Answered step by step

Verified Expert Solution

Question

1 Approved Answer

10&11? 10 Problem 10-1A Analysis of income effects of additional business LO A1 Jones Products manufactures and sells to wholesalers approximately 500,000 packages per year

10&11?

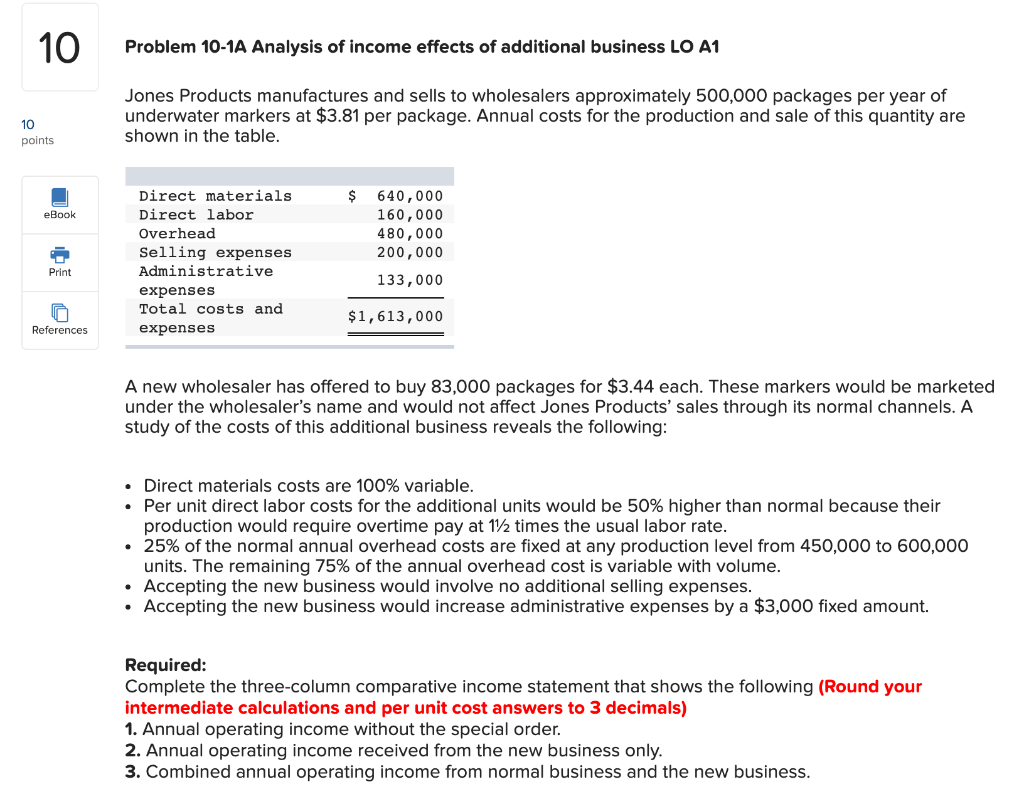

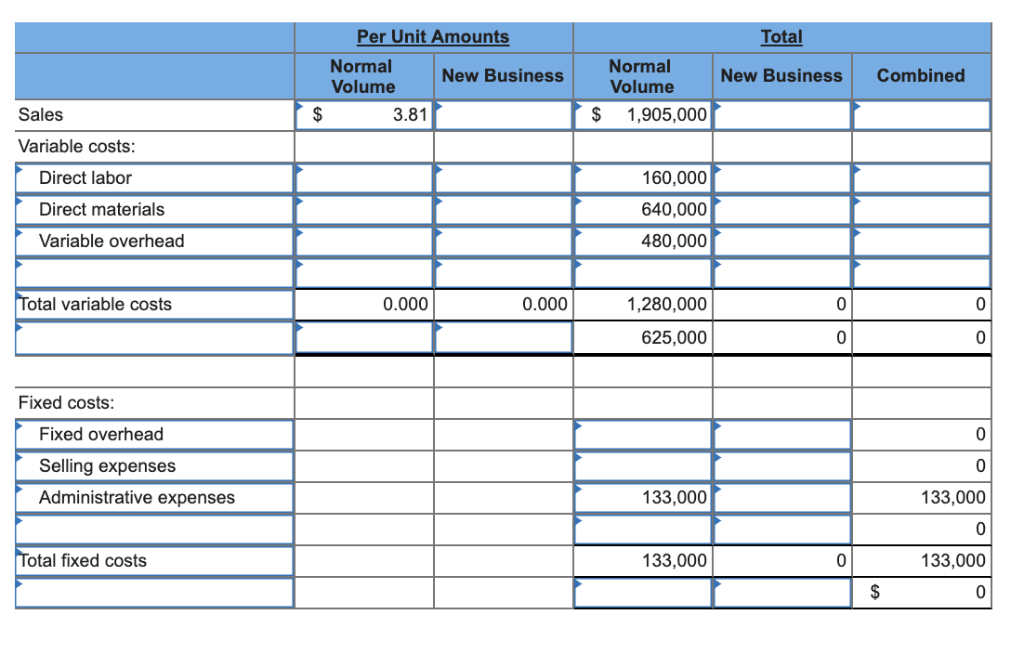

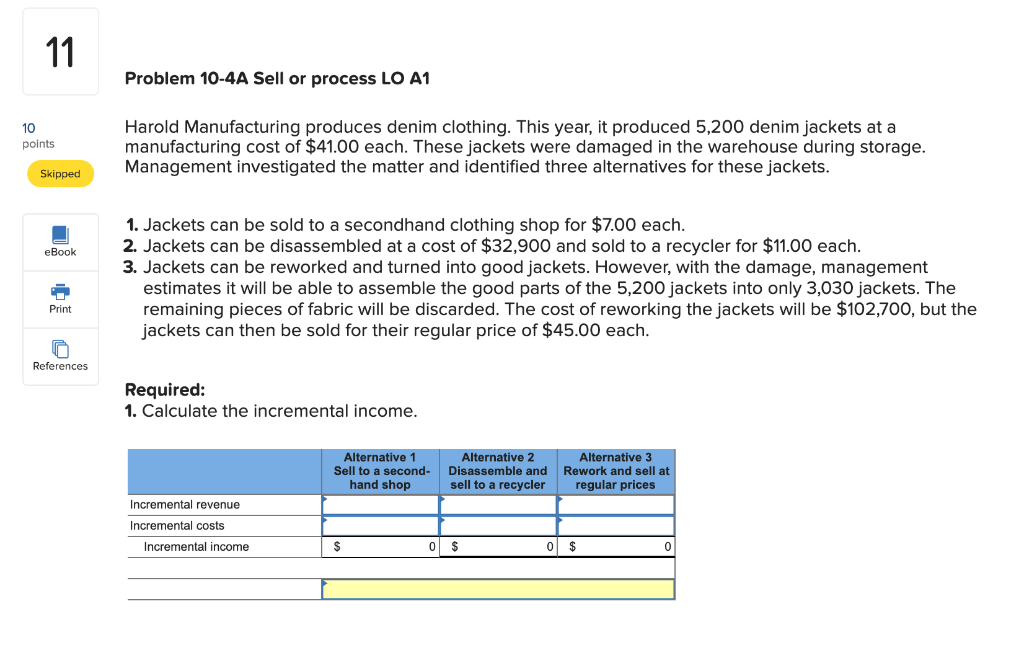

10 Problem 10-1A Analysis of income effects of additional business LO A1 Jones Products manufactures and sells to wholesalers approximately 500,000 packages per year of underwater markers at $3.81 per package. Annual costs for the production and sale of this quantity are shown in the table. 10 points 640,000 160,000 480,000 200,000 Direct materials Direct labor Overhead Selling expenses Administrative expenses Total costs and expenses eBook Print 133,000 $1,613,000 References A new wholesaler has offered to buy 83,000 packages for $3.44 each. These markers would be marketed under the wholesaler's name and would not affect Jones Products' sales through its normal channels. A study of the costs of this additional business reveals the following . Direct materials costs are 100% variable. Per unit direct labor costs for the additional units would be 50% higher than normal because their production would require overtime pay at 1/2 times the usual labor rate 25% of the normal annual overhead costs are fixed at any production level from 450,000 to 600,000 units. The remaining 75% of the annual overhead cost is variable with volume. Accepting the new business would involve no additional selling expenses Accepting the new business would increase administrative expenses by a $3,000 fixed amount. Required: Complete the three-column comparative income statement that shows the following (Round your intermediate calculations and per unit cost answers to 3 decimals) 1. Annual operating income without the special order. 2. Annual operating income received from the new business only 3. Combined annual operating income from normal business and the new business Per Unit Amounts Total Normal Volume Normal Volume New Business New Business Combined 3.81 $ 1,905,000 Sales Variable costs Direct labor Direct materials Variable overhead 160,000 640,000 480,000 0.000 otal variable costs 0.000 1,280,000 625,000 0 Fixed costs Fixed overhead Selling expenses Administrative expenses 0 133,000 133,000 otal fixed costs 133,000 133,000 Problem 10-4A Sell or process LO A1 Harold Manufacturing produces denim clothing. This year, it produced 5,200 denim jackets at a manufacturing cost of $41.00 each. These jackets were damaged in the warehouse during storage Management investigated the matter and identified three alternatives for these jackets 10 points Skipped 1. Jackets can be sold to a secondhand clothing shop for $7.00 each 2. Jackets can be disassembled at a cost of $32,900 and sold to a recycler for $11.00 each 3. Jackets can be reworked and turned into good jackets. However, with the damage, management Book estimates it will be able to assemble the good parts of the 5,200 jackets into only 3,030 jackets. The remaining pieces of fabric will be discarded. The cost of reworking the jackets will be $102,700, but the jackets can then be sold for their regular price of $45.00 each Print References Required: 1. Calculate the incremental income Alternative 2 Sell to a second Disassemble and Rework and sell at sell to a recycler Alternative 1 Alternative 3 hand shop regular prices Incremental revenue Incremental costs Incremental income 0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started