Answered step by step

Verified Expert Solution

Question

1 Approved Answer

11 and 12 QUESTION 11 Miller Industries is planning its operations for next year. Jordan Miller, the CFO, wants you to forecast the firm's additional

11 and 12

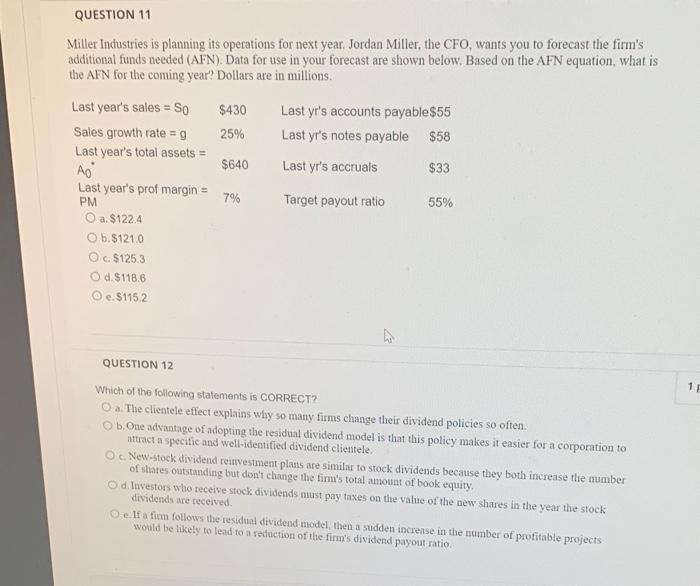

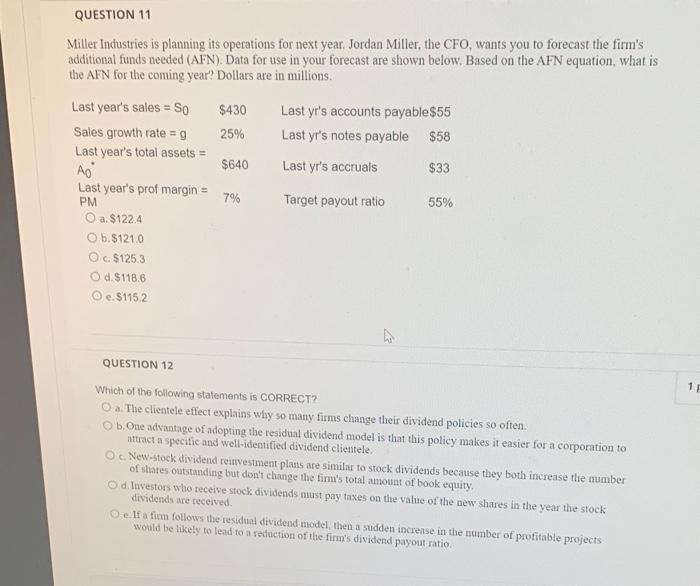

QUESTION 11 Miller Industries is planning its operations for next year. Jordan Miller, the CFO, wants you to forecast the firm's additional funds needed (AFN). Data for use in your forecast are shown below. Based on the AFN equation, what is the AFN for the coming year? Dollars are in millions Last year's sales - So $430 Last yr's accounts payable $55 Sales growth rate = 9 25% Last yr's notes payable $58 Last year's total assets = $640 Last yr's accruals $33 Last year's prof margin = PM 7% Target payout ratio 55% O a. $122.4 O b. $121.0 O c $125.3 d. $118.6 e. $115.2 QUESTION 12 1 Which of the following statements is CORRECT? O a. The clientele effect explains why so many firms change their dividend policies so often. b. One advantage of adopting the residual dividend model that this policy makes it easier for a corporation to attract a specific and well-identified dividend clientele Oc New-stock dividend reinvestment plans are similar to stock dividends because they both increase the number of shares outstanding but don't change the firm's total amount of book equity Od. Investors who receive stock dividends must pay taxes on the value of the new shares in the year the stock dividends are received Oe. If a firm follows the residual dividend model then a sudden increase in the number of profitable projects would be likely to lead to a seduction of the firm's dividend payout ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started