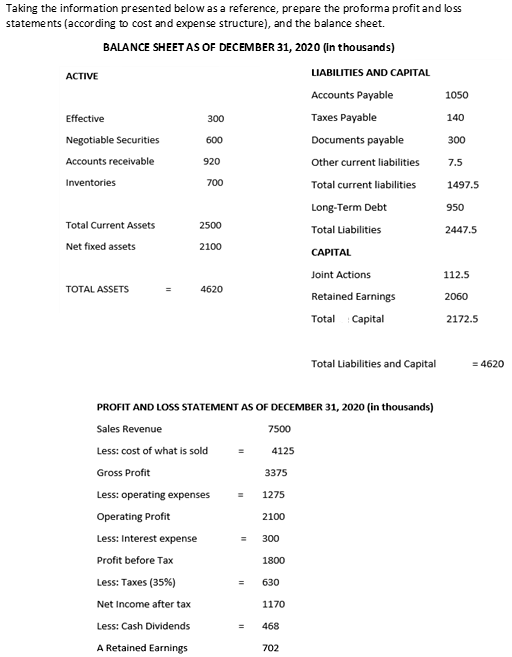

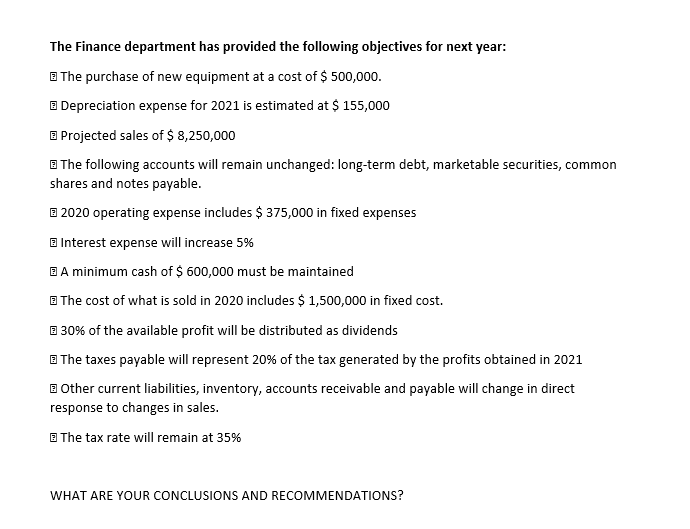

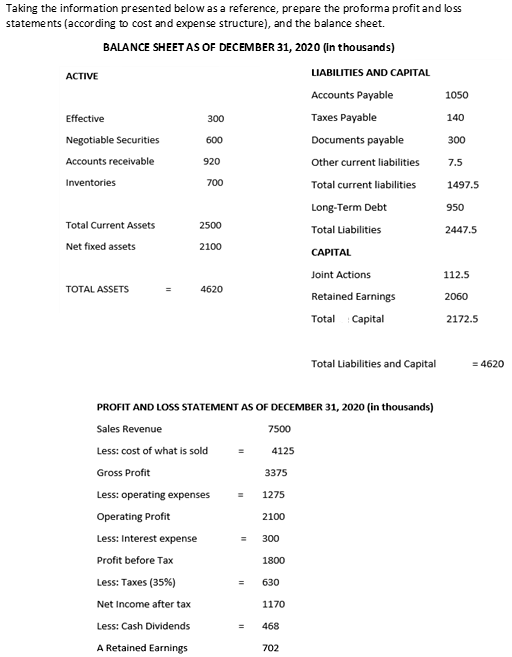

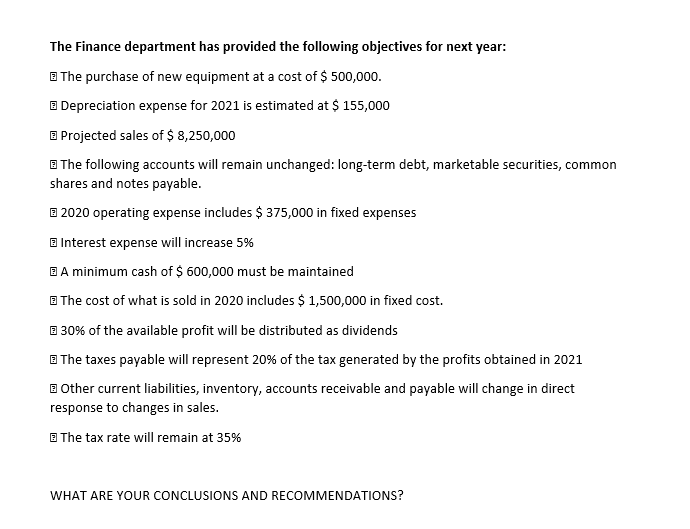

1050 300 140 Taking the information presented below as a reference, prepare the proforma profit and loss statements (according to cost and expense structure), and the balance sheet. BALANCE SHEET AS OF DECEMBER 31, 2020 (In thousands) ACTIVE LIABILITIES AND CAPITAL Accounts Payable Effective Taxes Payable Negotiable Securities 600 Documents payable 300 Accounts receivable 920 Other current liabilities Inventories 700 Total current liabilities Long-Term Debt Total Current Assets Total Liabilities Net fixed assets 2100 CAPITAL Joint Actions 112.5 TOTAL ASSETS Retained Earnings Total Capital 2172.5 7.5 1497.5 950 2500 2447.5 4620 2060 Total Liabilities and Capital = 4620 4125 PROFIT AND LOSS STATEMENT AS OF DECEMBER 31, 2020 (in thousands) Sales Revenue 7500 Less: cost of what is sold Gross Profit 3375 Less: operating expenses 1275 Operating Profit 2100 Less: Interest expense Profit before Tax 1800 Less: Taxes (35%) Net Income after tax 1170 Less: Cash Dividends A Retained Earnings = 300 630 = 468 702 The Finance department has provided the following objectives for next year: E The purchase of new equipment at a cost of $ 500,000. E Depreciation expense for 2021 is estimated at $ 155,000 Projected sales of $ 8,250,000 The following accounts will remain unchanged: long-term debt, marketable securities, common shares and notes payable. 3 2020 operating expense includes $ 375,000 in fixed expenses Interest expense will increase 5% E A minimum cash of $ 600,000 must be maintained E The cost of what is sold in 2020 includes $ 1,500,000 in fixed cost. 3 30% of the available profit will be distributed as dividends E The taxes payable will represent 20% of the tax generated by the profits obtained in 2021 E Other current liabilities, inventory, accounts receivable and payable will change in direct response to changes in sales. The tax rate will remain at 35% WHAT ARE YOUR CONCLUSIONS AND RECOMMENDATIONS? 1050 300 140 Taking the information presented below as a reference, prepare the proforma profit and loss statements (according to cost and expense structure), and the balance sheet. BALANCE SHEET AS OF DECEMBER 31, 2020 (In thousands) ACTIVE LIABILITIES AND CAPITAL Accounts Payable Effective Taxes Payable Negotiable Securities 600 Documents payable 300 Accounts receivable 920 Other current liabilities Inventories 700 Total current liabilities Long-Term Debt Total Current Assets Total Liabilities Net fixed assets 2100 CAPITAL Joint Actions 112.5 TOTAL ASSETS Retained Earnings Total Capital 2172.5 7.5 1497.5 950 2500 2447.5 4620 2060 Total Liabilities and Capital = 4620 4125 PROFIT AND LOSS STATEMENT AS OF DECEMBER 31, 2020 (in thousands) Sales Revenue 7500 Less: cost of what is sold Gross Profit 3375 Less: operating expenses 1275 Operating Profit 2100 Less: Interest expense Profit before Tax 1800 Less: Taxes (35%) Net Income after tax 1170 Less: Cash Dividends A Retained Earnings = 300 630 = 468 702 The Finance department has provided the following objectives for next year: E The purchase of new equipment at a cost of $ 500,000. E Depreciation expense for 2021 is estimated at $ 155,000 Projected sales of $ 8,250,000 The following accounts will remain unchanged: long-term debt, marketable securities, common shares and notes payable. 3 2020 operating expense includes $ 375,000 in fixed expenses Interest expense will increase 5% E A minimum cash of $ 600,000 must be maintained E The cost of what is sold in 2020 includes $ 1,500,000 in fixed cost. 3 30% of the available profit will be distributed as dividends E The taxes payable will represent 20% of the tax generated by the profits obtained in 2021 E Other current liabilities, inventory, accounts receivable and payable will change in direct response to changes in sales. The tax rate will remain at 35% WHAT ARE YOUR CONCLUSIONS AND RECOMMENDATIONS