Answered step by step

Verified Expert Solution

Question

1 Approved Answer

10-3 10-4 0-14 Sonya Inc. is expected to pay a $0.80 per share dividend at the end of the year (that is, D =

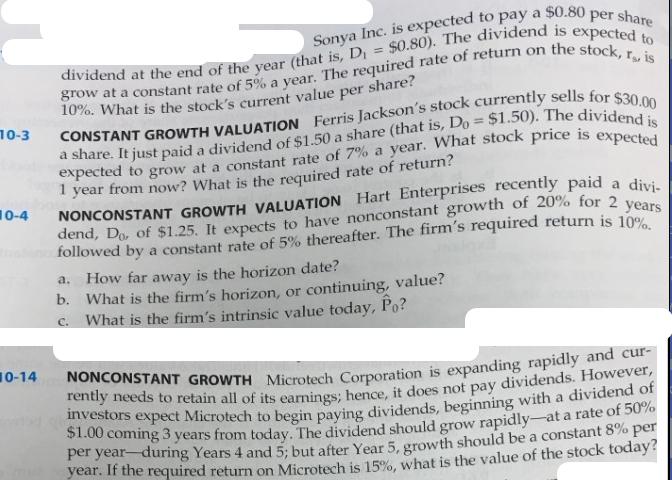

10-3 10-4 0-14 Sonya Inc. is expected to pay a $0.80 per share dividend at the end of the year (that is, D = $0.80). The dividend is expected to grow at a constant rate of 5% a year. The required rate of return on the stock, r, is 10%. What is the stock's current value per share? CONSTANT GROWTH VALUATION Ferris Jackson's stock currently sells for $30.00 a share. It just paid a dividend of $1.50 a share (that is, Do= $1.50). The dividend is expected to grow at a constant rate of 7% a year. What stock price is expected 1 year from now? What is the required rate of return? NONCONSTANT GROWTH VALUATION Hart Enterprises recently paid a divi- dend, Do, of $1.25. It expects to have nonconstant growth of 20% for 2 years followed by a constant rate of 5% thereafter. The firm's required return is 10%. a. How far away is the horizon date? b. What is the firm's horizon, or continuing, value? c. What is the firm's intrinsic value today, Po? NONCONSTANT GROWTH Microtech Corporation is expanding rapidly and cur- rently needs to retain all of its earnings; hence, it does not pay dividends. However, investors expect Microtech to begin paying dividends, beginning with a dividend of $1.00 coming 3 years from today. The dividend should grow rapidly-at a rate of 50% per year during Years 4 and 5; but after Year 5, growth should be a constant 8% per year. If the required return on Microtech is 15%, what is the value of the stock today?

Step by Step Solution

★★★★★

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the values requested in the given problems we can use the formulas for stock valuation 1 Constant Growth Valuation a Stocks current value per share To calculate the current value per shar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started