Answered step by step

Verified Expert Solution

Question

1 Approved Answer

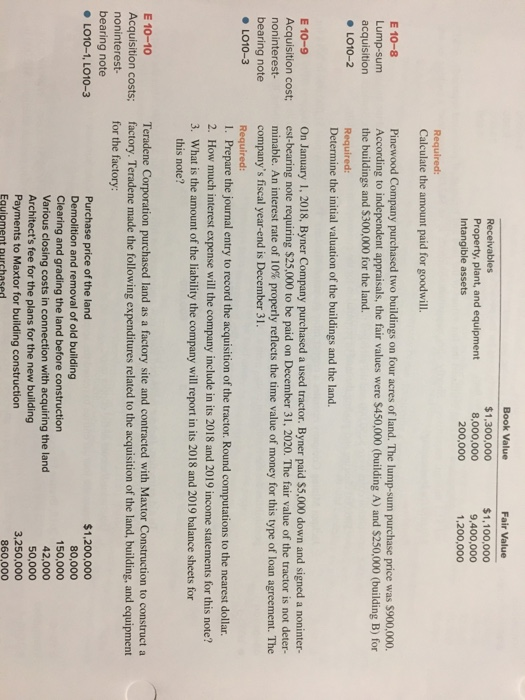

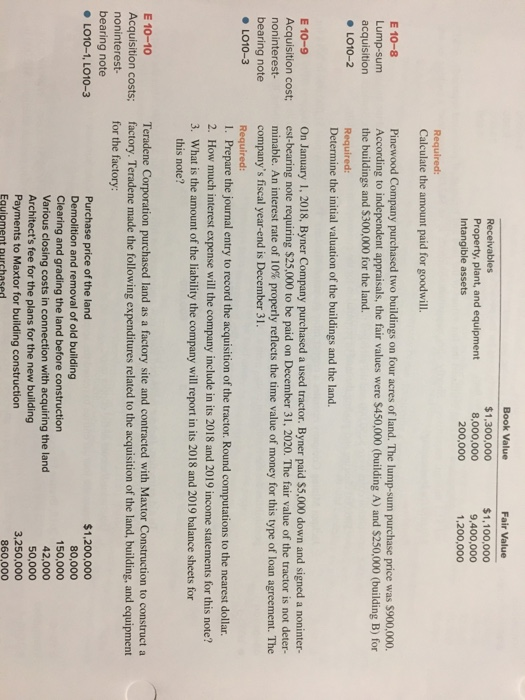

10-8 Receivables Property, plant, and equipment Intangible assets Book Value $1,300,000 8,000,000 200,000 Fair Value $1,100,000 9,400,000 1,200,000 Required: Calculate the amount paid for goodwill.

10-8

Receivables Property, plant, and equipment Intangible assets Book Value $1,300,000 8,000,000 200,000 Fair Value $1,100,000 9,400,000 1,200,000 Required: Calculate the amount paid for goodwill. E 10-8 Lump-sum acquisition LO10-2 Pinewood Company purchased two buildings on four acres of land. The lump-sum purchase price was $900,000. According to independent appraisals, the fair values were $450,000 (building A) and $250,000 (building B) for the buildings and $300,000 for the land. Required: Determine the initial valuation of the buildings and the land. E 10-9 Acquisition cost; noninterest- bearing note .LO10-3 On January 1, 2018, Byner Company purchased a used tractor. Byner paid $5,000 down and signed a noninter- est-bearing note requiring $25,000 to be paid on December 31, 2020. The fair value of the tractor is not deter- minable. An interest rate of 10% properly reflects the time value of money for this type of loan agreement. The company's fiscal year-end is December 31. Required: 1. Prepare the journal entry to record the acquisition of the tractor. Round computations to the nearest dollar. 2. How much interest expense will the company include in its 2018 and 2019 income statements for this note? 3. What is the amount of the liability the company will report in its 2018 and 2019 balance sheets for this note? E 10-10 Acquisition costs; noninterest bearing note .LO10-1, LO10-3 Teradene Corporation purchased land as a factory site and contracted with Maxtor Construction to construct a factory. Teradene made the following expenditures related to the acquisition of the land, building, and equipment for the factory: Purchase price of the land $1,200,000 Demolition and removal of old building 80,000 Clearing and grading the land before construction 150,000 Various closing costs in connection with acquiring the land 42.000 Architect's fee for the plans for the new building 50,000 Payments to Maxtor for building construction 3,250,000 Equipment purchased 860,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started