Answered step by step

Verified Expert Solution

Question

1 Approved Answer

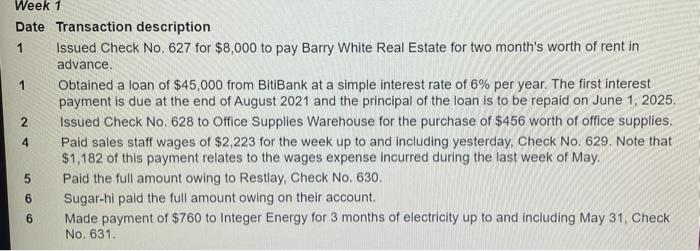

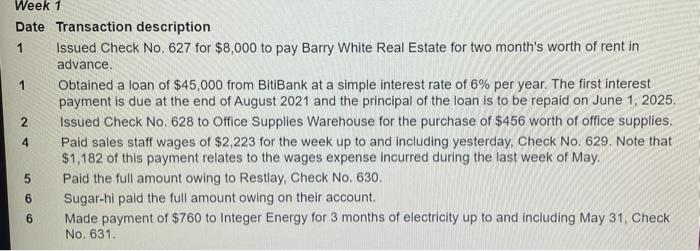

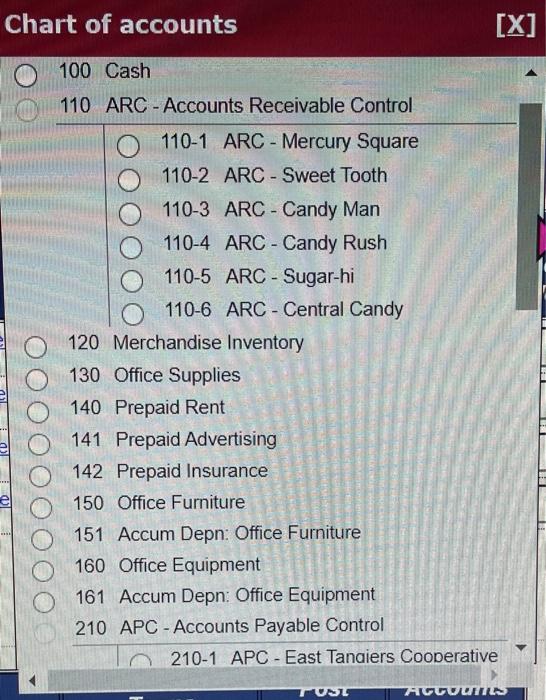

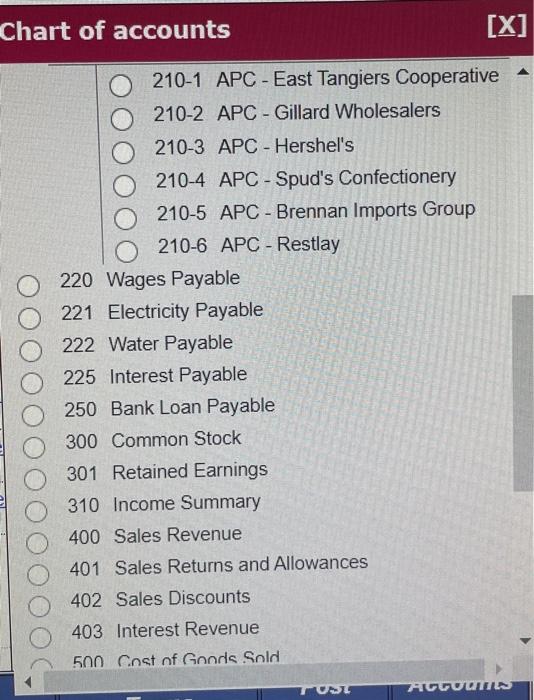

use the chart of accounts for the account section. use week 1 transactions and add them to the to the right chart and use the

use the chart of accounts for the account section.

use week 1 transactions and add them to the to the right chart and use the chart of accounts for the description.

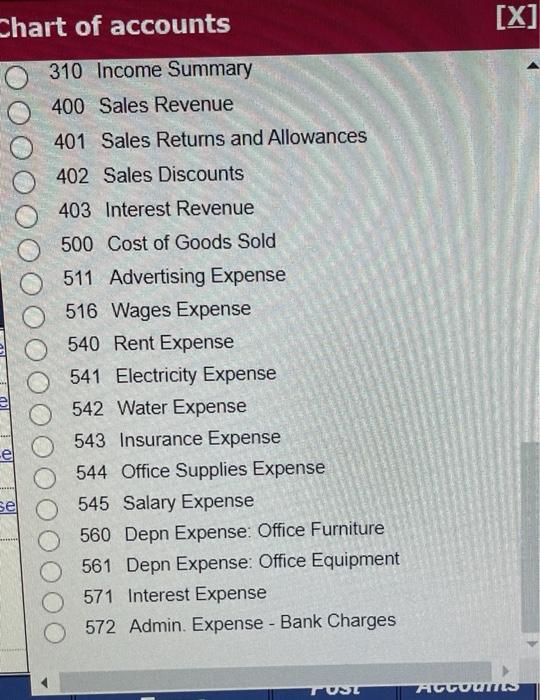

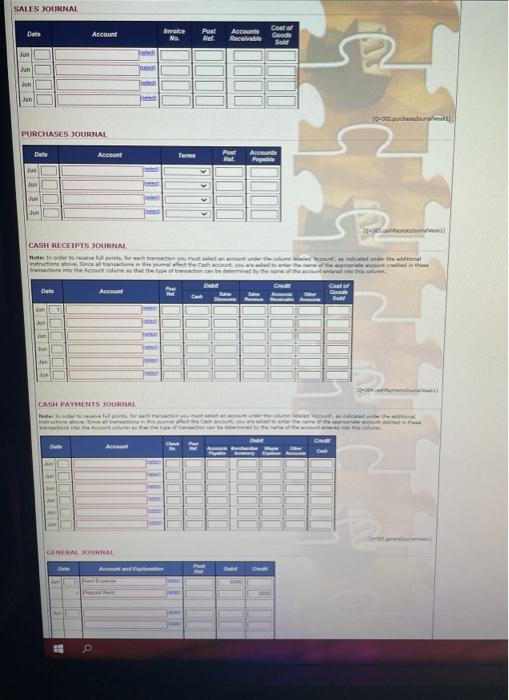

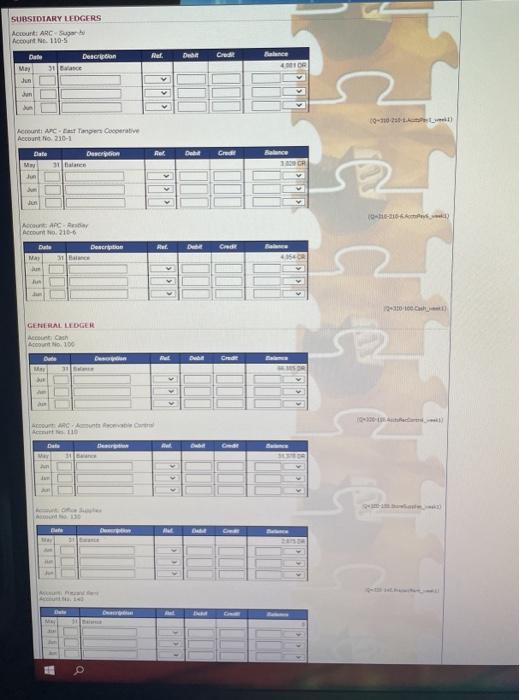

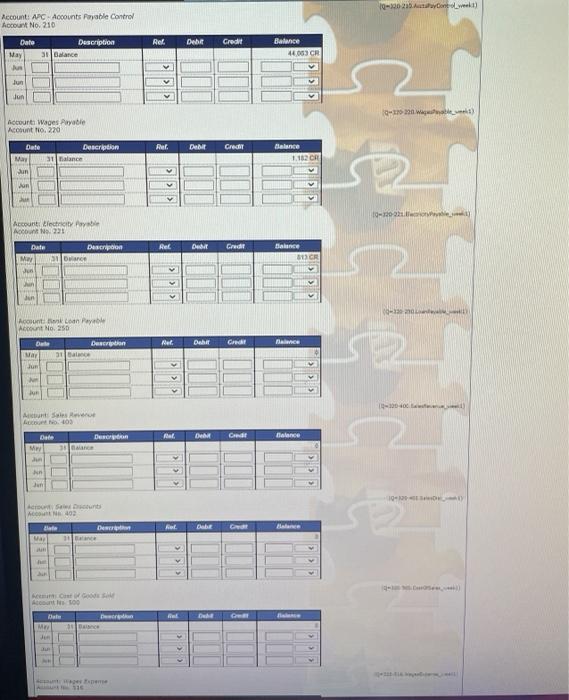

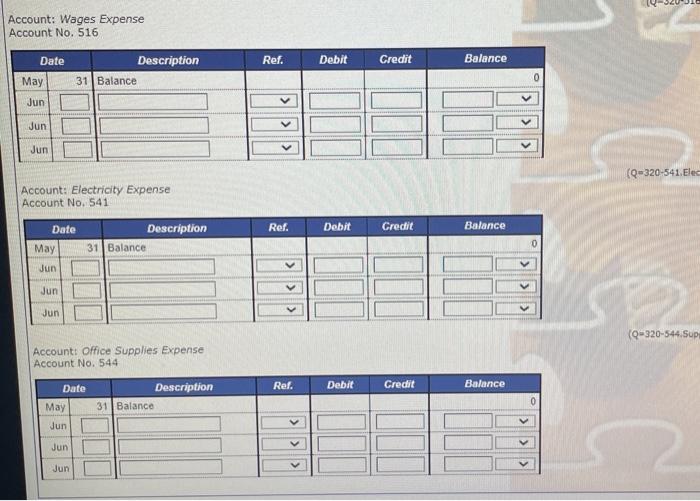

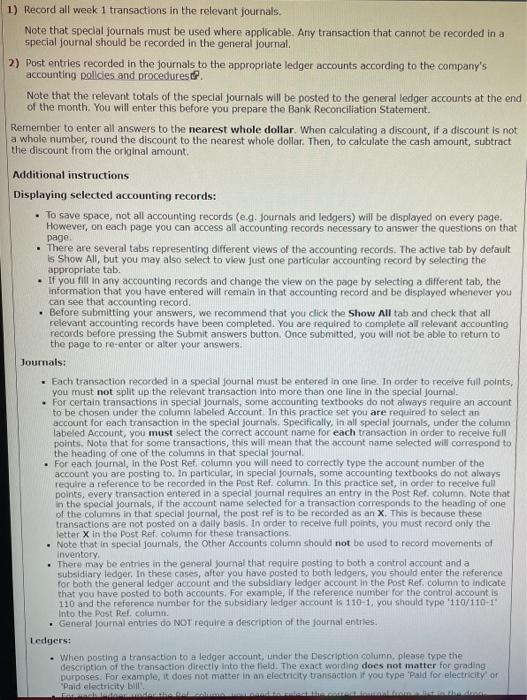

1 Week 1 Date Transaction description Issued Check No. 627 for $8,000 to pay Barry White Real Estate for two month's worth of rent in advance. Obtained a loan of $45,000 from BitiBank at a simple interest rate of 6% per year. The first interest payment is due at the end of August 2021 and the principal of the loan is to be repaid on June 1, 2025. 2 Issued Check No. 628 to Office Supplies Warehouse for the purchase of $456 worth of office supplies. Paid sales staff wages of $2,223 for the week up to and including yesterday, Check No. 629. Note that $1,182 of this payment relates to the wages expense incurred during the last week of May. Paid the full amount owing to Restlay. Check No. 630. Sugar-hi paid the full amount owing on their account. Made payment of $760 to Integer Energy for 3 months of electricity up to and including May 31, Check No. 631 4 5 6 6 Chart of accounts [X] 100 Cash 110 ARC - Accounts Receivable Control O 110-1 ARC - Mercury Square 110-2 ARC - Sweet Tooth 110-3 ARC - Candy Man O 110-4 ARC - Candy Rush O 110-5 ARC - Sugar-hi 110-6 ARC - Central Candy 120 Merchandise Inventory 130 Office Supplies 140 Prepaid Rent 141 Prepaid Advertising 142 Prepaid Insurance 150 Office Furniture 0 151 Accum Depn: Office Furniture O 160 Office Equipment 0 161 Accum Depn: Office Equipment 210 APC - Accounts Payable Control 210-1 APC - East Tanaiers Cooperative TUL Actuums Chart of accounts [X] 210-1 APC - East Tangiers Cooperative 210-2 APC - Gillard Wholesalers 210-3 APC - Hershel's 210-4 APC - Spud's Confectionery 210-5 APC - Brennan Imports Group 210-6 APC - Restlay 220 Wages Payable 221 Electricity Payable 222 Water Payable 225 Interest Payable 250 Bank Loan Payable 300 Common Stock 301 Retained Earnings 310 Income Summary 400 Sales Revenue 401 Sales Returns and Allowances 402 Sales Discounts 403 Interest Revenue 500 Cost of Goods Sold Accounts TUL Chart of accounts [X] 310 Income Summary 400 Sales Revenue 401 Sales Returns and Allowances 402 Sales Discounts 403 Interest Revenue 500 Cost of Goods Sold 511 Advertising Expense 516 Wages Expense 540 Rent Expense 541 Electricity Expense 542 Water Expense 543 Insurance Expense 544 Office Supplies Expense 545 Salary Expense 560 Depn Expense: Office Furniture 561 Depn Expense: Office Equipment 571 Interest Expense 572 Admin. Expense - Bank Charges el se TUL AJUUS SALES JOURNAL Date Account Arvoice Na Post RE Acco Receive Center Good Sold Jun PURCHASLS JOURNAL Date Acco For Rul Ana Page Jun UDO hun CASH RECEIPTS JOURNAL Nota derro con Dut Ace This Custar Gate Sale INDD02 CASH PAYMENTS JOURNAL toote LDEELE GENERAL JOHOR Adam AL SUBSIDIARY LEDGERS Account ARC Sugar Account N. 110-5 Date Description Mer 31 Ref ce Jun (10) Four PC orative Account No 230-1 Daha ema Ensuriya be Balance 14R 16.) ARC Account 210-6 Desert D Date MA B LOR 5 GENERAL LEDGER AGE 100 s Dube Desa AGOTARCIA enite 11 Det Der 3 JIIG 10 Da 10-2025. Dont Lweli) Account: APC Accounts Payable Control Rocount No. 210 Ref Debe Credit Date May Description 3. Balance Balance 44053 CR Jun Q1 20 ) Account Wages Payable Account 0.220 Per Dhil Craar Date May Description 31 lance Balance 1.182 CR sun : AR 10. Account lectricity N21 Descripcion Ret Dar Credit Dute Me Balance SUSCR 31 1913 AcountLoan Pay Account No. 250 Description Rer. Daha Gred 31B Jun 10040 A Sales LUB403 Date Descripti Ral Du Cad Dance M 3 332 III 10-20 contact MOON 02 Der wa FEEL Account 100 M 3 Account: Wages Expense Account No. 516 Date Ref. Debit Credit Balance Description 31 Balance May Jun Jun Jun (Q-320-541.Ele Account: Electricity Expense Account No. 541 Ref. Debit Credit Balance Date May Description 31 Balance 0 Jun Jun Jun (Q=320-544. Sup! Account Office Supplies Expense Account No. 544 Date Description Ref. Debit Credit Balance 0 May 31 Balance Jun Jun Jun 1) Record all week 1 transactions in the relevant journals. Note that special journals must be used where applicable. Any transaction that cannot be recorded in a special journal should be recorded in the general Journal 2) Post entries recorded in the Journals to the appropriate ledger accounts according to the company's accounting polides and procedures Note that the relevant totals of the special journals will be posted to the general ledger accounts at the end of the month. You will enter this before you prepare the Bank Reconciliation Statement. Remember to enter all answers to the nearest whole dollar. When calculating a discount, if a discount is not a whole number, round the discount to the nearest whole dollar. Then, to calculate the cash amount, subtract the discount from the original amount Additional instructions Displaying selected accounting records: To save space, not all accounting records (e.g. Journals and ledgers) will be displayed on every page. However, on each page you can access all accounting records necessary to answer the questions on that page . There are several tabs representing different views of the accounting records. The active tab by default is Show All, but you may also select to view just one particular accounting record by selecting the appropriate tab. . If you fill in any accounting records and change the view on the page by selecting a different tab, the information that you have entered will remain in that accounting record and be displayed whenever you can see that accounting record. Before submitting your answers, we recommend that you click the Show All tab and check that all relevant accounting records have been completed. You are required to complete all relevant accounting records before pressing the Submit answers button. Once submitted, you will not be able to return to the page to re-enter or alter your answers Journals: Each transaction recorded in a special foumal must be entered in one line. In order to receive full points, you must not split up the relevant transaction into more than one line in the special Journal. . For certain transactions in special journals, some accounting textbooks do not always require an account to be chosen under the column labeled Account In this practice set you are required to select an account for each transaction in the special Journals. Specifically, in all special journals, under the column labeled Account, you must select the correct account name for each transaction in order to receive full points. Note that for some transactions, this will mean that the account name selected will correspond to the heading of one of the columns in that special journal For each journal. In the Post Ref. column you will need to correctly type the account number of the account you are posting to. In particular, in special journals, some accounting textbooks do not always require a reference to be recorded in the Post Ref. column. In this practice set, in order to receive full points, every transaction entered in a special Journal requires an entry in the Post Ref. column. Note that in the special Joumals, if the account name selected for a transaction corresponds to the heading of one of the columns in that special journal, the post ref is to be recorded as an X. This is because these transactions are not posted on a daily basis. In order to receive full points, you must record only the . Note that in special journals, the Other Accounts column should not be used to record movements of inventory . There may be entries in the general Journal that require posting to both a control account and a subsidiary ledger, In these cases, after you have posted to both ledgers, you should enter the reference for both the general ledger account and the subsidiary ledger account in the Post Ref. column to indicate that you have posted to both accounts. For example, if the reference number for the control account is 110 and the reference number for the subsidiary ledger account is 110-1, you should type '110/110-1 Into the Past Ref. column. . General Journal entries do NOT require a description of the journal entries. Ledgers: . When posting a transaction to a ledger account, under the Description column, please type the description of the transaction directly into the field. The exact wording does not matter for grading purposes. For example, it does not matter in an electricity transaction if you type 'Pald for electricity or "Paid electricity bill Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started