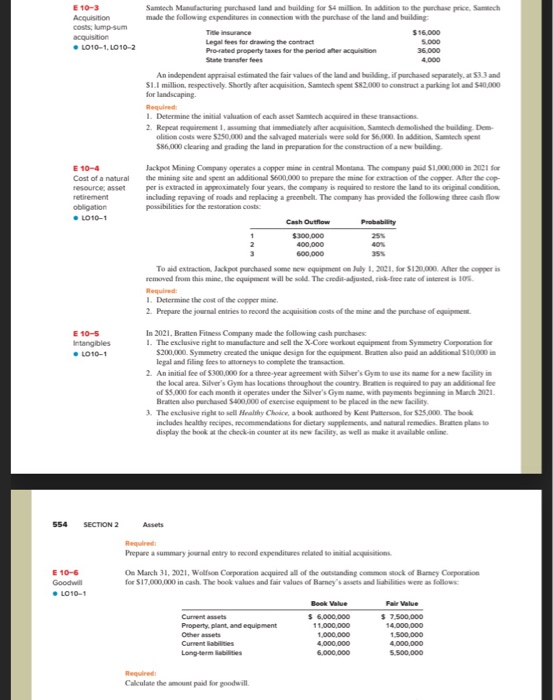

E 10-3 Samtech Manufacturing purchased land and building for S4 million. In addition to the purchase price. Suntech Acquisition made the following expenditures in connection with the purchase of the land and building costs,lump sum acquisition Title insurance $16.000 Legal fees for drawing the contract 5.000 L010-1, L010-2 Pro-rated property taxes for the perioder acquisition 36.000 State transfer fees 4.000 An independent appraisal estimated the fair values of the land and building, if purchased separately at 533 and S1.1 million, respectively. Shortly after acquisition. Samtech spent $82,000 to construct a parking lot and S40,000 for landscaping Required 1. Determine the initial valuation of each asset Samtech acquired in these transactions 2. Repeal requirement assuming that immediately after acquisition. Samtech demolished the building. Dom olition costs were $250.000 and the salvaged materials were sold for $6,000. In addition, Samtech spent $86,000 clearing and grading the land in preparation for the construction of a new building E 10-4 Jackpot Mining Company operates a copper mine in central Montana. The company paid $1,000,000 in 2001 for Cost of a natural the mining site and spent an additional $600,000 to prepare the mine for extractice of the copper. After the cop resource, asset per is extracted in approximately four years, the company is required to restore the land to its original condition retirement including repaving of roads and replacing a greenbelt. The company has provided the following the cash flow obligation possibilities for the restoration costs L010-1 Cash Outflow Probability 1 $300.000 400.000 40% 600,000 To aid extraction, Jackpot purchased some new equipment on July 1, 2001, for $120,000. After the copper is removed from this mine, the equipment will be sold. The credit-adjusted risk-fue rate of interest is 10 Required 1. Determine the cost of the coppermine 2. Prepare the journal entries to record the acquisitice costs of the mine and the purchase of equipment E 10-5 In 2021. Bratten Fitness Company made the following cash purchases Intangibles 1. The exclusive right to manufacture and sell the X-Core workout equipment from Symmetry Corporation for L010-1 $200,000. Symmetry created the unique design for the equipment. Bratten also paid an additional $10,000 in legal and filing fees to attorneys to complete the transaction 2. An initial fee of $300,000 for a three-year agreement with Silver's Gym to use its name for a new facility in the local area. Silver's Gym has locations throughout the country. Braten is required to pay an additional fee of $5,000 for each month it operates under the Silver's Gym name, with payments beginning in March 2021 Bratten also purchased $400.000 of exercise equipment to be placed in the new facility. 3. The exclusive right to sell Healthy Choice, a book authored by Kent Patterson for $25,000. The book includes healthy recipes, recommendations for dietary supplements, and natural remedies. Bruten plans to display the book at the check-in counter at its new facility, as well as make it available online 554 SECTION 2 Assets E 10-6 Goodwill L010-1 Prepare a summary journal entry to record expenditures related to initial acquisitions On March 31, 2021. Wolfson Corporation acquired all of the outstanding common stock of Bamey Corporation for $17.000.000 in cash. The book values and fair values of Barney's assets and liabilities were as follows Current assets Property, plant, and equipment Others Current liabilities Long-term Book Value $ 6.000.000 11.000.000 1,000,000 4,000,000 6.000.000 Fair Value $ 7.500.000 14.000.000 1.500.000 4,000,000 5.500,000 Required Calculate the amount paid for goodwill