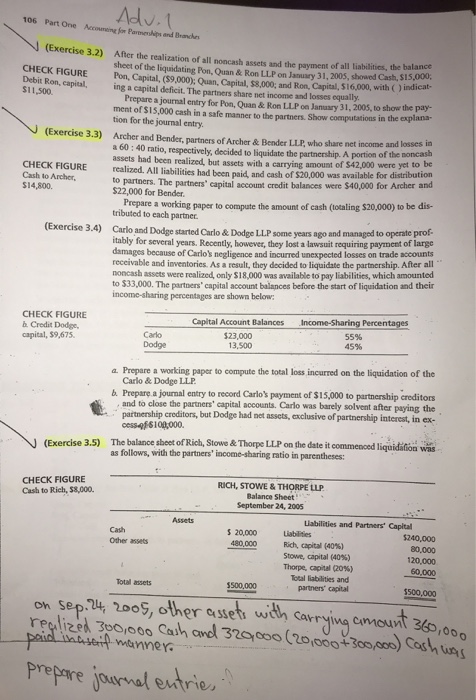

106 Part One Accouming or Parmeships and Branckes (Exercise 3.2) After the realization of all noncash assets and the payment of all liabilitics, the balance sheet of the liquidating Pon, Quan &Ron LLP on January 31, 2005, showed Cash, $15,000 HECK FIGURE Pon, Capital,($9,000); Quan, Capital, $8,000; and Ron, Capital, $16,000, with () indicat- Debit Ron, capital, ing a capital deficit. The partners share net income and losses equally $11,500. Prepare a journal entry for Pon, Quan &Ron LLP oa Janusary 31,2005, to show the pay- ment of $15,000 cash in a safe manner to the partners. Show computations in the explana- tion for the journal entry (Exercise 3.3) Archer and Bender, partners of Archer & Bender LLP, who share net income and losses a 60:40 ratio, respectively, decided to liquidate the partnership. A portion of the assets had been realized, but assets with a carrying amount of $42,000 realized. All liabilities had been paid, and cash of $20,000 noncash be were yet to CHECK FIGURE Cash to Archer, was available for distribution to partners. The partners' capital account credit balances were $40,000 for Archer and $22,000 for Bender. $14,800. Prepare a working paper to compute the amount of cash (totaling $20,000) to be dis- tributed to each partner Carlo and Dodge started Carlo & Dodge LLP s itably for several years. Recently, however, they lost a lawsuit r damages because of Carlo's negligence and incurred unexpected losses on trade accounts receivable and inventories. As a result, they decided to liquidate the partnership. After all noncash assets were realized, only $18,000 was available to pay liabilities, which amounted to $33,000. The partners capital account balances before the start of liquidation and their income-sharing percentages are shown below some years ago and managed to operate prof requiring payment of large (Exercise 3.4) CHECK FIGURE b Credit Dodge, capital, 59,675 Caplital Account Balances Carlo Dodge 23,000 13,500 55% 45% a Prepare a working paper to compute the total loss incurred on the liquidation of the Carlo & Dodge LLP b. Prepare a journal entry to record Carlo's payment of $15,000 to partnership creditors and to close the partners' capital accountsCarlo was barely solvent after paying the partnership creditors, but Dodge had net assets, axclusive of partnership interest, in ex (Exercise 3.5) The balance sheet of Rich, Stowe&Thorpe LLP on the date it commenced liquidaion was as follows, with the partners' income-sharing ratio in parentheses: CHECK FIGURE Cash to Rich, $8,000. RICH, STOWE & THORPE LLP Balance Sheet September 24, 2005 Liabilities and Partners' Capital $240,000 Cash Other assets S 20,000 480,0 Rich, capital (40%) Stowe, capital (40%) Thorpe, capital (20%) 000 20,000 60,000 Total liabilities and partners capital Total assets $500,000 $500,000 on Sep.D4 2oos, other assets uith carrying cmount 3,00 regli zed 300,00 Couh owl 329 oo (20'000+300,000) Cash unf prepre jnerval eutrie entre