1040 Scenario # 1: I need help badly

Mister and Mayda Money have hired you to prepare their 2018 Federal income tax return. Please determine which forms you will need based on the information provided. The 2018 forms can be printed from www.irs.gov. The return must be prepared using pen or pencil and you can take a picture of it or though word documen is fine as well. Please turn the returns into Professor Staebell at the beginning of class on the day they are due. The taxpayers name is Mister Money. His wifes name is Mayda Money and they have two children together, Marry Money and Iam Money. Misters mother, Lotta Money, lives with Mister, too. Lotta does not pay any portion of the household expense and Mister pays for Lottas groceries and medical expenses during the year. Lotta receives $1,000 a month of social security income and it is all deposited into a savings account that she does not touch. Mister has a daughter from a previous marriage, Mia Money. Misters ex-wife is the custodial parent of Mia and has signed a form 8332 agreeing not to claim Mia as a dependent in odd years. The Moneys live at 44 Oasis Lane, Rochester NY 14622. The following are the dates of birth and SS#s for each of the Moneys: Mister: 3/2/1949 SS# 111-22-3456 Mayda 1/15/1963 SS# 222-33-4567 Marry: 8/2/1998 SS# 121-34-6785 Lotta: 10/1/1929 SS# 001-23-2172 Mia: 3/21/1995 SS# 103-33-4400 Iam: 10/15/2003 SS# 109-33-8902 Other Information: - The Moneys are not very political and they do not contribute to any campaign election funds. - The Moneys would like their filing status to be whatever is most advantageous from a tax standpoint - Everyone in the household had MEC (minimum essential coverage) health insurance. - Maydas mother passed away during the year. Right before her mother passed away, she gave Mayda $2,500 and right after she passed away, Mayda received life insurance proceeds of $10,000. - Mayda got into a serious car accident during the year. Because of these injuries, she became depressed and angry, had difficulty sleeping, and experienced significant loss of appetite. Because of these problems, she was referred to a psychologist and a therapist. All of these problems are directly related to the accident, and she received $100,000 compensation for mental pain and suffering due to the accident. - Mayda is a pre-school teacher. Mister is an accountant. - The itemized deductions totaled $19,125 for the year. - Mister worked at Wegmans for part of the year. He retired in July and started collecting his retirement. - Marry is a college student but has a full scholarship and has to pay no tuition out-of-pocket. Additional documentation provided by the Moneys attached. The Moneys do not want any tax due to be withdrawn from their bank account and they do not want any refunds directly deposited into their bank account. If the Moneys are getting a refund, they do not want it credited to next year. Scenario Reminders: Round numbers to the closest whole number. Use commas when writing numbers greater than $999, i.e. 1,000 instead of 1000 Staple 1040 and attachments together using the order sequence number on the top right of each form/schedule o 1040 o Forms and Schedules o Worksheets On the 1040 page 1, the Sign Here and Paid Preparer Use Only sections will not be graded. Please do not fill these sections in.

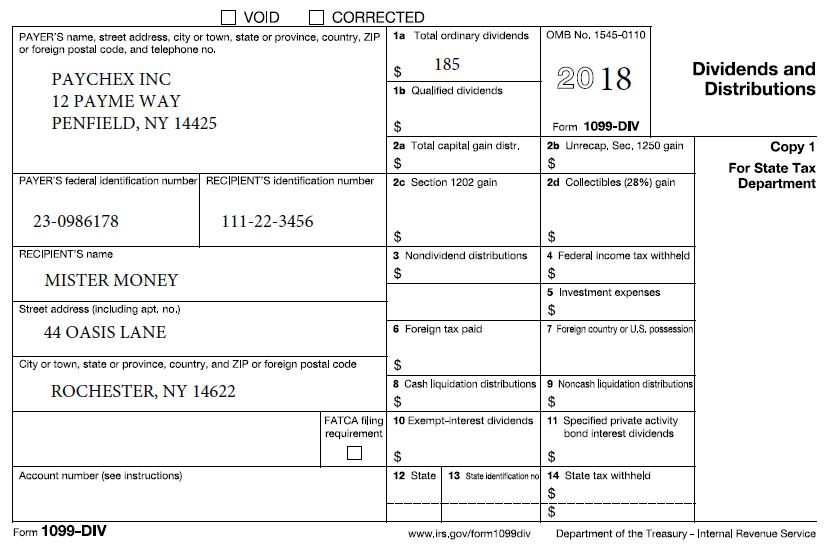

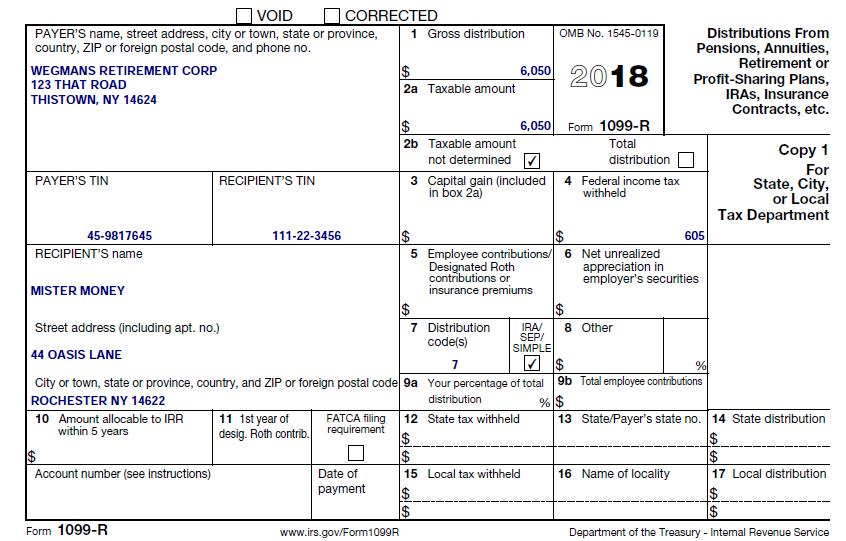

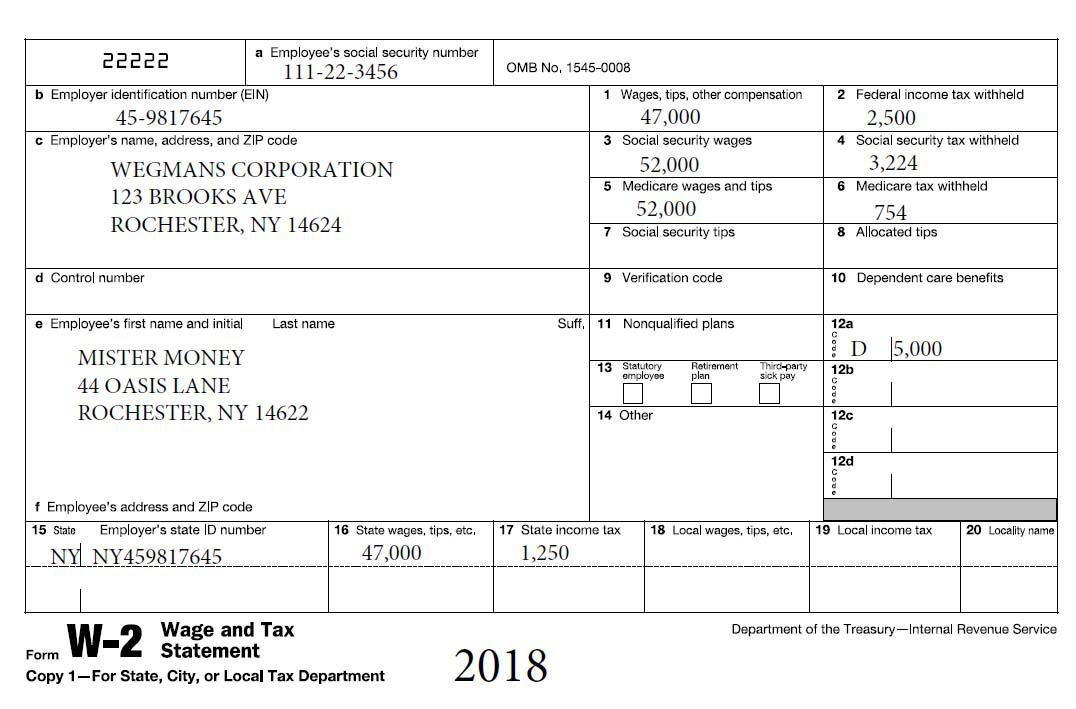

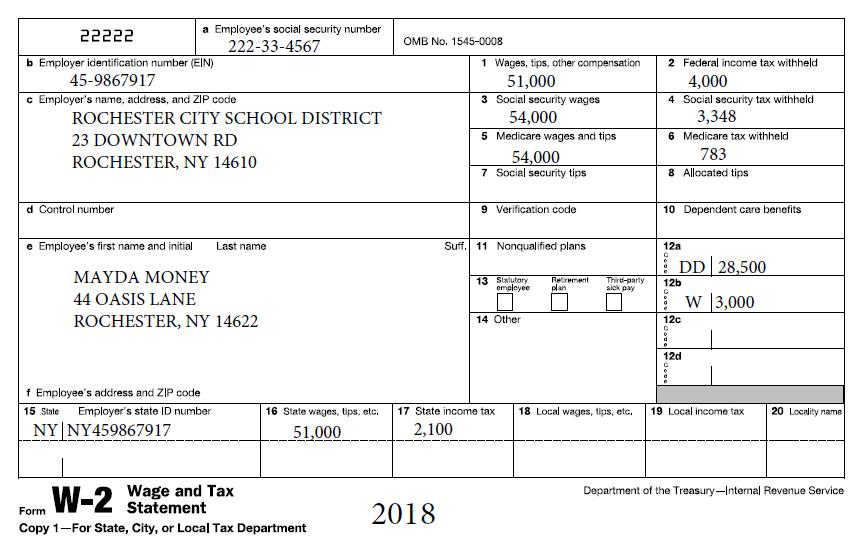

Additional documents that are important information:

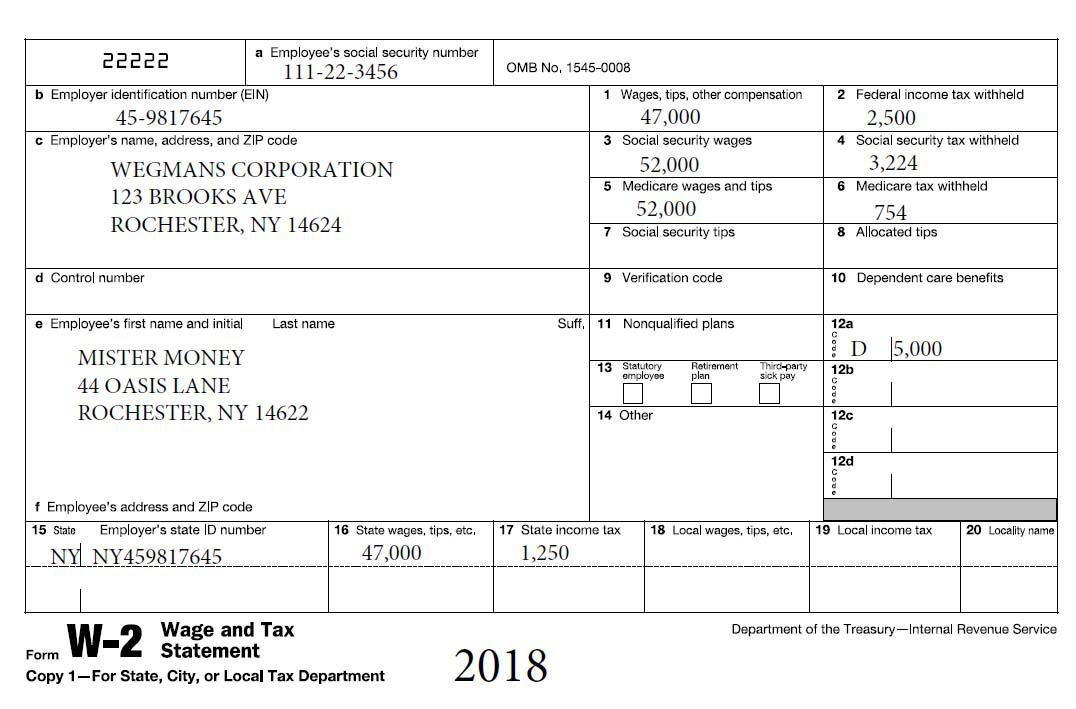

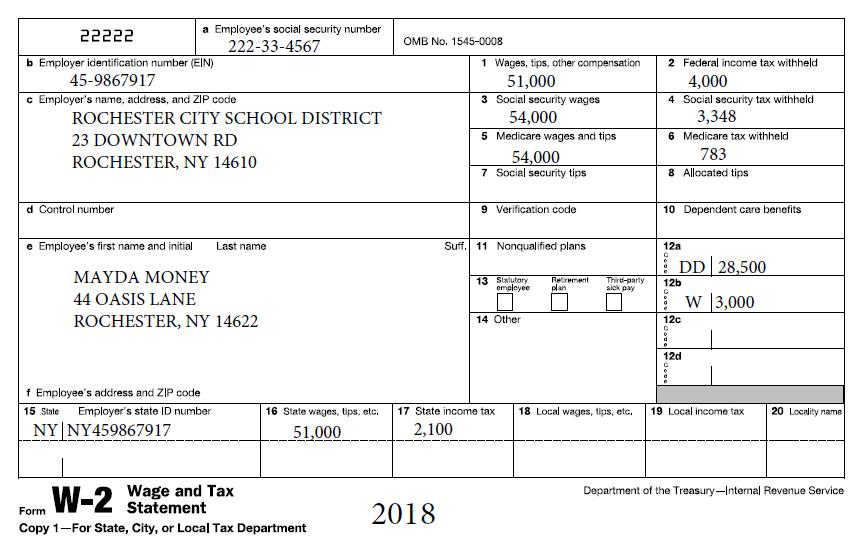

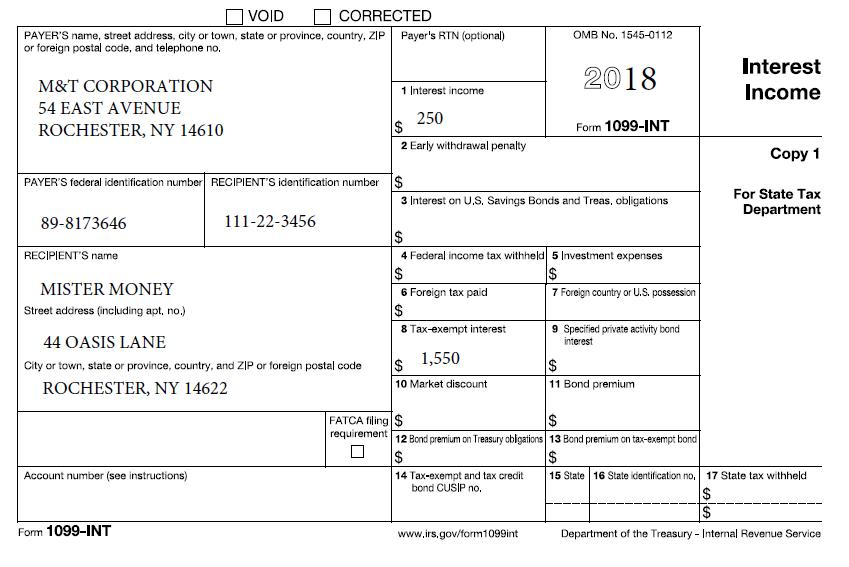

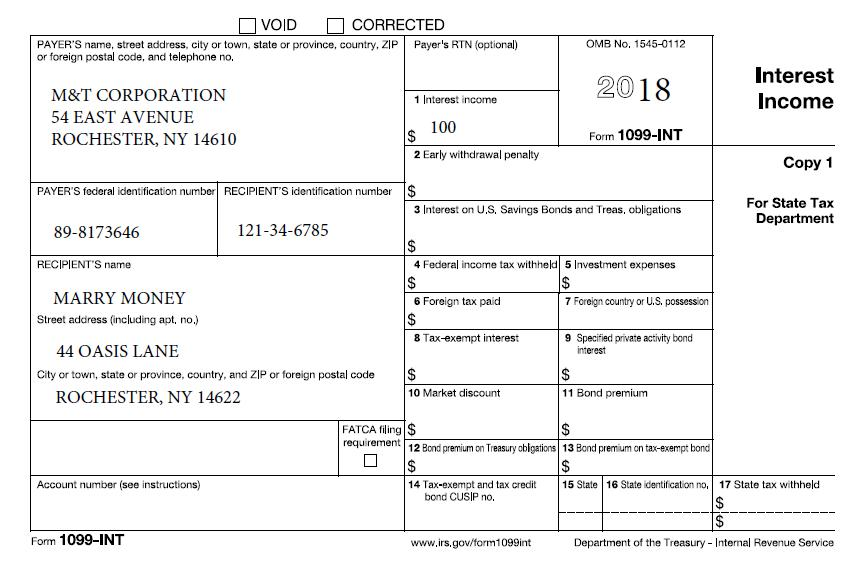

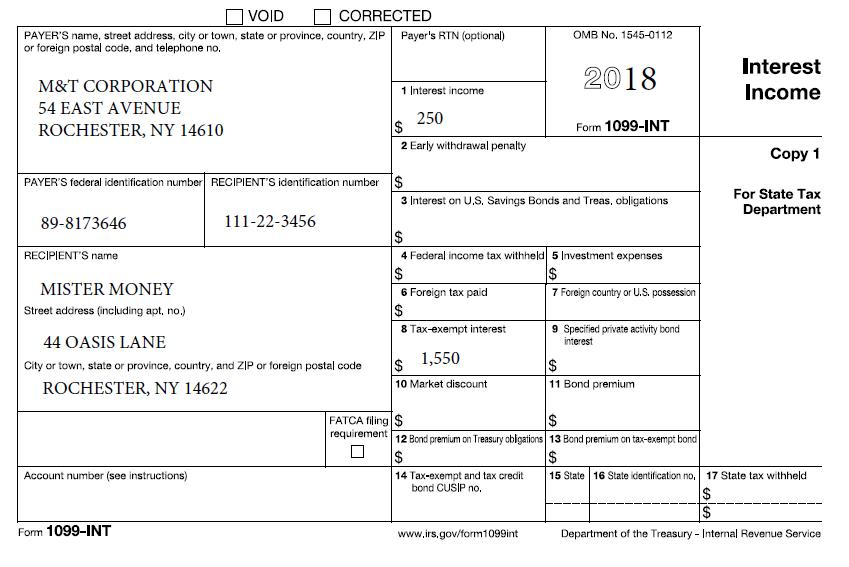

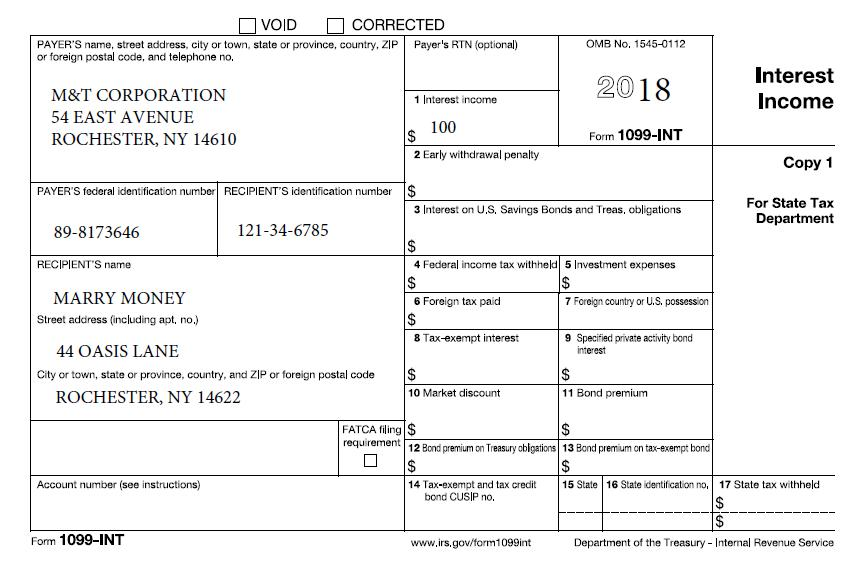

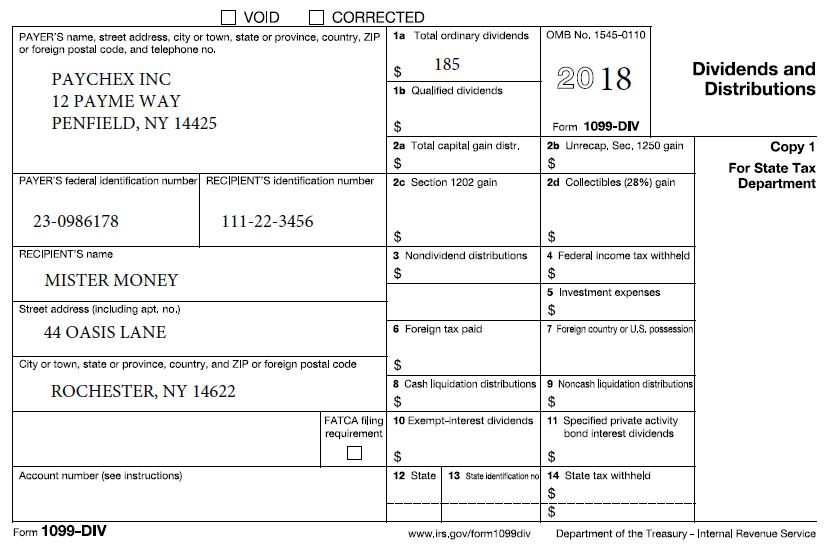

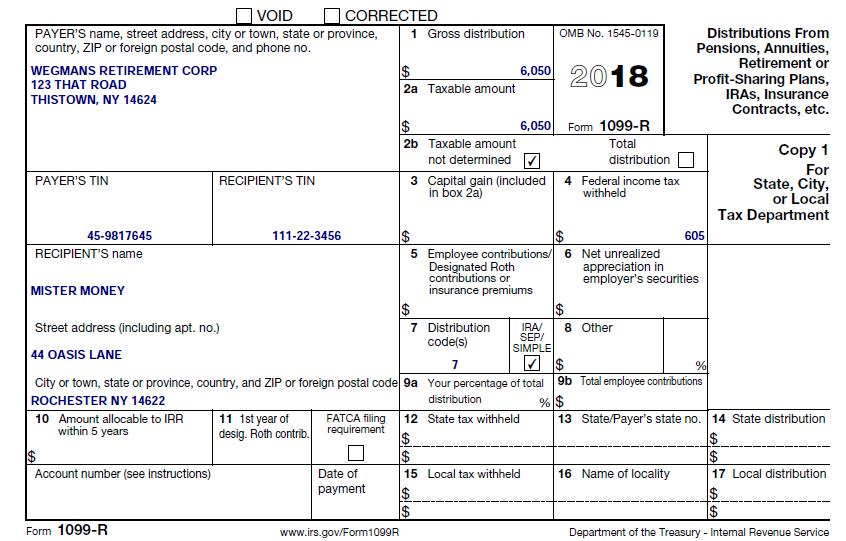

22222 a Employee's social security number 111-22-3456 b Employer identification number (EIN) 45-9817645 c Employer's name, address, and ZIP code WEGMANS CORPORATION 123 BROOKS AVE ROCHESTER, NY 14624 OMB No 1545-0008 1 Wages, tips, other compensation 47,000 3 Social security wages 52,000 5 Medicare wages and tips 52,000 7 Social security tips 2 Federal income tax withheld 2,500 4 Social security tax withheld 3,224 6 Medicare tax withheld 754 8 Allocated tips d Control number 9 Verification code 10 Dependent care benefits e Employee's first name and initial Last name Suff, 11 Nonqualified plans 12a D 15,000 Retirement 13 Statutory employee Third party sick pay 12b MISTER MONEY 44 OASIS LANE ROCHESTER, NY 14622 14 Other 12d f Employee's address and ZIP code 15 State Employer's state ID number NY NY459817645 18 Local wages, tips, etc. 19 Local income tax 20 Locality name 16 State wages, tips, etc. 47,000 17 State income tax 1,250 Department of the Treasury-Internal Revenue Service Wage and Tax Form Statement Copy 1-For State, City, or Local Tax Department 2018 a Employee's social security number 22222 222-33-4567 b Employer identification number (EIN) 45-9867917 c Employer's name, address, and ZIP code ROCHESTER CITY SCHOOL DISTRICT 23 DOWNTOWN RD ROCHESTER, NY 14610 OMB No. 1545-0008 1 Wages, tips, other compensation 51,000 3 Social security wages 54,000 5 Medicare wages and tips 54,000 7 Social security tips | 2 Federal income tax withheld 4,000 4 Social security tax withheld 3,348 6 Medicare tax withheld 783 8 Allocated tips d Control number 9 Verification code 10 Dependent care benefits e Employee's first name and initial Last name Suff. 11 Nonqualified plans DD 28,500 13 Statutory Retirement Third-party MAYDA MONEY 44 OASIS LANE ROCHESTER, NY 14622 200 W 3,000 14 Other 12c f Employee's address and ZIP code 15 State Employer's state ID number NYNY459867917 18 Local wages, tips, etc. 19 Local income tax 20 Locality name 16 State wages, tips, etc. 51,000 17 State income tax 2,100 2 Department of the Treasury - Internal Revenue Service Wage and Tax Form Statement Copy 1-For State, City, or Local Tax Department 2018 OVOD O CORRECTED PAYER'S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no. Payer's RIN (optional) OMB No. 1545-0112 2018 Interest Income 1 Interest income M&T CORPORATION 54 EAST AVENUE ROCHESTER, NY 14610 250 Form 1099-INT 2 Early withdrawal penalty Copy 1 PAYER'S federal identification number RECIPIENT'S identification number 3 Interest on U.S. Savings Bonds and Treas, obligations For State Tax Department 89-8173646 111-22-3456 RECIPIENT'S name 4 Federal income tax withheld 5 Investment expenses 6 Foreign tax paid MISTER MONEY Street address (including apt, no.) 7 Foreign country or U.S. possession 8 Tax-exempt interest 9 Specified private activity bond interest 44 OASIS LANE City or town, state or province, country, and ZIP or foreign postal code ROCHESTER, NY 14622 $ 1,550 10 Market discount 11 Bond premium FATCA filing $ requirement12 Band premium on Treasury oblications 13 Bond premium on tax-exempt bond Account number (see instructions) 15 State 16 State cientification no. 17 State tax withheld 14 Tax-exempt and tax credit bond CUSIP no. Form 1099-INT www.irs.gov/farm1099int Department of the Treasury - Internal Revenue Service VOID OCORRECTED PAYER'S name, street address, city or town, state or province, country, ZIP | Payer's RTN (optional) or foreign postal code, and telephone no. OMB No. 1545-0112 2018 Interest Income 1 Interest income M&T CORPORATION 54 EAST AVENUE ROCHESTER, NY 14610 100 Form 1099-INT 2 Early withdrawal penalty Copy 1 PAYER'S federal identification number RECIPIENT'S identification number ($ 3 Interest on U.S. Savings Bonds and Treas, obligations 89-8173646 121-34-6785 For State Tax Department RECIPIENT'S name 4 Federal income tax withheld 5 Investment expenses 6 Foreign tax paid 7 Foreign country or U.S. possession MARRY MONEY Street address (including apt, no.) $ 8 Tax-exempt interest 9 Specified private activity bond interest 44 OASIS LANE City or town, state or province, country, and ZIP or foreign postal code ROCHESTER, NY 14622 10 Market discount 11 Bond premium FATCA filing $ requirement 12 Bond premium on Treasury obligations 13 Bond premium on tax-exempt bond Account number (see instructions) 14 Tax-exempt and tax credit bond CUSIP no. 15 State 16 State identification no. 17 State tax withheld Form 1099-INT www.irs.gov/form1099int Department of the Treasury - Internal Revenue Service VOID OCORRECTED OMB No. 1545-0110 PAYER'S name, street address, city or town, state or province, country, ZIP | 1a Total ordinary dividends or foreign postal code, and telephone no. 185 PAYCHEX INC 1b Qualified dividends 12 PAYME WAY PENFIELD, NY 14425 2018 Dividends and Distributions Form 1099-DIV 2b Unrecap, Sec, 1250 gain 2a Total capital gain distr. Copy1 For State Tax Department PAYER'S federal identification number RECIPIENT'S identification number | 20 Section 1202 gain 2d Collectibles (28%) gain 23-0986178 111-22-3456 3 Nondividend distributions 4 Federal income tax withheld RECIPIENT'S name MISTER MONEY 5 Investment expenses Street address (including apt. no.) 44 OASIS LANE 6 Foreign tax paid 7 Foreign country or U.S. possession City or town, state or province, country, and ZIP or foreign postal code ROCHESTER, NY 14622 $ 8 Cash liquidation distributions 9 Noncash liquidation distributions 10 Exempt-interest dividends FATCA filing requirement 11 Specified private activity bond interest dividends Account number (see instructions) 12 State 13 State identification no 14 State tax withheld Form 1099-DIV www.irs.gov/form 1099div Department of the Treasury - Internal Revenue Service OMB No. 1545-0119 VOID 1 CORRECTED PAYER'S name, street address, city or town, state or province, 1 1 Gross distribution country, ZIP or foreign postal code, and phone no. WEGMANS RETIREMENT CORP 123 THAT ROAD 2a Taxable amount THISTOWN, NY 14624 6,050 2018 Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAS, Insurance Contracts, etc. 6,050 2b Taxable amount not determined 7 3 Capital gain (included in box 2a) Form 1099-R Total distribution 4 Federal income tax withheld PAYER'S TIN RECIPIENT'S TIN Copy 1 For State, City, or Local Tax Department 111-22-3456 45-9817645 RECIPIENT'S name 605 5 Employee contributions/ 6 Net unrealized Designated Roth appreciation in contributions or employer's securities insurance premiums MISTER MONEY 9 Street address (including apt. no.) 7 Distribution IRA 8 Other code(s) 44 OASIS LANE vs City or town, state or province, country, and ZIP or foreign postal code 9a Your percentage of total 9b Total employee contributions ROCHESTER NY 14622 distribution % $ 10 Amount allocable to IRR 11 1st year of FATCA filing 12 State tax withheld 13 State/Payer's state no. 14 State distribution within 5 years desig. Roth contrib. requirement Account number (see instructions) 15 Local tax withheld 16 Name of locality Date of payment 17 Local distribution A Form 1099-R www.irs.gov/Form1099R Department of the Treasury - Internal Revenue Service 22222 a Employee's social security number 111-22-3456 b Employer identification number (EIN) 45-9817645 c Employer's name, address, and ZIP code WEGMANS CORPORATION 123 BROOKS AVE ROCHESTER, NY 14624 OMB No 1545-0008 1 Wages, tips, other compensation 47,000 3 Social security wages 52,000 5 Medicare wages and tips 52,000 7 Social security tips 2 Federal income tax withheld 2,500 4 Social security tax withheld 3,224 6 Medicare tax withheld 754 8 Allocated tips d Control number 9 Verification code 10 Dependent care benefits e Employee's first name and initial Last name Suff, 11 Nonqualified plans 12a D 15,000 Retirement 13 Statutory employee Third party sick pay 12b MISTER MONEY 44 OASIS LANE ROCHESTER, NY 14622 14 Other 12d f Employee's address and ZIP code 15 State Employer's state ID number NY NY459817645 18 Local wages, tips, etc. 19 Local income tax 20 Locality name 16 State wages, tips, etc. 47,000 17 State income tax 1,250 Department of the Treasury-Internal Revenue Service Wage and Tax Form Statement Copy 1-For State, City, or Local Tax Department 2018 a Employee's social security number 22222 222-33-4567 b Employer identification number (EIN) 45-9867917 c Employer's name, address, and ZIP code ROCHESTER CITY SCHOOL DISTRICT 23 DOWNTOWN RD ROCHESTER, NY 14610 OMB No. 1545-0008 1 Wages, tips, other compensation 51,000 3 Social security wages 54,000 5 Medicare wages and tips 54,000 7 Social security tips | 2 Federal income tax withheld 4,000 4 Social security tax withheld 3,348 6 Medicare tax withheld 783 8 Allocated tips d Control number 9 Verification code 10 Dependent care benefits e Employee's first name and initial Last name Suff. 11 Nonqualified plans DD 28,500 13 Statutory Retirement Third-party MAYDA MONEY 44 OASIS LANE ROCHESTER, NY 14622 200 W 3,000 14 Other 12c f Employee's address and ZIP code 15 State Employer's state ID number NYNY459867917 18 Local wages, tips, etc. 19 Local income tax 20 Locality name 16 State wages, tips, etc. 51,000 17 State income tax 2,100 2 Department of the Treasury - Internal Revenue Service Wage and Tax Form Statement Copy 1-For State, City, or Local Tax Department 2018 OVOD O CORRECTED PAYER'S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no. Payer's RIN (optional) OMB No. 1545-0112 2018 Interest Income 1 Interest income M&T CORPORATION 54 EAST AVENUE ROCHESTER, NY 14610 250 Form 1099-INT 2 Early withdrawal penalty Copy 1 PAYER'S federal identification number RECIPIENT'S identification number 3 Interest on U.S. Savings Bonds and Treas, obligations For State Tax Department 89-8173646 111-22-3456 RECIPIENT'S name 4 Federal income tax withheld 5 Investment expenses 6 Foreign tax paid MISTER MONEY Street address (including apt, no.) 7 Foreign country or U.S. possession 8 Tax-exempt interest 9 Specified private activity bond interest 44 OASIS LANE City or town, state or province, country, and ZIP or foreign postal code ROCHESTER, NY 14622 $ 1,550 10 Market discount 11 Bond premium FATCA filing $ requirement12 Band premium on Treasury oblications 13 Bond premium on tax-exempt bond Account number (see instructions) 15 State 16 State cientification no. 17 State tax withheld 14 Tax-exempt and tax credit bond CUSIP no. Form 1099-INT www.irs.gov/farm1099int Department of the Treasury - Internal Revenue Service VOID OCORRECTED PAYER'S name, street address, city or town, state or province, country, ZIP | Payer's RTN (optional) or foreign postal code, and telephone no. OMB No. 1545-0112 2018 Interest Income 1 Interest income M&T CORPORATION 54 EAST AVENUE ROCHESTER, NY 14610 100 Form 1099-INT 2 Early withdrawal penalty Copy 1 PAYER'S federal identification number RECIPIENT'S identification number ($ 3 Interest on U.S. Savings Bonds and Treas, obligations 89-8173646 121-34-6785 For State Tax Department RECIPIENT'S name 4 Federal income tax withheld 5 Investment expenses 6 Foreign tax paid 7 Foreign country or U.S. possession MARRY MONEY Street address (including apt, no.) $ 8 Tax-exempt interest 9 Specified private activity bond interest 44 OASIS LANE City or town, state or province, country, and ZIP or foreign postal code ROCHESTER, NY 14622 10 Market discount 11 Bond premium FATCA filing $ requirement 12 Bond premium on Treasury obligations 13 Bond premium on tax-exempt bond Account number (see instructions) 14 Tax-exempt and tax credit bond CUSIP no. 15 State 16 State identification no. 17 State tax withheld Form 1099-INT www.irs.gov/form1099int Department of the Treasury - Internal Revenue Service VOID OCORRECTED OMB No. 1545-0110 PAYER'S name, street address, city or town, state or province, country, ZIP | 1a Total ordinary dividends or foreign postal code, and telephone no. 185 PAYCHEX INC 1b Qualified dividends 12 PAYME WAY PENFIELD, NY 14425 2018 Dividends and Distributions Form 1099-DIV 2b Unrecap, Sec, 1250 gain 2a Total capital gain distr. Copy1 For State Tax Department PAYER'S federal identification number RECIPIENT'S identification number | 20 Section 1202 gain 2d Collectibles (28%) gain 23-0986178 111-22-3456 3 Nondividend distributions 4 Federal income tax withheld RECIPIENT'S name MISTER MONEY 5 Investment expenses Street address (including apt. no.) 44 OASIS LANE 6 Foreign tax paid 7 Foreign country or U.S. possession City or town, state or province, country, and ZIP or foreign postal code ROCHESTER, NY 14622 $ 8 Cash liquidation distributions 9 Noncash liquidation distributions 10 Exempt-interest dividends FATCA filing requirement 11 Specified private activity bond interest dividends Account number (see instructions) 12 State 13 State identification no 14 State tax withheld Form 1099-DIV www.irs.gov/form 1099div Department of the Treasury - Internal Revenue Service OMB No. 1545-0119 VOID 1 CORRECTED PAYER'S name, street address, city or town, state or province, 1 1 Gross distribution country, ZIP or foreign postal code, and phone no. WEGMANS RETIREMENT CORP 123 THAT ROAD 2a Taxable amount THISTOWN, NY 14624 6,050 2018 Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAS, Insurance Contracts, etc. 6,050 2b Taxable amount not determined 7 3 Capital gain (included in box 2a) Form 1099-R Total distribution 4 Federal income tax withheld PAYER'S TIN RECIPIENT'S TIN Copy 1 For State, City, or Local Tax Department 111-22-3456 45-9817645 RECIPIENT'S name 605 5 Employee contributions/ 6 Net unrealized Designated Roth appreciation in contributions or employer's securities insurance premiums MISTER MONEY 9 Street address (including apt. no.) 7 Distribution IRA 8 Other code(s) 44 OASIS LANE vs City or town, state or province, country, and ZIP or foreign postal code 9a Your percentage of total 9b Total employee contributions ROCHESTER NY 14622 distribution % $ 10 Amount allocable to IRR 11 1st year of FATCA filing 12 State tax withheld 13 State/Payer's state no. 14 State distribution within 5 years desig. Roth contrib. requirement Account number (see instructions) 15 Local tax withheld 16 Name of locality Date of payment 17 Local distribution A Form 1099-R www.irs.gov/Form1099R Department of the Treasury - Internal Revenue Service