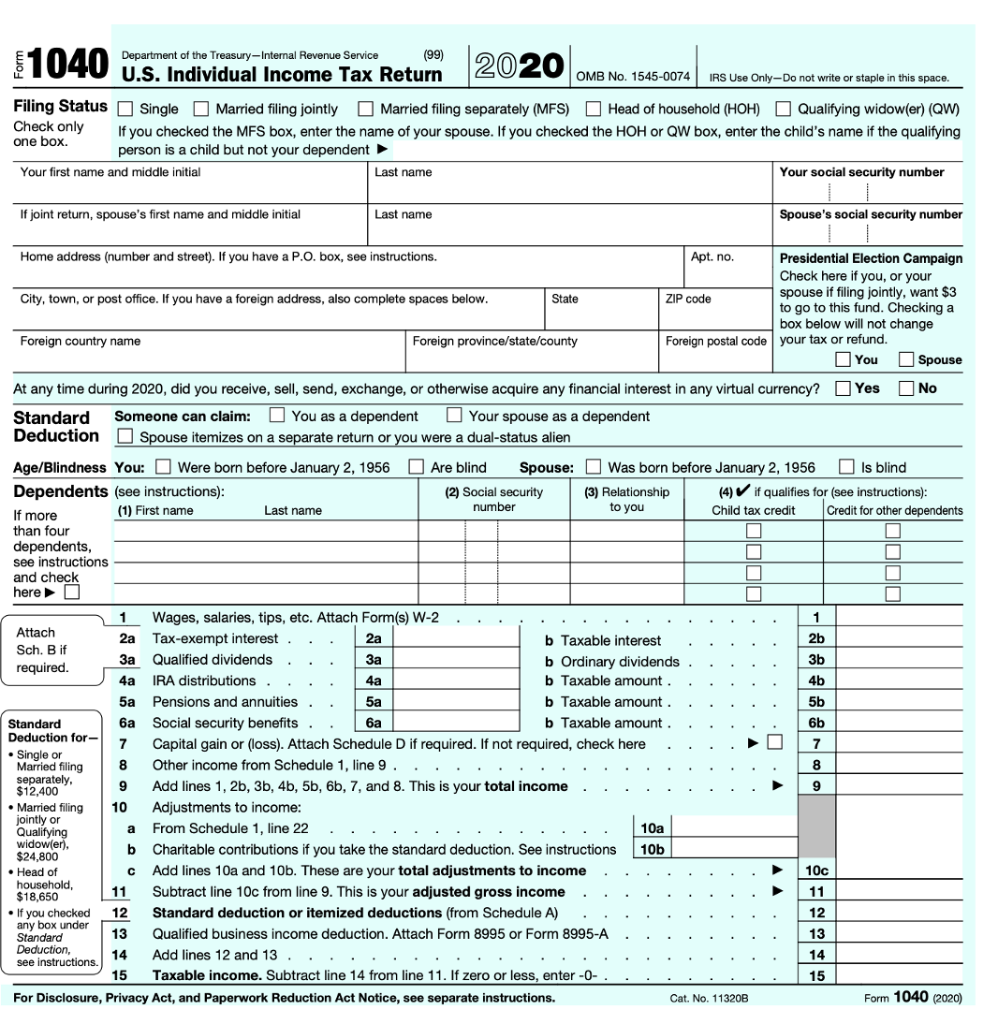

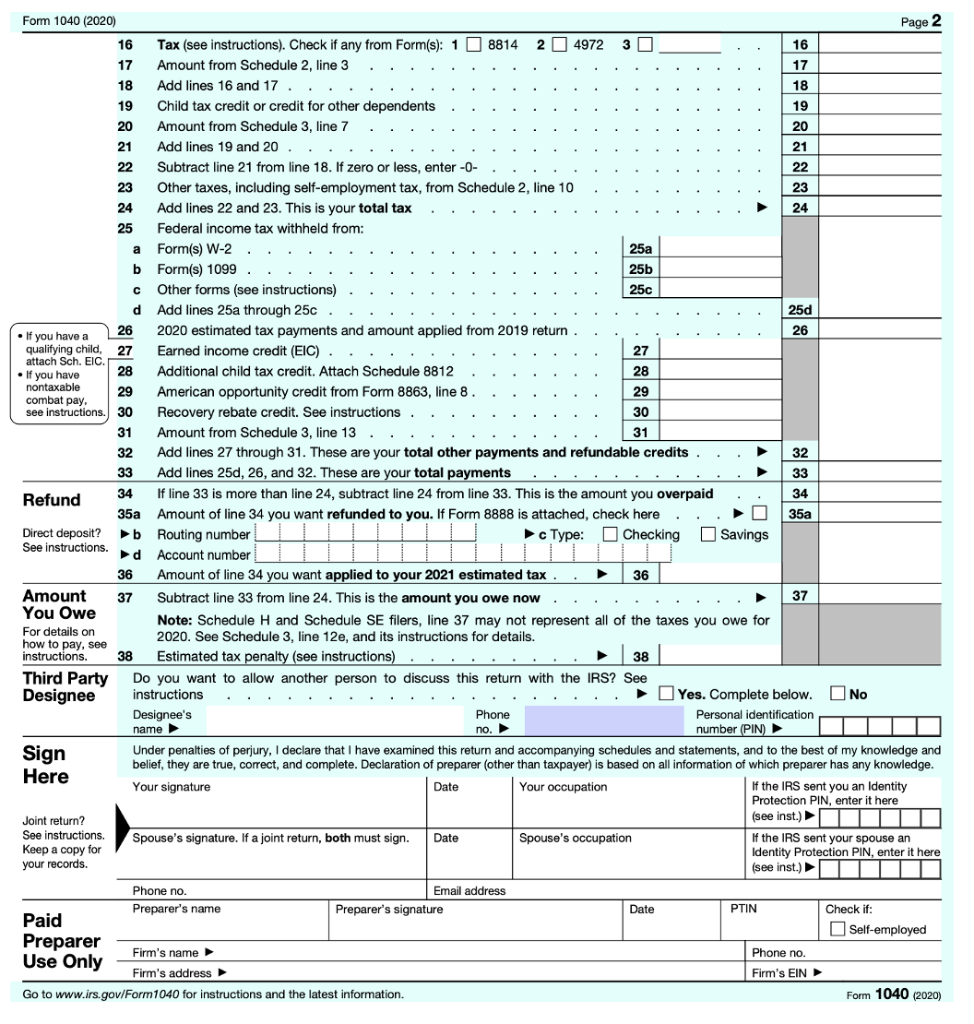

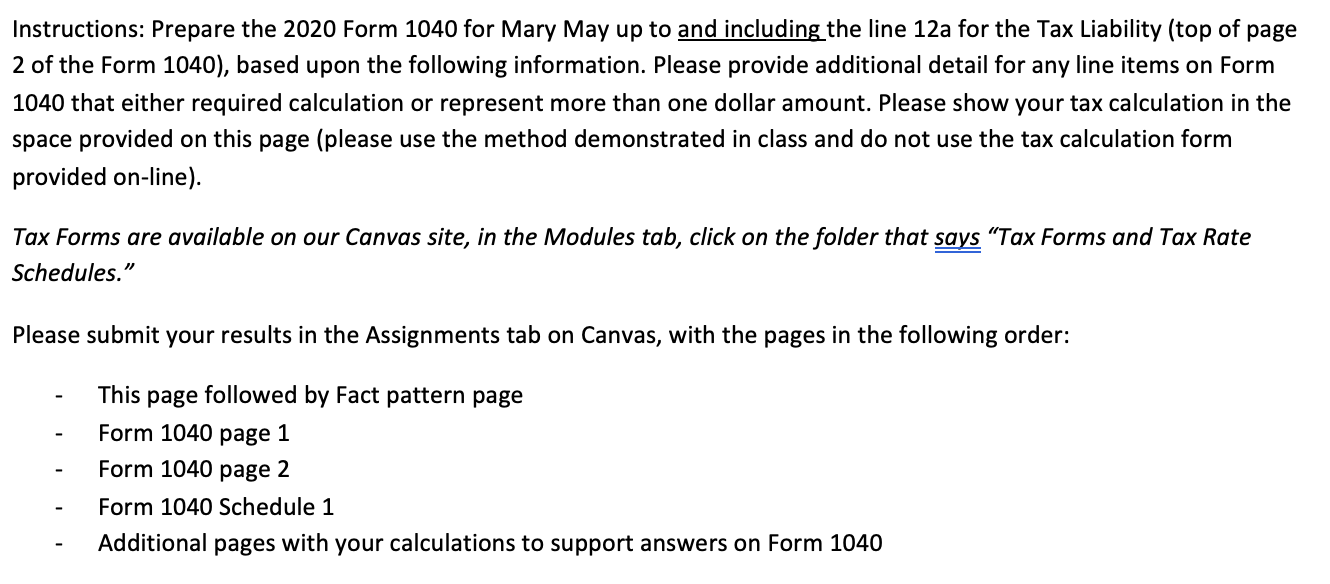

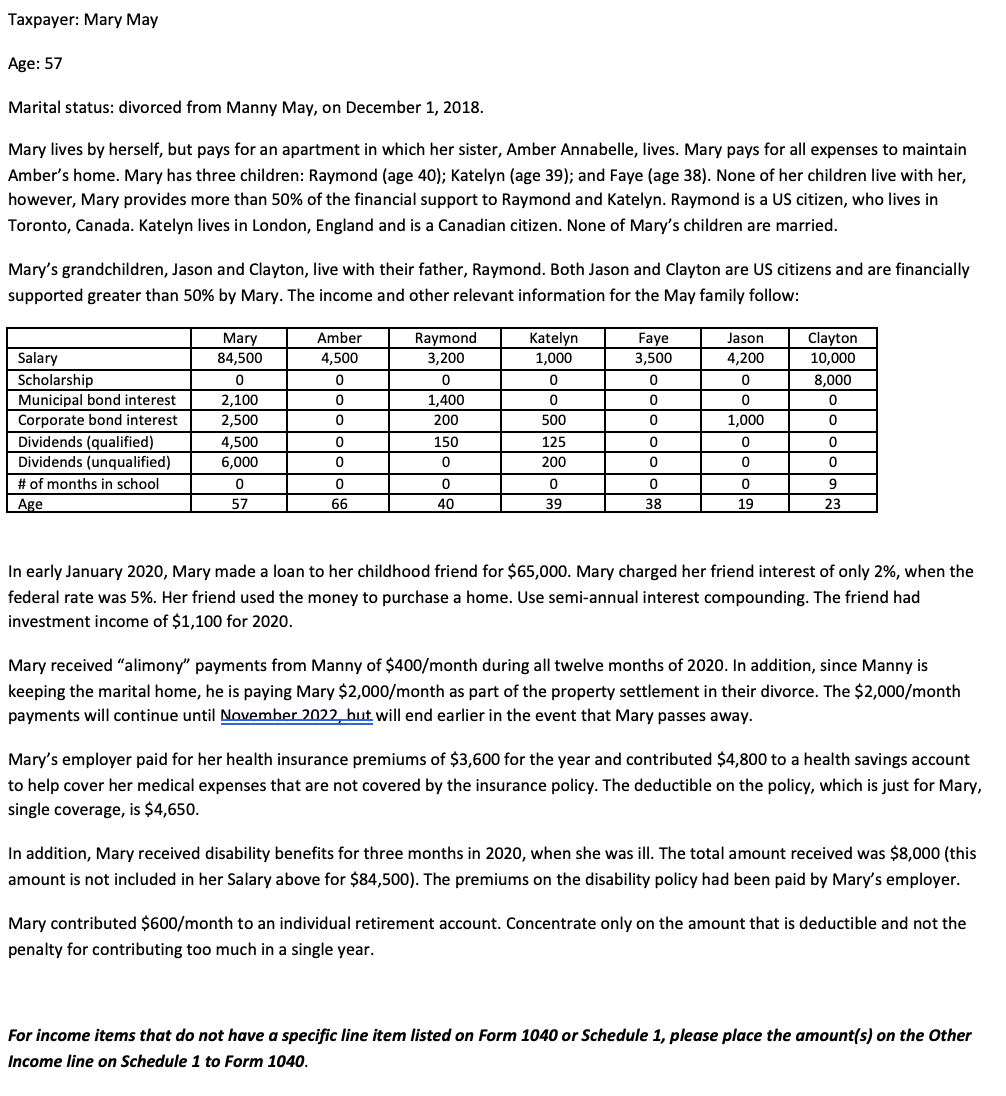

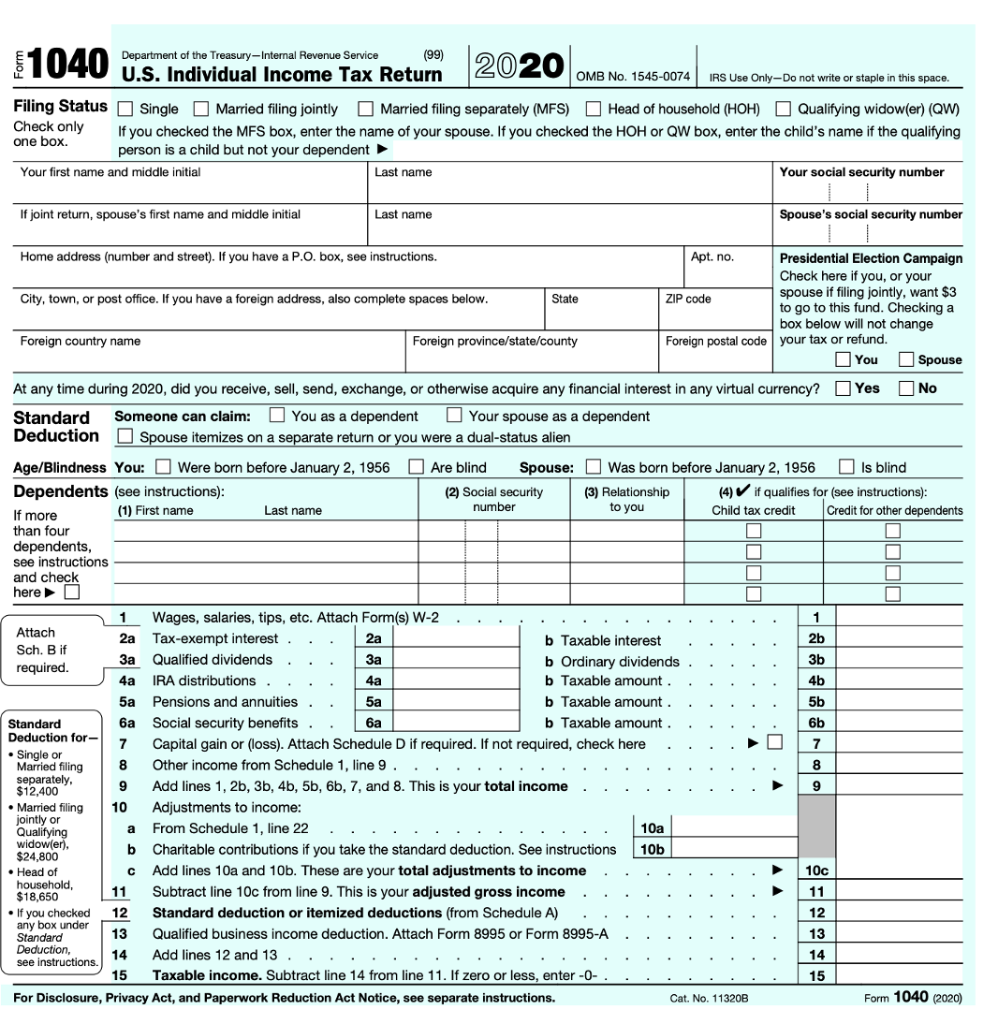

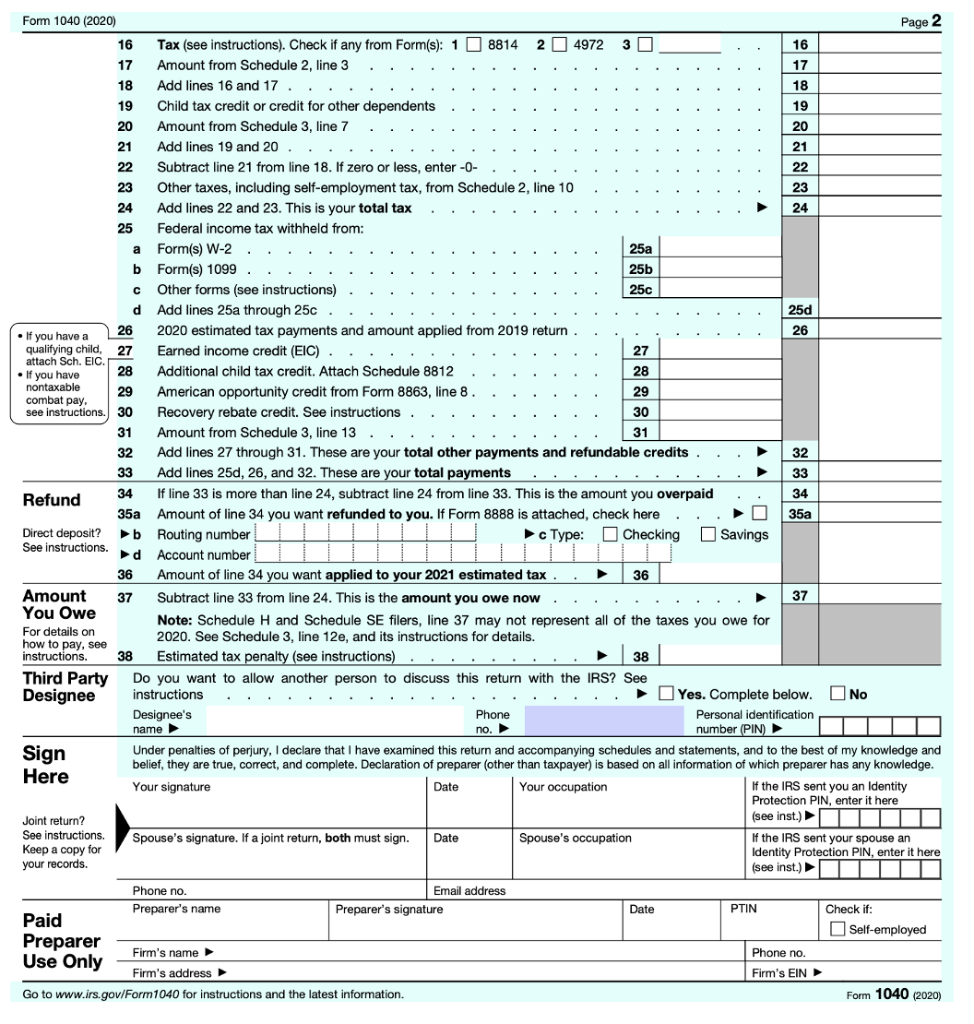

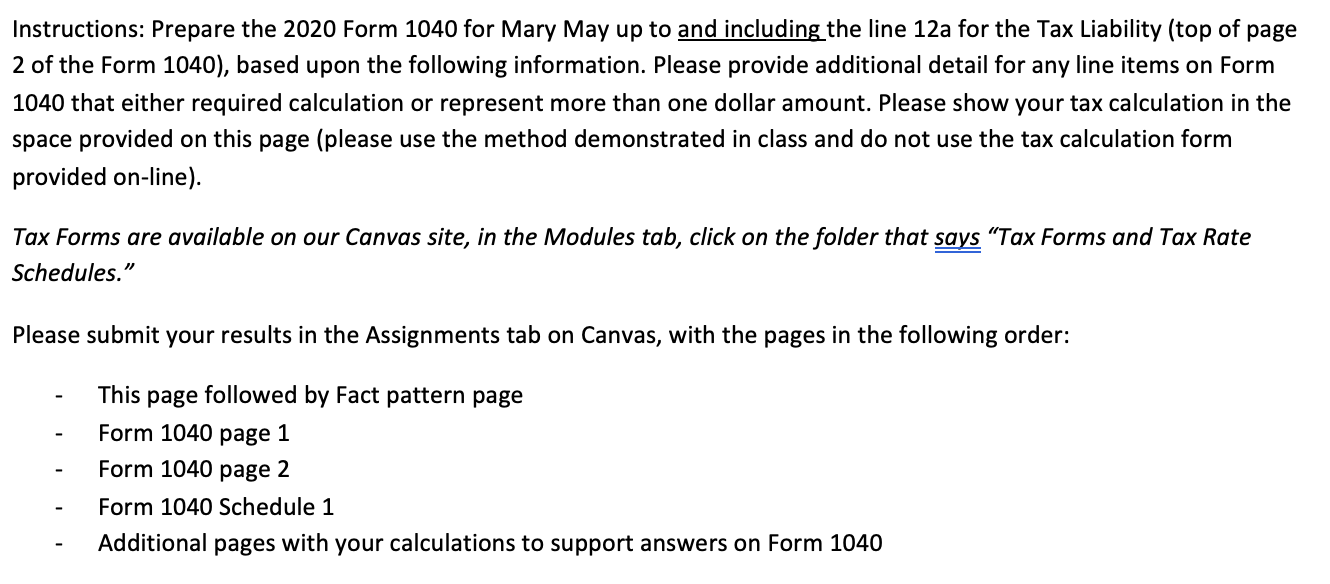

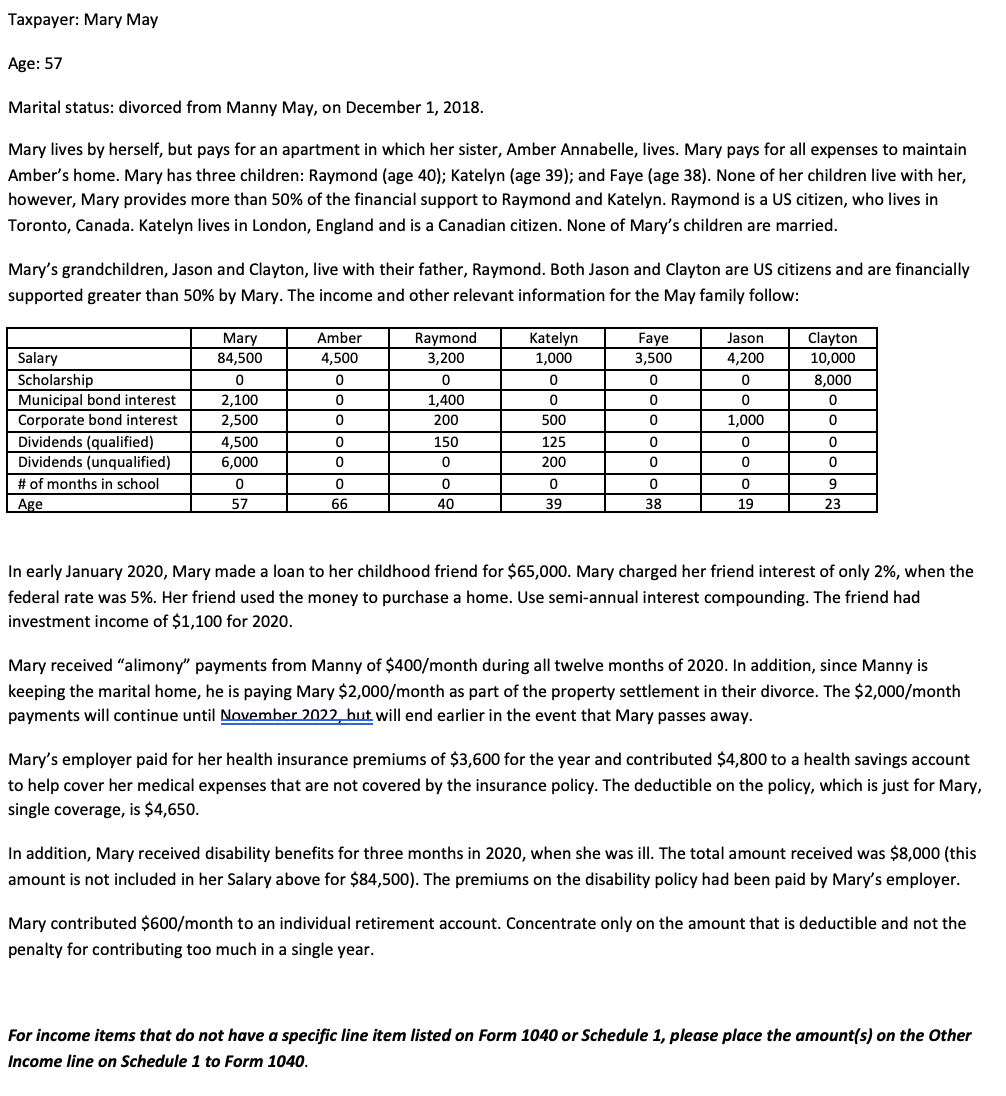

1040 Department of the Treasury-Internal Revenue Service (99) U.S. Individual Income Tax Return 2020 OMB No. 1545-0074 IRS Use Only-Do not write or staple in this space Filing Status Single Married filing jointly Married filing separately (MFS) Head of household (HOH) Qualifying widow(er) (QW) Check only If you checked the MFS box, enter the name of your spouse. If you checked the HOH or QW box, enter the child's name if the qualifying one box. person is a child but not your dependent Your first name and middle initial Last name Your social security number If joint return, spouse's first name and middle initial Last name Spouse's social security number Home address (number and street). If you have a P.O. box, see instructions. City, town, or post office. If you have a foreign address, also complete spaces below. State Apt. no. Presidential Election Campaign Check here if you, or your ZIP code spouse if filing jointly, want $3 to go to this fund. Checking a box below will not change Foreign postal code your tax or refund. Spouse Foreign country name Foreign province/state/county You 1 No At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency? Yes Standard Someone can claim: You as a dependent Your spouse as a dependent Deduction Spouse itemizes on a separate return or you were a dual-status alien Age/Blindness You: Were born before January 2, 1956 Are blind Spouse: Was born before January 2, 1956 Is blind Dependents (see instructions): (2) Social security (3) Relationship (4) Vif qualifies for (see instructions): number Last name (1) First name to you Child tax credit If more Credit for other dependents than four dependents, see instructions and check here 1 Wages, salaries, tips, etc. Attach Form(s) W-2 Attach 2a Tax-exempt interest 2a b Taxable interest 2b Sch. Bif 3a Qualified dividends b Ordinary dividends 3b required. 4a IRA distributions. 4a b Taxable amount 4b 5a Pensions and annuities. 5a b Taxable amount 5b Standard 6a Social security benefits 6 b Taxable amount 6b Deduction for 7 Capital gain or loss). Attach Schedule D if required. If not required, check here 0 7 Single or Married filing 8 Other income from Schedule 1, line 9. 8 separately, 9 9 $12.400 Add lines 1, 2b, 3b, 45, 56, 66, 7, and 8. This is your total income Married filing 10 Adjustments to income: jointly or Qualifying a From Schedule 1, line 22 10a widower, b Charitable contributions if you take the standard deduction. See instructions 10b $24,800 Head of Add lines 10a and 10b. These are your total adjustments to income 10c household, 11 Subtract line 10c from line 9. This is your adjusted gross income $18,650 11 If you checked 12 Standard deduction or itemized deductions (from Schedule A) 12 any box under Standard 13 Qualified business income deduction. Attach Form 8995 or Form 8995-A 13 Deduction, 14 Add lines 12 and 13 14 see instructions. 15 Taxable income. Subtract line 14 from line 11. If zero or less, enter-O- 15 For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11320B Form 1040 (2020) Page 2 32 Form 1040 (2020) 16 Tax (see instructions). Check if any from Form(s): 1 8814 2 4972 4972 3 30 16 17 Amount from Schedule 2, line 3 17 18 Add lines 16 and 17 ... 18 19 Child tax credit or credit for other dependents 19 20 Amount from Schedule 3, line 7 20 21 Add lines 19 and 20 .. 21 22 Subtract line 21 from line 18. If zero or less, enter -0- 22 23 Other taxes, including self-employment tax, from Schedule 2, line 10 23 24 Add lines 22 and 23. This is your total tax 24 25 Federal income tax withheld from: a Form(s) W-2. 25a b Form(s) 1099 25b c Other forms (see instructions) 25c d Add lines 25a through 25c 25d 26 If you have a 26 2020 estimated tax payments and amount applied from 2019 return qualifying child. 27 Earned income credit (EIC). 27 attach Sch. EIC. If you have 28 Additional child tax credit. Attach Schedule 8812 28 nontaxable 29 American opportunity credit from Form 8863, line 8. 29 combat pay. see instructions. 30 Recovery rebate credit. See instructions... 30 31 Amount from Schedule 3, line 13.. 31 32 Add lines 27 through 31. These are your total other payments and refundable credits 33 Add lines 25d, 26, and 32. These are your total payments 33 Refund 34 If line 33 is more than line 24, subtract line 24 from line 33. This is the amount you overpaid 34 35a Amount of line 34 you want refunded to you. If Form 8888 is attached, check here 35a Direct deposit? Routing number c Type: Checking Savings d Account number 36 Amount of line 34 you want applied to your 2021 estimated tax 36 Amount 37 Subtract line 33 from line 24. This is the amount you owe now You Owe Note: Schedule H and Schedule SE filers, line 37 may not represent all of the taxes you owe for For details on 2020. See Schedule 3, line 12e, and its instructions for details. how to pay, see instructions. 38 Estimated tax penalty (see instructions) 38 Third Party Do you want to allow another person to discuss this return with the IRS? See Designee instructions Yes. Complete below. No Designee's Phone Personal identification name no. number (PIN) Sign Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. Here Your signature Date Your occupation If the IRS sent you an identity Protection PIN, enter it here Joint return? (see inst.) See instructions Spouse's signature. If a joint return, both must sign. Date Spouse's occupation If the IRS sent your spouse an Keep a copy for Identity Protection PIN, enter it here your records. (see inst.) Phone no. Email address Preparer's name Preparer's signature Date PTIN Check if: Paid Self-employed Preparer Firm's name Use Only Phone no. Firm's address Firm's EIN Go to www.irs.gov/Form 1040 for instructions and the latest information. . Form 1040 (2020) See instructions.d 37 Instructions: Prepare the 2020 Form 1040 for Mary May up to and including the line 12a for the Tax Liability (top of page 2 of the Form 1040), based upon the following information. Please provide additional detail for any line items on Form 1040 that either required calculation or represent more than one dollar amount. Please show your tax calculation in the space provided on this page (please use the method demonstrated in class and do not use the tax calculation form provided on-line). Tax Forms are available on our Canvas site, in the Modules tab, click on the folder that says "Tax Forms and Tax Rate Schedules." Please submit your results in the Assignments tab on Canvas, with the pages in the following order: This page followed by Fact pattern page Form 1040 page 1 Form 1040 page 2 Form 1040 Schedule 1 Additional pages with your calculations to support answers on Form 1040 Taxpayer: Mary May Age: 57 Marital status: divorced from Manny May, on December 1, 2018. Mary lives by herself, but pays for an apartment in which her sister, Amber Annabelle, lives. Mary pays for all expenses to maintain Amber's home. Mary has three children: Raymond (age 40); Katelyn (age 39); and Faye (age 38). None of her children live with her, however, Mary provides more than 50% of the financial support to Raymond and Katelyn. Raymond is a US citizen, who lives in Toronto, Canada. Katelyn lives in London, England and is a Canadian citizen. None of Mary's children are married. Mary's grandchildren, Jason and Clayton, live with their father, Raymond. Both Jason and Clayton are US citizens and are financially supported greater than 50% by Mary. The income and other relevant information for the May family follow: Amber 4,500 Faye 3,500 0 0 Mary 84,500 0 2,100 2,500 4,500 000 Raymond 3,200 0 1,400 200 150 0 Salary Scholarship Municipal bond interest Corporate bond interest Dividends (qualified) Dividends (unqualified) # of months in school Age 0 Katelyn 1,000 0 0 500 125 200 Jason 4,200 0 0 1,000 0 Clayton 10,000 8,000 0 0 0 0 0 0 0 0 0 0 0 0 0 57 0 66 0 40 0 39 0 38 0 19 9 23 In early January 2020, Mary made a loan to her childhood friend for $65,000. Mary charged her friend interest of only 2%, when the federal rate was 5%. Her friend used the money to purchase a home. Use semi-annual interest compounding. The friend had investment income of $1,100 for 2020. Mary received "alimony" payments from Manny of $400/month during all twelve months of 2020. In addition, since Manny is keeping the marital home, he is paying Mary $2,000/month as part of the property settlement in their divorce. The $2,000/month payments will continue until November 2022 but will end earlier in the event that Mary passes away. Mary's employer paid for her health insurance premiums of $3,600 for the year and contributed $4,800 to a health savings account to help cover her medical expenses that are not covered by the insurance policy. The deductible on the policy, which is just for Mary, single coverage, is $4,650. In addition, Mary received disability benefits for three months in 2020, when she was ill. The total amount received was $8,000 (this amount is not included in her Salary above for $84,500). The premiums on the disability policy had been paid by Mary's employer. Mary contributed $600/month to an individual retirement account. Concentrate only on the amount that is deductible and not the penalty for contributing too much in a single year. For income items that do not have a specific line item listed on Form 1040 or Schedule 1, please place the amount(s) on the Other Income line on Schedule 1 to Form 1040. 1040 Department of the Treasury-Internal Revenue Service (99) U.S. Individual Income Tax Return 2020 OMB No. 1545-0074 IRS Use Only-Do not write or staple in this space Filing Status Single Married filing jointly Married filing separately (MFS) Head of household (HOH) Qualifying widow(er) (QW) Check only If you checked the MFS box, enter the name of your spouse. If you checked the HOH or QW box, enter the child's name if the qualifying one box. person is a child but not your dependent Your first name and middle initial Last name Your social security number If joint return, spouse's first name and middle initial Last name Spouse's social security number Home address (number and street). If you have a P.O. box, see instructions. City, town, or post office. If you have a foreign address, also complete spaces below. State Apt. no. Presidential Election Campaign Check here if you, or your ZIP code spouse if filing jointly, want $3 to go to this fund. Checking a box below will not change Foreign postal code your tax or refund. Spouse Foreign country name Foreign province/state/county You 1 No At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency? Yes Standard Someone can claim: You as a dependent Your spouse as a dependent Deduction Spouse itemizes on a separate return or you were a dual-status alien Age/Blindness You: Were born before January 2, 1956 Are blind Spouse: Was born before January 2, 1956 Is blind Dependents (see instructions): (2) Social security (3) Relationship (4) Vif qualifies for (see instructions): number Last name (1) First name to you Child tax credit If more Credit for other dependents than four dependents, see instructions and check here 1 Wages, salaries, tips, etc. Attach Form(s) W-2 Attach 2a Tax-exempt interest 2a b Taxable interest 2b Sch. Bif 3a Qualified dividends b Ordinary dividends 3b required. 4a IRA distributions. 4a b Taxable amount 4b 5a Pensions and annuities. 5a b Taxable amount 5b Standard 6a Social security benefits 6 b Taxable amount 6b Deduction for 7 Capital gain or loss). Attach Schedule D if required. If not required, check here 0 7 Single or Married filing 8 Other income from Schedule 1, line 9. 8 separately, 9 9 $12.400 Add lines 1, 2b, 3b, 45, 56, 66, 7, and 8. This is your total income Married filing 10 Adjustments to income: jointly or Qualifying a From Schedule 1, line 22 10a widower, b Charitable contributions if you take the standard deduction. See instructions 10b $24,800 Head of Add lines 10a and 10b. These are your total adjustments to income 10c household, 11 Subtract line 10c from line 9. This is your adjusted gross income $18,650 11 If you checked 12 Standard deduction or itemized deductions (from Schedule A) 12 any box under Standard 13 Qualified business income deduction. Attach Form 8995 or Form 8995-A 13 Deduction, 14 Add lines 12 and 13 14 see instructions. 15 Taxable income. Subtract line 14 from line 11. If zero or less, enter-O- 15 For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11320B Form 1040 (2020) Page 2 32 Form 1040 (2020) 16 Tax (see instructions). Check if any from Form(s): 1 8814 2 4972 4972 3 30 16 17 Amount from Schedule 2, line 3 17 18 Add lines 16 and 17 ... 18 19 Child tax credit or credit for other dependents 19 20 Amount from Schedule 3, line 7 20 21 Add lines 19 and 20 .. 21 22 Subtract line 21 from line 18. If zero or less, enter -0- 22 23 Other taxes, including self-employment tax, from Schedule 2, line 10 23 24 Add lines 22 and 23. This is your total tax 24 25 Federal income tax withheld from: a Form(s) W-2. 25a b Form(s) 1099 25b c Other forms (see instructions) 25c d Add lines 25a through 25c 25d 26 If you have a 26 2020 estimated tax payments and amount applied from 2019 return qualifying child. 27 Earned income credit (EIC). 27 attach Sch. EIC. If you have 28 Additional child tax credit. Attach Schedule 8812 28 nontaxable 29 American opportunity credit from Form 8863, line 8. 29 combat pay. see instructions. 30 Recovery rebate credit. See instructions... 30 31 Amount from Schedule 3, line 13.. 31 32 Add lines 27 through 31. These are your total other payments and refundable credits 33 Add lines 25d, 26, and 32. These are your total payments 33 Refund 34 If line 33 is more than line 24, subtract line 24 from line 33. This is the amount you overpaid 34 35a Amount of line 34 you want refunded to you. If Form 8888 is attached, check here 35a Direct deposit? Routing number c Type: Checking Savings d Account number 36 Amount of line 34 you want applied to your 2021 estimated tax 36 Amount 37 Subtract line 33 from line 24. This is the amount you owe now You Owe Note: Schedule H and Schedule SE filers, line 37 may not represent all of the taxes you owe for For details on 2020. See Schedule 3, line 12e, and its instructions for details. how to pay, see instructions. 38 Estimated tax penalty (see instructions) 38 Third Party Do you want to allow another person to discuss this return with the IRS? See Designee instructions Yes. Complete below. No Designee's Phone Personal identification name no. number (PIN) Sign Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. Here Your signature Date Your occupation If the IRS sent you an identity Protection PIN, enter it here Joint return? (see inst.) See instructions Spouse's signature. If a joint return, both must sign. Date Spouse's occupation If the IRS sent your spouse an Keep a copy for Identity Protection PIN, enter it here your records. (see inst.) Phone no. Email address Preparer's name Preparer's signature Date PTIN Check if: Paid Self-employed Preparer Firm's name Use Only Phone no. Firm's address Firm's EIN Go to www.irs.gov/Form 1040 for instructions and the latest information. . Form 1040 (2020) See instructions.d 37 Instructions: Prepare the 2020 Form 1040 for Mary May up to and including the line 12a for the Tax Liability (top of page 2 of the Form 1040), based upon the following information. Please provide additional detail for any line items on Form 1040 that either required calculation or represent more than one dollar amount. Please show your tax calculation in the space provided on this page (please use the method demonstrated in class and do not use the tax calculation form provided on-line). Tax Forms are available on our Canvas site, in the Modules tab, click on the folder that says "Tax Forms and Tax Rate Schedules." Please submit your results in the Assignments tab on Canvas, with the pages in the following order: This page followed by Fact pattern page Form 1040 page 1 Form 1040 page 2 Form 1040 Schedule 1 Additional pages with your calculations to support answers on Form 1040 Taxpayer: Mary May Age: 57 Marital status: divorced from Manny May, on December 1, 2018. Mary lives by herself, but pays for an apartment in which her sister, Amber Annabelle, lives. Mary pays for all expenses to maintain Amber's home. Mary has three children: Raymond (age 40); Katelyn (age 39); and Faye (age 38). None of her children live with her, however, Mary provides more than 50% of the financial support to Raymond and Katelyn. Raymond is a US citizen, who lives in Toronto, Canada. Katelyn lives in London, England and is a Canadian citizen. None of Mary's children are married. Mary's grandchildren, Jason and Clayton, live with their father, Raymond. Both Jason and Clayton are US citizens and are financially supported greater than 50% by Mary. The income and other relevant information for the May family follow: Amber 4,500 Faye 3,500 0 0 Mary 84,500 0 2,100 2,500 4,500 000 Raymond 3,200 0 1,400 200 150 0 Salary Scholarship Municipal bond interest Corporate bond interest Dividends (qualified) Dividends (unqualified) # of months in school Age 0 Katelyn 1,000 0 0 500 125 200 Jason 4,200 0 0 1,000 0 Clayton 10,000 8,000 0 0 0 0 0 0 0 0 0 0 0 0 0 57 0 66 0 40 0 39 0 38 0 19 9 23 In early January 2020, Mary made a loan to her childhood friend for $65,000. Mary charged her friend interest of only 2%, when the federal rate was 5%. Her friend used the money to purchase a home. Use semi-annual interest compounding. The friend had investment income of $1,100 for 2020. Mary received "alimony" payments from Manny of $400/month during all twelve months of 2020. In addition, since Manny is keeping the marital home, he is paying Mary $2,000/month as part of the property settlement in their divorce. The $2,000/month payments will continue until November 2022 but will end earlier in the event that Mary passes away. Mary's employer paid for her health insurance premiums of $3,600 for the year and contributed $4,800 to a health savings account to help cover her medical expenses that are not covered by the insurance policy. The deductible on the policy, which is just for Mary, single coverage, is $4,650. In addition, Mary received disability benefits for three months in 2020, when she was ill. The total amount received was $8,000 (this amount is not included in her Salary above for $84,500). The premiums on the disability policy had been paid by Mary's employer. Mary contributed $600/month to an individual retirement account. Concentrate only on the amount that is deductible and not the penalty for contributing too much in a single year. For income items that do not have a specific line item listed on Form 1040 or Schedule 1, please place the amount(s) on the Other Income line on Schedule 1 to Form 1040