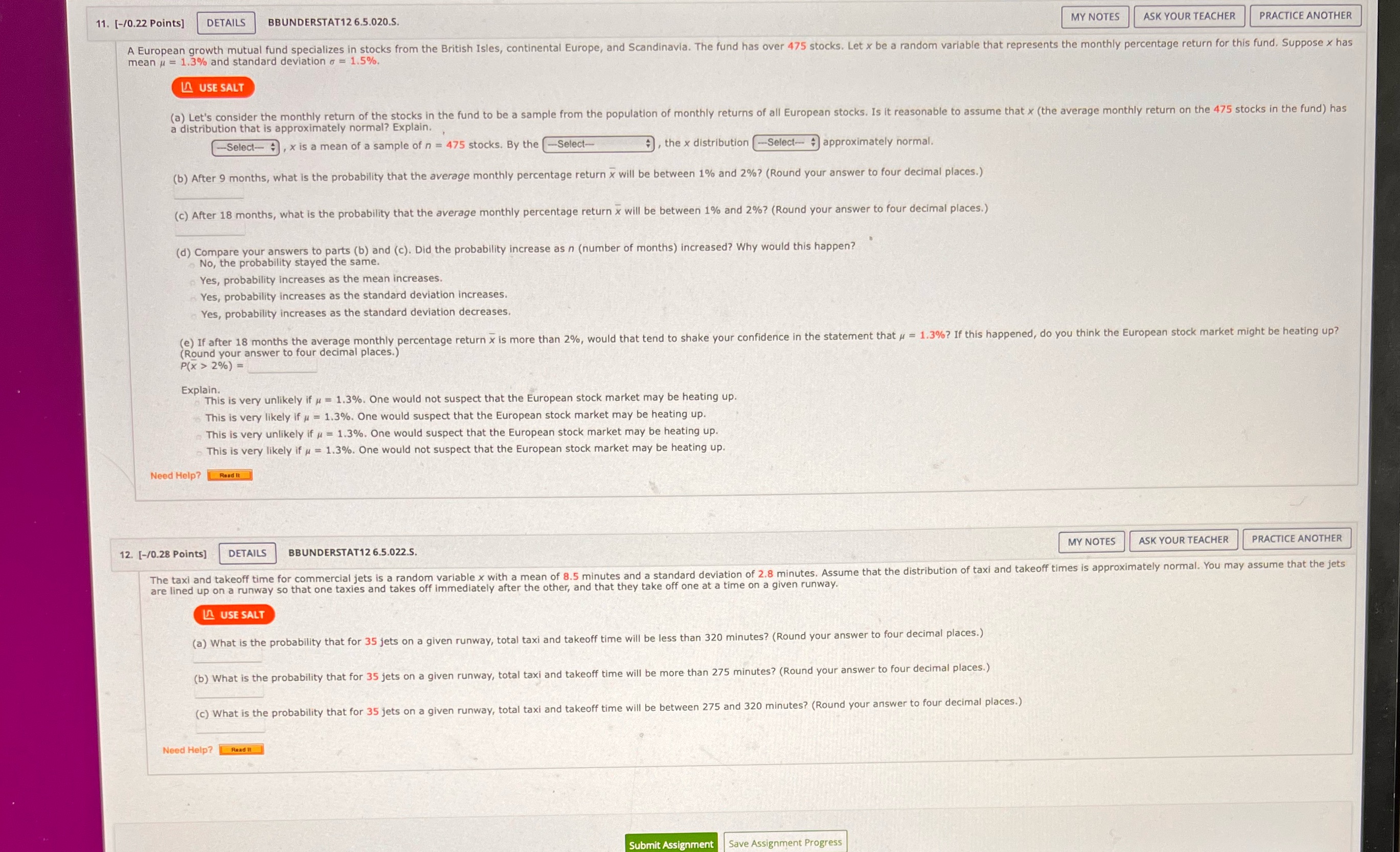

11. [-/0.22 Points] DETAILS BBUNDERSTAT12 6.5.020.5. MY NOTES ASK YOUR TEACHER PRACTICE ANOTHER A European growth mutual fund specializes in stocks from the British Isles, continental Europe, and Scandinavia. The fund has over 475 stocks. Let x be a random variable that represents the monthly percentage return for this fund. Suppose x has mean # = 1.3% and standard deviation o = 1.5%. LA USE SALT (a) Let's consider the monthly return of the stocks in the fund to be a sample from the population of monthly returns of all European stocks. Is it reasonable to assume that x (the average monthly return on the 475 stocks in the fund) has a distribution that is approximately normal? Explain. -Select- , x is a mean of a sample of n = 475 stocks. By the (-Select- *, the x distribution (-Select- + approximately normal. (b) After 9 months, what is the probability that the average monthly percentage return x will be between 1% and 2%? (Round your answer to four decimal places.) c) After 18 months, what is the probability that the average monthly percentage return x will be between 1% and 2%? (Round your answer to four decimal places.) (d) Compare your answers to parts (b) and (c). Did the probability increase as n (number of months) increased? Why would this happen? No, the probability stayed the same. Yes, probability increases as the mean increases. Yes, probability increases as the standard deviation increases. Yes, probability increases as the standard deviation decreases. (e) If after 18 months the average monthly percentage return x is more than 2%, would that tend to shake your confidence in the statement that , = 1.3%? If this happened, do you think the European stock market might be heating up? (Round your answer to four decimal places.) P(x > 2%) = Explain. This is very unlikely if # = 1.3%. One would not suspect that the European stock market may be heating up. This is very likely if u = 1.3%. One would suspect that the European stock market may be heating up. This is very unlikely if u = 1.3%. One would suspect that the European stock market may be heating up. This is very likely if u = 1.3%. One would not suspect that the European stock market may be heating up. Need Help? Read It 12. [-/0.28 Points] DETAILS BBUNDERSTAT12 6.5.022.5. MY NOTES ASK YOUR TEACHER PRACTICE ANOTHER The taxi and takeoff time for commercial jets is a random variable x with a mean of 8.5 minutes and a standard deviation of 2.8 minutes. Assume that the distribution of taxi and takeoff times is approximately normal. You may assume that the jets are lined up on a runway so that one taxies and takes off immediately after the other, and that they take off one at a time on a given runway. LA USE SALT (a) What is the probability that for 35 jets on a given runway, total taxi and takeoff time will be less than 320 minutes? (Round your answer to four decimal places.) (b) What is the probability that for 35 jets on a given runway, total taxi and takeoff time will be more than 275 minutes? (Round your answer to four decimal places.) (c) What is the probability that for 35 jets on a given runway, total taxi and takeoff time will be between 275 and 320 minutes? (Round your answer to four decimal places.) Need Help? Read Submit Assignment Save Assignment Progress