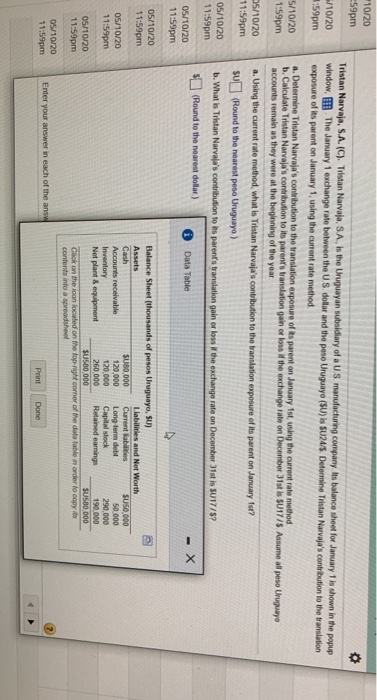

*10/20 59pm 5/10/20 1:59pm 5/10/20 1:59pm Tristan Narvaja, S.A. (C). Tristan Narvaja, SA, is the Uruguayan subsidiary of a US manufacturing company is balance sheet for January 1 is shown in the popup window, The January 1 exchange rate between the US dolar and the peso Uruguayo (SU) is S024/5. Determine Tristan Narvaja's contribution to the translation exposure of its parent on January 1, using the current rate method a. Determine Tristan Narvaja's contribution to the translation exposure of its parent on January 1st, using the current rate method b. Calculate Tristan Narvaja's contribution to its parent's translation gain or loss the exchange rate on December 31st is SUI7/5 Assume all peso Uruyo accounts remain as they were at the beginning of the year a. Using the current rate method, what is Tristan Narvaja's contribution to the translation exposure of its parent on January 1st? SU (Round to the nearest peso Uruguayo ) b. What is Tristan Narvaja's contribution to lis parent's translation gain or loss the exchange rate on December is SU17/57 (Round to the nearest dollar) Data Table 35/10/20 11:59pm 05/10/20 11:59pm 05/10/20 11:59pm 05/10/20 11:59pm 05/10/20 11:59pm Balance Sheet (thousands of pesos Uruguayo, SU) Assets Llabilities and Net Worth Cash SU80,000 Current liabilities SU50.000 Accounts receivable 120,000 Long-term debt 50,000 Inventory 120.000 Capital stock 290,000 Net plant & equipment 260.000 Retained earnings 190.000 SU500 000 SU500,000 Click on the icon located on the top right corner of the datatable in order to copy its contents into a spreadsheet 05/10/20 11:59 pm 05/10/20 11:59pm Enter your answer in each of the answ Print Done *10/20 59pm 5/10/20 1:59pm 5/10/20 1:59pm Tristan Narvaja, S.A. (C). Tristan Narvaja, SA, is the Uruguayan subsidiary of a US manufacturing company is balance sheet for January 1 is shown in the popup window, The January 1 exchange rate between the US dolar and the peso Uruguayo (SU) is S024/5. Determine Tristan Narvaja's contribution to the translation exposure of its parent on January 1, using the current rate method a. Determine Tristan Narvaja's contribution to the translation exposure of its parent on January 1st, using the current rate method b. Calculate Tristan Narvaja's contribution to its parent's translation gain or loss the exchange rate on December 31st is SUI7/5 Assume all peso Uruyo accounts remain as they were at the beginning of the year a. Using the current rate method, what is Tristan Narvaja's contribution to the translation exposure of its parent on January 1st? SU (Round to the nearest peso Uruguayo ) b. What is Tristan Narvaja's contribution to lis parent's translation gain or loss the exchange rate on December is SU17/57 (Round to the nearest dollar) Data Table 35/10/20 11:59pm 05/10/20 11:59pm 05/10/20 11:59pm 05/10/20 11:59pm 05/10/20 11:59pm Balance Sheet (thousands of pesos Uruguayo, SU) Assets Llabilities and Net Worth Cash SU80,000 Current liabilities SU50.000 Accounts receivable 120,000 Long-term debt 50,000 Inventory 120.000 Capital stock 290,000 Net plant & equipment 260.000 Retained earnings 190.000 SU500 000 SU500,000 Click on the icon located on the top right corner of the datatable in order to copy its contents into a spreadsheet 05/10/20 11:59 pm 05/10/20 11:59pm Enter your answer in each of the answ Print Done