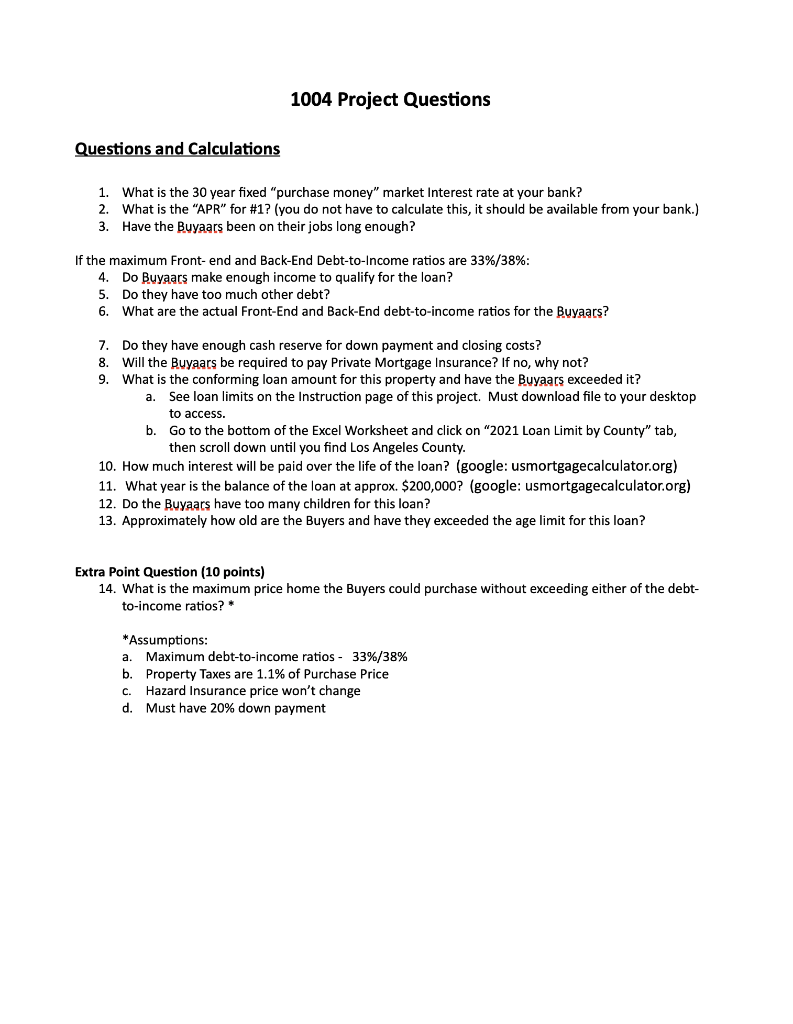

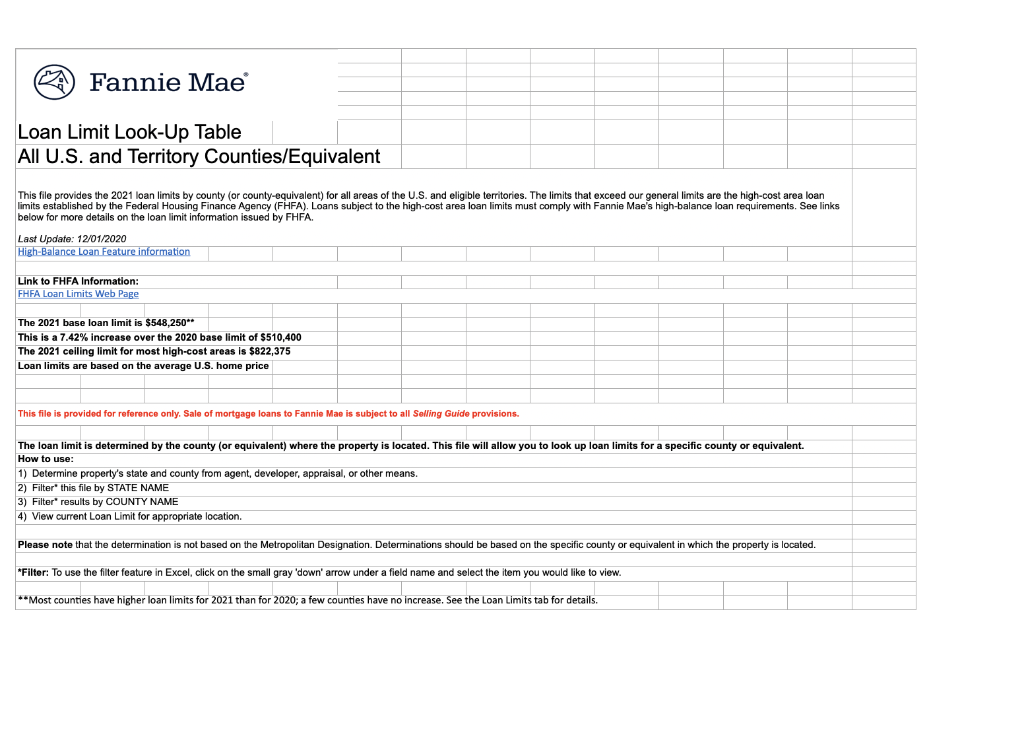

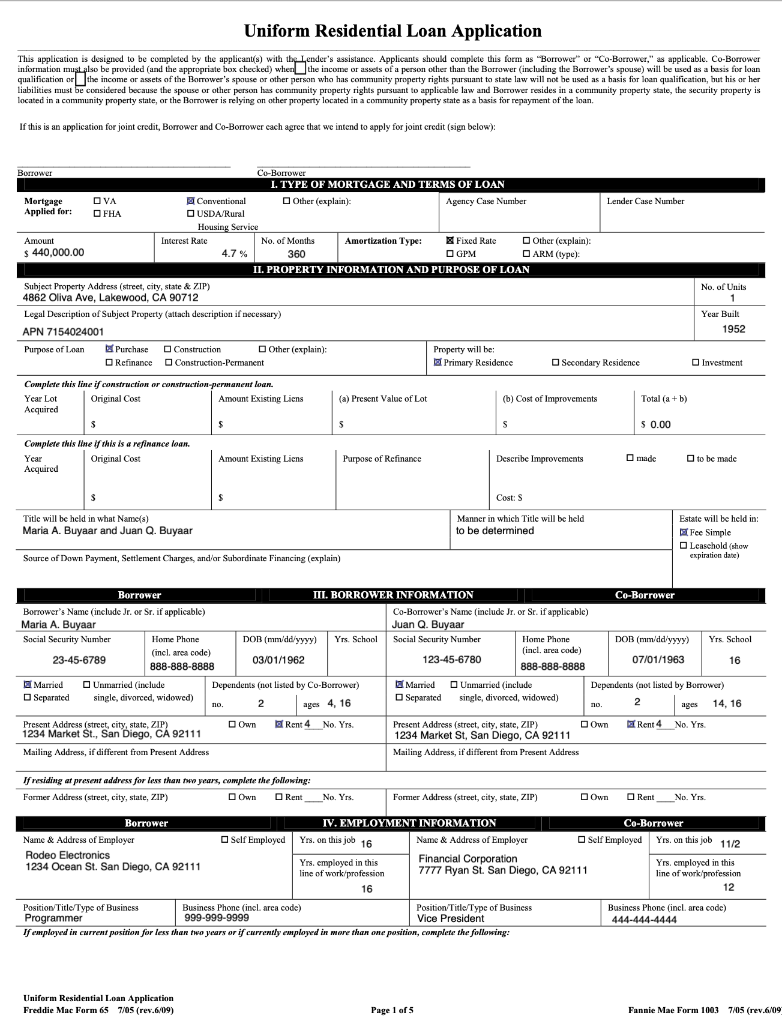

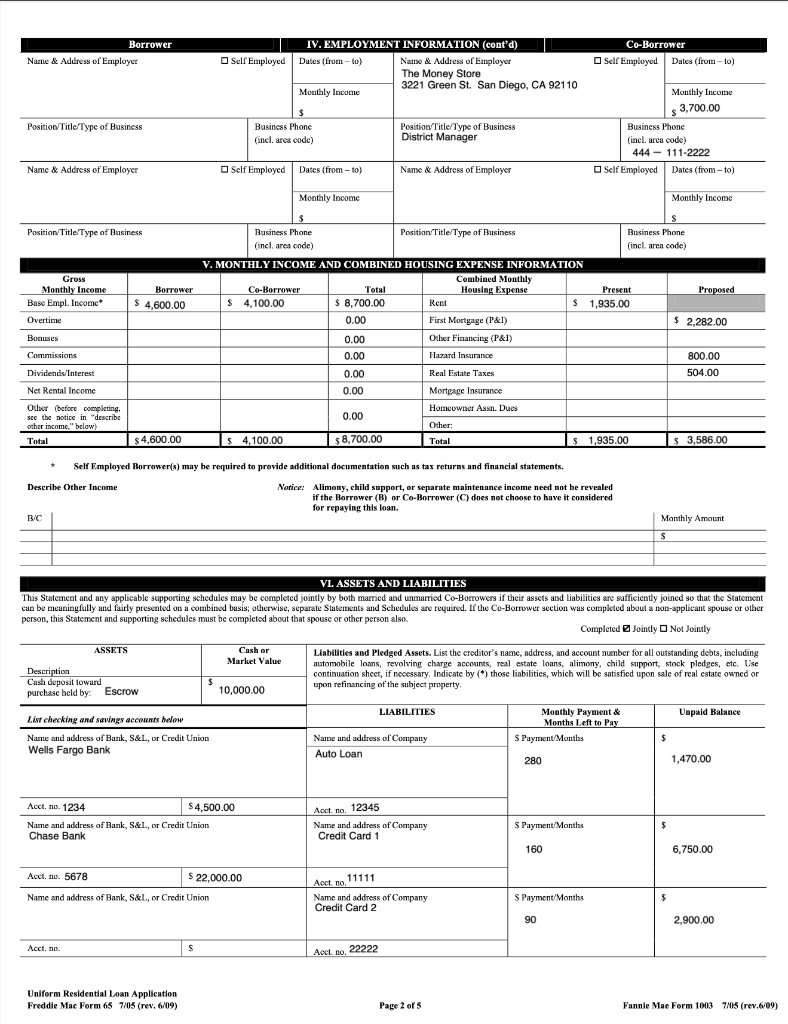

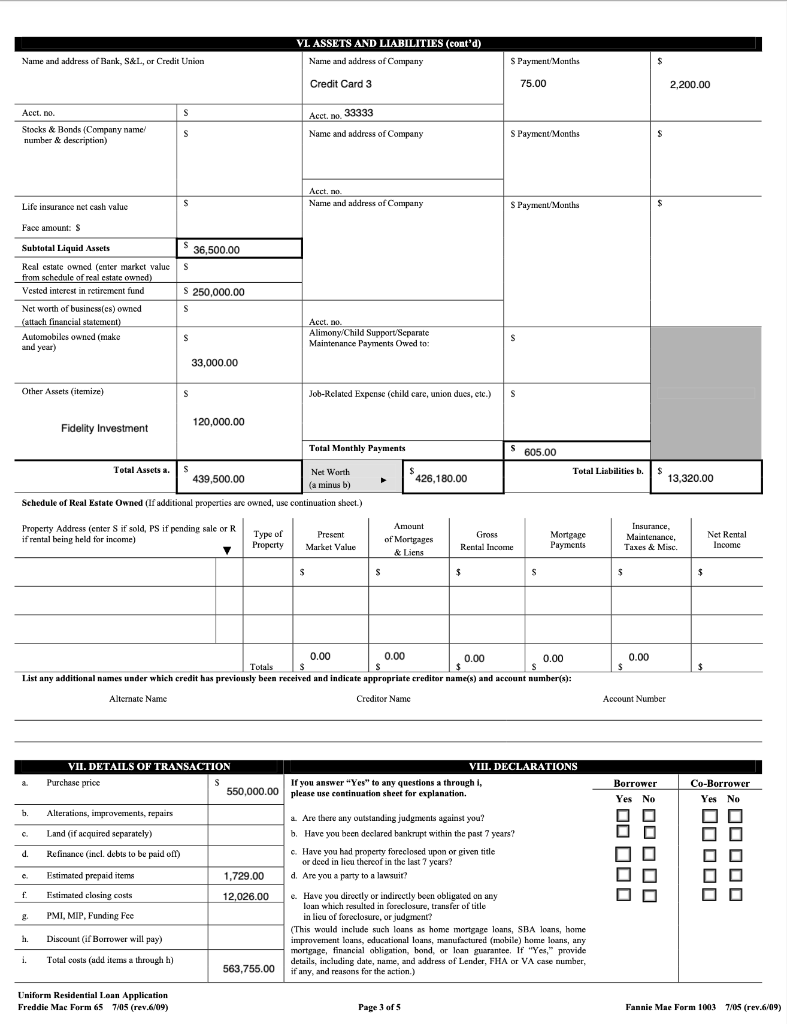

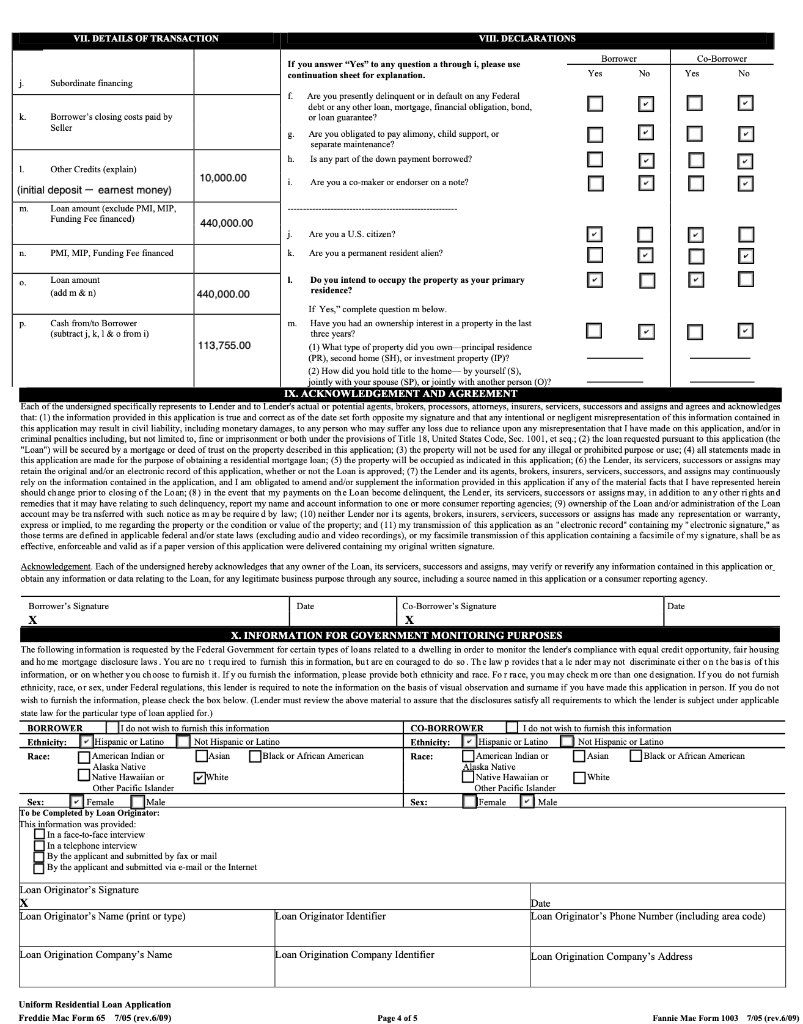

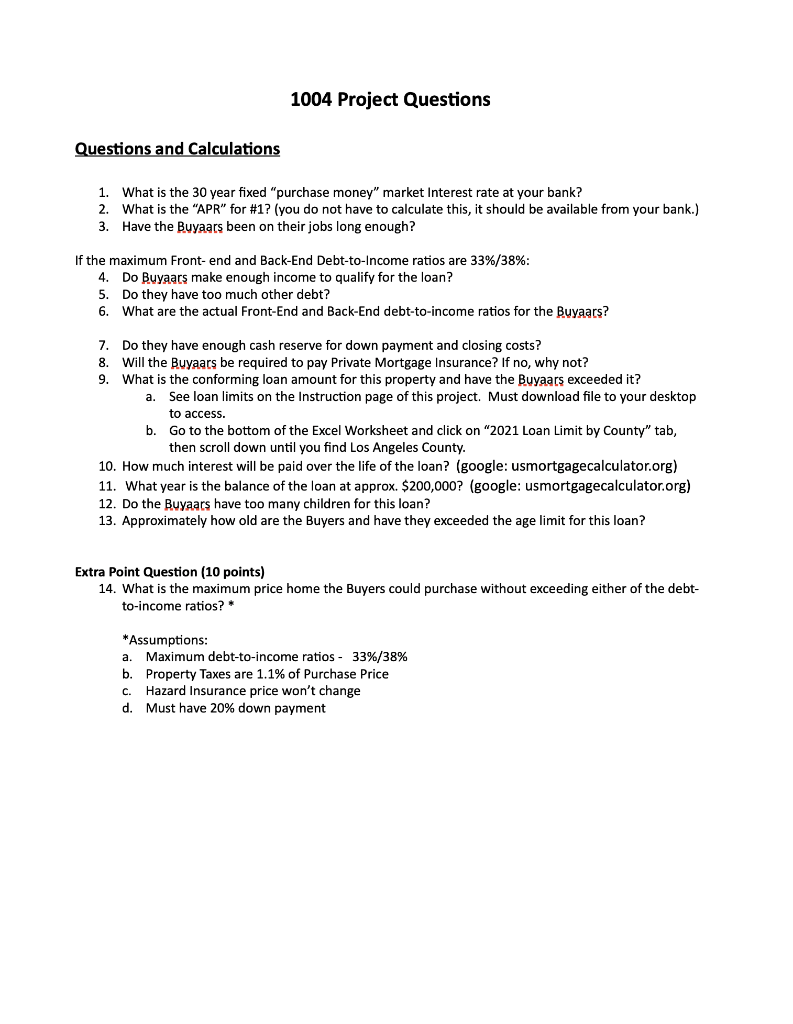

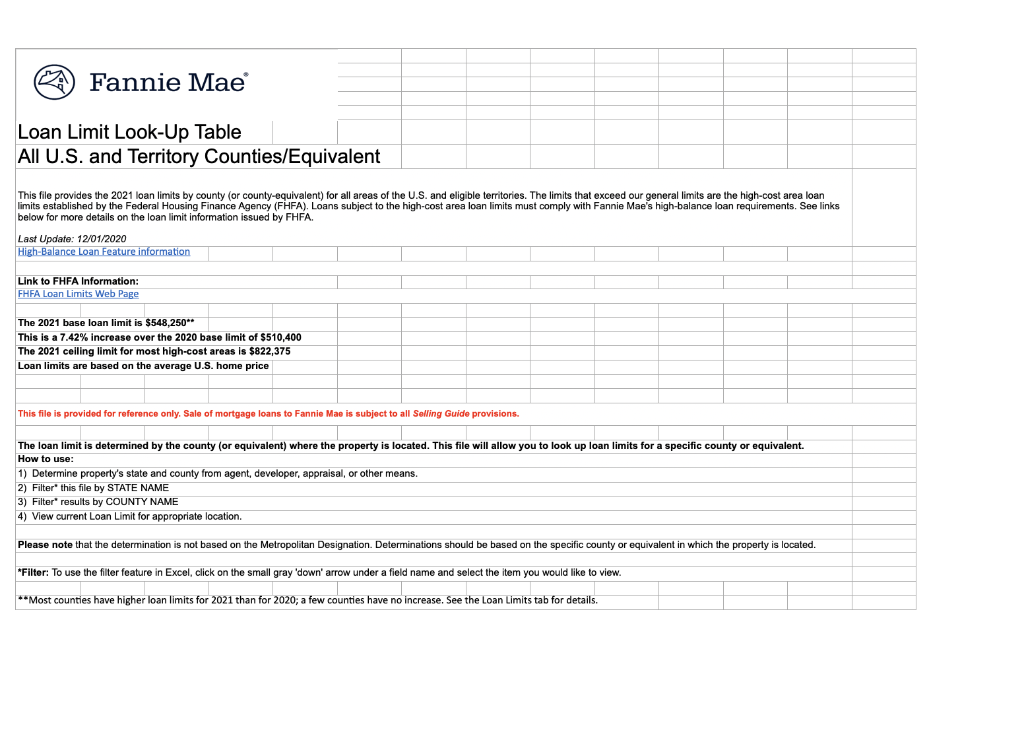

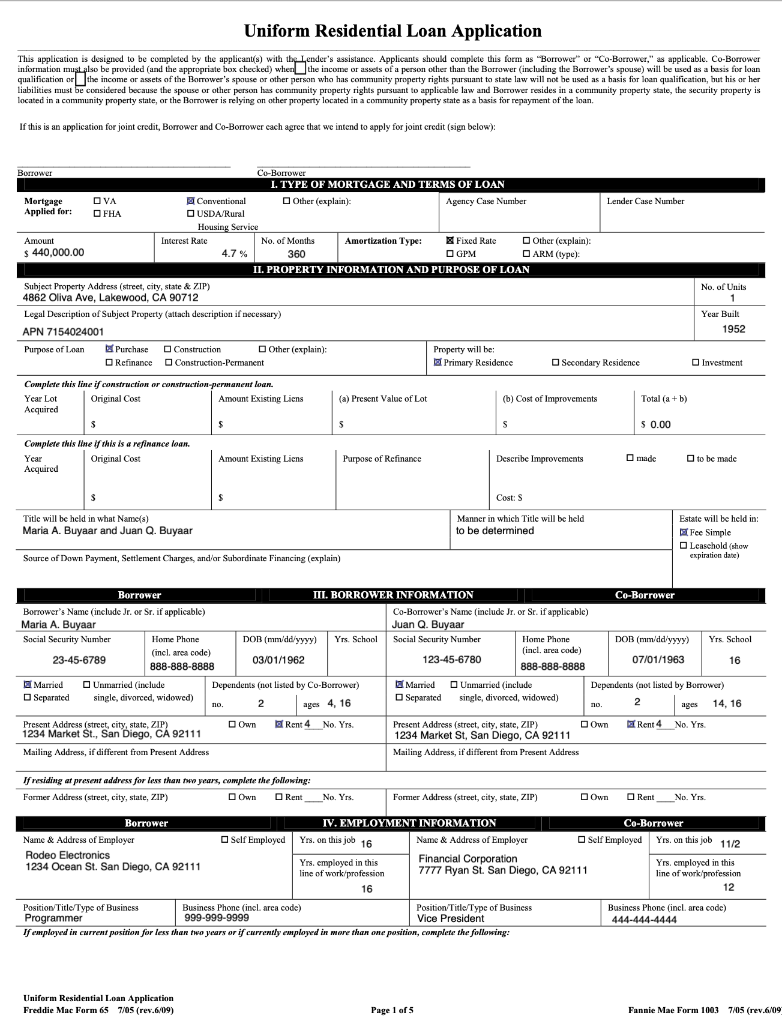

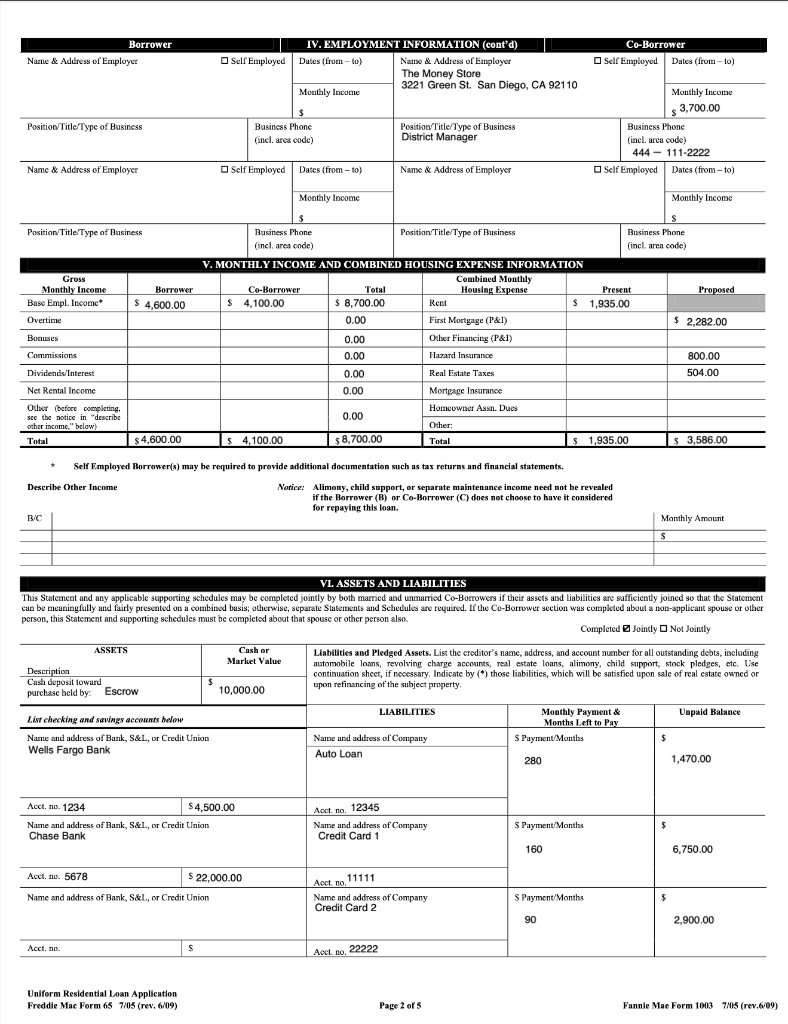

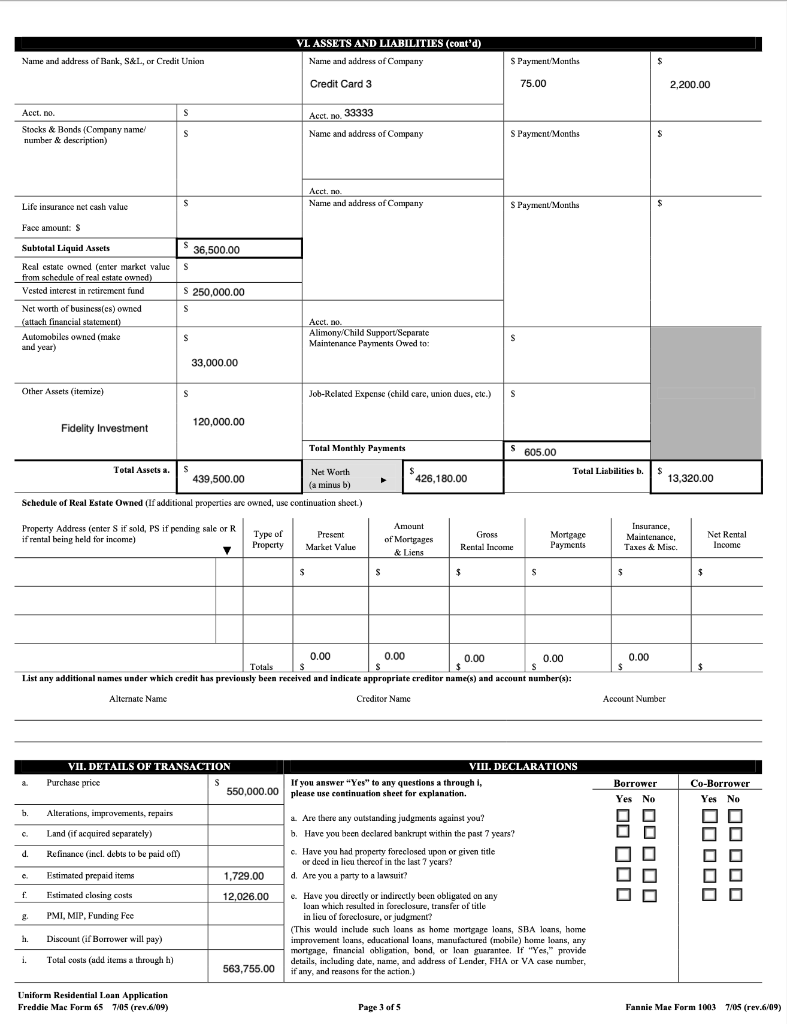

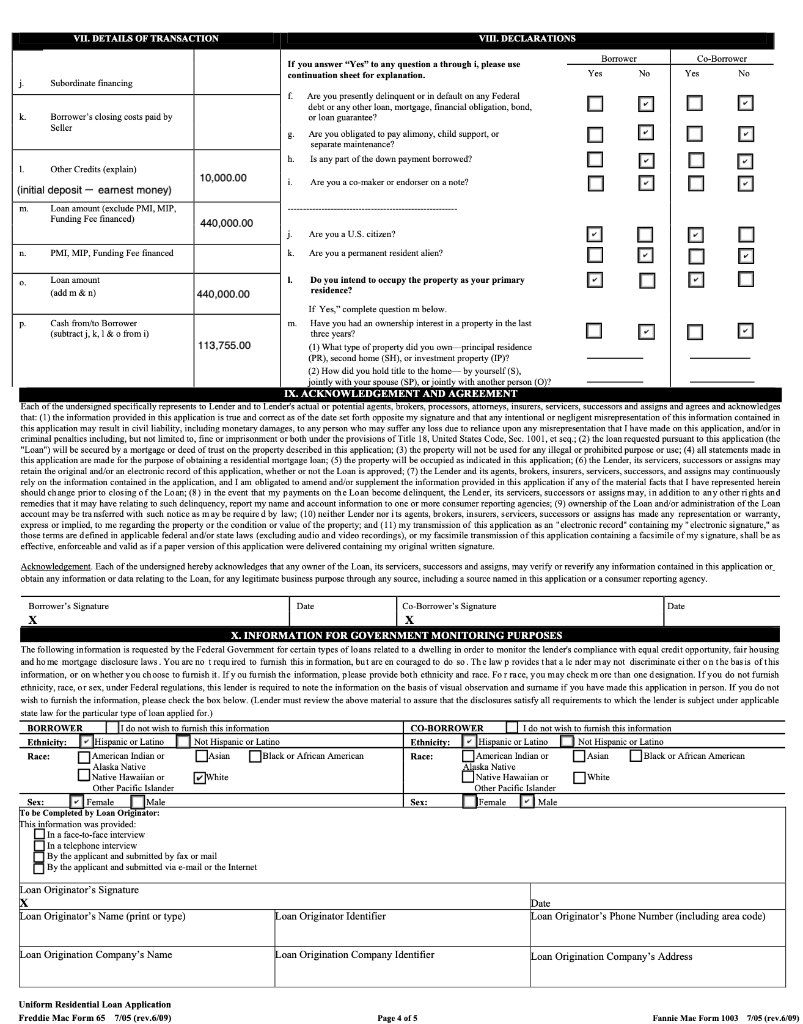

1004 Project Questions Questions and Calculations 1. What is the 30 year fixed "purchase money" market Interest rate at your bank? 2. What is the "APR" for #1? (you do not have to calculate this, it should be available from your bank.) 3. Have the Buyaars been on their jobs long enough? If the maximum Front-end and Back-End Debt-to-Income ratios are 33%/38%: 4. Do Buyaars make enough income to qualify for the loan? 5. Do they have too much other debt? 6. What are the actual Front-End and Back-End debt-to-income ratios for the Buyaars? 7. Do they have enough cash reserve for down payment and closing costs? 8. Will the Buyaars be required to pay Private Mortgage Insurance? If no, why not? 9. What is the conforming loan amount for this property and have the Buyaars exceeded it? a. See loan limits on the Instruction page of this project. Must download file to your desktop to access. b. Go to the bottom of the Excel Worksheet and click on "2021 Loan Limit by County" tab, then scroll down until you find Los Angeles County. 10. How much interest will be paid over the life of the loan? (google: usmortgagecalculator.org) 11. What year is the balance of the loan at approx. $200,000? (google: usmortgagecalculator.org) 12. Do the Buyears have too many children for this loan? 13. Approximately how old are the Buyers and have they exceeded the age limit for this loan? Extra Point Question (10 points) 14. What is the maximum price home the Buyers could purchase without exceeding either of the debt- to-income ratios? *Assumptions: a. Maximum debt-to-income ratios - 33%/38% b. Property Taxes are 1.1% of Purchase Price C. Hazard Insurance price won't change d. Must have 20% down payment Fannie Mae Loan Limit Look-Up Table All U.S. and Territory Counties/Equivalent This file provides the 2021 loan limits by county (or county-equivalent) for all areas of the U.S. and eligible territories. The limits that exceed our general limits are the high-cost area loan limits established by the Federal Housing Finance Agency (FHFA). Loans subject to the high-cost area loan limits must comply with Fannie Mae's high-balance loan requirements. See links below for more details on the loan limit information issued by FHFA. Last Update: 12/01/2020 High-Balance Loan Feature Information Link to FHFA Information: FHFA Loan Limits Web Page The 2021 base loan limit is $548,250 This is a 7.42% increase over the 2020 base limit of $510,400 The 2021 ceiling limit for most high-cost areas is $822,375 Loan limits are based on the average U.S. home price This file is provided for reference only. Sale of mortgage loans to Fannie Mae is subject to all Selling Guide provisions. The loan limit is determined by the county (or equivalent) where the property s located. This file will allow you to look up loan limits for a specific county or equivalent. How to use: 1) Determine property's state and county from agent, developer, appraisal, or other means. 2) Filter this file by STATE NAME 3) Filter results by COUNTY NAME 4) View current Loan Limit for appropriate location. Please note that the determination is not based on the Metropolitan Designation. Determinations should be based on the specific county or equivalent in which the property is located. *Filter: To use the filter feature in Excel, click on the small gray 'down' arrow under a field name and select the item you would like to view. **Most counties have higher loan limits for 2021 than for 2020; a few counties have no increase. See the Loan Limits tab for details. Uniform Residential Loan Application This application is designed to be completed by the applicant's) with the Lender's assistance. Applicants should complete this form as "Borrower" or "Co-Borrower," as applicable. Co-Borrower information must also be provided (and the appropriate box checked when the income or assets of a person other than the Borrower (including the Borrower's spouse) will be used as a basis for loan qualification or the income or assets of the Borrower's spause or other person who has community property rights pursuant to state law will not be used as a basis for loan qualification, but his or her liabilities must be considered because the spouse or other person has community property rights pursuant to applicable law and Borrower resides in a community property state, the security property is located in a community property state, or the Borrower is relying on other property located in a community property state as a basis for repayment of the loan, If this is an application for joint credit, Borrower and Co-Borrower cach agree that we intend to apply for joint credit (sign below) Borrower Co-Borrower I. TYPE OF MORTGAGE AND TERMS OF LOAN Mortgage OVA Conventional Other (explain) Agency Case Number Lender Case Number Applied for: OFHA USDA/Rural Housing Service Amount Interest Rate No. of Months Amortization Type: Fixed Rate Other (explain) $ 440,000.00 4.7% 360 O GPM ARM (type) II. PROPERTY INFORMATION AND PURPOSE OF LOAN Subject Property Address (street, city, state & ZIP) 4862 Oliva Ave, Lakewood, CA 90712 Legal Description of Subject Property (attach description if necessary) APN 7154024001 Purpose of Loan Purchase Construction Other (explain); Property will be: Refinance Construction-Permanent Primary Residence Secondary Residence No. of Units 1 Year Built 1952 Investment (a) Present Value of Lot Complete this line if construction or construction-permanent loan. Year Lot Original Cost Amount Existing Liens Acquired $ (b) Cost of Improvements Total (a + b) s S $ 0.00 Complete this line if this is a refinance loan. Year Original Cost Acquired Amount Existing Liens Purpose of Refinance Describe Improvements made to be made S $ Cost: Title will be held in what Name(s) Maria A. Buyaar and Juan Q. Buyaar Manner in which Title will be held to be determined Estate will be held in Fee Simple Leasehold (show expiration date) Source of Down Payment, Settlement Charges, and/or Subordinate Financing (explain) Borrower TTI. BORROWER INFORMATION Co-Borrower Borrower's Name (include Jr. or Sr. if applicable) Co-Borrower's Name (include Jr. or Sr. if applicable) Maria A. Buyaar Juan Q. Buyaar Social Security Number Home Phone DOB (mm/dd/yyyy) Yrs. School Social Security Number Home Phone DOB (mm/dd/yyyy) Yrs. School (incl. area code) (incl. area code) 23-45-6789 03/01/1962 123-45-6780 07/01/1963 16 888-888-8888 888-888-8888 Married Unmarried include Dependents (not listed by Co-Borrower) Married Unmarried include Dependents (not listed by Borrower) Separated single, divorced, widowed) Separated no. 2 single, divorced, widowed) 2 no. 2 ages 14. 16 Present Address (street, city, state, ZIP) DOwn Rent 4 No. Yrs. Present Address (street, city, state, ZIP) Own Rent 4 No. Yrs. 1234 Market St., San Diego, CA 92111 1234 Market St, San Diego, CA 92111 Mailing Address, if different from Present Address Mailing Address, if different from Present Address ages 4, 16 If residing at present address for less than two years, complete the following: Former Address (street, city, state, ZIP) DOwn Rent No. Yrs. Former Address (street, city, state, ZIP) D Own Rent No. Yrs. Yrs. on this job 11/2 Borrower IV. EMPLOYMENT INFORMATION Co-Borrower Name & Address of Employer Self Employed Yrs. on this job 16 Name & Address of Employer Self Employed Rodeo Electronics Yrs, employed in this Financial Corporation Yrs, employed in this 1234 Ocean St. San Diego, CA 92111 line of work/profession 7777 Ryan St. San Diego, CA 92111 line of work profession 16 12 Position Title/Type of Business Business Phone (incl. area code) Position Title/Type of Business Business Phone (incl. arca code) Programmer 999-999-9999 Vice President 444-444-4444 If exployed in current position for less than two years or if currently employed in more than one position, complete the following: Uniform Residential Loan Application Freddie Mac Form 65 7/05 (rev.6/09) Page 1 of 5 Fannie Mae Form 100.3 7/05 (rev.6/09 Borrower Name & Address of Employer IV. EMPLOYMENT INFORMATION (contd) Self Employed Dates (from-to) Name & Address of Employer The Money Store 3221 Green St. San Diego, CA 92110 Monthly Income Co-Borrower Self Employed Dales (from-to) Position Title Type of Business Business Phone (incl. area code) Position Title/Type of Business District Manager Monthly Income 3,700.00 Business Phone (incl. area code) 444 - 111-2222 Self Employed Dates (from-to) Name & Address of Employer Self Employed Dates (from-to) Name & Address of Employer Monthly Income Monthly Income Position Title Type of Business Gross Monthly Income Base Empl. Income Overtime Borrower $ 4,600.00 $ S Business Phone Position Title/Type of Business Business Phone (incl. area code) (incl.aren code) V. MONTHLY INCOME AND COMBINED HOUSING EXPENSE INFORMATION Combined Monthly Co-Borrower Total Housing Expense Present Proposed $ 4,100.00 $ 8,700.00 Rent $ 1,935.00 0.00 First Mortgage (P&I) $ 2,282.00 0.00 Other Financing (P&I) & 0.00 Hazard Insurance 800.00 0.00 Real Estate Taxes 504.00 0.00 Mortgage Insurance Homeowner Assn. Dues 0.00 Other: $ 4,100.00 $8,700.00 Total $ 1,935.00 $ 3,586.00 Bonuses Commissions Dividends/Interest Net Rental Income Other (before completing, see the notice in "describe other income." below) Total $ 4,600.00 Self Employed Borrower(s) may be required to provide additional documentation such as tax returns and financial statements. Describe Other Income Notice: Alimony, child support, or separate maintenance income need not be revealed if the Borrower (B) or Co-Borrower (C) does not choose to have it considered for repaying this loan. B/C Monthly Amount $ VI. ASSETS AND LIABILITIES This Statement and any applicable supporting schedules may be completed jointly by both married and unmarried Co-Borrowers if their assets and liabilities are sufficiently joined so that the Statement can be meaningfully and fairly presented on a combined basis; otherwise, separate Statements and Schedules are required. If the Co-Borrower section was completed about a non-applicant spouse or other person, this statement and supporting schedules must be completed about that spouse or other person also. Completed Jointly Not Jointly ASSETS Cash or Market Value Description Cash deposit toward purchase held by: Liabilities and Pledged Assets. List the creditor's name, address, and account number for all outstanding debts, including automobile loans, revolving charge accounts, real estate loans, alimony, child support, stock pledges, etc. Use continuation sheet, if necessary. Indicate by (*) those liabilities, which will be satisfied upon sale of real estate owned or upon refinancing of the subject property $ Escrow 10,000.00 LIABILITIES Unpaid Balance List checking and savings accounts below Name and address of Bank, S&L, or Credit Union Wells Fargo Bank Monthly Payment & Months Left to Pay S Payment/Months $ Name and address of Company Auto Loan 280 1,470.00 Acct. no. 12345 Acct. no. 1234 $4,500.00 Name and address of Bank, S&L, or Credit Union Chase Bank Name and address of Company Credit Card 1 S Payment/Months $ 160 6,750.00 Acct. no. 5678 $ 22,000.00 Name and address of Bank, S&L, or Credit Union . Name and address of Company Credit Card 2 S Payment/Months $ 90 2,900.00 Acct. no. S $ Aestno, 22222 Uniform Residential Loan Application Freddie Mac Form 65 7/05 (rev. 6/09) Pago 2015 Page 2 of 5 Fannie Mae Form 1003 7/05 (rev.6/09) Name and address of Bank, S&L, or Credit Union VL ASSETS AND LIABILITIES (cont'd) Name and address of Company Credit Card 3 3 S Payment/Months $ 75.00 2,200.00 s Acet, no. 33333 Acct. no. Stocks & Bonds (Company name number & description) S Name and address of Company S Payment/Months S Acet, no Name and address of Company Life insurance net cash value s S Payment/Months $ S 36,500.00 Face amount: $ Subtotal Liquid Assets Real estate owned (enter market value from schedule of real estate owned) Vested interest in retirement fund S S 250,000.00 S Net worth of business(es) owned (attach financial statement) Automobiles owned (make and year) s s Acct. no. Alimony/Child Support/Separate Maintenance Payments Owed to: s 33,000.00 Other Assets (itemize) S Job-Related Expense (child care, union dues, etc.) S 120,000.00 Fidelity Investment Total Monthly Payments S 605.00 $ 426,180.00 Total Liabilities b. 13,320.00 Total Assets a. Net Worth 439,500.00 (a minus b) Schedule of Real Estate Owned (If additional properties are owned, use continuation sboct.) Property Address Center S if sold, PS if pending sale or R if rental being held for income) 7 Type of Property Present Market Value Amount of Mortgages & Liens Gross Rental Income Mortgage Payments Insurance, Maintenance, Taxes & Misc. Net Rental Income s $ s $ S s $ 0.00 $ $ 0.00 0.00 0.00 Totals 0.00 S $ $ List any additional names under which credit has previously been received and indicate appropriate creditor name(s) and account number(s): Alternate Name Creditor Name Account Number VII. DETAILS OF TRANSACTION Purchase price S 550,000.00 VIII. DECLARATIONS If you answer "Yes" to any questions a through i, please use continuation sheet for explanation. Borrower Yes No Co-Borrower Yes No b. Alterations, improvements, repairs Land (if acquired separately) d. Refinance (incl. debts to be paid off) Estimated prepaid items 1,729.00 12,026.00 a Are there any outstanding judgments against you? b. Have you been declared bankrupt within the past 7 years? c. Have you had property foreclosed upon or given title or deed in licu thereof in the last 7 years? d. Are you a party to a lawsuit? e. Have you directly or indirectly been obligated on any loan which resulted in foreclosure, transfer of title in lieu of foreclosure, or judgment? (This would include such loans as home mortgage loans, SBA loans, home improvement loans, educational loans, manufactured (mobile) home loans, any mortgage, financial obligation, bond, or loan guarantee. If "Yes," provide details, including date, name, and address of Lender, FHA or VA case number, if any, and reasons for the action.) f Estimated closing costs PMI, MIP, Funding Fee h. Discount (if Borrower will pay) Total costs (add items a through h) 563,755.00 Uniform Residential Loan Application Freddie Mae Form 65 7/05 (rev.6/09) Page 3 of 5 Fannie Mae Form 1003 7/05 (rev.6/09) VII. DETAILS OF TRANSACTION VII. DECLARATIONS Borrower Yes No Co-Borrower Yes No j Subordinate financing If you answer "Yes" to any question a through i, please use continuation sheet for explanation. 1. Are you presently delinquent or in default on any Federal debt or any other loan, mortgage, financial obligation, bond, or loan guarantee Are you obligated to pay alimony, child support, or separate maintenance? . Is any part of the down payment borrowed? k. Borrower's closing costs paid by Seller 1. Other Credits (explain) 10,000.00 i. Are you a co-ruker or endorser on a note? (initial deposit - earnest money) Loan amount (exclude PMI, MIP, Funding Fee financed) 440,000.00 j. Are you a U.S. citizen? PMI, MIP, Funding Fee financed Are you a permanent resident alien? . m Loan amount I. Do you intend to occupy the property as your primary (add m&n) 440,000.00 residence? If Yes," complete question m below P Cash from/to Borrower Have you had an ownership interest in a property in the last (subtract.k, 1&o from i) three years? 113,755.00 (1) What type of property did you own principal residence (PR), second home (SH), or investment property (IP)? (2) How did you hold title to the home by yourself (S), jointly with your spouse (SP), or jointly with another person (OY? IX. ACKNOWLEDGEMENT AND AGREEMENT Each of the undersigned specifically represents to Lender and to Lender's actual or potential agents, brokers, processors, attorneys, insurers, servicers, successors and assigns and agrees and acknowledges that: (1) the information provided in this application is true and correct as of the date set forth opposite my signature and that any intentional or negligent misrepresentation of this information contained in this application may result in civil liability, including monetary damages, to any person who may suffer any loss due to reliance upon any misrepresentation that I have made on this application, and/or in criminal penalties including, but not limited to, fine or imprisonment or both under the provisions of Title 18, United States Code, Sec. 1001, et seq., (2) the loan requested pursuant to this application (the "Loan") will be secured by a mortgage or deed of trust on the property described in this application; (3) the property will not be used for any illegal or prohibited purpose or use; (4) all statements made in this application are made for the purpose of obtaining a residential mortgage loan; (5) the property will be occupied as indicated in this application; (6) the Lender, its services, successors or assigns may retain the original and/or an electronic record of this application, whether or not the Loan is approved; (7) the Lender and its agents, brokers, insurers, servicers, successors, and assigns may continuously rely on the information contained in the application, and I am obligated to amend and/or supplement the information provided in this application if any of the material facts that I have represented herein should change prior to closing of the Loan; (8) in the event that my payments on the Loan become delinquent, the Lender, its servicers, successors or assigns may, in addition to any other rights and remedies that it may have relating to such delinquency, report my name and account information to one or more consumer reporting agencies: (9) ownership of the Loan and/or administration of the Loan account may be transferred with such notice as may be required by law; (10) neither Lender nor its agents, brokers, insurers, servicers, successors or assigns has made any representation or warranty, express or implied, to me regarding the property or the condition or value of the property; and (11) my transmission of this application as an "electronic record" containing my electronic signature," as those terms are defined in applicable federal and/or state laws (excluding audio and video recordings), or my facsimile transmission of this application containing a facsimile of my signature, shall be as effective, enforceable and valid as if a paper version of this application were delivered containing my original written signature. Acknowledgement. Each of the undersigned hereby acknowledges that any owner of the Loan, its servicers, successors and assigns, may verify or reverify any information contained in this application or obtain any information or data relating to the Loan, for any legitimate business purpose through any source, including a source named in this application or a consumer reporting agency. Borrower's Signature Date Co-Borrower's Signature Date X X. INFORMATION FOR GOVERNMENT MONITORING PURPOSES The following information is requested by the Federal Government for certain types of loans related to a dwelling in order to monitor the lender's compliance with equal credit opportunity, fair housing and home mortgage disclosure laws. You are not required to furnish this information, but are en couraged to do so. The law provides that a le nder may not discriminate cither on the basis of this information, or on whether you choose to fumishit. If you fu mish the information, please provide both ethnicity and race. For race, you may check more than one designation. If you do not furnish ethnicity, race, or sex, under Federal regulations, this lender is required to note the information on the basis of visual observation and sumame if you have made this application in person. If you do not wish to furnish the information, please check the box below. (Lender must review the above material to assure that the disclosures satisfy all requirements to which the lender is subject under applicable state law for the particular type of loan applied for.) BORROWER I do not wish to furnish this information CO-BORROWER I do not wish to fumish this information Ethnicity: Hispanic or Latino Not Hispanic or Latino Ethnicity: Hispanic or Latino Not Hispanic or Latino Race: American Indian or Asian Black or African American Race: American Indian or Asian Black or African American Alaska Native Alaska Native Native Hawaiian or White Native Hawaiian or white Other Pacific Islander Other Pacific Islander Sex: Female Male Sex: Female Male To be Completed by Loan Originatori This information was provided In a face-to-face interview In a telephone interview By the applicant and submitted by fax or mail By the applicant and submitted via e-mail or the Internet Loan Originator's Signature X Loan Originator's Name (print or type) Loan Originator Identifier Date Loan Originator's Phone Number (including area code) Loan Origination Company's Name Loan Origination Company Identifier Loan Origination Company's Address Uniform Residential Loan Application Freddie Mac Form 65 7/05 (rev.6/09) Page 4 of 5 Fannie Mae Form 1003 7/05 (rev.6/09) 1004 Project Questions Questions and Calculations 1. What is the 30 year fixed "purchase money" market Interest rate at your bank? 2. What is the "APR" for #1? (you do not have to calculate this, it should be available from your bank.) 3. Have the Buyaars been on their jobs long enough? If the maximum Front-end and Back-End Debt-to-Income ratios are 33%/38%: 4. Do Buyaars make enough income to qualify for the loan? 5. Do they have too much other debt? 6. What are the actual Front-End and Back-End debt-to-income ratios for the Buyaars? 7. Do they have enough cash reserve for down payment and closing costs? 8. Will the Buyaars be required to pay Private Mortgage Insurance? If no, why not? 9. What is the conforming loan amount for this property and have the Buyaars exceeded it? a. See loan limits on the Instruction page of this project. Must download file to your desktop to access. b. Go to the bottom of the Excel Worksheet and click on "2021 Loan Limit by County" tab, then scroll down until you find Los Angeles County. 10. How much interest will be paid over the life of the loan? (google: usmortgagecalculator.org) 11. What year is the balance of the loan at approx. $200,000? (google: usmortgagecalculator.org) 12. Do the Buyears have too many children for this loan? 13. Approximately how old are the Buyers and have they exceeded the age limit for this loan? Extra Point Question (10 points) 14. What is the maximum price home the Buyers could purchase without exceeding either of the debt- to-income ratios? *Assumptions: a. Maximum debt-to-income ratios - 33%/38% b. Property Taxes are 1.1% of Purchase Price C. Hazard Insurance price won't change d. Must have 20% down payment Fannie Mae Loan Limit Look-Up Table All U.S. and Territory Counties/Equivalent This file provides the 2021 loan limits by county (or county-equivalent) for all areas of the U.S. and eligible territories. The limits that exceed our general limits are the high-cost area loan limits established by the Federal Housing Finance Agency (FHFA). Loans subject to the high-cost area loan limits must comply with Fannie Mae's high-balance loan requirements. See links below for more details on the loan limit information issued by FHFA. Last Update: 12/01/2020 High-Balance Loan Feature Information Link to FHFA Information: FHFA Loan Limits Web Page The 2021 base loan limit is $548,250 This is a 7.42% increase over the 2020 base limit of $510,400 The 2021 ceiling limit for most high-cost areas is $822,375 Loan limits are based on the average U.S. home price This file is provided for reference only. Sale of mortgage loans to Fannie Mae is subject to all Selling Guide provisions. The loan limit is determined by the county (or equivalent) where the property s located. This file will allow you to look up loan limits for a specific county or equivalent. How to use: 1) Determine property's state and county from agent, developer, appraisal, or other means. 2) Filter this file by STATE NAME 3) Filter results by COUNTY NAME 4) View current Loan Limit for appropriate location. Please note that the determination is not based on the Metropolitan Designation. Determinations should be based on the specific county or equivalent in which the property is located. *Filter: To use the filter feature in Excel, click on the small gray 'down' arrow under a field name and select the item you would like to view. **Most counties have higher loan limits for 2021 than for 2020; a few counties have no increase. See the Loan Limits tab for details. Uniform Residential Loan Application This application is designed to be completed by the applicant's) with the Lender's assistance. Applicants should complete this form as "Borrower" or "Co-Borrower," as applicable. Co-Borrower information must also be provided (and the appropriate box checked when the income or assets of a person other than the Borrower (including the Borrower's spouse) will be used as a basis for loan qualification or the income or assets of the Borrower's spause or other person who has community property rights pursuant to state law will not be used as a basis for loan qualification, but his or her liabilities must be considered because the spouse or other person has community property rights pursuant to applicable law and Borrower resides in a community property state, the security property is located in a community property state, or the Borrower is relying on other property located in a community property state as a basis for repayment of the loan, If this is an application for joint credit, Borrower and Co-Borrower cach agree that we intend to apply for joint credit (sign below) Borrower Co-Borrower I. TYPE OF MORTGAGE AND TERMS OF LOAN Mortgage OVA Conventional Other (explain) Agency Case Number Lender Case Number Applied for: OFHA USDA/Rural Housing Service Amount Interest Rate No. of Months Amortization Type: Fixed Rate Other (explain) $ 440,000.00 4.7% 360 O GPM ARM (type) II. PROPERTY INFORMATION AND PURPOSE OF LOAN Subject Property Address (street, city, state & ZIP) 4862 Oliva Ave, Lakewood, CA 90712 Legal Description of Subject Property (attach description if necessary) APN 7154024001 Purpose of Loan Purchase Construction Other (explain); Property will be: Refinance Construction-Permanent Primary Residence Secondary Residence No. of Units 1 Year Built 1952 Investment (a) Present Value of Lot Complete this line if construction or construction-permanent loan. Year Lot Original Cost Amount Existing Liens Acquired $ (b) Cost of Improvements Total (a + b) s S $ 0.00 Complete this line if this is a refinance loan. Year Original Cost Acquired Amount Existing Liens Purpose of Refinance Describe Improvements made to be made S $ Cost: Title will be held in what Name(s) Maria A. Buyaar and Juan Q. Buyaar Manner in which Title will be held to be determined Estate will be held in Fee Simple Leasehold (show expiration date) Source of Down Payment, Settlement Charges, and/or Subordinate Financing (explain) Borrower TTI. BORROWER INFORMATION Co-Borrower Borrower's Name (include Jr. or Sr. if applicable) Co-Borrower's Name (include Jr. or Sr. if applicable) Maria A. Buyaar Juan Q. Buyaar Social Security Number Home Phone DOB (mm/dd/yyyy) Yrs. School Social Security Number Home Phone DOB (mm/dd/yyyy) Yrs. School (incl. area code) (incl. area code) 23-45-6789 03/01/1962 123-45-6780 07/01/1963 16 888-888-8888 888-888-8888 Married Unmarried include Dependents (not listed by Co-Borrower) Married Unmarried include Dependents (not listed by Borrower) Separated single, divorced, widowed) Separated no. 2 single, divorced, widowed) 2 no. 2 ages 14. 16 Present Address (street, city, state, ZIP) DOwn Rent 4 No. Yrs. Present Address (street, city, state, ZIP) Own Rent 4 No. Yrs. 1234 Market St., San Diego, CA 92111 1234 Market St, San Diego, CA 92111 Mailing Address, if different from Present Address Mailing Address, if different from Present Address ages 4, 16 If residing at present address for less than two years, complete the following: Former Address (street, city, state, ZIP) DOwn Rent No. Yrs. Former Address (street, city, state, ZIP) D Own Rent No. Yrs. Yrs. on this job 11/2 Borrower IV. EMPLOYMENT INFORMATION Co-Borrower Name & Address of Employer Self Employed Yrs. on this job 16 Name & Address of Employer Self Employed Rodeo Electronics Yrs, employed in this Financial Corporation Yrs, employed in this 1234 Ocean St. San Diego, CA 92111 line of work/profession 7777 Ryan St. San Diego, CA 92111 line of work profession 16 12 Position Title/Type of Business Business Phone (incl. area code) Position Title/Type of Business Business Phone (incl. arca code) Programmer 999-999-9999 Vice President 444-444-4444 If exployed in current position for less than two years or if currently employed in more than one position, complete the following: Uniform Residential Loan Application Freddie Mac Form 65 7/05 (rev.6/09) Page 1 of 5 Fannie Mae Form 100.3 7/05 (rev.6/09 Borrower Name & Address of Employer IV. EMPLOYMENT INFORMATION (contd) Self Employed Dates (from-to) Name & Address of Employer The Money Store 3221 Green St. San Diego, CA 92110 Monthly Income Co-Borrower Self Employed Dales (from-to) Position Title Type of Business Business Phone (incl. area code) Position Title/Type of Business District Manager Monthly Income 3,700.00 Business Phone (incl. area code) 444 - 111-2222 Self Employed Dates (from-to) Name & Address of Employer Self Employed Dates (from-to) Name & Address of Employer Monthly Income Monthly Income Position Title Type of Business Gross Monthly Income Base Empl. Income Overtime Borrower $ 4,600.00 $ S Business Phone Position Title/Type of Business Business Phone (incl. area code) (incl.aren code) V. MONTHLY INCOME AND COMBINED HOUSING EXPENSE INFORMATION Combined Monthly Co-Borrower Total Housing Expense Present Proposed $ 4,100.00 $ 8,700.00 Rent $ 1,935.00 0.00 First Mortgage (P&I) $ 2,282.00 0.00 Other Financing (P&I) & 0.00 Hazard Insurance 800.00 0.00 Real Estate Taxes 504.00 0.00 Mortgage Insurance Homeowner Assn. Dues 0.00 Other: $ 4,100.00 $8,700.00 Total $ 1,935.00 $ 3,586.00 Bonuses Commissions Dividends/Interest Net Rental Income Other (before completing, see the notice in "describe other income." below) Total $ 4,600.00 Self Employed Borrower(s) may be required to provide additional documentation such as tax returns and financial statements. Describe Other Income Notice: Alimony, child support, or separate maintenance income need not be revealed if the Borrower (B) or Co-Borrower (C) does not choose to have it considered for repaying this loan. B/C Monthly Amount $ VI. ASSETS AND LIABILITIES This Statement and any applicable supporting schedules may be completed jointly by both married and unmarried Co-Borrowers if their assets and liabilities are sufficiently joined so that the Statement can be meaningfully and fairly presented on a combined basis; otherwise, separate Statements and Schedules are required. If the Co-Borrower section was completed about a non-applicant spouse or other person, this statement and supporting schedules must be completed about that spouse or other person also. Completed Jointly Not Jointly ASSETS Cash or Market Value Description Cash deposit toward purchase held by: Liabilities and Pledged Assets. List the creditor's name, address, and account number for all outstanding debts, including automobile loans, revolving charge accounts, real estate loans, alimony, child support, stock pledges, etc. Use continuation sheet, if necessary. Indicate by (*) those liabilities, which will be satisfied upon sale of real estate owned or upon refinancing of the subject property $ Escrow 10,000.00 LIABILITIES Unpaid Balance List checking and savings accounts below Name and address of Bank, S&L, or Credit Union Wells Fargo Bank Monthly Payment & Months Left to Pay S Payment/Months $ Name and address of Company Auto Loan 280 1,470.00 Acct. no. 12345 Acct. no. 1234 $4,500.00 Name and address of Bank, S&L, or Credit Union Chase Bank Name and address of Company Credit Card 1 S Payment/Months $ 160 6,750.00 Acct. no. 5678 $ 22,000.00 Name and address of Bank, S&L, or Credit Union . Name and address of Company Credit Card 2 S Payment/Months $ 90 2,900.00 Acct. no. S $ Aestno, 22222 Uniform Residential Loan Application Freddie Mac Form 65 7/05 (rev. 6/09) Pago 2015 Page 2 of 5 Fannie Mae Form 1003 7/05 (rev.6/09) Name and address of Bank, S&L, or Credit Union VL ASSETS AND LIABILITIES (cont'd) Name and address of Company Credit Card 3 3 S Payment/Months $ 75.00 2,200.00 s Acet, no. 33333 Acct. no. Stocks & Bonds (Company name number & description) S Name and address of Company S Payment/Months S Acet, no Name and address of Company Life insurance net cash value s S Payment/Months $ S 36,500.00 Face amount: $ Subtotal Liquid Assets Real estate owned (enter market value from schedule of real estate owned) Vested interest in retirement fund S S 250,000.00 S Net worth of business(es) owned (attach financial statement) Automobiles owned (make and year) s s Acct. no. Alimony/Child Support/Separate Maintenance Payments Owed to: s 33,000.00 Other Assets (itemize) S Job-Related Expense (child care, union dues, etc.) S 120,000.00 Fidelity Investment Total Monthly Payments S 605.00 $ 426,180.00 Total Liabilities b. 13,320.00 Total Assets a. Net Worth 439,500.00 (a minus b) Schedule of Real Estate Owned (If additional properties are owned, use continuation sboct.) Property Address Center S if sold, PS if pending sale or R if rental being held for income) 7 Type of Property Present Market Value Amount of Mortgages & Liens Gross Rental Income Mortgage Payments Insurance, Maintenance, Taxes & Misc. Net Rental Income s $ s $ S s $ 0.00 $ $ 0.00 0.00 0.00 Totals 0.00 S $ $ List any additional names under which credit has previously been received and indicate appropriate creditor name(s) and account number(s): Alternate Name Creditor Name Account Number VII. DETAILS OF TRANSACTION Purchase price S 550,000.00 VIII. DECLARATIONS If you answer "Yes" to any questions a through i, please use continuation sheet for explanation. Borrower Yes No Co-Borrower Yes No b. Alterations, improvements, repairs Land (if acquired separately) d. Refinance (incl. debts to be paid off) Estimated prepaid items 1,729.00 12,026.00 a Are there any outstanding judgments against you? b. Have you been declared bankrupt within the past 7 years? c. Have you had property foreclosed upon or given title or deed in licu thereof in the last 7 years? d. Are you a party to a lawsuit? e. Have you directly or indirectly been obligated on any loan which resulted in foreclosure, transfer of title in lieu of foreclosure, or judgment? (This would include such loans as home mortgage loans, SBA loans, home improvement loans, educational loans, manufactured (mobile) home loans, any mortgage, financial obligation, bond, or loan guarantee. If "Yes," provide details, including date, name, and address of Lender, FHA or VA case number, if any, and reasons for the action.) f Estimated closing costs PMI, MIP, Funding Fee h. Discount (if Borrower will pay) Total costs (add items a through h) 563,755.00 Uniform Residential Loan Application Freddie Mae Form 65 7/05 (rev.6/09) Page 3 of 5 Fannie Mae Form 1003 7/05 (rev.6/09) VII. DETAILS OF TRANSACTION VII. DECLARATIONS Borrower Yes No Co-Borrower Yes No j Subordinate financing If you answer "Yes" to any question a through i, please use continuation sheet for explanation. 1. Are you presently delinquent or in default on any Federal debt or any other loan, mortgage, financial obligation, bond, or loan guarantee Are you obligated to pay alimony, child support, or separate maintenance? . Is any part of the down payment borrowed? k. Borrower's closing costs paid by Seller 1. Other Credits (explain) 10,000.00 i. Are you a co-ruker or endorser on a note? (initial deposit - earnest money) Loan amount (exclude PMI, MIP, Funding Fee financed) 440,000.00 j. Are you a U.S. citizen? PMI, MIP, Funding Fee financed Are you a permanent resident alien? . m Loan amount I. Do you intend to occupy the property as your primary (add m&n) 440,000.00 residence? If Yes," complete question m below P Cash from/to Borrower Have you had an ownership interest in a property in the last (subtract.k, 1&o from i) three years? 113,755.00 (1) What type of property did you own principal residence (PR), second home (SH), or investment property (IP)? (2) How did you hold title to the home by yourself (S), jointly with your spouse (SP), or jointly with another person (OY? IX. ACKNOWLEDGEMENT AND AGREEMENT Each of the undersigned specifically represents to Lender and to Lender's actual or potential agents, brokers, processors, attorneys, insurers, servicers, successors and assigns and agrees and acknowledges that: (1) the information provided in this application is true and correct as of the date set forth opposite my signature and that any intentional or negligent misrepresentation of this information contained in this application may result in civil liability, including monetary damages, to any person who may suffer any loss due to reliance upon any misrepresentation that I have made on this application, and/or in criminal penalties including, but not limited to, fine or imprisonment or both under the provisions of Title 18, United States Code, Sec. 1001, et seq., (2) the loan requested pursuant to this application (the "Loan") will be secured by a mortgage or deed of trust on the property described in this application; (3) the property will not be used for any illegal or prohibited purpose or use; (4) all statements made in this application are made for the purpose of obtaining a residential mortgage loan; (5) the property will be occupied as indicated in this application; (6) the Lender, its services, successors or assigns may retain the original and/or an electronic record of this application, whether or not the Loan is approved; (7) the Lender and its agents, brokers, insurers, servicers, successors, and assigns may continuously rely on the information contained in the application, and I am obligated to amend and/or supplement the information provided in this application if any of the material facts that I have represented herein should change prior to closing of the Loan; (8) in the event that my payments on the Loan become delinquent, the Lender, its servicers, successors or assigns may, in addition to any other rights and remedies that it may have relating to such delinquency, report my name and account information to one or more consumer reporting agencies: (9) ownership of the Loan and/or administration of the Loan account may be transferred with such notice as may be required by law; (10) neither Lender nor its agents, brokers, insurers, servicers, successors or assigns has made any representation or warranty, express or implied, to me regarding the property or the condition or value of the property; and (11) my transmission of this application as an "electronic record" containing my electronic signature," as those terms are defined in applicable federal and/or state laws (excluding audio and video recordings), or my facsimile transmission of this application containing a facsimile of my signature, shall be as effective, enforceable and valid as if a paper version of this application were delivered containing my original written signature. Acknowledgement. Each of the undersigned hereby acknowledges that any owner of the Loan, its servicers, successors and assigns, may verify or reverify any information contained in this application or obtain any information or data relating to the Loan, for any legitimate business purpose through any source, including a source named in this application or a consumer reporting agency. Borrower's Signature Date Co-Borrower's Signature Date X X. INFORMATION FOR GOVERNMENT MONITORING PURPOSES The following information is requested by the Federal Government for certain types of loans related to a dwelling in order to monitor the lender's compliance with equal credit opportunity, fair housing and home mortgage disclosure laws. You are not required to furnish this information, but are en couraged to do so. The law provides that a le nder may not discriminate cither on the basis of this information, or on whether you choose to fumishit. If you fu mish the information, please provide both ethnicity and race. For race, you may check more than one designation. If you do not furnish ethnicity, race, or sex, under Federal regulations, this lender is required to note the information on the basis of visual observation and sumame if you have made this application in person. If you do not wish to furnish the information, please check the box below. (Lender must review the above material to assure that the disclosures satisfy all requirements to which the lender is subject under applicable state law for the particular type of loan applied for.) BORROWER I do not wish to furnish this information CO-BORROWER I do not wish to fumish this information Ethnicity: Hispanic or Latino Not Hispanic or Latino Ethnicity: Hispanic or Latino Not Hispanic or Latino Race: American Indian or Asian Black or African American Race: American Indian or Asian Black or African American Alaska Native Alaska Native Native Hawaiian or White Native Hawaiian or white Other Pacific Islander Other Pacific Islander Sex: Female Male Sex: Female Male To be Completed by Loan Originatori This information was provided In a face-to-face interview In a telephone interview By the applicant and submitted by fax or mail By the applicant and submitted via e-mail or the Internet Loan Originator's Signature X Loan Originator's Name (print or type) Loan Originator Identifier Date Loan Originator's Phone Number (including area code) Loan Origination Company's Name Loan Origination Company Identifier Loan Origination Company's Address Uniform Residential Loan Application Freddie Mac Form 65 7/05 (rev.6/09) Page 4 of 5 Fannie Mae Form 1003 7/05 (rev.6/09)