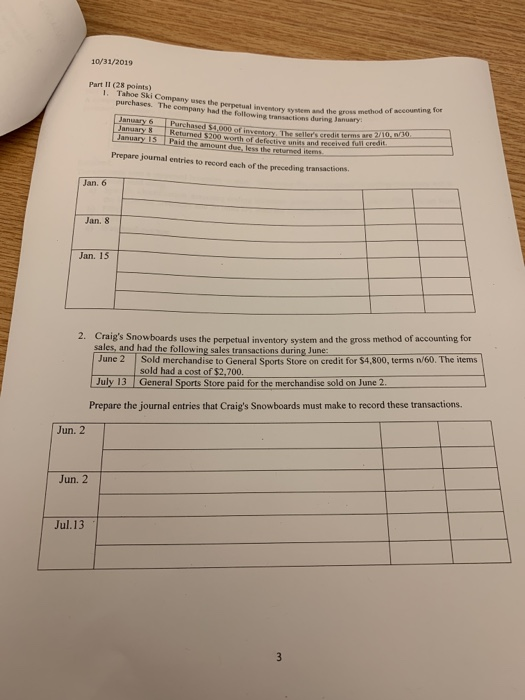

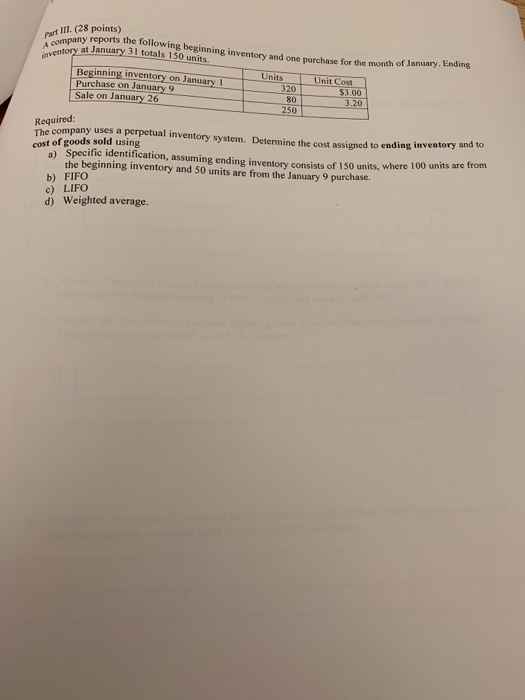

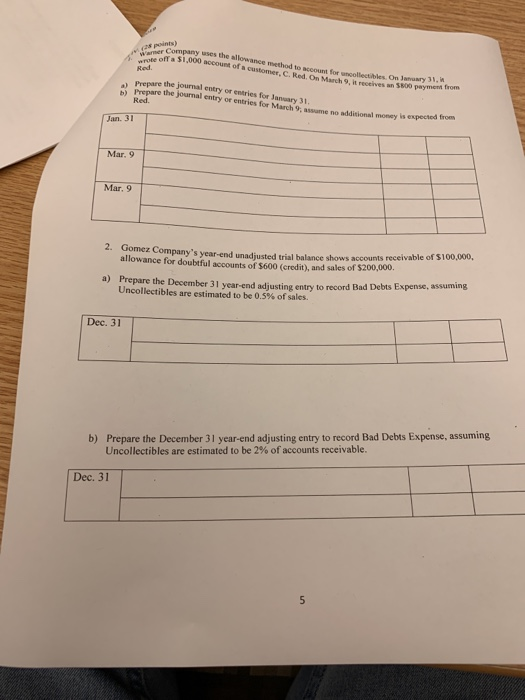

10/31/2019 Part II (28 points) 1. Tahoe Ski Companyy uses the perpetual invemtory system and the gross method of accounting for purchases. The company had the following transactions during January January 6 January 8 January 15 Purchased $4,000 of inventory. The seller's credit terms are 2/10, n/30 Returned $200 worth of defective units and received full credil Paid the amount due, less the returned items Prepare jourmal entries to record each of the preceding transactions. Jan. 6 Jan. 8 Jan. 15 2. Craig's Snowboards uses the perpetual inventory system and the gross method of accounting for sales, and had the following sales transactions during June: June 2 Sold merchandise to General Sports Store on credit for $4,800, terms n/60. The items sold had a cost of $2,700. General Sports Store paid for the merchandise sold on June 2 July 13 Prepare the journal entries that Craig's Snowboards must make to record these transactions. Jun. 2 Jun. 2 Jul.13 3 Part III. (28 points) A company reports the following beginning inventory and one purchase for the month of January. Ending inventory at January 31 totals 150 units. Beginning inventory on January 1 Purchase on January 9 Sale on January 26 Units Unit Cost $3.00 3.20 320 80 250 Required: The company uses a perpetual inventory system. Determine the cost assigned to ending inventory and to cost of goods sold using a) Specific identification, assuming ending inventory consists of 150 units, where 100 units are from the beginning inventory and 50 units are from the January 9 purchase. b) FIFO c) LIFO d) Weighted average. (28 points) Wamer Company uses the allowance method to account for yngollectibles On January 31, i wrote off a $1,000 apcount of a customer, C. Red. On March 9, it receives an 5800 payment from Red. a) Prepare the journal entry or entries for January 31. b) Prepare the journal entry or entries for March 9, assume no additional money is expected from Red Jan. 31 Mar. 9 Mar. 9 2. Gomez Company's year-end unadjusted trial balance shows accounts receivable of $100,000, allowance for doubtful accounts of $600 (credit), and sales of $200,000. a Prepare the December 31 year-end adjusting entry to record Bad Debts Expense, assuming. Uncollectibles are estimated to be 0.5 % of sales Dec. 31 b) Prepare the December 31 year-end adjusting entry to record Bad Debts Expense, assuming, Uncollectibles are estimated to be 2% of accounts receivable. Dec. 31 5