Answered step by step

Verified Expert Solution

Question

1 Approved Answer

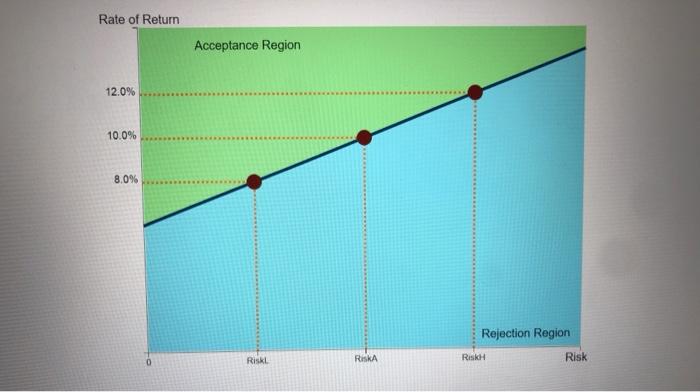

103 Conceptual Overview: Explore how the trade-off between risk and the cost of capital can be used to choose a project. The tine represents WACC,

103

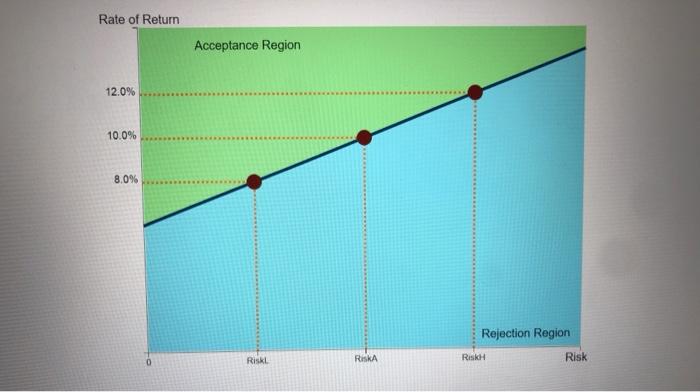

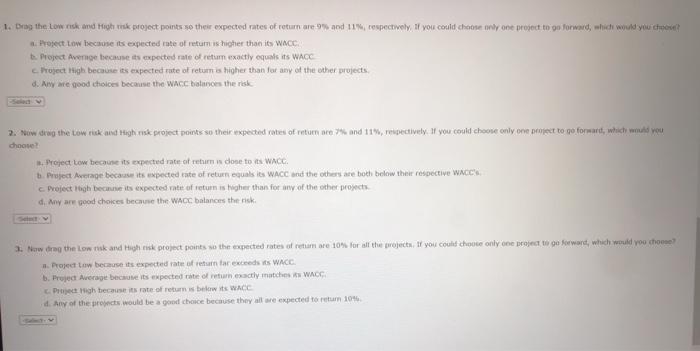

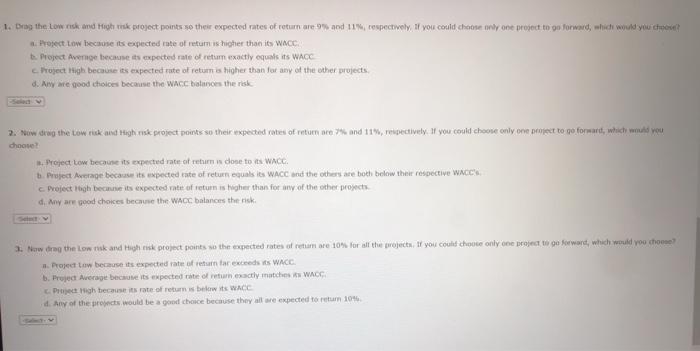

Conceptual Overview: Explore how the trade-off between risk and the cost of capital can be used to choose a project. The tine represents WACC, the weighted average cost of capital as a function of risk. Three frems or projects with the risk levels Rickl (low), RA (average and up are highlighted. The vertical axis shows each project's expected rate of return. The area above the line is the "Acceptance Region Projects in this region are expected to return more than the weighted average cost of capital as a function of risk. The lower area is the "Rejection Region Projects in this region are expected to return less than the weighted average cost of capital as a function of risk The expected tube of return for the Low risk and High risk projects can be changed by dragoing their dots up and down. Drag them to see how they move from one region to the other Rate of Return Acceptance Region 12.05 100% 8:04 Rate of Return Acceptance Region 12.0% 10.0% 8.0% Rejection Region Risk Risk Risk Risk 1. Drag the town and High risk project points so their expected rates of returnare 9 and 11%, respectively. If you could choose only one project to go forward, which would you have Prorect Low because its expected rate of retumis higher than its WACC t Project Avenge because its expected rate of return exactly equalsits WACC Project Righ because its expected rate of return is higher than for any of the other projects d. Any are good choices because the WACC balances the risk 2. Now drag the tow rock and right project points so their expected votes of tumore and 11.ripectively. If you could choose only one project to go forward, which would you choose? Project Low because its expected rate of return is done to its WACC) b. Project Average because its expected to return qualsis WACC and the others are both below their respective WACC Project toigh because its expected voter of return is higher than for any of the other projects d. Any are good choices because the WACC balances the risk Now drag the low risk and High risk project points so the expected rates of are 10% for all the projects. If you could choose only one project to forward, which would you choose Project tow because its expected rate of return far exceeds WACC b. Project Average because its expected to return exactly matches WAGE Pigh because its rate of returns below WACC d. Any of the projects would be a good choice because they all are expected to return 107

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started