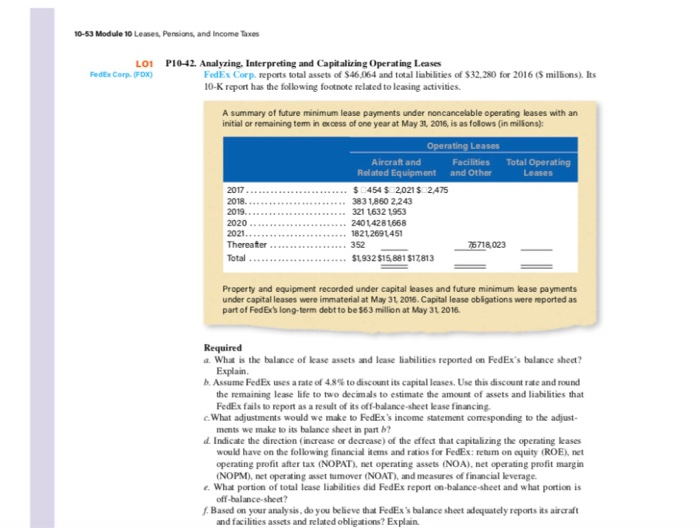

10-53 Module 10 Leases, Pensions, and income Taxes LO1 FedEx Corp. (FOX P10-42. Analyzing. Interpreting and Capitalizing Operating Leases FedEx Corp. reports total assets of $46,064 and total liabilities of $32,280 for 2016 (5 millions). Its 10-K report has the following footnote related to leasing activities. A summary of future minimum lease payments under noncancelable operating leases with an initial or remaining term in excess of one year at May 31, 2016, is as follows (in millions): 2017 2018 Operating Leases Aircraft and Facilities Total Operating Related Equipment and other Leases $ 454 $ 2021 $ 2475 383 1.860 2243 321 1632 1953 2401428 1668 18212691451 76718,023 $1932 $15.881 $17,813 2020 2021 Thereater Total... 352 Property and equipment recorded under capital leases and future minimum lease payments under capital leases were immaterial at May 31, 2016. Capital lease obligations were reported as part of FedEx's long-term debt to be 563 million at May 31, 2016 Required a. What is the balance of lease assets and lease liabilities reported on FedEx's balance sheet? Explain. b. Assume FedEx uses a rate of 4.8% to discount its capital cases. Use this discount rate and round the remaining lease life to two decimals to estimate the amount of assets and liabilities that FedEx fails to report as a result of its off-balance-sheet lease financing What adjustments would we make to FedEx's income statement coresponding to the adjust- ments we make to its balance sheet in part b? d. Indicate the direction (increase or decrease of the effect that capitalizing the operating leases would have on the following financial items and ratios for FedEx: retum on equity (ROE). net operating profit after tax (NOPAT), net operating assets (NOA), net operating profit margin (NOPM), net operating asset tumover (NOAT), and measures of financial leverage. c. What portion of total lease liabilities did FedEx report on-balance-sheet and what portion is off-balance-sheet? f. Based on your analysis, do you believe that FedEx's balance sheet adequately reports its aircraft and facilities assets and related obligations? Explain 10-53 Module 10 Leases, Pensions, and income Taxes LO1 FedEx Corp. (FOX P10-42. Analyzing. Interpreting and Capitalizing Operating Leases FedEx Corp. reports total assets of $46,064 and total liabilities of $32,280 for 2016 (5 millions). Its 10-K report has the following footnote related to leasing activities. A summary of future minimum lease payments under noncancelable operating leases with an initial or remaining term in excess of one year at May 31, 2016, is as follows (in millions): 2017 2018 Operating Leases Aircraft and Facilities Total Operating Related Equipment and other Leases $ 454 $ 2021 $ 2475 383 1.860 2243 321 1632 1953 2401428 1668 18212691451 76718,023 $1932 $15.881 $17,813 2020 2021 Thereater Total... 352 Property and equipment recorded under capital leases and future minimum lease payments under capital leases were immaterial at May 31, 2016. Capital lease obligations were reported as part of FedEx's long-term debt to be 563 million at May 31, 2016 Required a. What is the balance of lease assets and lease liabilities reported on FedEx's balance sheet? Explain. b. Assume FedEx uses a rate of 4.8% to discount its capital cases. Use this discount rate and round the remaining lease life to two decimals to estimate the amount of assets and liabilities that FedEx fails to report as a result of its off-balance-sheet lease financing What adjustments would we make to FedEx's income statement coresponding to the adjust- ments we make to its balance sheet in part b? d. Indicate the direction (increase or decrease of the effect that capitalizing the operating leases would have on the following financial items and ratios for FedEx: retum on equity (ROE). net operating profit after tax (NOPAT), net operating assets (NOA), net operating profit margin (NOPM), net operating asset tumover (NOAT), and measures of financial leverage. c. What portion of total lease liabilities did FedEx report on-balance-sheet and what portion is off-balance-sheet? f. Based on your analysis, do you believe that FedEx's balance sheet adequately reports its aircraft and facilities assets and related obligations? Explain