Answered step by step

Verified Expert Solution

Question

1 Approved Answer

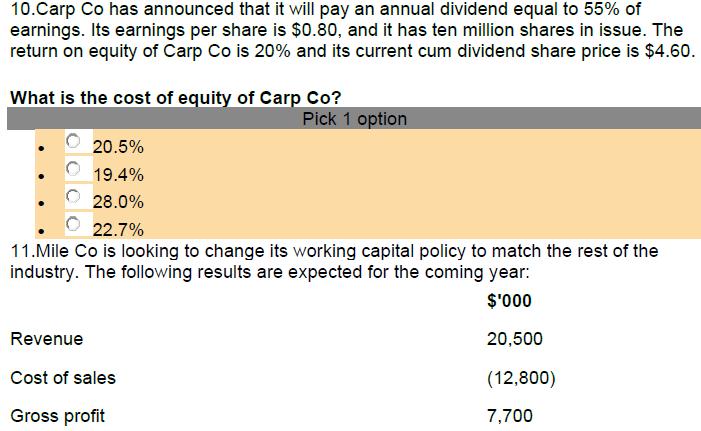

10.Carp Co has announced that it will pay an annual dividend equal to 55% of earnings. Its earnings per share is $0.80, and it

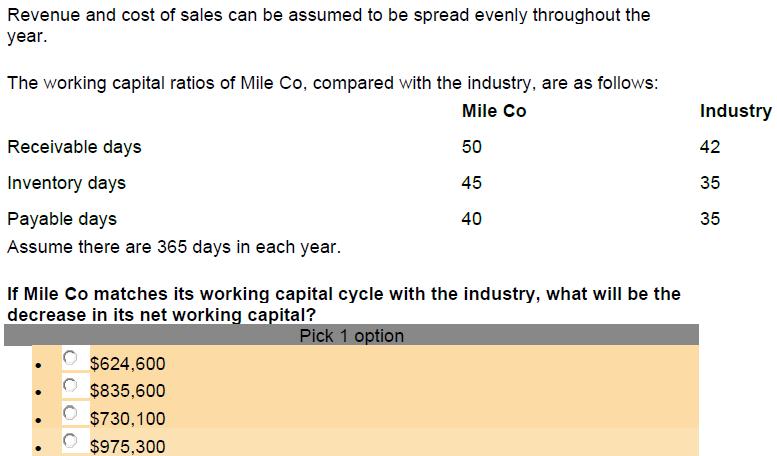

10.Carp Co has announced that it will pay an annual dividend equal to 55% of earnings. Its earnings per share is $0.80, and it has ten million shares in issue. The return on equity of Carp Co is 20% and its current cum dividend share price is $4.60. What is the cost of equity of Carp Co? 20.5% 19.4% Pick 1 option 28.0% 22.7% 11.Mile Co is looking to change its working capital policy to match the rest of the industry. The following results are expected for the coming year: Revenue Cost of sales Gross profit $'000 20,500 (12,800) 7,700 Revenue and cost of sales can be assumed to be spread evenly throughout the year. The working capital ratios of Mile Co, compared with the industry, are as follows: Receivable days Inventory days Mile Co 50 45 40 Payable days Assume there are 365 days in each year. If Mile Co matches its working capital cycle with the industry, what will be the decrease in its net working capital? $624,600 $835,600 $730,100 $975,300 Pick 1 option Industry 42 35 35

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the cost of equity for Carp Co we can use the Dividend Discount Model DDM formula Cost ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started