Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1011 I need 200% perfect answer of both parts. Please please give answer in less than 30 minutes. Just give perfect answer. No explanation needed.

1011 I need 200% perfect answer of both parts. Please please give answer in less than 30 minutes. Just give perfect answer. No explanation needed. I will give positive rating.

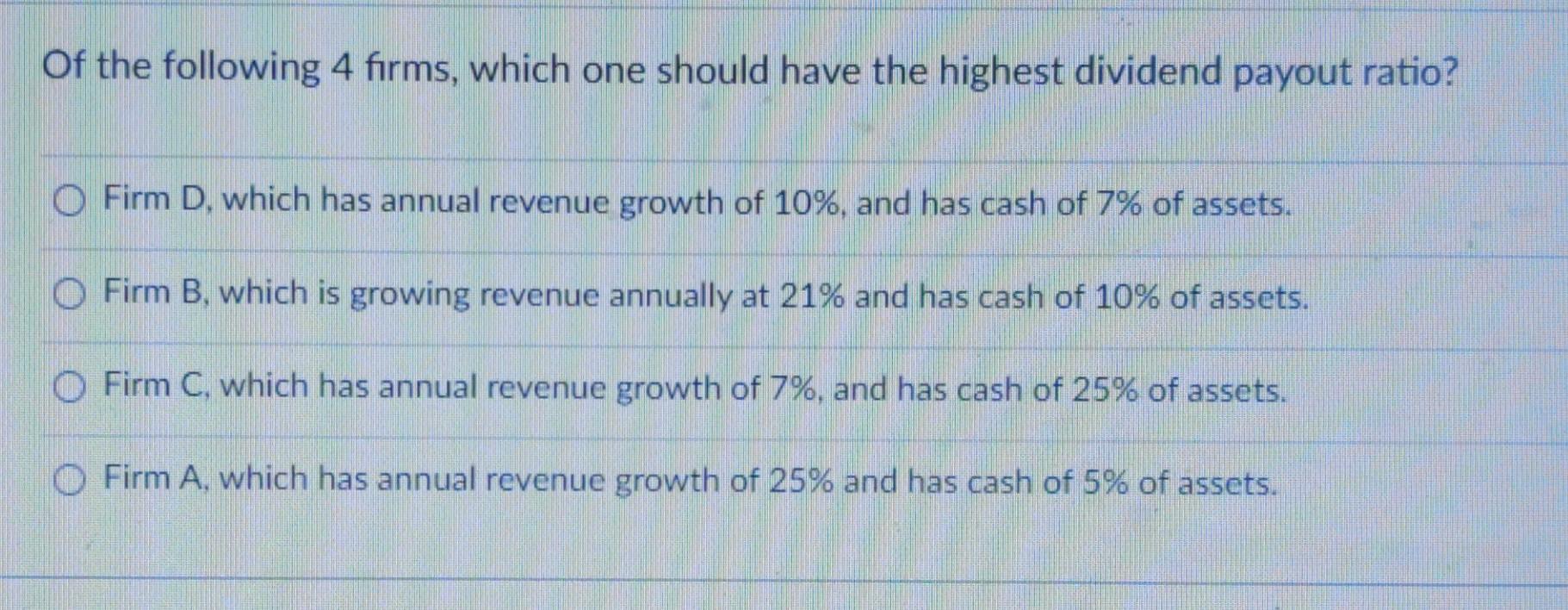

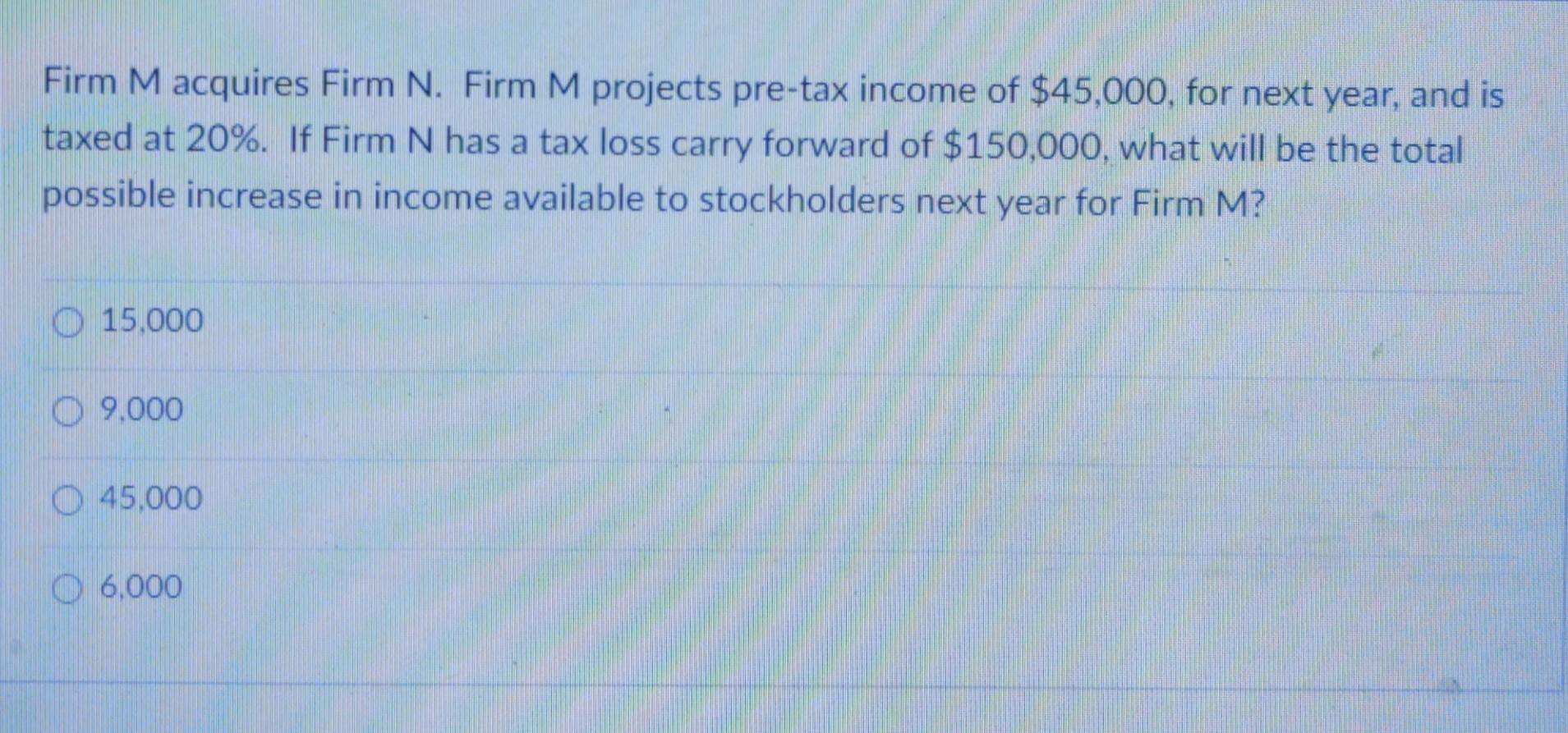

Of the following 4 firms, which one should have the highest dividend payout ratio? Firm D, which has annual revenue growth of 10%, and has cash of 7% of assets. O Firm B, which is growing revenue annually at 21% and has cash of 10% of assets. Firm C, which has annual revenue growth of 7%, and has cash of 25% of assets. Firm A, which has annual revenue growth of 25% and has cash of 5% of assets. Firm M acquires Firm N. Firm M projects pre-tax income of $45,000, for next year, and is taxed at 20%. If Firm N has a tax loss carry forward of $150,000, what will be the total a possible increase in income available to stockholders next year for Firm M? O 15,000 O 9.000 O 45,000 6.000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started