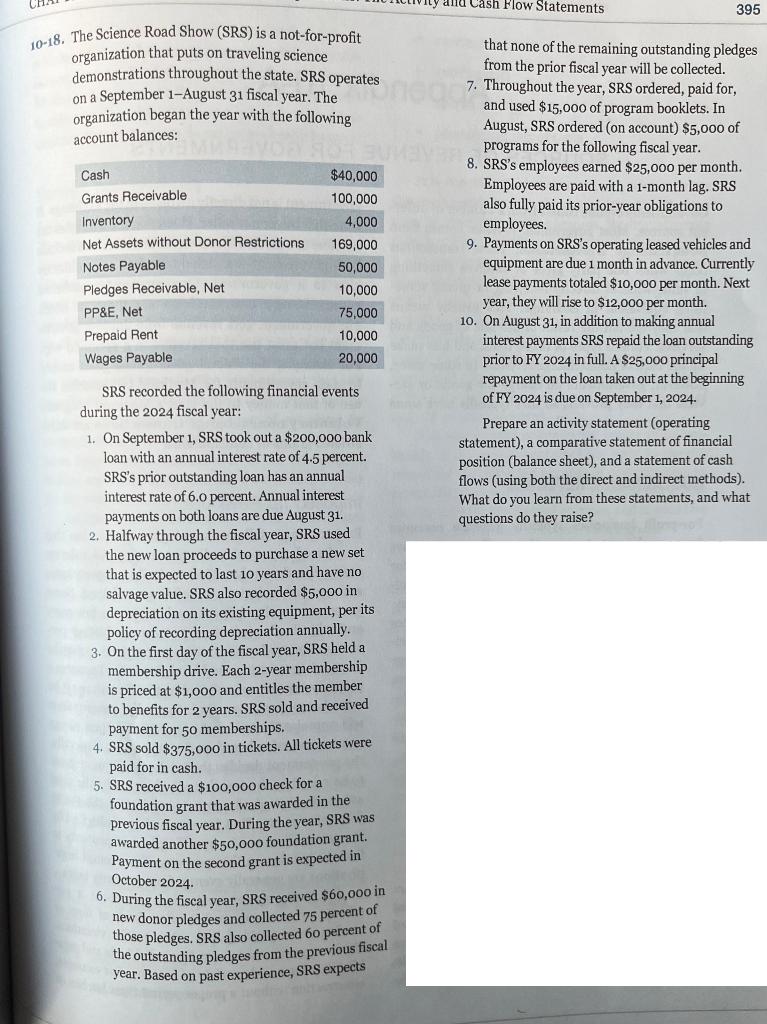

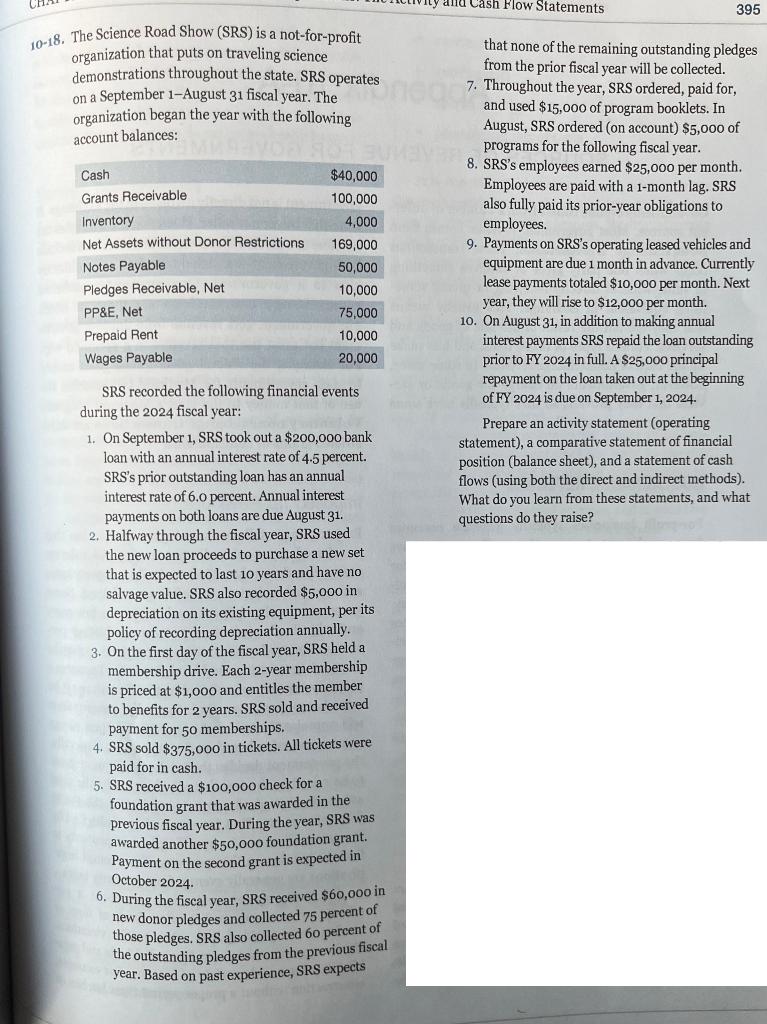

10-18. The Science Road Show (SRS) is a not-for-profit that none of the remaining outstanding pledges organization that puts on traveling science from the prior fiscal year will be collected. demonstrationsthroughoutthestate.SRSoperatesonaSeptember1-August31fiscalyear.The7.Throughouttheyear,SRSordered,paidfor, the new loan proceeds to purchase a new set that is expected to last 10 years and have no salvage value. SRS also recorded $5,000 in depreciation on its existing equipment, per its policy of recording depreciation annually. 3. On the first day of the fiscal year, SRS held a membership drive. Each 2-year membership is priced at $1,000 and entitles the member to benefits for 2 years. SRS sold and received payment for 50 memberships. 4. SRS sold $375,000 in tickets. All tickets were paid for in cash. 5. SRS received a $100,000 check for a foundation grant that was awarded in the previous fiscal year. During the year, SRS was awarded another $50,000 foundation grant. Payment on the second grant is expected in October 2024. 6. During the fiscal year, SRS received $60,000 in new donor pledges and collected 75 percent of those pledges. SRS also collected 60 percent of the outstanding pledges from the previous fiscal year. Based on past experience, SRS expects 10-18. The Science Road Show (SRS) is a not-for-profit that none of the remaining outstanding pledges organization that puts on traveling science from the prior fiscal year will be collected. demonstrationsthroughoutthestate.SRSoperatesonaSeptember1-August31fiscalyear.The7.Throughouttheyear,SRSordered,paidfor, the new loan proceeds to purchase a new set that is expected to last 10 years and have no salvage value. SRS also recorded $5,000 in depreciation on its existing equipment, per its policy of recording depreciation annually. 3. On the first day of the fiscal year, SRS held a membership drive. Each 2-year membership is priced at $1,000 and entitles the member to benefits for 2 years. SRS sold and received payment for 50 memberships. 4. SRS sold $375,000 in tickets. All tickets were paid for in cash. 5. SRS received a $100,000 check for a foundation grant that was awarded in the previous fiscal year. During the year, SRS was awarded another $50,000 foundation grant. Payment on the second grant is expected in October 2024. 6. During the fiscal year, SRS received $60,000 in new donor pledges and collected 75 percent of those pledges. SRS also collected 60 percent of the outstanding pledges from the previous fiscal year. Based on past experience, SRS expects