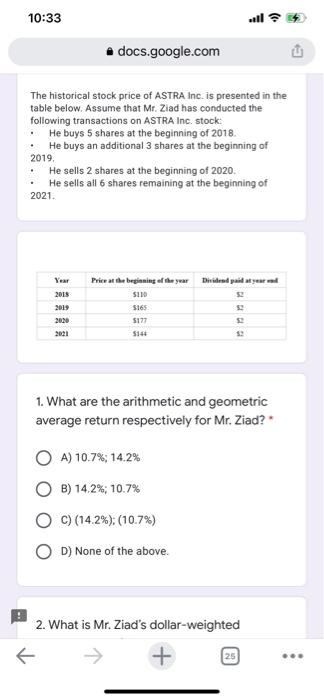

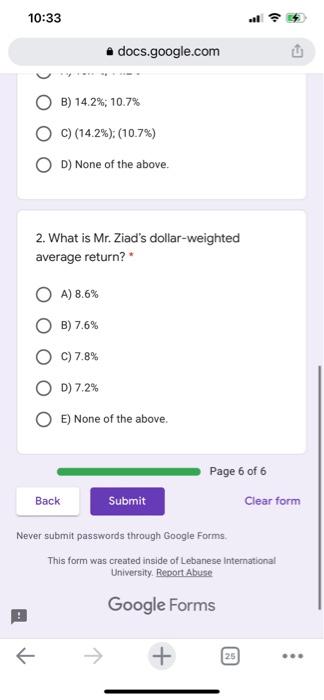

10:33 all 4 .docs.google.com The historical stock price of ASTRA Inc. is presented in the table below. Assume that Mr. Ziad has conducted the following transactions on ASTRA Inc. stock He buys 5 shares at the beginning of 2018 He buys an additional 3 shares at the beginning of 2019, He sells 2 shares at the beginning of 2020 He sells all 6 shares remaining at the beginning of 2021 Year Dividendidate 2018 2019 Price at the beginning of the year 5110 5165 5177 5140 2130 2030 2021 1. What are the arithmetic and geometric average return respectively for Mr. Ziad? OA) 10.7%; 14.2% B) 14.2%; 10.7% C) (14.2%) (10.7%) D) None of the above. 2. What is Mr. Ziad's dollar-weighted + 25 10:33 docs.google.com B) 14.2%; 10.7% C) (14.2%) (10.7%) OD) None of the above. 2. What is Mr. Ziad's dollar-weighted average return? A) 8.6% B) 7.6% C) 7.8% D) 7.2% E) None of the above Page 6 of 6 Back Submit Clear form Never submit passwords through Google Forms This form was created inside of Lebanese International University. Report Abuse Google Forms + 25 10:33 all 4 .docs.google.com The historical stock price of ASTRA Inc. is presented in the table below. Assume that Mr. Ziad has conducted the following transactions on ASTRA Inc. stock He buys 5 shares at the beginning of 2018 He buys an additional 3 shares at the beginning of 2019, He sells 2 shares at the beginning of 2020 He sells all 6 shares remaining at the beginning of 2021 Year Dividendidate 2018 2019 Price at the beginning of the year 5110 5165 5177 5140 2130 2030 2021 1. What are the arithmetic and geometric average return respectively for Mr. Ziad? OA) 10.7%; 14.2% B) 14.2%; 10.7% C) (14.2%) (10.7%) D) None of the above. 2. What is Mr. Ziad's dollar-weighted + 25 10:33 docs.google.com B) 14.2%; 10.7% C) (14.2%) (10.7%) OD) None of the above. 2. What is Mr. Ziad's dollar-weighted average return? A) 8.6% B) 7.6% C) 7.8% D) 7.2% E) None of the above Page 6 of 6 Back Submit Clear form Never submit passwords through Google Forms This form was created inside of Lebanese International University. Report Abuse Google Forms + 25