Answered step by step

Verified Expert Solution

Question

1 Approved Answer

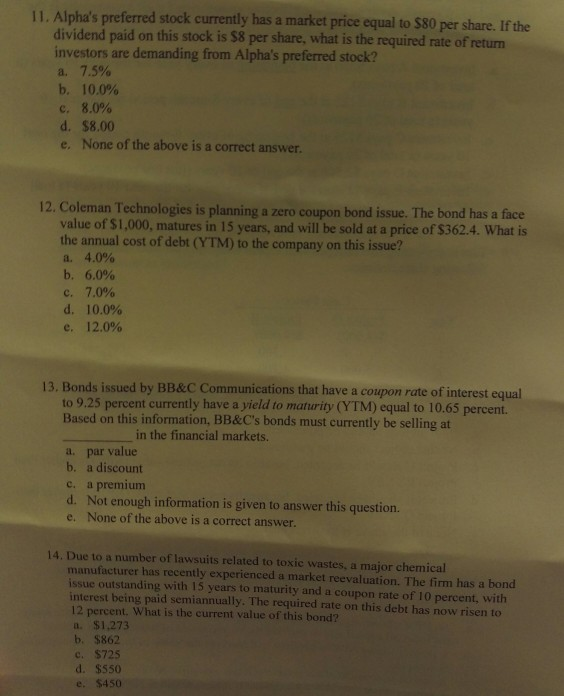

11. Alpha's preferr ed stock currently has a market price equal to $80 per share. If the dividend paid on this stock is $8 per

11. Alpha's preferr ed stock currently has a market price equal to $80 per share. If the dividend paid on this stock is $8 per share, what is the required rate of return investors are demanding from Alpha's preferred stock? a. 7.5% b. 10.0% c. 8.000 d. $8.00 e. None of the above is a correct answer. 12. Coleman Technologies is planning a zero coupon bond issue. The bond has a face value of $1,000, matures in 15 years, and will be sold at a price of $362.4. What is the annual cost of debt (YTM) to the company on this issue? a. 4.0% b. 6.0% e. 7.0% d. 10.0% e. 12.0% 13. Bonds issued by BB&C Communications that have a coupon rate of interest equal to 9.25 percent currently have a yield to maturity (YTM) equal to 10.65 percent. Based on this information, BB&C's bonds must currently be selling at in the financial markets. a. par value b. a discount c. a premium d. Not enough information is given to answer this question. e. None of the above is a correct answer. 14. Due to a number of lawsuits related to toxic wastes, a major chemical manufacturer has recently experienced a market reevaluation. The firm has a bond issue outstanding with 15 years to maturity and a coupon rate of 10 percent, with interest being paid semiannually. The required rate on this debt has now risen to 12 percent. What is the current value of this bond? a. $1,273 b. $862 c. $725 d. $550 e. $450

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started