10-12 Macroeconomics

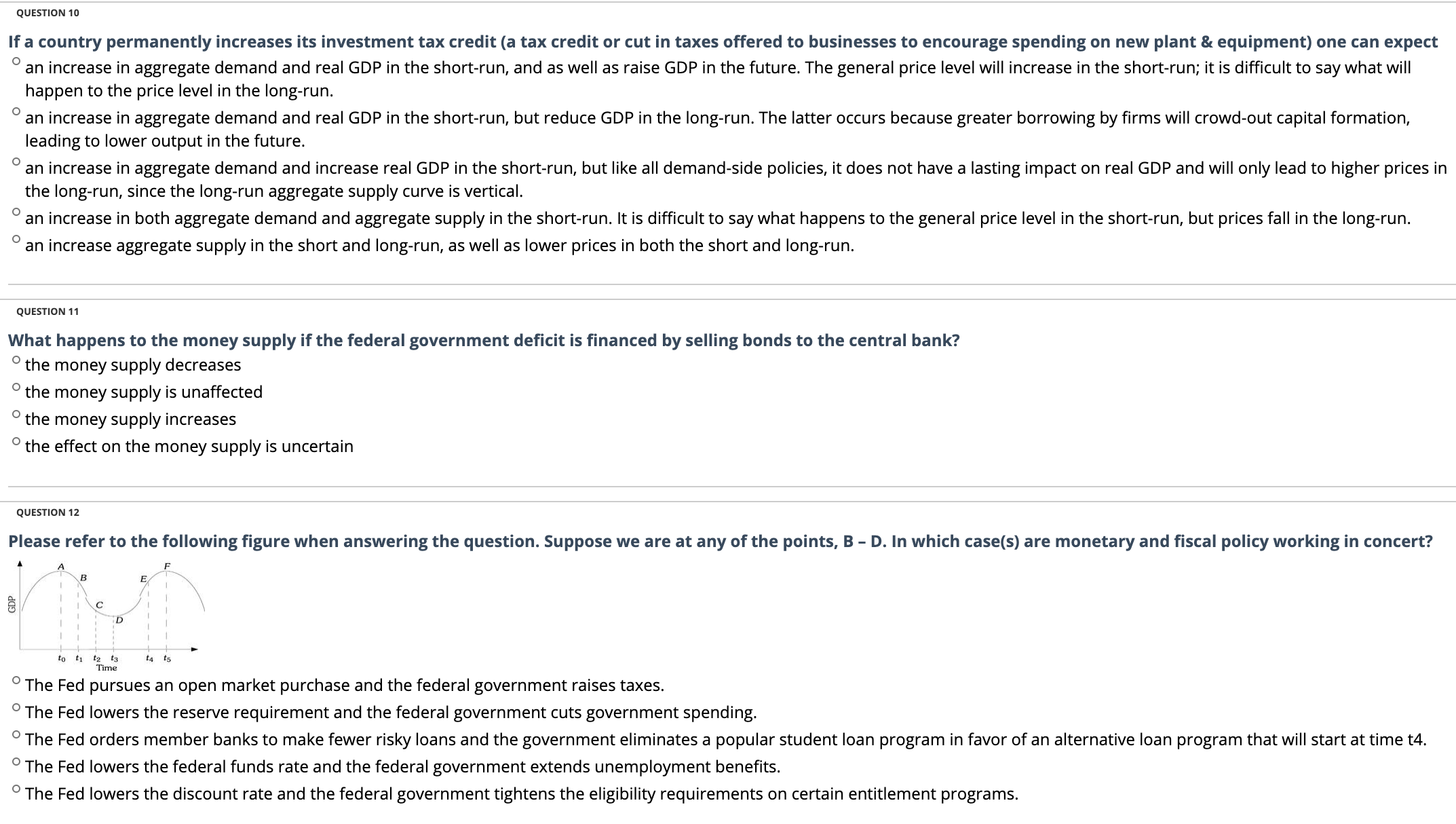

QUESTION 10 If a country permanently increases its investment tax credit (a tax credit or cut in taxes offered to businesses to encourage spending on new plant & equipment) one can expect an increase in aggregate demand and real GDP in the short-run, and as well as raise GDP in the future. The general price level will increase in the short-run; it is difcult to say what will happen to the price level in the long-run. an increase in aggregate demand and real GDP in the short-run, but reduce GDP in the long-run. The latter occurs because greater borrowing by rms will crowd-out capital formation, leading to lower output in the future. 0 an increase in aggregate demand and increase real GDP in the short-run, but like all demand-side policies, it does not have a lasting impact on real GDP and will only lead to higher prices in the long-run, since the long-run aggregate supply curve is vertical. an increase in both aggregate demand and aggregate supply in the short-run. It is difficult to say what happens to the general price level in the short-run, but prices fall in the long-run. an increase aggregate supply in the short and long-run, as well as lower prices in both the short and long-run. QUESTION 11 What happens to the money supply if the federal government deficit is financed by selling bonds to the central bank? the money supply decreases the money supply is unaffected O the money supply increases 0 the effect on the money supply is uncertain QUESTION 12 Please refer to the following gure when answering the question. Suppose we are at any of the points, 3 - D. In which case(s) are monetary and scal policy working in concert? A E l l l l l o/IYV In /E l l l l l l , , , > 1,, n :2 z, r. :5 Time 0 The Fed pursues an open market purchase and the federal government raises taxes. The Fed lowers the reserve requirement and the federal government cuts government spending. The Fed orders member banks to make fewer risky loans and the government eliminates a popular student loan program in favor of an alternative loan program that will start at time t4. The Fed lowers the federal funds rate and the federal government extends unemployment benets. 0 The Fed lowers the discount rate and the federal government tightens the eligibility requirements on certain entitlement programs