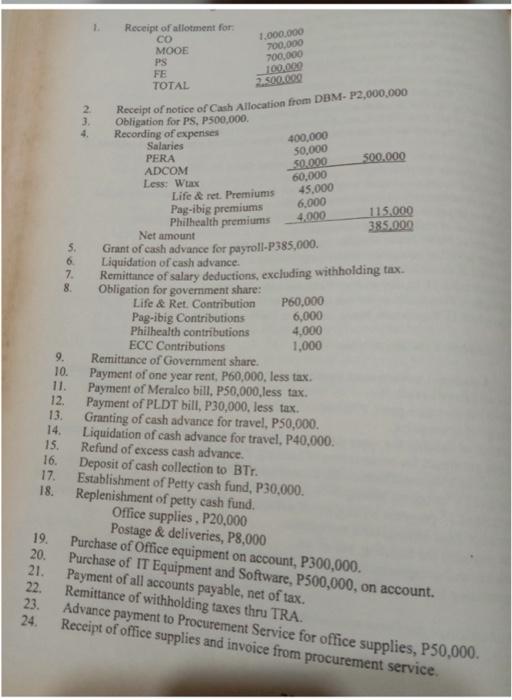

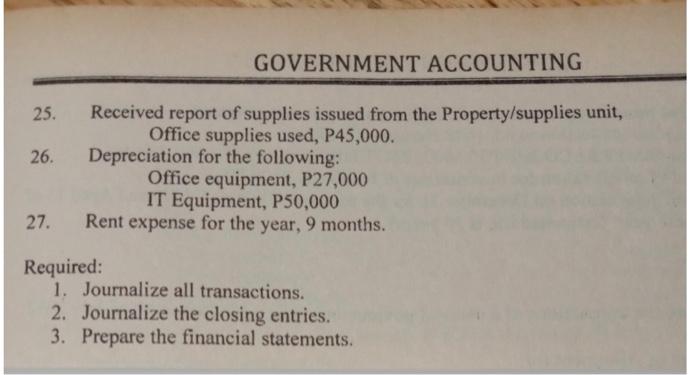

1.000.000 700.000 700.000 100.000 2.500.000 400,000 50,000 0.000 60.000 45.000 4.000 Receipt of allotment for: CO MOOE PS FE TOTAL 2. Receipt of notice of Cash Allocation from DBM-P2,000,000 3. Obligation for PS, P500,000 4. Recording of expenses Salaries PERA 500.000 ADCOM Less: Wax Life & net. Premiums Pag-ibig premiums 6.000 115.000 Philhealth premiums 385.000 Net amount 5. Grant of cash advance for payroll-P385,000. 6 Liquidation of cash advance. 7. Remittance of salary deductions, excluding withholding tax. 8. Obligation for government share: Life & Ret. Contribution P60,000 Pag-ibig Contributions 6,000 Philhealth contributions 4,000 ECC Contributions 1,000 9. Remittance of Government share. 10. Payment of one year rent, P60,000, less tax. 11. Payment of Meralco bill, P50,000,less tax. 12 Payment of PLDT bill, P30,000, less tax. 13 Granting of cash advance for travel, P50,000. 14. Liquidation of cash advance for travel, P40,000 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. Refund of excess cash advance. Deposit of cash collection to BTr. Establishment of Petty cash fund, P30,000. Replenishment of petty cash fund, Office supplies, P20,000 Postage & deliveries, P8,000 Purchase of Office equipment on account, P300,000. Purchase of IT Equipment and Software, P500,000, on account. Payment of all accounts payable, net of tax. Remittance of withholding taxes thru TRA. Advance payment to Procurement Service for office supplies, P50,000. Receipt of office supplies and invoice from procurement service. GOVERNMENT ACCOUNTING 25. 26. Received report of supplies issued from the Property/supplies unit, Office supplies used, P45,000. Depreciation for the following: Office equipment, P27,000 IT Equipment, P50,000 Rent expense for the year, 9 months. 27. Required: 1. Journalize all transactions. 2. Journalize the closing entries. 3. Prepare the financial statements. 1.000.000 700.000 700.000 100.000 2.500.000 400,000 50,000 0.000 60.000 45.000 4.000 Receipt of allotment for: CO MOOE PS FE TOTAL 2. Receipt of notice of Cash Allocation from DBM-P2,000,000 3. Obligation for PS, P500,000 4. Recording of expenses Salaries PERA 500.000 ADCOM Less: Wax Life & net. Premiums Pag-ibig premiums 6.000 115.000 Philhealth premiums 385.000 Net amount 5. Grant of cash advance for payroll-P385,000. 6 Liquidation of cash advance. 7. Remittance of salary deductions, excluding withholding tax. 8. Obligation for government share: Life & Ret. Contribution P60,000 Pag-ibig Contributions 6,000 Philhealth contributions 4,000 ECC Contributions 1,000 9. Remittance of Government share. 10. Payment of one year rent, P60,000, less tax. 11. Payment of Meralco bill, P50,000,less tax. 12 Payment of PLDT bill, P30,000, less tax. 13 Granting of cash advance for travel, P50,000. 14. Liquidation of cash advance for travel, P40,000 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. Refund of excess cash advance. Deposit of cash collection to BTr. Establishment of Petty cash fund, P30,000. Replenishment of petty cash fund, Office supplies, P20,000 Postage & deliveries, P8,000 Purchase of Office equipment on account, P300,000. Purchase of IT Equipment and Software, P500,000, on account. Payment of all accounts payable, net of tax. Remittance of withholding taxes thru TRA. Advance payment to Procurement Service for office supplies, P50,000. Receipt of office supplies and invoice from procurement service. GOVERNMENT ACCOUNTING 25. 26. Received report of supplies issued from the Property/supplies unit, Office supplies used, P45,000. Depreciation for the following: Office equipment, P27,000 IT Equipment, P50,000 Rent expense for the year, 9 months. 27. Required: 1. Journalize all transactions. 2. Journalize the closing entries. 3. Prepare the financial statements