Answered step by step

Verified Expert Solution

Question

1 Approved Answer

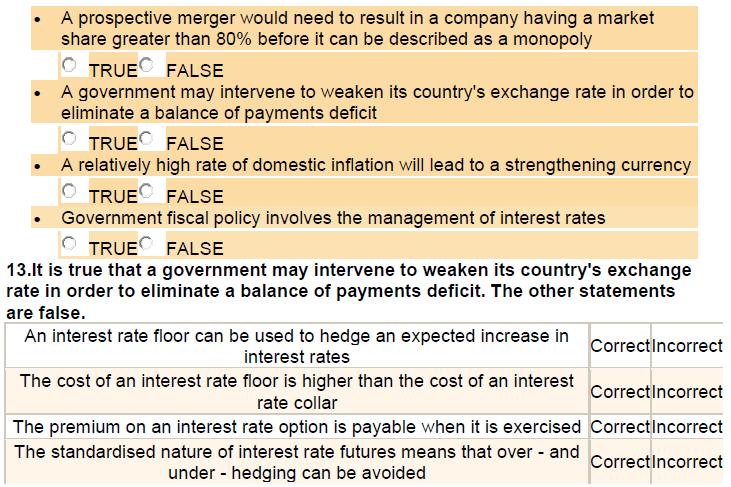

12.Indicate, by clicking on the relevant boxes, whether the following statements are true or false? A prospective merger would need to result in a

12.Indicate, by clicking on the relevant boxes, whether the following statements are true or false? A prospective merger would need to result in a company having a market share greater than 80% before it can be described as a monopoly TRUE FALSE A government may intervene to weaken its country's exchange rate in order to eliminate a balance of payments deficit TRUE FALSE A relatively high rate of domestic inflation will lead to a strengthening currency TRUE FALSE Government fiscal policy involves the management of interest rates TRUE FALSE 13.It is true that a government may intervene to weaken its country's exchange rate in order to eliminate a balance of payments deficit. The other statements are false. An interest rate floor can be used to hedge an expected increase in interest rates The cost of an interest rate floor is higher than the cost of an interest rate collar CorrectIncorrect CorrectIncorrect The premium on an interest rate option is payable when it is exercised Correct Incorrect The standardised nature of interest rate futures means that over - and Correct Incorrect under hedging can be avoided

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answers to Multiple Choice Questions 12 A prospective merger would need to result in a company havin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started