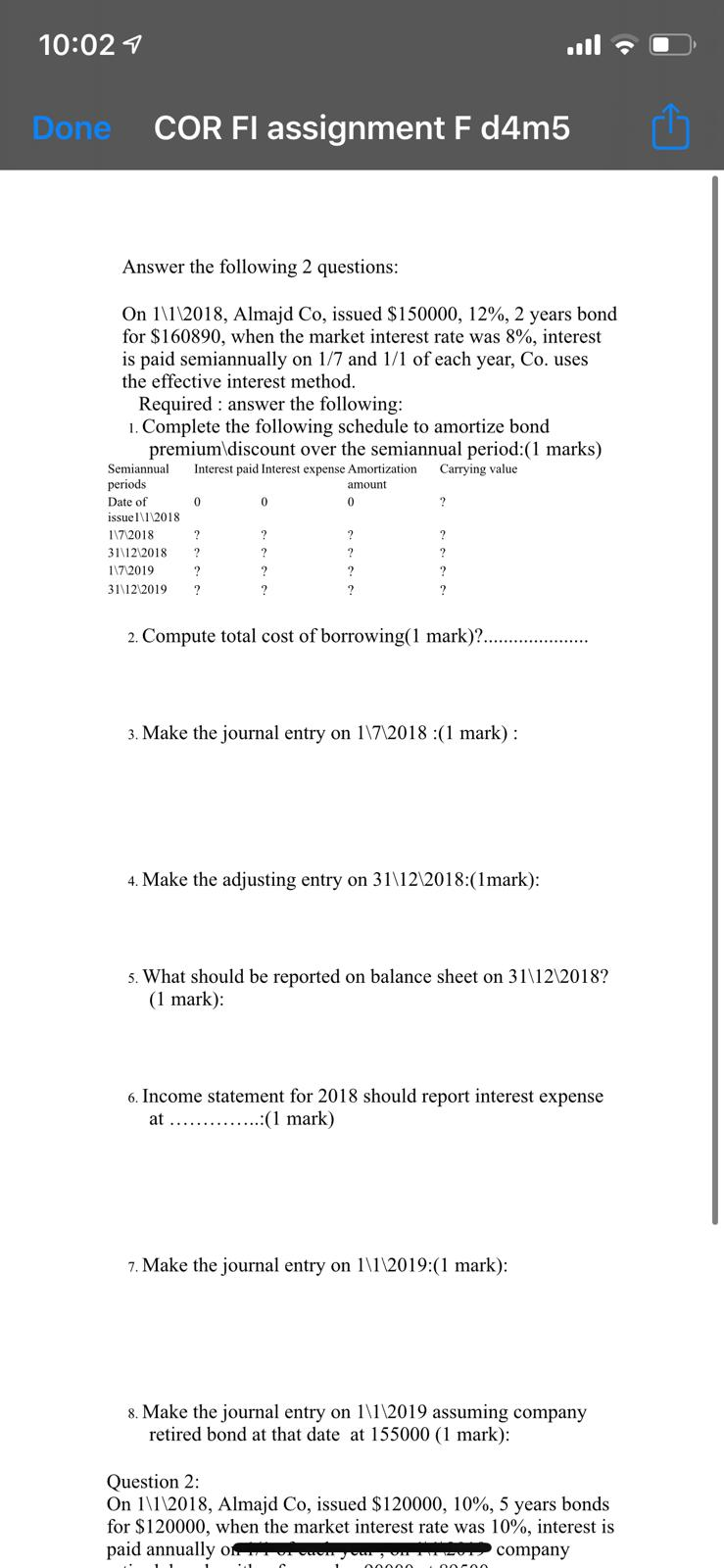

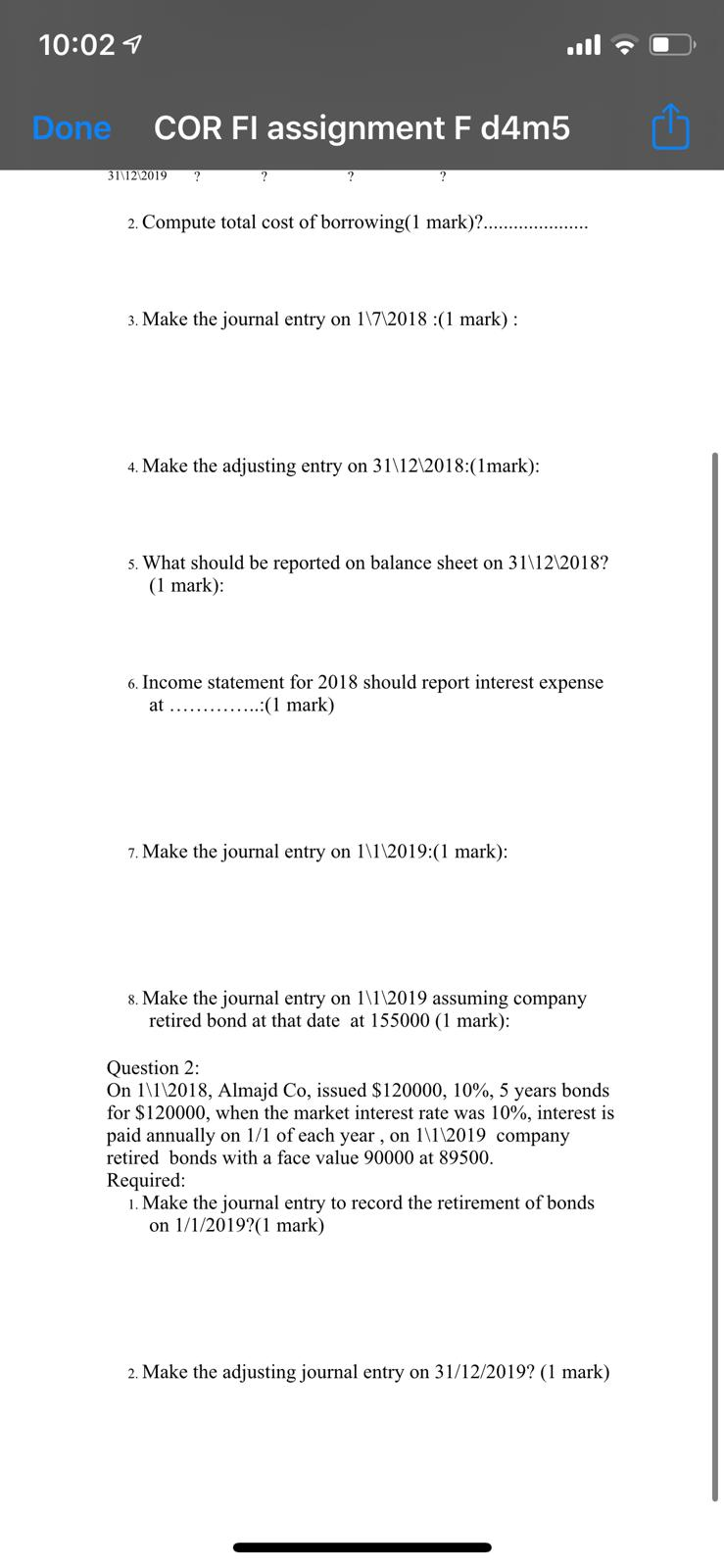

10:024 Done COR FI assignment F d4m5 i Answer the following 2 questions: On 1\1\2018, Almajd Co, issued $150000, 12%, 2 years bond for $160890, when the market interest rate was 8%, interest is paid semiannually on 1/7 and 1/1 of each year, Co. uses the effective interest method. Required : answer the following: 1. Complete the following schedule to amortize bond premium discount over the semiannual period:(1 marks) Semiannual Interest paid Interest expense Amortization Carrying value periods amount Date of 0 issue l\l\2018 117 2018 ? 31.12.2018 ? 1/7 2019 ? 31\12 2019 2. Compute total cost of borrowing(1 mark)?.. 3. Make the journal entry on 117\2018 :(1 mark): 4. Make the adjusting entry on 31\12\2018:(1mark): 5. What should be reported on balance sheet on 31\12\2018? (1 mark): 6. Income statement for 2018 should report interest expense at ..............:(1 mark) 7. Make the journal entry on 1\1\2019:(1 mark): 8. Make the journal entry on 1\1\2019 assuming company retired bond at that date at 155000 (1 mark): Question 2: On 1\1\2018, Almajd Co, issued $120000, 10%, 5 years bonds for $120000, when the market interest rate was 10%, interest is paid annually o ur company 10:024 Done COR FI assignment F d4m5 chi 311122019 ? ? 2. Compute total cost of borrowing(1 mark)?.. 3. Make the journal entry on 117\2018:(1 mark) : 4. Make the adjusting entry on 31\12\2018:(1mark): 5. What should be reported on balance sheet on 31\12 2018? (1 mark): 6. Income statement for 2018 should report interest expense at ..............:(1 mark) 7. Make the journal entry on 1\1\2019:(1 mark): 8. Make the journal entry on 1\1\2019 assuming company retired bond at that date at 155000 (1 mark): Question 2: On 1\1\2018, Almajd Co, issued $120000, 10%, 5 years bonds for $120000, when the market interest rate was 10%, interest is paid annually on 1/1 of each year, on 1\1\2019 company retired bonds with a face value 90000 at 89500. Required: 1. Make the journal entry to record the retirement of bonds on 1/1/2019?(1 mark) 2. Make the adjusting journal entry on 31/12/2019? (1 mark)