour % of materials cost 2. Compute the total overhead cost applied to Job 127 Total overhead cost 3-a. What would be the total cost recorded for Job 127? WOODGRAIN TECHNOLOGY Preparation FabricationTotal Direct materials Direct labour Manufacturing overhead Total cost 3-b. If the job contained 25 units, what would be the unit product cost? (Round your answer to 2 decimal places.) Unit product cost per unit 4. At the end of the year, the records of WoodGrain Technology revealed the following actual cost and operating data for all jobs worked on during the year Department Machine-hours Direct labour-hours Direct materials cost Manufacturing overhead cost Preparation Fabrication 24,000 68,000 165,000 $420,000 $390,000 $740,000 73,000 30,000 What was the amount of underapplied or overapplied overhead in each department at the end of the year? Preparation department Fabrication department