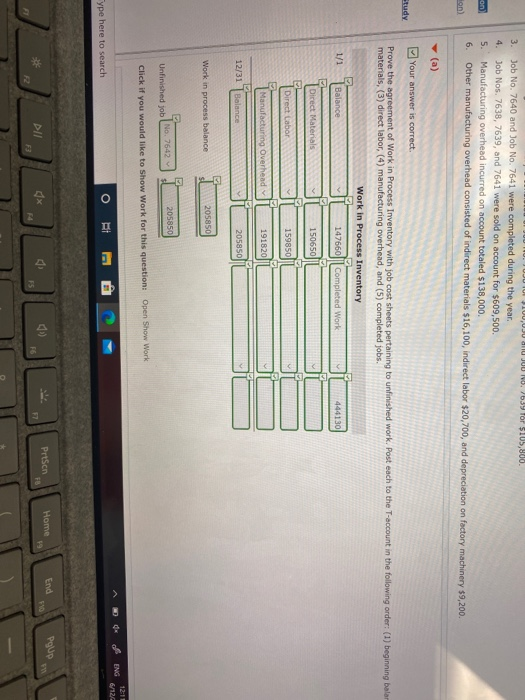

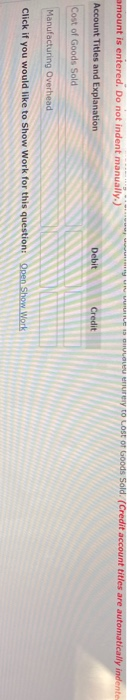

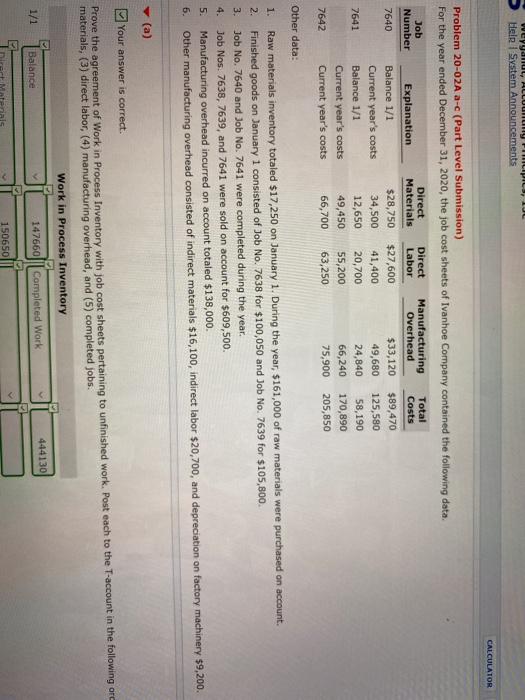

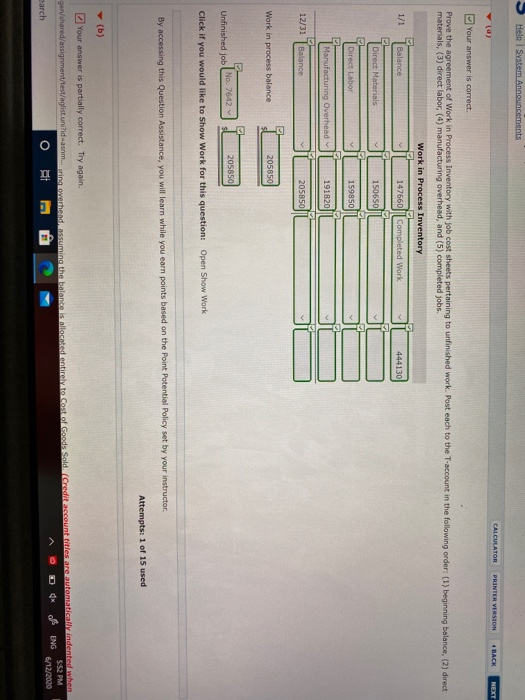

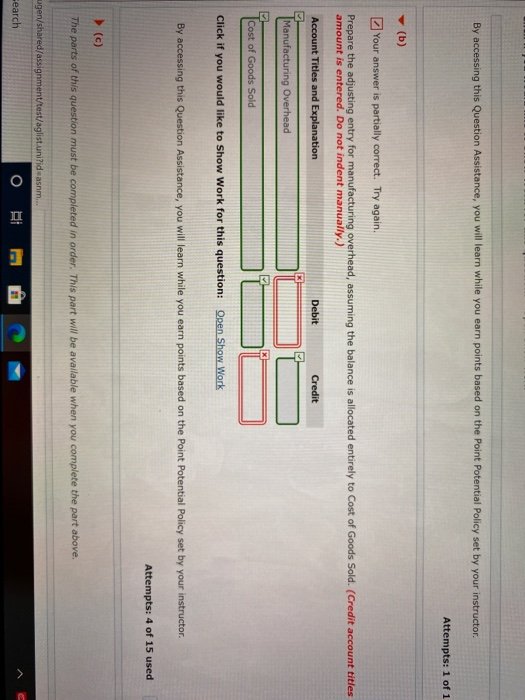

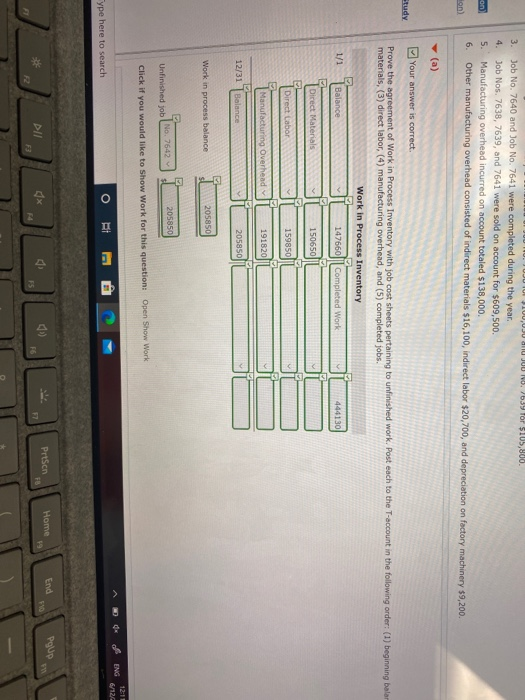

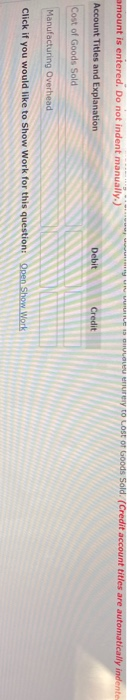

100,0JUU JUU 10./639 for $105,800. 3. Job No. 7640 and Job No. 7641 were completed during the year. 4. Job Nos. 7638, 7639, and 7641 were sold on account for $609,500. 5. Manufacturing overhead incurred on account totaled $138,000 6 Other manufacturing overhead consisted of indirect materials $16,100, indirect labor $20,700, and depreciation on factory machinery $9,200. on) (a) Your answer is correct. Study Prove the agreement of Work in Process Inventory with job cost sheets pertaining to unfinished work. Post each to the T-account in the following order: (1) beginning balar materials, (3) direct labor, (4) manufacturing overhead, and (5) completed jobs. Work in Process Inventory 1/1 Balance 147660|| Completed Work 444130 Direct Materials 150650 Direct Cabor 159850 Manufacturing Overhead 1918201 12/31 Balance 205850 Work in process balance 205850 No. 7642 205850 Unfinished job Click if you would like to Show Work for this question: Open Show Work ENG 12:11 6/127 o i ype here to search E Home Prisen End Poup ax FV F6 F7 F2 F3 amount is entered. Do not indent manually.) -- ww w UE try to cost of Goods Sold. (Credit account titles are automatically indente Account Titles and Explanation Debit Credit Cost of Goods Sold Manufacturing Overhead Click if you would like to Show Work for this question: Open Show Work weyyanut, ALLUUNNY PILIPILI, IUL Help System Announcements CALCULATOR Problem 20-02A a-c (Part Level Submission) For the year ended December 31, 2020, the job cost sheets of Ivanhoe Company contained the following data. Job Direct Direct Manufacturing Total Number Explanation Materials Labor Overhead Costs 7640 Balance 1/1 $28,750 $27,600 $33,120 $89,470 Current year's costs 34,500 41,400 49,680 125,580 7641 Balance 1/1 12,650 20,700 24,840 58,190 Current year's costs 49,450 55,200 66,240 170,890 7642 Current year's costs 66,700 63,250 75,900 205,850 Other data: 1. 2. 3. 4. 5. Raw materials inventory totaled $17,250 on January 1. During the year, $161,000 of raw materials were purchased on account. Finished goods on January 1 consisted of Job No. 7638 for $100,050 and Job No. 7639 for $105,800. Job No. 7640 and Job No. 7641 were completed during the year. Job Nos. 7638,7639, and 7641 were sold on account for $609,500. Manufacturing overhead incurred on account totaled $138,000. Other manufacturing overhead consisted of indirect materials $16,100, indirect labor $20,700, and depreciation on factory machinery $9,200. 6. (a) Your answer is correct. Prove the agreement of Work in Process Inventory with job cost sheets pertaining to unfinished work. Post each to the T-account in the following or materials, (3) direct labor, (4) manufacturing overhead, and (5) completed jobs. Work in Process Inventory 444130 1/1 Balance 147660 Completed Work 150650 Help System Announcements CALCULATOR PRINTER VERSION 4 BACK NEXT (a) Your answer is correct. Prove the agreement of Work in Process Inventory with job cost sheets pertaining to unfinished work. Post each to the T-account in the following order: (1) beginning balance, (2) direct materials, (3) direct labor, (4) manufacturing overhead, and (5) completed jobs. Work in Process Inventory 1/1 Balance 147660|| Completed Work 444130 Direct Materials 150650 Direct Labor 159850 Manufacturing Overhead 191820 12/31 Balance 205850 Work in process balance 205850 No. 7642 O5850 Unfinished job Click if you would like to Show Work for this question: Open Show Work By accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor Attempts: 1 of 15 used (b) Your answer is partially correct. Try again. gen/shared/assignment/test/aglistunitidasnm.ie owerhead, assuming the balance is allocated entirely to cost of Goods Sold (Credit account titles are automatically indented when 5:52 PM arch ENG 6/12/2020 at 5 By accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor. Attempts: 1 of 1 (b) Your answer is partially correct. Try again. Prepare the adjusting entry for manufacturing overhead, assuming the balance is allocated entirely to Cost of Goods Sold. (Credit account titles amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit Manufacturing Overhead Cost of Goods Sold Click if you would like to Show Work for this question: Qren Show Work By accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor. Attempts: 4 of 15 used (c) The parts of this question must be completed in order. This part will be available when you complete the part above. ugen/shared/assignment/test/aglist.uni?idasnm... Search o BI