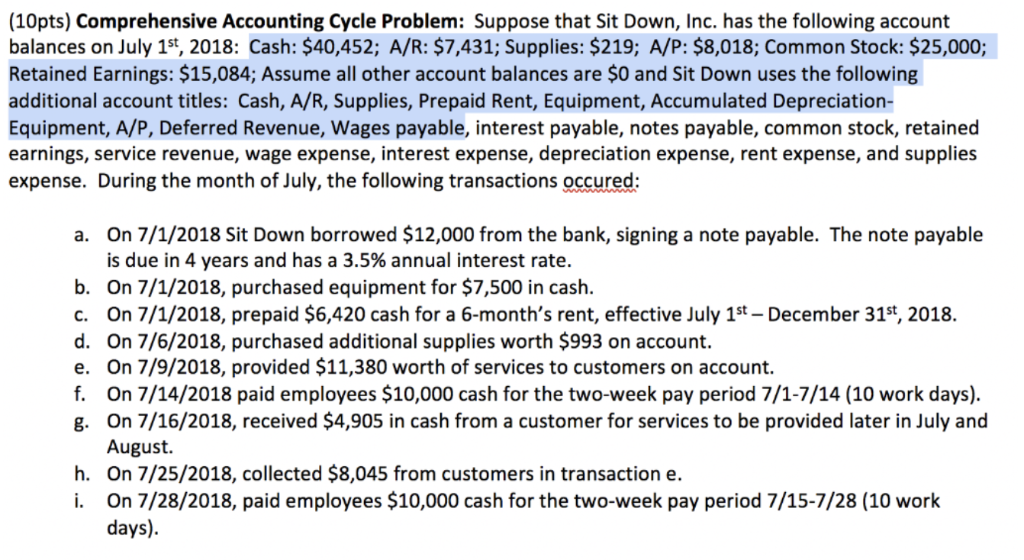

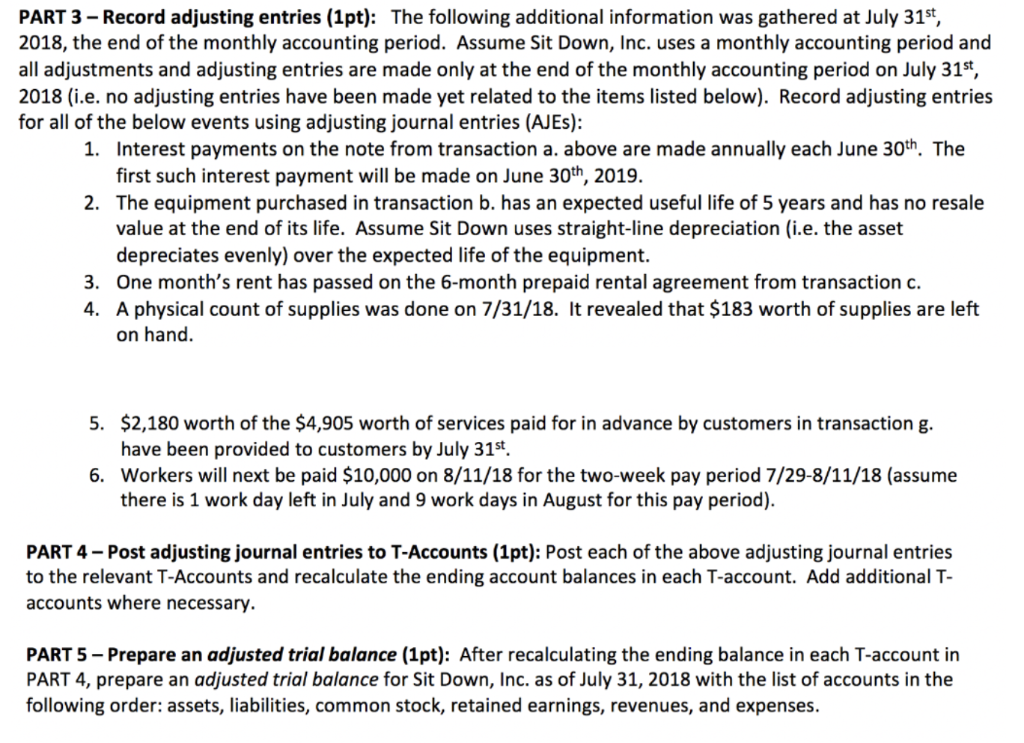

(10pts) Comprehensive Accounting Cycle Problem: Suppose that Sit Down, Inc. has the following account balances on July 1st, 2018. Cash: $40,452; A/R: $7,431; Supplies: $219, A/P $8,018, Common Stock: $25,000; Retained Earnings: $15,084; Assume all other account balances are $0 and Sit Down uses the following additional account titles: Cash, A/R, Supplies, Prepaid Rent, Equipment, Accumulated Depreciation- Equipment, A/P, Deferred Revenue, Wages payable, interest payable, notes payable, common stock, retained earnings, service revenue, wage expense, interest expense, depreciation expense, rent expense, and supplies expense. During the month of July, the following transactions occured: a. On 7/1/2018 Sit Down borrowed $12,000 from the bank, signing a note payable. The note payable is due in 4 years and has a 3.5% annual interest rate. b. On 7/1/2018, purchased equipment for $7,500 in cash. c. On 7/1/2018, prepaid $6,420 cash for a 6-month's rent, effective July 1st- December 31st, 2018. d. On 7/6/2018, purchased additional supplies worth $993 on account. e. On 7/9/2018, provided $11,380 worth of services to customers on account. f. On 7/14/2018 paid employees $10,000 cash for the two-week pay period 7/1-7/14 (10 work days). g. On 7/16/2018, received $4,905 in cash from a customer for services to be provided later in July and August. h. On 7/25/2018, collected $8,045 from customers in transaction e. i. On 7/28/2018, paid employees $10,000 cash for the two-week pay period 7/15-7/28 (10 work days). PART 3-Record adjusting entries (1pt): The following additional information was gathered at July 31st 2018, the end of the monthly accounting period. Assume Sit Down, Inc. uses a monthly accounting period and all adjustments and adjusting entries are made only at the end of the monthly accounting period on July 31st 2018 (i.e. no adjusting entries have been made yet related to the items listed below). Record adjusting entries for all of the below events using adjusting journal entries (AJEs): Interest payments on the note from transaction a. above are made annually each June 30th. The first such interest payment will be made on June 30th, 2019. 1. 2. The equipment purchased in transaction b. has an expected useful life of 5 years and has no resale value at the end of its life. Assume Sit Down uses straight-line depreciation (i.e. the asset depreciates evenly) over the expected life of the equipment. One month's rent has passed on the 6-month prepaid rental agreement from transaction c. A physical count of supplies was done on 7/31/18. It revealed that $183 worth of supplies are left on hand. 3. 4. $2,180 worth of the $4,905 worth of services paid for in advance by customers in transaction g have been provided to customers by July 31st. Workers will next be paid $10,000 on 8/11/18 for the two-week pay period 7/29-8/11/18 (assume there is 1 work day left in July and 9 work days in August for this pay period) 5. 6. PART 4 Post adjusting journal entries to T-Accounts (1pt): Post each of the above adjusting journal entries to the relevant T-Accounts and recalculate the ending account balances in each T-account. Add additional T- accounts where necessary. PART 5-Prepare an adjusted trial balance (1pt): After recalculating the ending balance in each T-account in PART 4, prepare an adjusted trial balance for Sit Down, Inc. as of July 31, 2018 with the list of accounts in the following order: assets, liabilities, common stock, retained earnings, revenues, and expenses