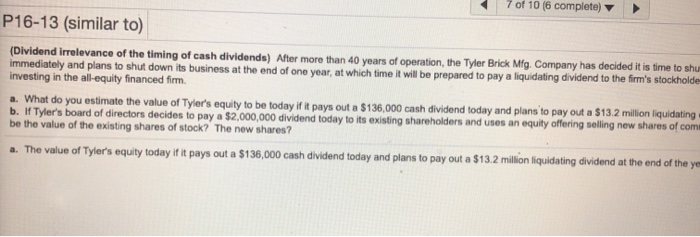

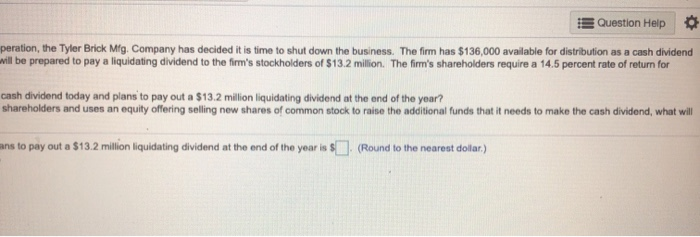

10-13 (similar to) Question cash divider o rdsbution 145 Dividend irrelevance of the timing of cash dividends) A more than 60 years of operation, the Tyler Brick My Company has decided time to shut down the business. The firm has 138000 w immediately and plans to shut down business at the end of one year at which time it will be prepared to pay a dividend the w hole of $132 The investing in the anced . What do you the value of thes e days out 1.000 de to pay u n g dund the end of the b. Tyler's board of directors decides to pay a 2.000.000 dividend today is sting share and s o ng was comm e n d tha be the value of the existing where of The t make the vided what P16-13 (similar to) estione Dividend relevance of the timing of cash dividenda er more than 40 years of person, the To y Company has decided t o what doe s Thema 1000 w for writion as a cash didend immediately and plans to shut down business at the end of one year which will be prepared to pay a g vided to the choirs of $12 milion. The sho r e a 14.5 percent role of return for Investing in the equity financed firm a. What do you estimate the value of Tyler's equity to be aday pays out a 10.000 cash dividend today and plans to pay out a 513 2 on g vided at the end of the year? b. If Tyler's board of director decides to pay a 2.000.000 dividend today to s h areholders and use an equity offering wling new shares of common to the s o unds and to make the cash divided what wil be the value of the shares of stock? The new wars? The value ofer's quity today it pays out $1.000 v nd day and to pay out 313.2 ng deded at the end of the years and to the nearest dollar) ULIULUI P16-13 (similar to) (Dividend irrelevance of the timing of cash dividends) After more than 40 years of operation, the Tyler Brick Mfg. Company has decided it is time to shu immediately and plans to shut down its business at the end of one year, at which time it will be prepared to pay a liquidating dividend to the firm's stockholde investing in the all-equity financed firm. a. What do you estimate the value of Tyler's equity to be today if it pays out a $136.000 cash dividend today and plans to pay out a $13.2 million liquidating b. If Tyler's board of directors decides to pay a $2,000,000 dividend today to its existing shareholders and uses an equity offering selling new shares of com be the value of the existing shares of stock? The new shares? a. The value of Tyler's equity today if it pays out a $136,000 cash dividend today and plans to pay out a $13.2 million liquidating dividend at the end of the ye Question Help peration, the Tyler Brick Mfg. Company has decided it is time to shut down the business. The firm has $136,000 available for distribution as a cash dividend will be prepared to pay a liquidating dividend to the firm's stockholders of $13.2 million. The firm's shareholders require a 14.5 percent rate of return for cash dividend today and plans to pay out a $13.2 million liquidating dividend at the end of the year? shareholders and uses an equity offering selling new shares of common stock to raise the additional funds that it needs to make the cash dividend, what will ins to pay out a $13.2 million liquidating dividend at the end of the year is (Round to the nearest dollar) OG Opts + 9 of 10 7 compte HW Score: 65%, 13 of 20 B16-12 (book/static) Related to Checkpoint 18.1) (Dividend irrelevance of the wing of cash dividends) The Caraway Seed Company is special gardening seeds and products many m order and internal customers. The firm has $200.000 available for distribution as a cash dividend me and plans to shut down business at the end of one year, which time will be prepared to pay a t ing dividend of 120 on to the firm's stockholders. The three require a 100 percent role of return for investing in the al equity financed firm a. What do you estimate the value of Carway's to be today it payout $200.000 cash dividend today and plans to pay a $1.20to n g dividend the end of the year b. Caraway's board of directors decides to pay a 100.000 vided today to its existing shareholders using an equity offering selling new shares of common to the 1400.000 de the cash a nd what be the value of the existing shares of stock? The new shares? The value of wwwy's equity today i s out $200.000 cash dividend today and to pay $120 milion de end of the end of the year and others ) 116-12 (book/static) Question Help (Related to Checkpoint 16.1) (Dividend irrelevance of the timing of cash dividends) The Caraway Seed Company sells specialty gardening seeds and products primarily to mal-order and Internet customers. The firm has $200,000 available for distribution as a cash dividend immediately and plans to shut down its business at the end of one year, at which time it will be prepared to pay a liquidating dividend of $1.20 million to the firm's stockholders. The firm's shareholders require a 10.0 percent rate of return for investing in the all-equity-financed firm. a. What do you estimate the value of Caraway's equity to be today if it pays out a $200,000 cash dividend today and plans to pay a $1.20 milion liquidating dividend at the end of the year? b. If Caraway's board of directors decides to pay a $600,000 dividend today to its existing shareholders using an equity offering selling new shares of common stock to raise the additional $400,000 it needs to make the cash dividend, what will be the value of the existing shares of stock? The new shares? a. The value of Caraway's equity today it pays out a $200,000 cash dividend today and plans to pay a $1.20 milion liquidating dividend at the end of the years (Round to the near dollar)