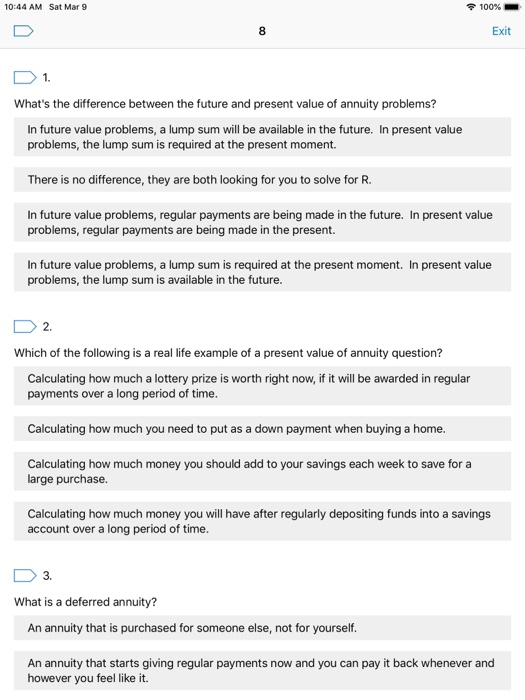

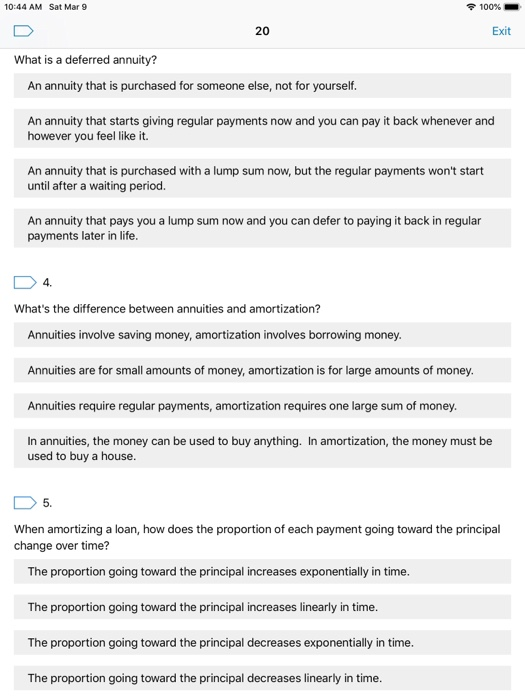

10:44 AM Sat Mar 9 100% Exit 1. What's the difference between the future and present value of annuity problems? In future value problems, a lump sum will be available in the future. In present value problems, the lump sum is required at the present moment. There is no difference, they are both looking for you to solve for R. In future value problems, regular payments are being made in the future. In present value problems, regular payments are being made in the present. In future value problems, a lump sum is required at the present moment. In present value problems, the lump sum is available in the future Which of the following is a real life example of a present value of annuity question? Calculating how much a lottery prize is worth right now, if it will be awarded in regular payments over a long period of time Calculating how much you need to put as a down payment when buying a home. Calculating how much money you should add to your savings each week to save fora large purchase. Calculating how much money you will have after regularly depositing funds into a savings account over a long period of time 3. What is a deferred annuity? An annuity that is purchased for someone else, not for yourself An annuity that starts giving regular payments now and you can pay it back whenever and however you feel like it. 10:44 AM Sat Mar 9 1005 20 Exit What is a deferred annuity? An annuity that is purchased for someone else, not for yourself An annuity that starts giving regular payments now and you can pay it back whenever and however you fel like it. An annuity that is purchased with a lump sum now, but the regular payments won't start until after a waiting period. An annuity that pays you a lump sum now and you can defer to paying it back in regular payments later in life. 4 What's the difference between annuities and amortization? Annuities involve saving money, amortization involves borrowing money. Annuities are for small amounts of money, amortization is for large amounts of money. Annuities require regular payments, amortization requires one large sum of money. In annuities, the money can be used to buy anything. In amortization, the money must be used to buy a house. 5 When amortizing a loan, how does the proportion of each payment going toward the principal change over time? The proportion going toward the principal increases exponentially in time. The proportion going toward the principal increases linearly in time. The proportion going toward the principal decreases exponentially in time. The proportion going toward the principal decreases linearly in time