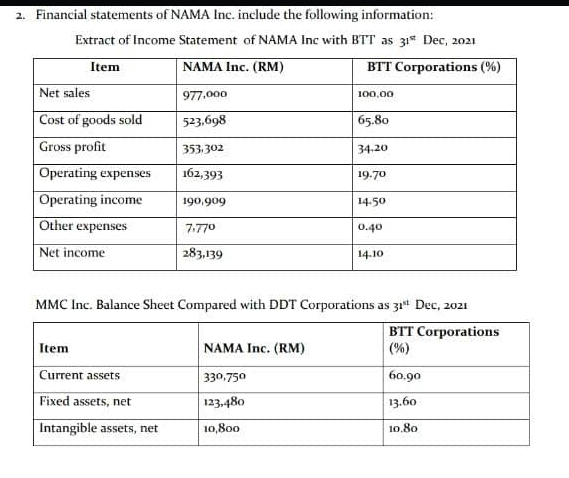

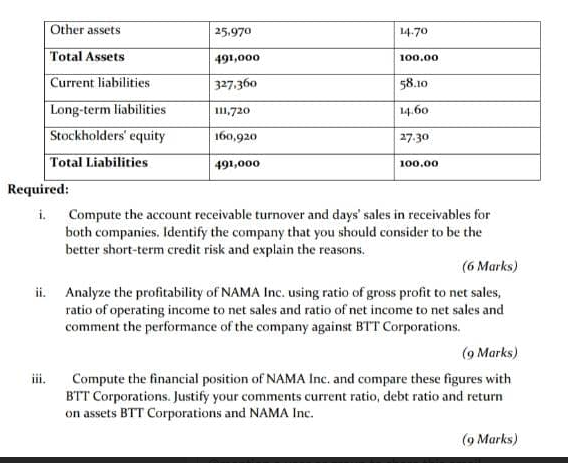

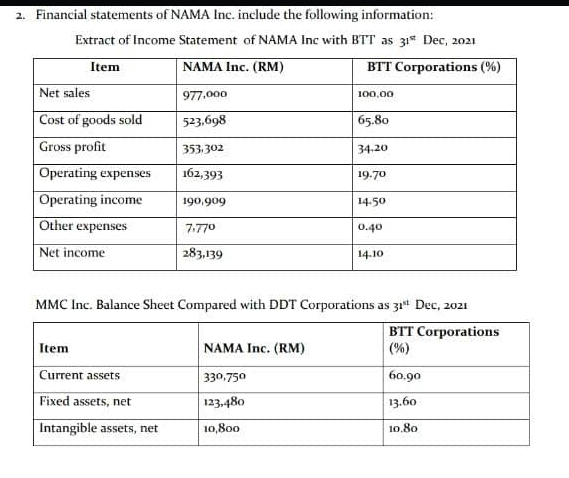

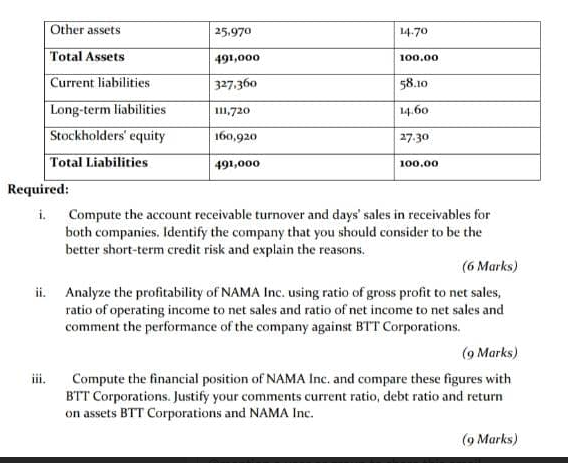

100,00 523,698 2. Financial statements of NAMA Inc. include the following information: Extract of Income Statement of NAMA Inc with BTT as 31 Dec, 2021 Item NAMA Inc. (RM) BTT Corporations (%) Net sales 977,000 Cost of goods sold 65.80 Gross profit 353, 302 34.20 Operating expenses 162,393 19.70 Operating income 190,909 14-50 Other expenses 7.770 0.40 Net income 283,139 14.10 MMC Inc. Balance Sheet Compared with DDT Corporations as 31 Dec, 2021 BTT Corporations Item NAMA Inc. (RM) (%) Current assets 60,90 Fixed assets, net 330.750 123,480 10,800 13.60 Intangible assets, net 10.80 100.00 Other assets 25,970 14.70 Total Assets 491,000 Current liabilities 327.360 58.10 Long-term liabilities 111,720 14.60 Stockholders' equity 160,920 27-30 Total Liabilities 491,000 100.00 Required: i. Compute the account receivable turnover and days' sales in receivables for both companies. Identify the company that you should consider to be the better short-term credit risk and explain the reasons. (6 Marks) ii. Analyze the profitability of NAMA Inc. using ratio of gross profit to net sales, ratio of operating income to net sales and ratio of net income to net sales and comment the performance of the company against BTT Corporations. (9 Marks) iii. Compute the financial position of NAMA Inc. and compare these figures with BTT Corporations. Justify your comments current ratio, debt ratio and return on assets BTT Corporations and NAMA Inc. (9 Marks) 100,00 523,698 2. Financial statements of NAMA Inc. include the following information: Extract of Income Statement of NAMA Inc with BTT as 31 Dec, 2021 Item NAMA Inc. (RM) BTT Corporations (%) Net sales 977,000 Cost of goods sold 65.80 Gross profit 353, 302 34.20 Operating expenses 162,393 19.70 Operating income 190,909 14-50 Other expenses 7.770 0.40 Net income 283,139 14.10 MMC Inc. Balance Sheet Compared with DDT Corporations as 31 Dec, 2021 BTT Corporations Item NAMA Inc. (RM) (%) Current assets 60,90 Fixed assets, net 330.750 123,480 10,800 13.60 Intangible assets, net 10.80 100.00 Other assets 25,970 14.70 Total Assets 491,000 Current liabilities 327.360 58.10 Long-term liabilities 111,720 14.60 Stockholders' equity 160,920 27-30 Total Liabilities 491,000 100.00 Required: i. Compute the account receivable turnover and days' sales in receivables for both companies. Identify the company that you should consider to be the better short-term credit risk and explain the reasons. (6 Marks) ii. Analyze the profitability of NAMA Inc. using ratio of gross profit to net sales, ratio of operating income to net sales and ratio of net income to net sales and comment the performance of the company against BTT Corporations. (9 Marks) iii. Compute the financial position of NAMA Inc. and compare these figures with BTT Corporations. Justify your comments current ratio, debt ratio and return on assets BTT Corporations and NAMA Inc. (9 Marks)