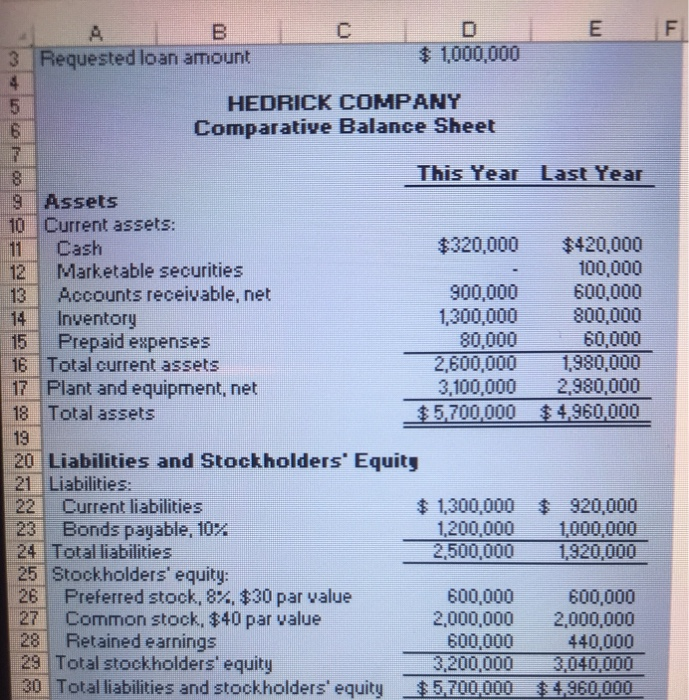

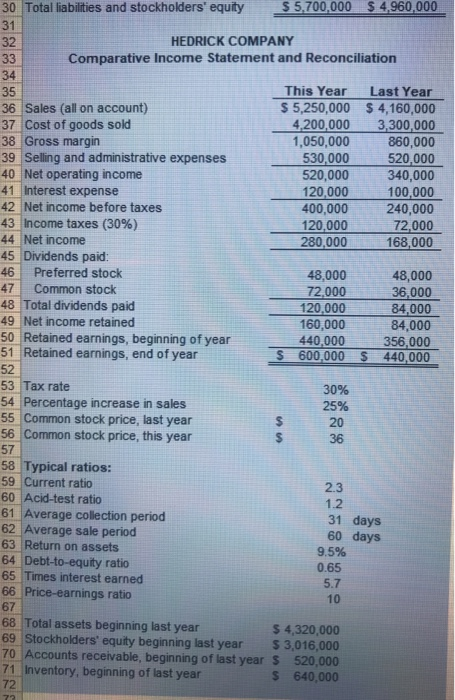

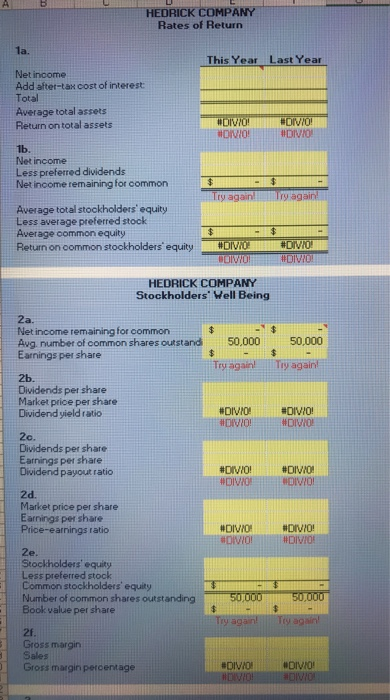

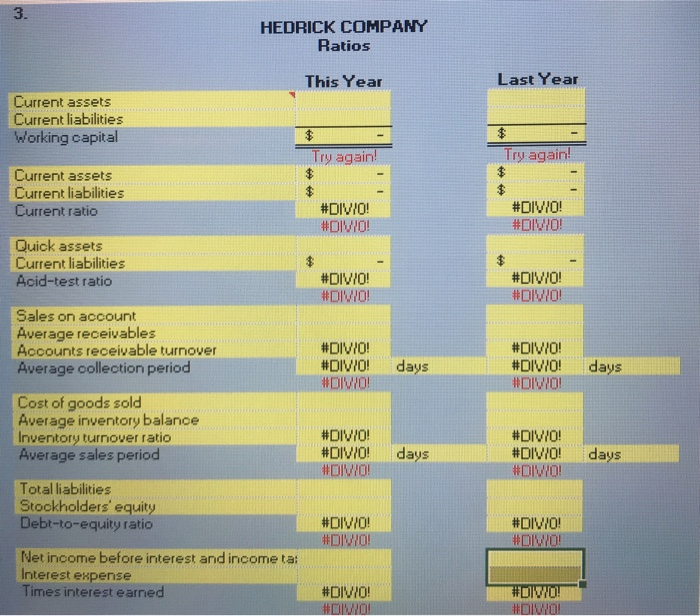

$1,000,000 3 Requested loan amount HEDRICK COMPANY Comparative Balance Sheet This Year Last Year 9 Assets 10 Current assets: 11 Cash 12 Marketable securities 13 Accounts receivable, net 14 Inventory 15 Prepaid expenses $320,000 $420,000 100,000 600,000 1,300,000 800,000 60,000 2,600,0001,980,000 3,100,000 2,980,000 5700,000 4960,000 80,000 16 Total current assets 17 Plant and equipment, net 18 Total assets 19 20 Liabilities and Stockholders' Equity 21 Liabilities: 22 Current liabilities 23 Bonds payable, 10% 24 Total liabilities 25 Stockholders' equity 26 Preferred stock, 8%, $30 par Yalue 27 Common stock, $40 par value 28 Retained earnings 29 Total stockholders' equity 30 Total liabilities and stockholders' equity 5700000 $ 1,300,000 920,000 1,200,000 1000,000 2,500,0001,920,000 600,000 2,000,000 2,000,000 440,000 3,200,000 3,040,000 $4960000 600,000 600,000 30 Total liabilities and stockholders' equity 31 $5700,000 $4960,000 HEDRICK COMPANY Comparative Income Statement and Reconciliation 32 34 35 36 Sales (all on account) 37 Cost of goods sold 38 Gross margin 39 Selling and administrative expenses 40 Net operating income 41 Interest expense 42 Net income before taxes 43 Income taxes (30%) 44 Net income 45 Dividends paid 46 Preferred stock 47 Common stock 48 Total dividends paid 49 Net income retained 50 Retained earnings, beginning of year 51 Retained earnings, end of year 52 53 Tax rate 54 Percentage increase in sales 55 Common stock price, last year 56 Common stock price, this year This Year Last Year s 5,250,000 $ 4,160,000 4,200,000 3,300,000 1,050,000 860,000 520,000 520,000 340,000 100000 400,000240,000 72,000 168,000 530,000 120000 120,000 280,000 48,000 48,000 36,000 84,000 84,000 160,000 S 600,000 S 440.000 30% 25% 20 36 58 Typical ratios: 59 Current ratio 60 Acid-test ratio 61 Average collection period 62 Average sale period 63 Return on assets 64 Debt-to-equity ratio 65 Times interest earned 66 Price-earnings ratio 67 68 Total assets beginning last year 69 Stockholders' equity beginning last year 3,016,000 70 Accounts receivable, beginning of last year $ 520,000 71 Inventory, beginning of last year 72 2.3 1.2 31 days 60 days 9.5% 0.65 5.7 10 S 4,320,000 S 640,000 OMPA Rates of Return NY HEDRICK C 1a. This Year Last Year Net income Add after-tax cost of interest Total Average total assets Return on total assets #ON//O! 1b. Net income Less preferred dividends Net income remaining for common Iry again!Try again Average total stockholders equity Less average preferred stoc Average common equity Return on common stockholders equity DIVIO HEDRICK COMPA Stockholders Well Being 2a. Net income remaining for common Awg number of common shares outstand50,000 Earnings per share 50,000 Try again! Ty ag 2b. Dividends per share Market price per share Dividend yield ratio #DIV/0! #DIVO Dividends per share Earnings per share Dividend payout ratio #DIV/O! #DIVIO! #DIV/0! 2d. Market price per share Earnings per share Price-earnings ratio #DIV #DIVIO! DIV/0! #DIVIO! 2e Stockholders' equity Less preferred stock Common stockholders' equity Number of common shares outst Book value per share 2f. Gross margin Sales Gross margin percentage #DIV/0! "DIVO 3 HEDRICK COMPANY Ratios Last Year This Year Current assets Current liabilities Working capital Try again Iry again Current assets Current liabilities Current ratio #DIV/0! #DIV/0! #DIVIO! #DIV/0! Quick assets Current liabilities Acid-test ratio #DIVO! #DIV/0! #DIV/0! Sales on account Average receivables Accounts receivable turnover # DIV/0! #DIV/0! # DIV/0! #DIV/0! 11 DIVIO! days days Average collection period Cost of goods sold Average inventory balance nventory turnover ratio Average sales period #DIV/0! #DIV/0! #DIVO! #DIVO #DIV/0! days days Total liabilities Stockholders' equity Debt-to-equity ratio #DIV/0! #DIVO! #DIV/0 Net income before interest and income ta: Interest expense Times interest earned #DIVO